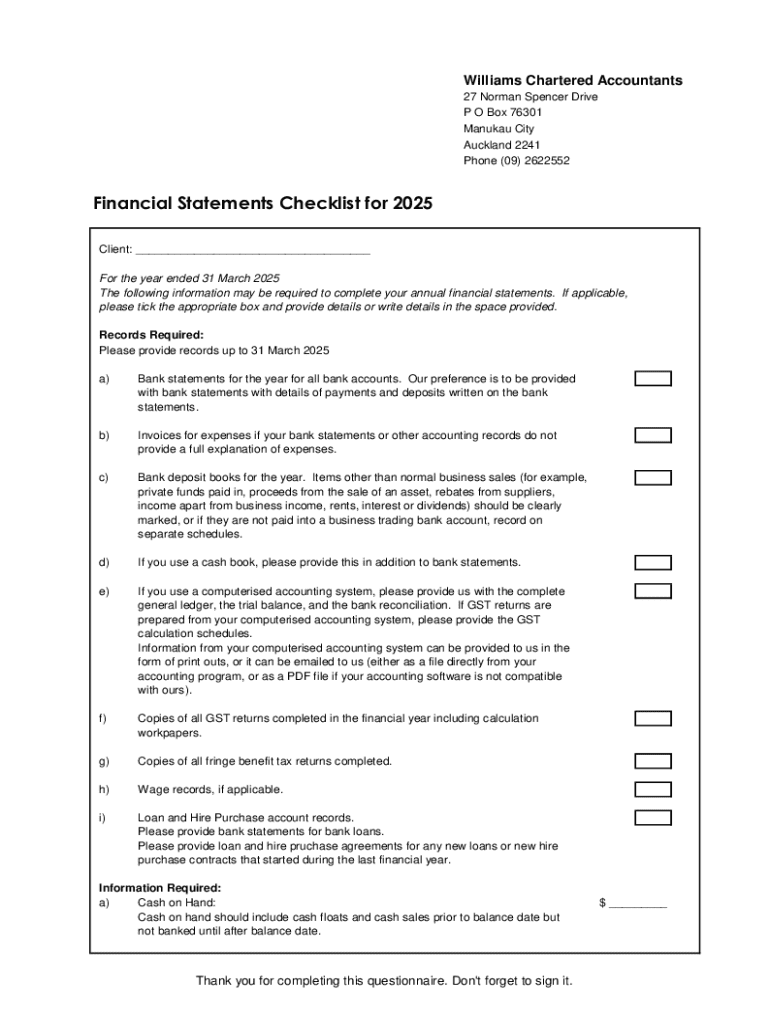

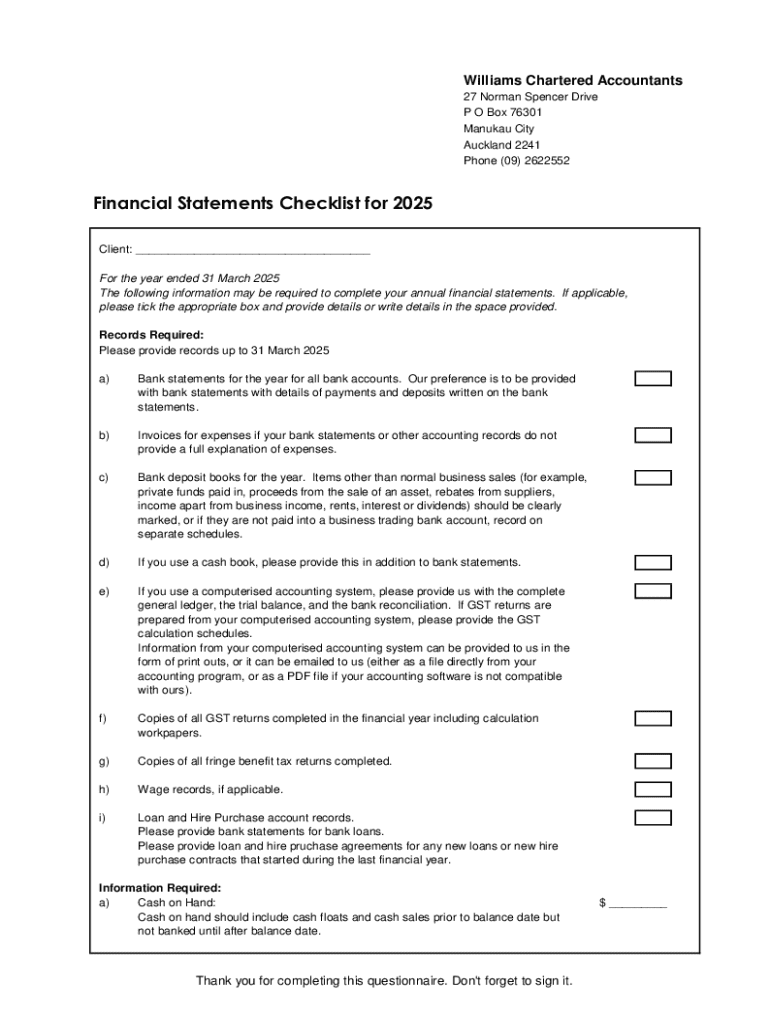

Get the free Financial Statements Checklist for 2025

Get, Create, Make and Sign financial statements checklist for

How to edit financial statements checklist for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial statements checklist for

How to fill out financial statements checklist for

Who needs financial statements checklist for?

Comprehensive financial statements checklist for form

Understanding financial statements

Financial statements serve as a foundational component in the accounting and finance landscape. They provide crucial insights into a company’s financial health, summarizing financial transactions over a specific period. The primary purpose of these documents is to facilitate decision-making by offering stakeholders, including investors, management, and regulatory bodies, an accurate picture of the organization's financial performance and position.

There are three main types of financial statements: the balance sheet, the income statement, and the cash flow statement. Each serves a unique purpose and collectively informs various stakeholders about the financial status and activities of an organization. Understanding these statements is paramount for accurate financial reporting and compliance.

The importance of a financial statements checklist

Implementing a financial statements checklist is vital for ensuring the accuracy and compliance of financial reports. It serves as a roadmap, guiding accountants through the complexities of financial documentation and helping to minimize the risk of errors. The presence of a checklist not only enhances the reliability of reports but also fosters trust and transparency among stakeholders.

Additionally, a checklist streamlines the document preparation process. By breaking down tasks and organizing necessary information, it allows individuals and teams to efficiently collaborate on document creation and reduces the likelihood of overlooking critical elements. Furthermore, it aids in maintaining consistency across financial reporting, ensuring that all necessary components are consistently addressed across periods.

Key components of a financial statements checklist

A well-structured financial statements checklist includes vital information for each statement type. Understanding this information is crucial for anyone involved in financial reporting, whether you are an accountant, a business owner, or a financial analyst. Each financial statement has unique requirements that must be addressed systematically.

For the balance sheet, the checklist should verify completeness in listing all assets, liabilities, and equity components. Similarly, the income statement should include detailed tracking of revenues, expenses, and ensure accurate net income is calculated. The cash flow statement needs comprehensive classifications of cash flows related to operating, investing, and financing activities.

In addition, including common financial statement metrics and ratios is vital for a comprehensive checklist. Liquidity, profitability, and solvency ratios play a crucial role in assessing the organization's financial stability and operational efficiency.

Step-by-step guide to using the financial statements checklist

To effectively utilize a financial statements checklist, it’s essential to follow a structured approach to gathering and organizing the necessary data. Start by prepping your documentation, pulling together all relevant financial records and transactions from your accounting system. This foundational step ensures you have everything needed before creating the individual statements.

Creating each financial statement involves specific steps, beginning with the balance sheet preparation. Start by listing all assets and categorizing them into current and non-current. Next, list liabilities and ensure that the equity presentation is accurate, reflecting retained earnings and additional paid-in capital.

Moving on to the income statement, revenue recognition is vital; ensure that all income is recorded in the right period. Track all expenses meticulously to achieve an accurate calculation of net income. Finally, the cash flow statement compilation requires classifying cash flows into operating, investing, and financing activities, followed by reconciling these flows to ensure completeness.

After compiling the statements, performing a final review and making necessary adjustments is crucial. This involves reconciliation against supporting documents, ensuring accuracy and completeness in financial reporting.

Common pitfalls in preparing financial statements

Despite the structured approach provided by a financial statements checklist, there remain common pitfalls that can lead to inaccurate reporting. One prevalent issue is overlooking critical assets or liabilities, which can skew financial insights. For example, if an organization forgets to include a significant liability, it may misrepresent its overall financial condition.

Errors in revenue recognition also pose a substantial risk. For instance, recognizing revenue too early or late can mislead stakeholders about the company's performance. Furthermore, misclassifying cash flows can distort a business’s operational effectiveness, affecting its perceived operational capacity. Addressing these potential pitfalls proactively ensures that financial reports are both accurate and reliable.

Best practices for financial statements reporting

Adopting best practices in financial statements reporting is essential for maintaining compliance with standards such as GAAP and IFRS. Organizations must ensure their financial statements are not only accurate but also reflective of the current regulatory landscape. Regularly updating checklists is a critical practice, helping organizations adapt to changes in financial regulations and reporting standards.

Moreover, utilizing software tools like pdfFiller can vastly enhance accuracy in document preparation. Such platforms facilitate collaboration among colleagues, enabling real-time updates and edits, while eSignature features streamline the approval process. This integration supports accountants and organizations in adhering to best practices and resource efficiency.

FAQs related to financial statements checklist

Individuals and teams must understand who can benefit from a financial statements checklist. Organizations of all sizes, from small businesses to large enterprises, can utilize this checklist to ensure thorough financial reporting. Additionally, preparers should know how often to prepare these statements; typically, financial statements are prepared at least quarterly, aligning with regulatory requirements and aiding in strategic decision-making.

Auditors also play a pivotal role in the financial statements preparation process; they assess the accuracy and compliance of reported figures, ensuring adherence to applicable guidelines. Their expertise can significantly enhance the credibility of the financial statements, fostering trust among stakeholders.

Real-world applications and scenarios

In practice, organizations that implement financial statements checklists can greatly improve their financial reporting effectiveness. For instance, several case studies illustrate how a diligent approach can resolve compliance issues, particularly in organizations that operate in heavily regulated sectors. By adhering to a checklist, these organizations mitigate risks associated with non-compliance and enhance their reputational standing.

Examples from various industries demonstrate that companies that routinely utilize checklists for financial reporting significantly decrease errors in their documents, streamlining internal processes and saving time. This proactive approach not only protects the organization but also contributes positively to its financial management strategies.

Incorporating technology in financial reporting

The ongoing advancement of technology has transformed financial reporting practices, particularly through cloud-based solutions for document management. Leveraging such solutions can simplify the document creation and approval process, allowing for easy access and updates from anywhere. Platforms like pdfFiller enhance this experience by providing interactive tools that facilitate effective financial reporting.

Utilizing these technological advancements enables accountants and organizations to bolster accuracy and efficiency in financial reporting. The capacity for collaborative editing not only accelerates the preparation process but creates a seamless workflow that minimizes errors, leading to better financial outcomes.

Looking ahead: future trends in financial reporting

The future of financial reporting is shaped by trends that emphasize the need for transparency and accuracy in document presentation. Regulatory bodies are increasingly introducing changes that mandate clearer disclosures, challenging organizations to adapt their practices accordingly. Emerging technologies also predict significant developments in document automation, streamlining repetitive tasks, and enabling more strategic financial analysis.

As companies prepare for these advancements, understanding regulatory changes that impact financial statement preparation is essential. Organizations must stay informed about upcoming regulations to remain compliant while also harnessing the power of technology to enhance their financial reporting capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find financial statements checklist for?

How do I edit financial statements checklist for in Chrome?

How do I fill out the financial statements checklist for form on my smartphone?

What is financial statements checklist for?

Who is required to file financial statements checklist for?

How to fill out financial statements checklist for?

What is the purpose of financial statements checklist for?

What information must be reported on financial statements checklist for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.