Get the free Nigerian Treasury Bill (ntb) Application/agreement

Get, Create, Make and Sign nigerian treasury bill ntb

How to edit nigerian treasury bill ntb online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nigerian treasury bill ntb

How to fill out nigerian treasury bill ntb

Who needs nigerian treasury bill ntb?

Understanding the Nigerian Treasury Bill NTB Form

Understanding Nigerian treasury bills (NTBs)

Nigerian Treasury Bills (NTBs) are short-term debt securities issued by the Federal Government of Nigeria to fund budget deficits or manage liquidity in the economy. Essentially, when you invest in NTBs, you are lending money to the government in exchange for periodic interest payments, with an assurance of capital return at maturity. They serve as a vital component of the Nigerian financial system, providing not only a means for the government to finance expenditures but also offering individuals and institutions a safe investment avenue.

NTBs are particularly important as they contribute to economic stability and liquidity in the financial markets. Investors, ranging from individuals to large institutions, leverage these instruments to diversify their portfolios and manage market volatility. By attracting investment in government securities, they help stabilize the economy and are instrumental in governmental financial planning.

Benefits of investing in NTBs

Investing in Nigerian Treasury Bills comes with a plethora of advantages that cater particularly well to conservative investors seeking lower-risk options. One of the most significant benefits is the financial security NTBs offer. These instruments are backed by the government, making them low-risk options compared to stocks or mutual funds, which may experience high volatility. Investors can be assured of receiving their capital back at maturity, along with predetermined interest rates.

Additionally, NTBs present predictable returns through fixed interest rates. Unlike variable-interest instruments where returns can fluctuate, NTBs afford investors the advantage of knowing exactly what their returns will be at cutoff, making cash flow predictions straightforward. Furthermore, NTBs provide flexibility in tenor options, with several maturity periods available to cater to different investment horizons. For instance, investors can choose between short, medium, or longer tenors based on their cash flow needs.

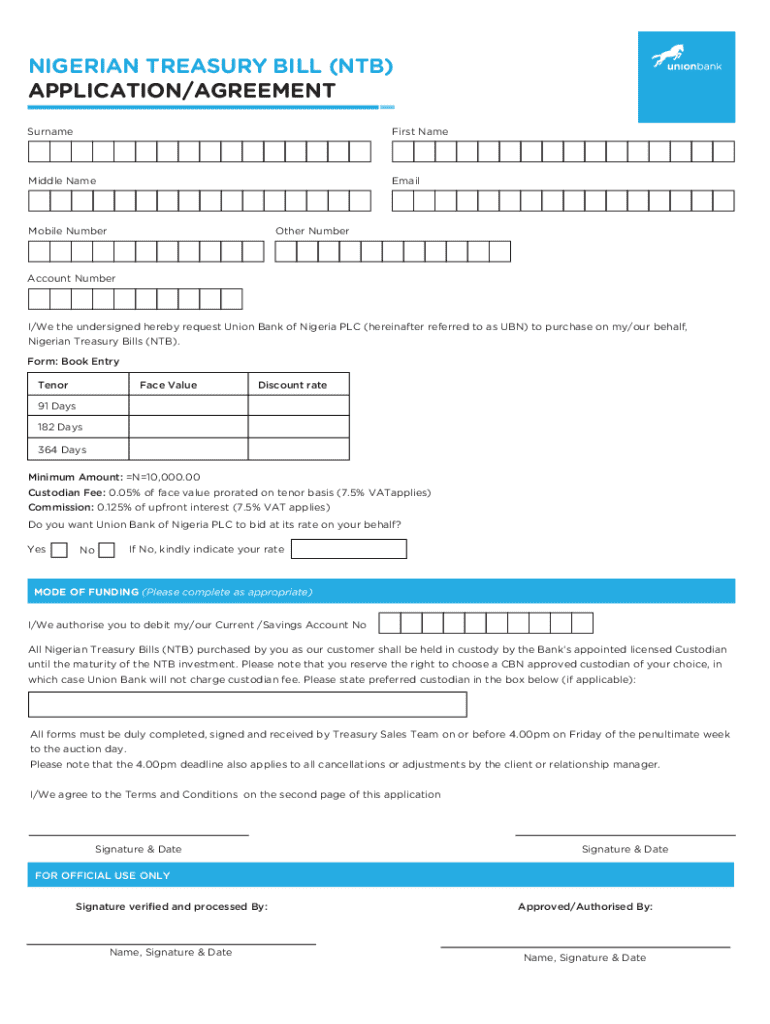

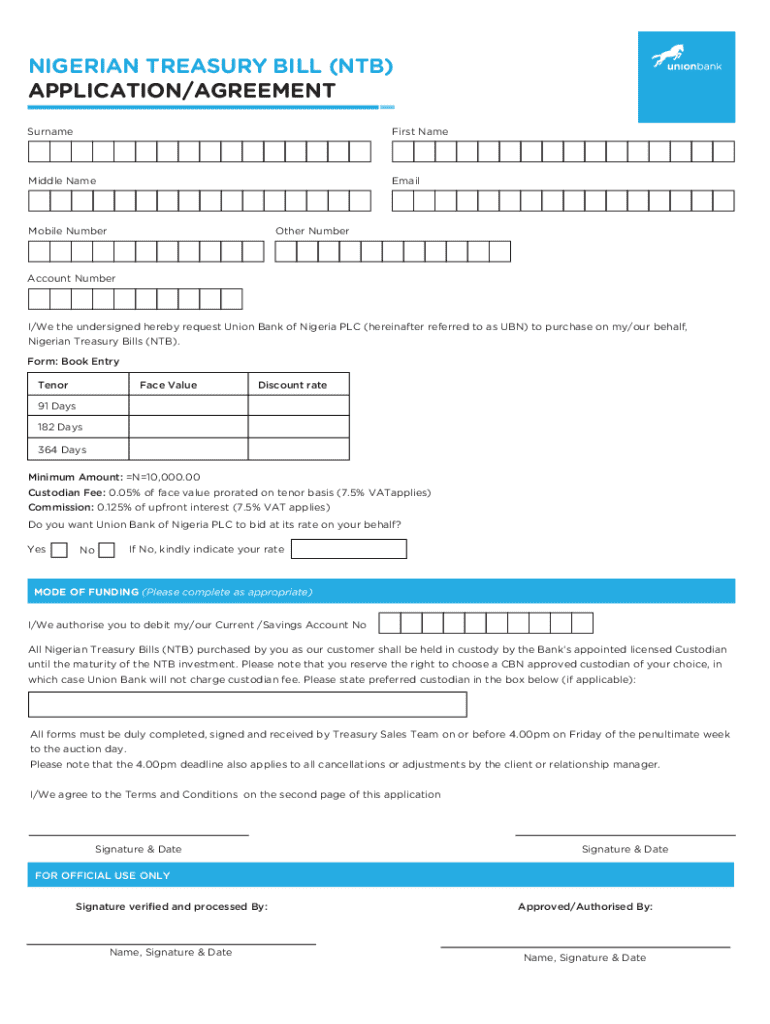

How to fill out the Nigerian Treasury Bill NTB form

Filling out the Nigerian Treasury Bill NTB form may seem daunting, but with a systematic approach, it becomes manageable. Start by gathering all required information, including personal identification details such as your National Identification Number, or other ID documents that validate your identity. Additionally, prepare your financial information, including your bank account details for where the funds will be sourced from and where interest payments should be directed.

Next, when filling in the NTB form, pay attention to detailed instructions provided for each section. Ensure that each entry is accurate and complete to avoid delays or rejections. Once the form is filled, you have two options for submission: online via the Central Bank's e-portal or physically at authorized bank branches. Make sure to retain a copy of your submission for your records.

Common mistakes to avoid

Investors often make common errors while completing the NTB form. One frequent mistake is entering incorrect personal identification numbers, which could lead to your application being rejected. It's also crucial to ensure your financial details correspond with your bank records; discrepancies here can set back the process considerably. Failing to sign the form or neglecting to date it are other typical oversights that can result in delays in processing.

To sidestep these issues, take the time to review your entries. Cross-reference all information against your documents to ensure accuracy. Regional variations in requirements can exist; hence, familiarize yourself with specifics that pertain to your area or chosen bank for submission. Consistency and attention to detail can save you from potential hassles.

Additional considerations while investing in NTBs

While the benefits of NTBs are clear, investors should also be aware of additional considerations that might impact their investment. Market risks are inherent in any investment-scenario, and movements in the macroeconomic landscape such as inflation, changes in interest rates, or political shifts can influence returns. Understanding these factors is crucial for making informed decisions regarding NTBs.

Navigating regulatory compliance is another essential aspect. Investors must be cognizant of the legal requirements stipulated by the Central Bank of Nigeria to prevent any inadvertent non-compliance issues. Familiarizing yourself with these policies and procedures adds another layer of protection to your investment decisions.

How pdfFiller enhances your NTB form experience

pdfFiller provides an excellent platform for efficiently handling your NTB forms by offering seamless document editing and eSigning features. This innovative, cloud-based tool allows you to fill and sign NTB forms from the comfort of your home, without the need for printing or physically mailing documents. With a user-friendly interface, users can easily navigate the NTB form, making the investment process simpler and more accessible.

Collaboration features are also noteworthy. Whether you're working with colleagues, financial advisors, or family members, pdfFiller supports real-time collaboration on document preparation, ensuring that everyone has a say in the process. Moreover, its document management capabilities enable you to store and manage your NTB forms efficiently, allowing easy retrieval whenever necessary. This results in enhanced organization and peace of mind throughout your investment journey.

Frequently asked questions (FAQ)

Investing in NTBs generates numerous questions from potential investors, primarily revolving around accessibility and procedural clarity. One frequently asked question is about the minimum investment amount required for NTBs. Generally, the minimum investment is set at ₦10,000, making it relatively accessible for average consumers.

Another common inquiry involves the frequency of NTB auctions. The Central Bank of Nigeria typically holds NTB auctions every two weeks, presenting consistent opportunities for investors. Additionally, if an investor misses the maturity date, it is critical to contact the issuing institution immediately to know the implications, as penalties may apply.

Staying informed about Nigerian treasury bills

To maximize your investments in NTBs, staying informed is imperative. Regularly consult government publications and reputable financial news platforms for updates on NTB interest rates, auction schedules, and new regulations affecting treasury bills. Such resources help investors adapt their strategies to the latest information and market trends, ensuring they make educated decisions.

Investors can also utilize various tracking tools and financial websites dedicated to treasury bill performance. These platforms provide real-time data, market analyses, and forecasts that further aid in analyzing potential investment risks and returns. By keeping yourself informed, you position your investment strategy to be proactive rather than reactive.

Contact information for further assistance

Should you need additional help while filling out the Nigerian Treasury Bill NTB form, numerous resources are available. From the Central Bank of Nigeria’s offices to authorized banks, assistance is just a visit or call away. Additionally, pdfFiller offers comprehensive customer support services. Visit our website for guidance, instructional content, and direct support contacts, ensuring you are never alone on your investment journey.

Further, online help sections pervade financial institutions' websites, providing FAQs and direct lines to support teams meant to guide investors like you. Proper avenues for assistance can greatly reduce the chances of making mistakes during the investment process.

Connecting with other financial instruments

Exploring how NTBs interact with other investment options can significantly enhance an investor’s strategy. Treasury bills often share characteristics with mutual funds and stocks, such as market risk and return variables, creating opportunities for portfolio diversification. For instance, while NTBs are typically low-risk, integrating mutual funds or other equities that yield higher returns could align with an investor’s risk appetite.

Moreover, diversifying your investment portfolio plays a crucial role in risk mitigation. A well-curated mix of NTBs, stocks, real estate, and mutual funds can ensure steady returns while combating extreme market fluctuations. It’s essential to evaluate not only what instruments to invest in but also how they relate to each other, how they perform under various market conditions, and how they fit into your overall financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get nigerian treasury bill ntb?

Can I create an eSignature for the nigerian treasury bill ntb in Gmail?

How do I edit nigerian treasury bill ntb on an Android device?

What is nigerian treasury bill ntb?

Who is required to file nigerian treasury bill ntb?

How to fill out nigerian treasury bill ntb?

What is the purpose of nigerian treasury bill ntb?

What information must be reported on nigerian treasury bill ntb?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.