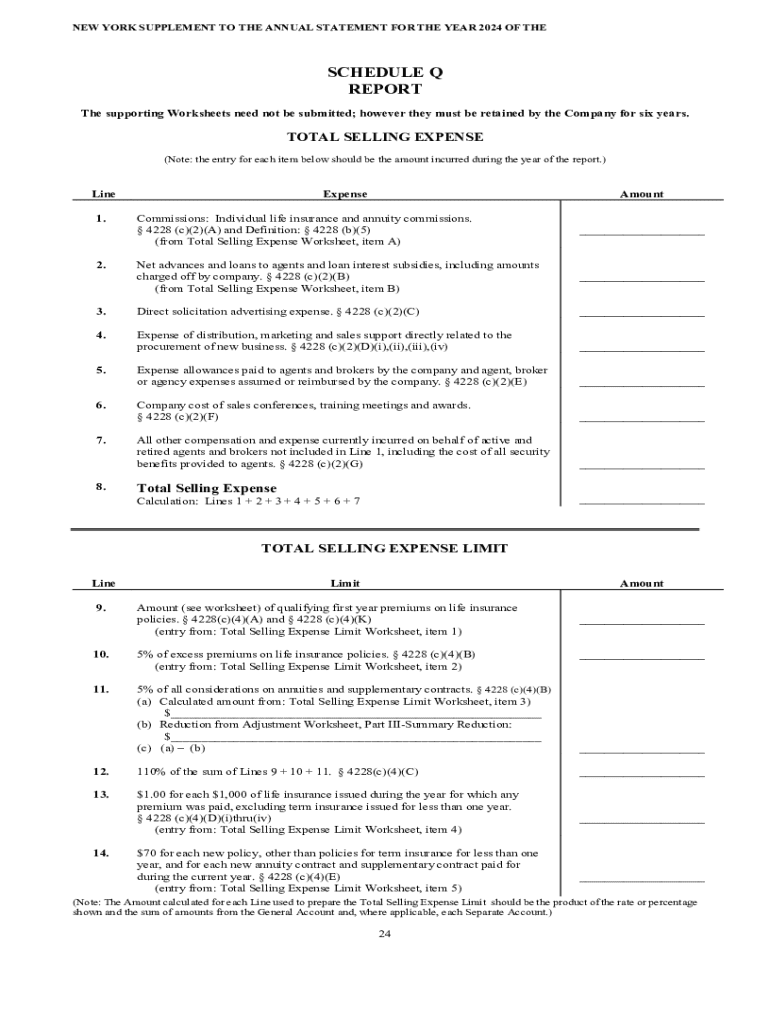

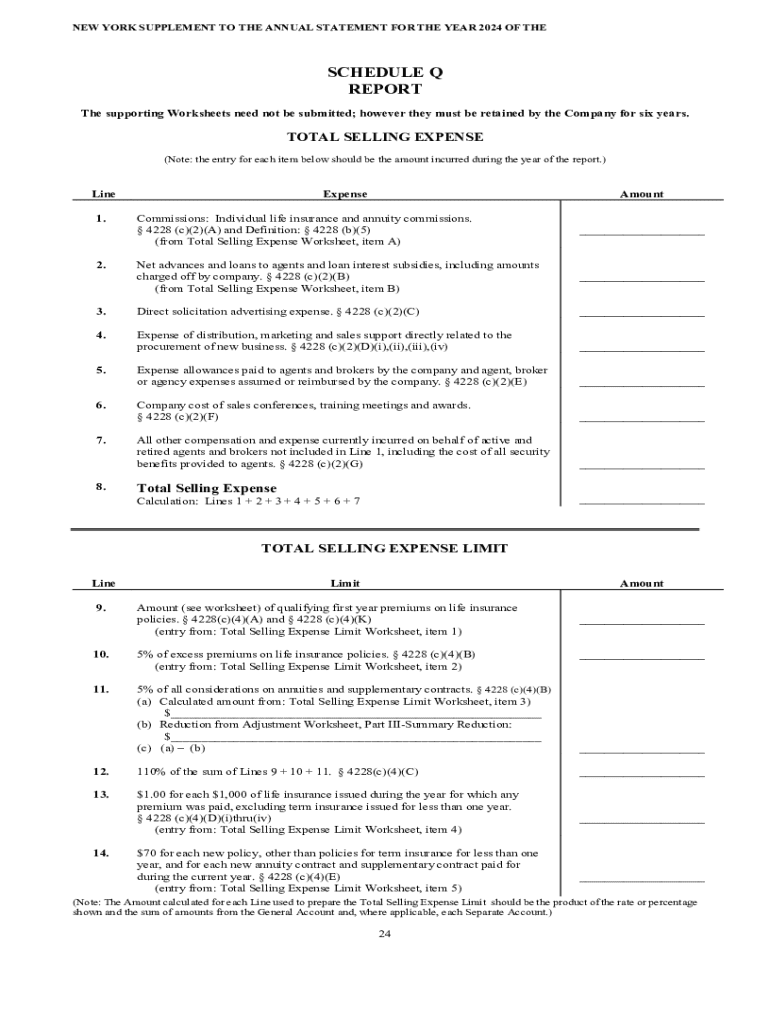

Get the free New York Supplement to the Annual Statement for the Year 2024 of the Schedule Q

Get, Create, Make and Sign new york supplement to

How to edit new york supplement to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new york supplement to

How to fill out new york supplement to

Who needs new york supplement to?

Complete guide to the New York supplement to form

Understanding the New York supplement to form

The New York Supplement to Form is a vital document that individuals may be required to complete for various administrative and legal processes, particularly in relation to government benefits and services. This supplement serves as an addendum to the primary form and provides additional information that may be needed to process applications efficiently.

Completing the supplement accurately is crucial as it ensures compliance with state regulations and helps avoid delays in processing. Providing precise information can prevent misunderstandings and reduce the risk of future complications. It's important for applicants to know when they need to utilize this supplement.

Preparing to fill out the New York supplement

Before diving into the details of filling out the New York supplement to form, it's essential to gather all required information and documents. This preparation will streamline the process and minimize the chance of incomplete submissions.

Key information you'll need includes:

When organizing your information, create a dedicated folder for these documents. Use clearly labeled subfolders for each category of information. Common mistakes to avoid include omitting crucial information, miscalculating income or expenses, and failing to update contact information.

Step-by-step instructions on filling out the supplement

Filling out the supplement can initially seem daunting, but breaking it down into sections makes the process manageable.

Section 1: Personal information

This section will request basic personal details, such as your name, address, and social security number. Ensure that all information matches official documents.

Section 2: Income and resources

You'll need to accurately list all income sources here. This may include wages, rental income, or social security benefits. Be thorough; discrepancies could affect decision-making.

Section 3: Medical expenses (if applicable)

If your application involves healthcare, enumerate medical expenses incurred in the past year and provide relevant documentation. This can include receipts and statements from healthcare providers.

Section 4: Additional information

This section asks for any extra details concerning your financial situation or personal circumstances that may assist in the review process. Honesty and thoroughness are essential.

Editing and reviewing your supplement form

Once you've filled out the New York supplement to form, it’s critical to review it thoroughly. A checklist can streamline this process. Key items to verify include:

Double-checking for accuracy is essential to prevent submission delays due to minor errors. Tools available on pdfFiller can assist in editing and enhancing forms in PDF format.

E-signing the New York supplement to form

New York law recognizes electronic signatures, making e-signing a convenient option for signing your documents. This adds a layer of security, ensuring that your submission is legally binding without the need for physical mailing.

Follow these steps to e-sign using pdfFiller:

pdfFiller also ensures that your electronic signature is protected with robust security measures.

Submitting your completed supplement

Submitting your New York supplement to form can be done in several ways based on your preference and circumstances. Ensure your submission is timely and follows all specified guidelines.

Be mindful of key deadlines related to your submission to ensure your application is processed without delay.

Tracking the status of your supplement

After submitting the New York supplement to form, tracking its status is vital. You can inquire through the submission method you chose or utilize online tracking tools when available.

If you encounter issues during the tracking process, consider these steps:

Common FAQs about the New York supplement to form

Understanding common questions can alleviate concerns during the submission process. Here are answers to frequently asked questions regarding the New York supplement to form.

Additional tools and resources on pdfFiller

pdfFiller offers a multitude of interactive features to simplify form management for the New York supplement to form. Users can take advantage of cloud-based capabilities that allow access from anywhere, making completing and managing documents efficient.

When comparing pdfFiller against competitor offerings, the platform excels in user-friendly options and comprehensive document management. This places pdfFiller in an advantageous position for individuals and teams alike seeking effective solutions.

Case studies/testimonials

Countless users have shared their success stories regarding the New York supplement to form. For instance, one user reported gaining access to critical assistance within weeks of submission due to the clarity and organization of their application.

Testimonies reflect how pdfFiller has simplified the process for many, reducing previous hurdles they faced when managing documents, leading to quicker access to necessary resources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my new york supplement to in Gmail?

How do I fill out the new york supplement to form on my smartphone?

How do I edit new york supplement to on an iOS device?

What is new york supplement to?

Who is required to file new york supplement to?

How to fill out new york supplement to?

What is the purpose of new york supplement to?

What information must be reported on new york supplement to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.