Understanding the Buy to Let Mortgage Form: A Comprehensive Guide

Understanding buy to let mortgages

A buy to let mortgage is specifically designed for individuals who purchase property with the intention of renting it out to tenants. Unlike standard residential mortgages, which are typically aimed at homeowners, buy to let mortgages cater to investors. Understanding how these work is crucial for successful property investment.

The main distinguishing factor is that buy to let mortgages are assessed on the potential rental income rather than solely on the borrower's personal income. This can offer opportunities for individuals looking to invest in real estate without depleting their personal finances.

Higher income potential from rental yields.

Diversification of asset portfolio, reducing investment risk.

Tax implications may favor property investors, such as possible deductions for expenses.

Overall, buy to let mortgages can provide lucrative income streams, making them attractive to both seasoned and novice investors.

The importance of the buy to let mortgage form

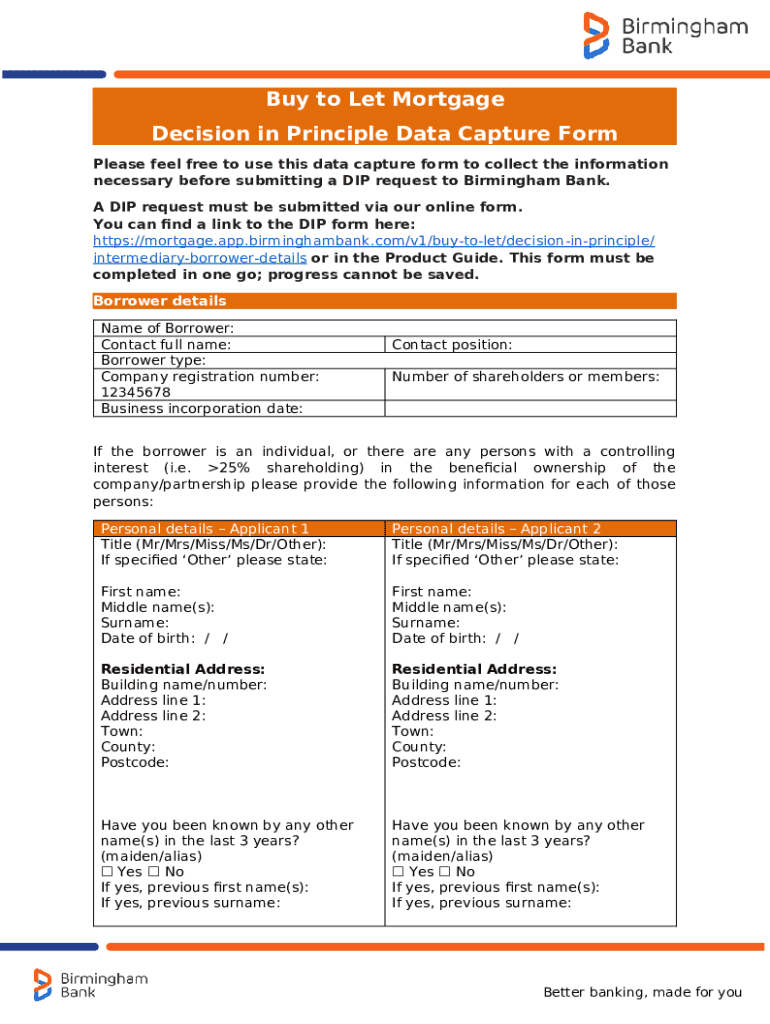

Completing the buy to let mortgage form accurately is essential. This form serves as the official document that lenders use to evaluate your application. Understanding its key features is vital for efficient completion.

Typically, the form contains sections detailing your personal information, financial situation, and specifics about the property you intend to buy. Familiarizing yourself with the terminology used can also ensure you understand what is required.

Personal details including name, address, and contact information.

Financial information such as income, existing debts, and credit status.

Property details including location, type, and planned rental yield.

Errors in this form can lead to delays or even denial of your application. Therefore, ensuring compliance with lender requirements is vital to increase your chances of a successful application.

Gathering required information before filling out the form

Before tackling the buy to let mortgage form, assembling the necessary financial information is paramount. This includes your personal financial details such as income, existing debts, and credit score, along with key details about the property.

The clearer your financial picture is, the easier it will be to complete the form. Be sure to gather all necessary documentation ahead of time to streamline the process.

Recent payslips and tax returns to prove your income.

Identification documents such as passports or driver's licenses.

Details about the property, including purchase price and type.

Having all required documents at your fingertips beforehand will not only simplify your experience but also prevent potential roadblocks during the application process.

Step-by-step guide to completing the buy to let mortgage form

When it's time to fill out the buy to let mortgage form, breaking it down into manageable sections helps ensure you don't miss crucial information. Starting with your address and personal details, it's critical to input accurate information.

Next, when delving into the financial information and assets section, report accurately while being mindful of any existing debts. In the declarations section, always err on the side of transparency.

Address and personal details: Ensure all information is up-to-date and correctly spelled.

Financial information and assets: Provide complete details about income and debts.

Declarations: Be honest about your financial status to avoid complications.

Each section should be thoroughly reviewed to avoid common pitfalls, such as missing information or errors that may lead to delays. Always check for completeness and accuracy before finalizing.

Editing and reviewing your form

After filling out the buy to let mortgage form, it's essential to undertake a thorough review. Utilizing tools like pdfFiller makes this process straightforward, allowing for easy editing of any mistakes you might have overlooked.

Collaboration also plays a crucial role in this stage. Sharing the draft form with trusted individuals for feedback can uncover areas that need adjustment, ensuring your final submission is as polished as possible.

Checklist before submission: Make sure all sections are filled, and required documents are attached.

Double-check compliance with lender requirements to prevent delays.

Seek feedback from peers or professionals to enhance accuracy.

Best practices for final reviews can make a significant difference in the approval process, so take your time to ensure that everything is in order.

Submitting the buy to let mortgage form

When it comes to submitting the buy to let mortgage form, understanding different methods is important. Many lenders now offer online submission processes, making it convenient to submit your application without the hassle of traditional mailing.

However, if you opt for traditional mailing, ensure that you follow any specific instructions provided by your lender to avoid unnecessary complications.

Online submission: Quick and efficient method for modern applications.

Traditional mailing: Ensure all documents are properly addressed and sent on time.

Lender-specific instructions: Always adhere to guidelines provided during the application process.

Post-submission, be proactive in monitoring your application status. Knowing what to expect after you send your application can ease any anxieties about the approval timeline.

Managing communication with lenders

Maintaining open lines of communication with your lender is key throughout the buy to let mortgage process. Being proactive can provide insights on the progression of your application and any necessary follow-ups.

Additionally, knowing how to handle any queries or requests for additional information can strengthen your relationships with lenders. Being responsive to their requests demonstrates your commitment and professionalism.

Best practices for following up: Regularly check in with your lender to stay informed.

Proactive responses to queries: Address any lender requests promptly for smoother processing.

Maintain professionalism in all communications to build trust with lenders.

Managing communication is often overlooked, yet it plays a vital role in achieving a successful mortgage application.

Using pdfFiller for ongoing document management

Using pdfFiller not only simplifies the completion of the buy to let mortgage form but also offers long-term solutions for document management. With features that allow you to store and retrieve your mortgage-related documents, you can maintain an organized file system.

The ability to track updates and signatures also ensures that all your documents are current and compliant with lending policies. This capability is invaluable as you navigate your investment journey.

Document storage: Keep all mortgage-related documents in one accessible location.

Updates and signatures: Easily track modifications and signatories to maintain document integrity.

Collaboration with professionals: Share documents effortlessly with mortgage brokers or agents.

pdfFiller empowers users to create, edit, and manage their documents seamlessly, making it an essential tool for anyone involved in property investment.

Interactive tools and resources

As you navigate the world of buy to let mortgages, utilizing interactive tools and resources can help enhance your decision-making process. Mortgage calculators, for instance, can provide estimates of potential returns and costs associated with your investment.

Engaging with interactive FAQs can also clarify common concerns and guide you through the intricacies of the mortgage process.

Mortgage calculators: Assess potential returns on your buy to let investment.

Budgeting tools: Help in planning finances related to your property.

Engaging FAQs: Address typical queries that arise during the mortgage process.

Employing these tools can help demystify the mortgage application process, empowering you to make well-informed investment decisions.

Real-life success stories & testimonials

Many successful buy to let investors have paved their way through diverse strategies that highlight the potential of property investment. These real-life success stories can provide valuable insight into effective investment practices.

From those who started with single family homes to individuals branching out into larger multifamily units, their experiences underscore the importance of thorough research, calculated risks, and adaptability in the buy to let market.

Case studies showcasing diversity in investment strategies.

Lessons learned from failed investments and the importance of resilience.

Tips from experienced investors on navigating challenges effectively.

Learning from these narratives not only inspires confidence but also prepares you for the hurdles that may arise during your investment journey.

Frequently asked questions

As prospective applicants dive into the buy to let mortgage landscape, common queries often arise. These queries typically relate to application processes, eligibility requirements, interest rates, and repayment terms.

Addressing these concerns upfront can ease anxiety and clarify expectations as you embark on your property investment journey.

What are the key eligibility criteria for a buy to let mortgage?

How is rental income evaluated by lenders?

What are the tax implications for buy to let property owners?

In conclusion, possessing a thorough understanding of the buy to let mortgage form and the entire application process can significantly enhance your chances of success in the property investment realm.