Get the free Offering Memorandum

Get, Create, Make and Sign offering memorandum

How to edit offering memorandum online

Uncompromising security for your PDF editing and eSignature needs

How to fill out offering memorandum

How to fill out offering memorandum

Who needs offering memorandum?

Offering Memorandum Form: A How-to Guide

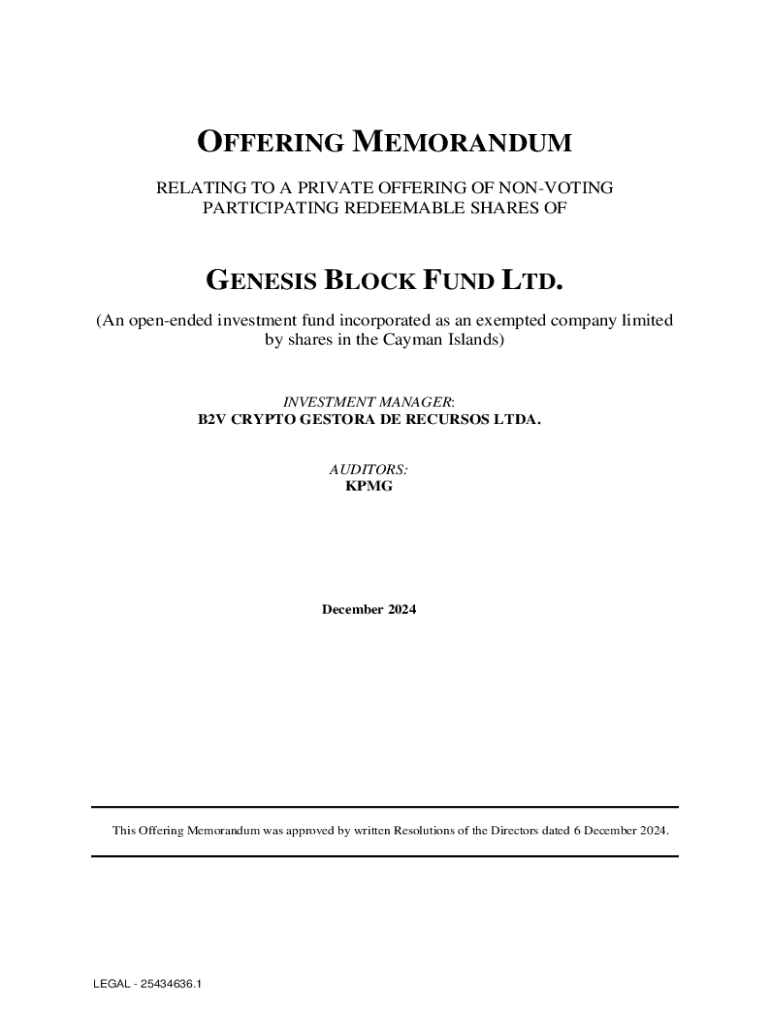

Understanding the offering memorandum

An offering memorandum is a comprehensive document that provides potential investors with all the crucial details they need regarding a security offering. This legally required document helps to ensure transparency and outlines the terms and conditions under which securities are being offered. It serves as both an informative brochure and a protective measure for issuers, ensuring that all pertinent information is shared with prospective investors.

Key components of an offering memorandum often include an executive summary, a detailed business description, extensive financial information, an analysis of the risk factors, and the intended use of proceeds. By laying out these critical elements, the offering memorandum not only engages potential investors but also assists in shaping their decision-making process.

An offering memorandum is generally required in the context of private placements and is crucial when seeking investments from individuals or institutional investors. Without it, companies may face scrutiny and challenges in securing the necessary funds to fuel operations or growth.

Its importance in investment transactions cannot be overstated; it acts as a safeguard for both the issuer and investor, ensuring that all parties have a clear understanding and access to relevant information before making financial decisions.

Types of offering memoranda

Offering memoranda can be classified into two main types based on the issuer's qualifications: qualifying issuers and non-qualifying issuers. Qualifying issuers are typically those that meet certain criteria set forth by regulatory bodies, making their offerings attractive to a wider range of investors due to perceived legitimacy and regulatory compliance.

Conversely, non-qualifying issuers may face additional scrutiny and limitations on their offerings, making the structure of their offering memorandum significantly more critical. Moreover, there is a distinction between private placement memorandums and traditional offering memorandums. While both serve similar purposes, the private placement memorandum is tailored specifically for private investments, highlighting unique metrics and risk factors pertinent to private transactions.

Industries like real estate, technology, and healthcare may require nuanced approaches in their offering memoranda, where industry-specific risks, financial projections, and operational intricacies should be well-articulated to effectively communicate value to prospective investors.

Step-by-step guide to creating an offering memorandum

Creating an effective offering memorandum begins with gathering all necessary information. This involves collecting accurate financial data, including historical performance and future projections, as well as drafting detailed business descriptions that convey the core essence and unique selling propositions of the company. Clarity and precision are paramount as this document serves as a critical reference point for potential investors.

When structuring your offering memorandum, a recommended table of contents usually includes categories like executive summary, business overview, financial statements, market analysis, risk factors, and use of proceeds. Providing clear headings and subheadings enhances readability and enables interested individuals to locate essential information quickly. Tuning the content length typically sees optimal memoranda spanning around 20-30 pages, balancing depth with accessibility.

Customizing the content for your audience is also crucial. Understanding potential investor backgrounds will allow you to tailor your messaging effectively. For instance, specialists in venture capital may appreciate a more detailed analysis of growth trajectories, while individual investors might benefit from simplified summaries and accessible language.

Filling out the offering memorandum form

Utilizing a platform like pdfFiller simplifies the document creation process for your offering memorandum. To start, access the offering memorandum template available on pdfFiller. On this platform, you will find tools that aid in creating comprehensive documents while ensuring compliance with industry standards.

Filling out the form step by step involves inputting data in designated fields and carefully reviewing each section. Ensuring accuracy in financial data and business details is essential. The platform's user-friendly interface offers guidance throughout the process, making it easy for users to navigate between sections without confusion.

pdfFiller also offers robust editing options and tools. Users can leverage text editing features to refine language and clarity, insert images and graphs for visual representation, and enhance overall presentation value. This interoperability ensures that the presentation aligns with the brand's image.

Collaboration within teams is another highlight of pdfFiller. The platform allows team members to comment and review the content collaboratively, fostering a seamless workflow. Task assignments can also be designated to divide responsibilities effectively, ensuring that the document is completed on time with input from all relevant stakeholders.

Legal and compliance considerations

Navigating legal and compliance considerations is a pivotal aspect of the offering memorandum process. Depending on the jurisdiction and the nature of the security being offered, various regulations govern the usage of offering memoranda. These rules are designed to protect investors and ensure that accurate information is disclosed in a timely manner.

Common legal pitfalls include failing to disclose significant risks, overstating financial forecasts, or misrepresenting the company’s standing. Clear, consistent documentation and adherence to stipulated guidelines can mitigate these issues. Therefore, consulting a legal professional, especially one well-versed in securities law, is advisable when drafting an offering memorandum.

Signing and finalizing your offering memorandum

In the digital age, the importance of eSigning your offering memorandum cannot be understated. This technology not only expedites the process but also enhances the security of document traversal. With pdfFiller, eSigning features enable users to execute documents electronically, facilitating prompt execution while maintaining strong legal validity.

To eSign your offering memorandum through pdfFiller, you can follow an intuitive process where you simply click on designated areas in the document to add your signature. Ensuring that all necessary parties sign the document is crucial for its validity, so utilize the platform's tracking features to confirm completion. Before widespread distribution, conducting a final review checklist is essential; verifying details, cross-referencing financial projections, and ensuring that all regulatory requirements are met will bolster the document's integrity.

Distributing the offering memorandum

Sharing your offering memorandum effectively is critical for maximizing reach and engagement. Best practices for distribution include utilizing email campaigns for direct outreach to targeted investor lists and sharing on online platforms where potential investors may frequent. Such platforms can range from crowdfunding sites to networks specifically designed for private equity.

Tracking recipient engagement with your offering memorandum can be accomplished through analytics provided by pdfFiller. Monitoring opens, interactions, and downloads allows issuers to gauge interest and strategize follow-ups, ensuring that no potential investment opportunity is overlooked.

Managing and storing an offering memorandum

The management and secure storage of your offering memorandum is vital for maintaining operational efficiency and safeguarding sensitive information. Leveraging cloud-based document management systems like pdfFiller allows for easy access across devices and locations, significantly enhancing operational agility while ensuring all documents are organized.

Organizing your offering memorandum within pdfFiller will help streamline processes and accessibility. The platform offers features to tag documents, set permissions, and create categorized folders, simplifying retrieval and reducing time spent on document management. Security features further ensure that sensitive information is protected, providing peace of mind for both issuers and investors.

Frequently asked questions

Understanding the distinctions between an offering memorandum and a prospectus is fundamental. While both are used to provide investors with information, offering memoranda are typically used in private placements and regulatory exemptions, whereas prospectuses are more common in public offerings.

Regular updates to offering memoranda are crucial, particularly when there are significant shifts in financial performance, operational changes, or material risks. As a general rule of thumb, reviewing your memorandum quarterly can help keep information relevant and accurate.

Additionally, offering memoranda can be adapted for different fundraising rounds, provided the critical components reflect the specific context of each round, addressing risks and opportunities uniquely relevant to each fundraising scenario.

Additional insights

Case studies of successful offerings using memoranda illustrate the importance of building trust and transparency during the fundraising process. Notable examples highlight how issuing well-structured offering memoranda has led to securing desired funding levels, reinforcing the document’s efficacy in the investment landscape.

Moreover, innovative trends in document preparation and management continue to evolve. Adopting cutting-edge technologies and streamlined workflows enhances the overall experience for both issuers and investors. User experiences and testimonials regarding pdfFiller's offering memorandum solutions reflect tangible benefits like ease of use, efficiency in collaboration, and significant time savings. This indicates a growing reliance on integrated solutions for managing complex documents in the financial space.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my offering memorandum in Gmail?

How can I edit offering memorandum on a smartphone?

How do I edit offering memorandum on an iOS device?

What is offering memorandum?

Who is required to file offering memorandum?

How to fill out offering memorandum?

What is the purpose of offering memorandum?

What information must be reported on offering memorandum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.