Get the free New Business Investment Form - Legal Entity

Get, Create, Make and Sign new business investment form

Editing new business investment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new business investment form

How to fill out new business investment form

Who needs new business investment form?

A comprehensive guide to the new business investment form

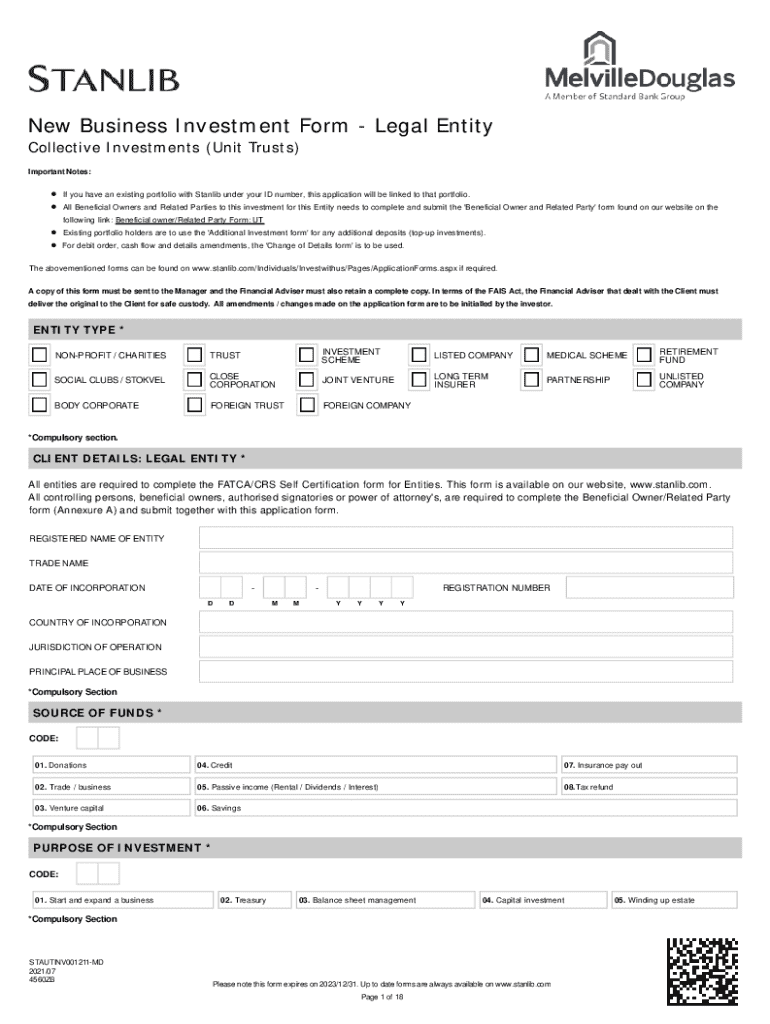

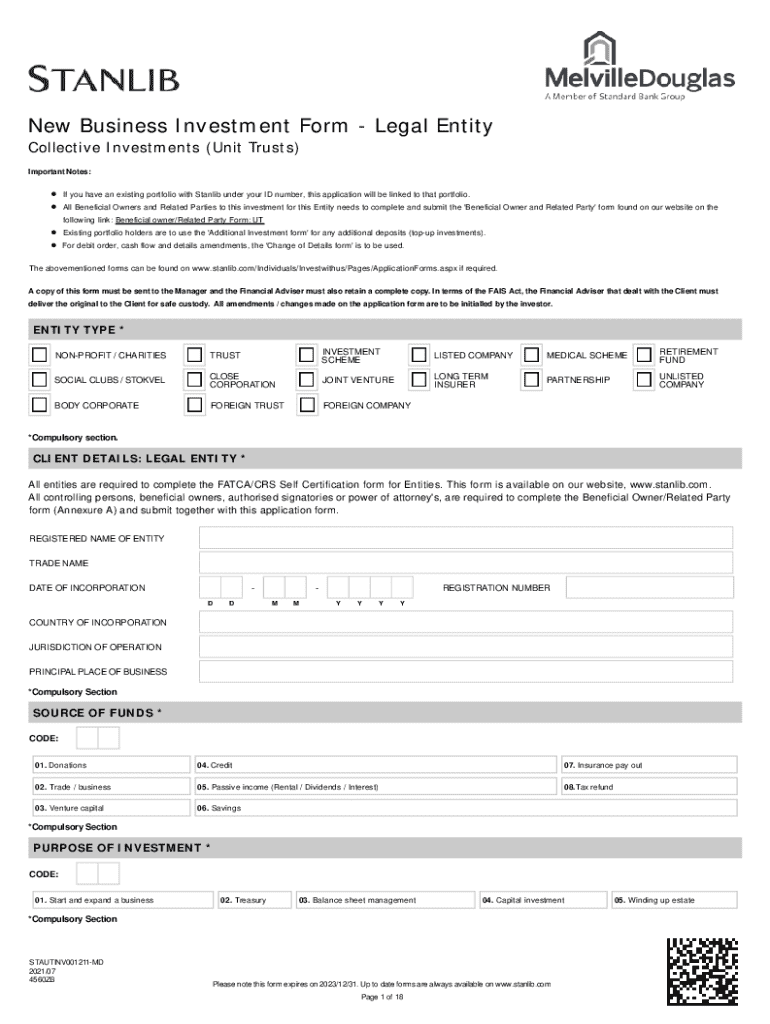

Overview of the new business investment form

A new business investment form serves as a crucial document that potential investors submit to express their interest in funding a business venture. This form is strategically designed to gather essential information about the investment opportunity and the involved parties. By having a standardized format, it facilitates clear communication between investors and entrepreneurs, streamlining the processes involved in securing financial backing.

The importance of the new business investment form cannot be overstated. It acts as the first point of contact between businesses looking for funding and potential investors, ensuring that all relevant details are presented upfront. A well-completed form can significantly expedite the investment process, allowing investors to assess opportunities quickly and enabling businesses to secure necessary funding more efficiently.

Preparing to fill out the form

Before filling out the new business investment form, it’s essential to gather all necessary information and documentation. This includes comprehensive business plans outlining objectives, current operations, and future goals. Financial statements detailing cash flow, profit margins, and potential revenue streams are also crucial. A checklist for potential investors may include documents such as tax returns, budgets, and market analysis reports, which provide clear insights into the business’s financial health.

Understanding the key terms and sections found in the form is just as important. Terms like 'capital structure' and 'return on investment' are frequently mentioned and should be clear to anyone completing the form. Each section typically includes topics like personal information, business structure, investment details, and financial projections. Knowing what to expect helps in providing accurate and relevant information.

Step-by-step guide to completing the new business investment form

Completing the new business investment form can be simplified by breaking it down into manageable sections. Start with your personal information. This should be accurate and complete, ensuring your contact details are easily readable. Next, when filling out the business information section, declare your business structure (e.g., LLC, Corporation) and ownership specifics clearly to provide context about your organization.

The investment details section is where you specify the amount you're seeking, the type of investment (equity or debt), and the purpose of the funds. Provide honest and thorough financial projections to support your request; this includes revenue forecasts, expense estimates, and anticipated profit margins. Lastly, attach any supporting documents following the form’s instructions, ensuring they are well-organized and clearly referenced.

Editing and reviewing the form

Once you've filled out the new business investment form, the next vital step is editing and reviewing the details. Utilizing pdfFiller tools for document editing allows you to make necessary changes accurately. Features like annotations, highlighting, and commenting enhance your submission, enabling clarity and focus where needed. Engaging in a review process helps catch errors early and allows for incorporating feedback from team members.

Proofreading is crucial to avoid common errors such as typos or miscalculations in financial sections. Establish a collaboration process where team members check each other's work. This not only reduces mistakes but can also lead to richer insights and improvements to your investment proposal.

Signing and submitting the new business investment form

Following a thorough review, the next step involves signing the form. eSigning the document using pdfFiller is a straightforward process that ensures you comply with all legal standards necessary for your submission. This not only expedites the signing process but also adds a layer of credibility to your application by allowing you to maintain a digital record.

The submission process should be approached methodically. Whether submitting online or through mail, follow the guidelines outlined on the new business investment form. Ensure you keep a copy of your submission, allowing you to track its status later. Set reminders for any follow-ups as necessary to enhance communication with potential investors, demonstrating your commitment and professionalism.

Managing your investment forms

After submitting the new business investment form, organizing your documents becomes a priority for effective management. Establish best practices for document management, which may include creating digital folders to store forms, maintaining a calendar for tracking submission deadlines, and a checklist for necessary follow-ups. These practices will save you time and effort in the long run, enabling easier retrieval of documents when needed.

It's crucial to stay informed about any changes in investment requirements and legal obligations. Regularly visit industry-specific resources or join investment forums where updates are shared. Continuous learning about evolving business investment practices not only enhances your submission quality but also keeps you ahead of the competition.

Interactive tools for investors

pdfFiller offers a suite of interactive features tailored to ensure that filling out the new business investment form is as seamless as possible. These tools assist in every aspect of form completion, from filling in your personal details to collaborating effectively on sections that require input from multiple team members. Utilizing interactive templates specifically for investment forms makes the process not only easier but also more engaging.

Additionally, incorporating a FAQ section can be beneficial for users to find answers to common questions regarding the new business investment form. Detailed explanations help clarify potential uncertainties and ensure users submit their applications with confidence.

Related forms and templates

In addition to the new business investment form, several other investment-related forms may play a crucial role in your business finance journey. These include forms for loan applications, grant proposals, and angel investor agreements, which are all geared toward securing financial support. Understanding these forms can better equip investors and business owners to navigate the funding landscape effectively.

Custom templates for business planning available within pdfFiller provide a robust foundation for organizing your proposals and projections. These forms are designed to cater specifically to various business scenarios, facilitating tailored approaches to securing investment.

Comparison with traditional paper forms

Utilizing digital formats for the new business investment form provides numerous advantages over traditional paper submissions. Digital forms are fillable, allowing quick changes and proofreading, while also significantly reducing the time taken for submission. Key benefits include the ability to store and share forms easily, alongside the assurance that necessary files are accessible when needed.

Further, pdfFiller enhances the investment process by offering comprehensive solutions to manage investments digitally. This not only saves time but also minimizes environmental impact by reducing paper use. Investors can track and manage their submissions through a user-friendly interface, allowing for a seamless investment experience.

Final insights on successful investments

As you prepare to submit the new business investment form, several strategic tips can increase your chances of success. Crucial considerations include establishing a clear investment narrative, demonstrating potential returns for investors, and maintaining flexibility throughout the process. Investors appreciate transparency and detailed financial projections; thus, articulating these aspects clearly can significantly enhance your proposal.

Moreover, consider long-term strategies for effective business investment management. Evaluate your investment approach regularly, adapt to changing market conditions, and maintain open lines of communication with your investors. This ongoing relationship-building will foster trust and support long-term growth, benefitting both parties involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new business investment form in Gmail?

How do I complete new business investment form online?

How can I edit new business investment form on a smartphone?

What is new business investment form?

Who is required to file new business investment form?

How to fill out new business investment form?

What is the purpose of new business investment form?

What information must be reported on new business investment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.