Get the free All Risks Proposal Form - geminia co

Get, Create, Make and Sign all risks proposal form

How to edit all risks proposal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out all risks proposal form

How to fill out all risks proposal form

Who needs all risks proposal form?

All Risks Proposal Form: How-to Guide Long-Read

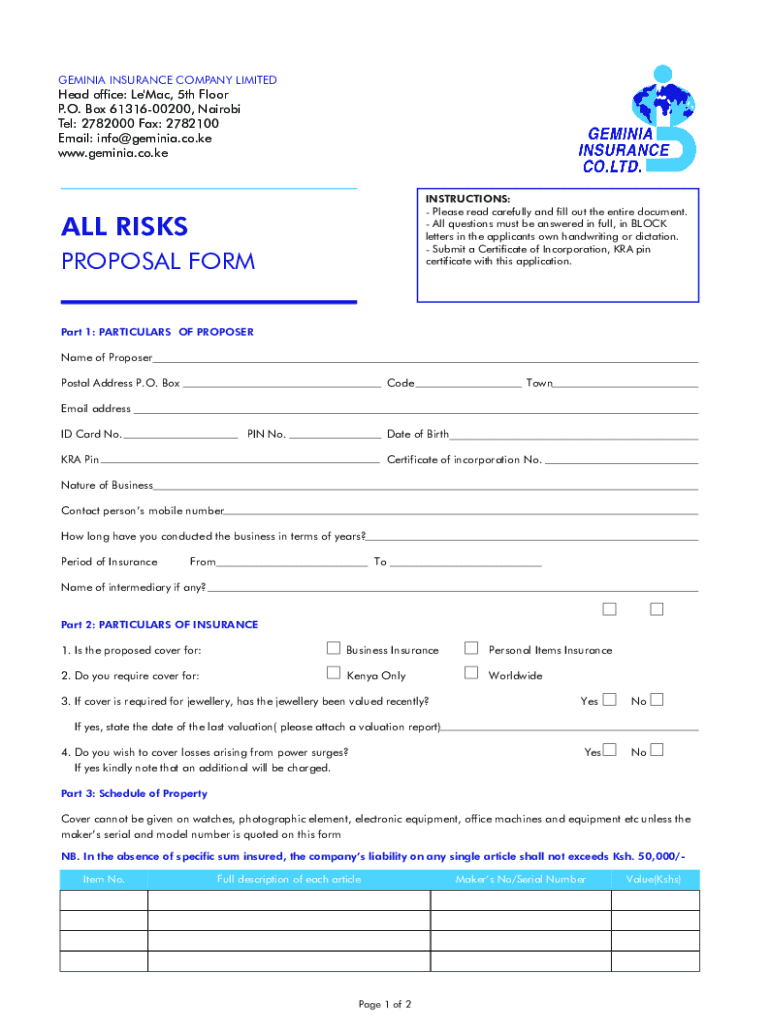

Understanding the all risks proposal form

An all risks proposal form is a document used in the insurance industry that provides a comprehensive overview of an applicant's insurance requirements and potential coverage needs. This form enables individuals and businesses to detail their assets and the associated risks they face, helping insurers assess the level of coverage necessary to protect against unexpected events.

Key components of the form typically include personal information, coverage details, and a series of risk assessment questions. Each of these sections is designed to gather in-depth information that allows the insurer to tailor appropriate policies.

The importance of an all risks proposal form cannot be overstated. It serves as a crucial initial step in the insurance application process, ensuring that both the insurer and the applicant are aligned regarding coverage levels and expectations.

Preparing to fill out your all risks proposal form

Preparation is essential for accurately completing an all risks proposal form. Before filling it out, gather all the necessary documentation to streamline the process and minimize errors.

Start by collecting identification documents, such as your driver’s license or passport, as well as financial records that outline your assets and liabilities. Accurate financial documentation can help in evaluating your coverage needs.

Understanding your coverage needs is also critical. Take time to assess your property and assets, both tangible and intangible, and identify potential risks. This proactive approach will ensure that you’re not caught underinsured in the event of a loss.

Detailed step-by-step instructions for completing the form

Completing the all risks proposal form requires meticulous attention to detail. Here’s a breakdown of each section to guide you through the process.

Section 1: Personal Information

Accurate input of your personal details is crucial. Include your full name, date of birth, address, and contact information. Ensure spelling is correct, as these details will affect communication and documentation.

Section 2: Coverage Requirements

Determine the right coverage amount by evaluating the value of your assets. Select specific types of coverage such as property, liability, and business interruption, based on your unique needs. Be realistic about your coverage to ensure adequate protection.

Section 3: Risk Assessment Questions

It’s essential to assess risks honestly. Think about factors like location, the nature of your business, and historical claim data. Reporting these accurately helps insurers understand your unique situation.

Section 4: Additional Information and Notes

Providing extra context is essential, especially if you have unique circumstances. Clarify any special conditions or needs directly related to your property or business. This additional information can significantly influence your insurer's decision.

Editing and customizing your all risks proposal form

Once the all risks proposal form is filled out, it's time to edit and customize your document. pdfFiller offers robust tools to ensure your proposal is polished and compliant.

Utilize features like text edits and field adjustments, which allow you to make changes easily. Review your document thoroughly to minimize the risk of errors before submission.

Signing and submitting your proposal

With your all risks proposal form complete and edited, the next step is signing and submitting it. pdfFiller enables efficient electronic signatures, ensuring a seamless process.

Adhering to best practices during submission can make a significant difference. Conduct a final review before submission using a checklist that includes ensuring all sections are filled out and required documents are attached.

Managing your all risks proposal form

After submission, managing your all risks proposal form is essential. Knowing how to track your submission status can help alleviate anxiety and provide clarity regarding your application.

Using pdfFiller, you can effortlessly check the status of your submission. Additionally, be prepared to handle follow-up inquiries from insurers, which may require additional information or clarification on certain points.

Tips for a successful all risks insurance application

Completing an all risks proposal successfully demands vigilance and accuracy. Avoiding common pitfalls can enhance your application’s chances of approval.

Misreporting risks or underestimating your coverage needs can lead to complications down the line. It's crucial to paint an accurate picture of your situation.

Leveraging pdfFiller for ongoing document management

pdfFiller not only aids in the initial completion of the all risks proposal form but also simplifies ongoing document management. The platform provides cloud-based accessibility, allowing you to retrieve documents anytime, anywhere.

Utilizing collaboration tools can enhance efficiency, especially for teams working on insurance-related paperwork. You can integrate your all risks proposal form with other document management processes, making it easier to maintain oversight of various forms.

Real-world examples and case studies

Learning from real-world examples can provide valuable insights. Successful proposals offer a template for best practices, showcasing what makes an all risks proposal effective.

Conversely, exploring lessons learned from poorly executed submissions highlights common errors and oversights. Such cases stress the importance of clearly presenting information and addressing risks accurately.

Frequently asked questions (faqs) about all risks proposal forms

Addressing common misconceptions about the all risks proposal form is crucial for prospective applicants. Many applicants have questions regarding the eligibility and specific requirements of the form.

Clarification on these points ensures that individuals and teams approach the proposal process with confidence, paving the way for a smoother insurance application experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get all risks proposal form?

How do I make changes in all risks proposal form?

How do I complete all risks proposal form on an Android device?

What is all risks proposal form?

Who is required to file all risks proposal form?

How to fill out all risks proposal form?

What is the purpose of all risks proposal form?

What information must be reported on all risks proposal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.