Get the free Cca – Employer’s Return of Income Tax Withheld

Get, Create, Make and Sign cca employers return of

Editing cca employers return of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cca employers return of

How to fill out cca employers return of

Who needs cca employers return of?

Understanding the CCA Employers Return of Form: A Comprehensive Guide

Understanding the CCA Employers Return of Form

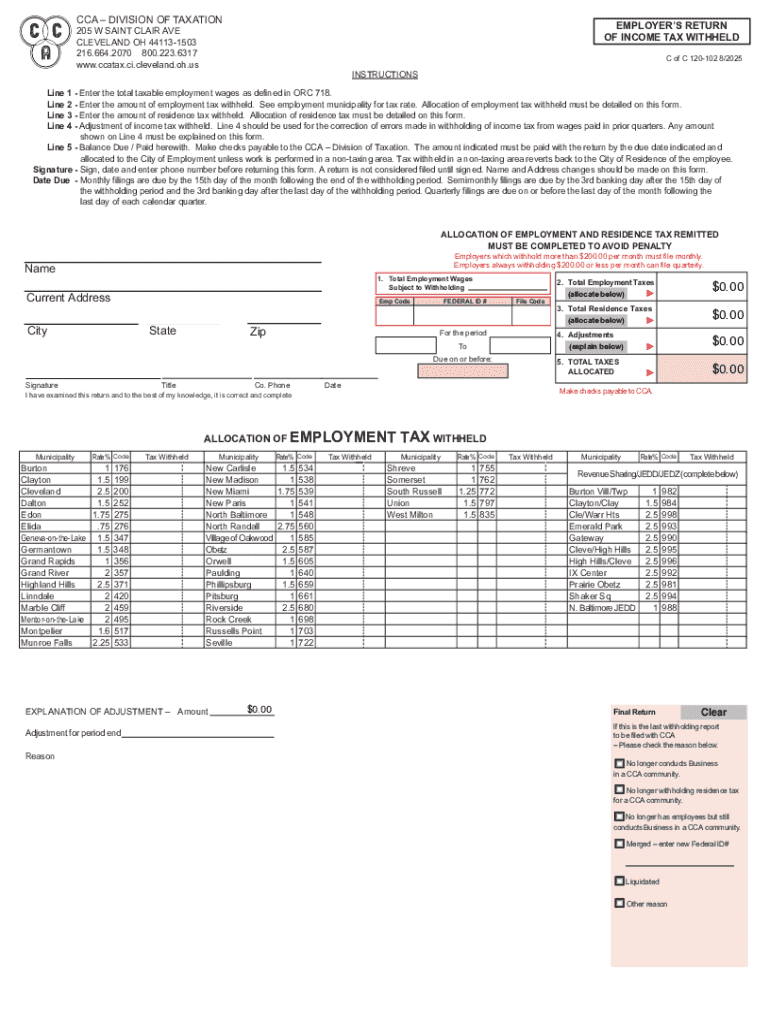

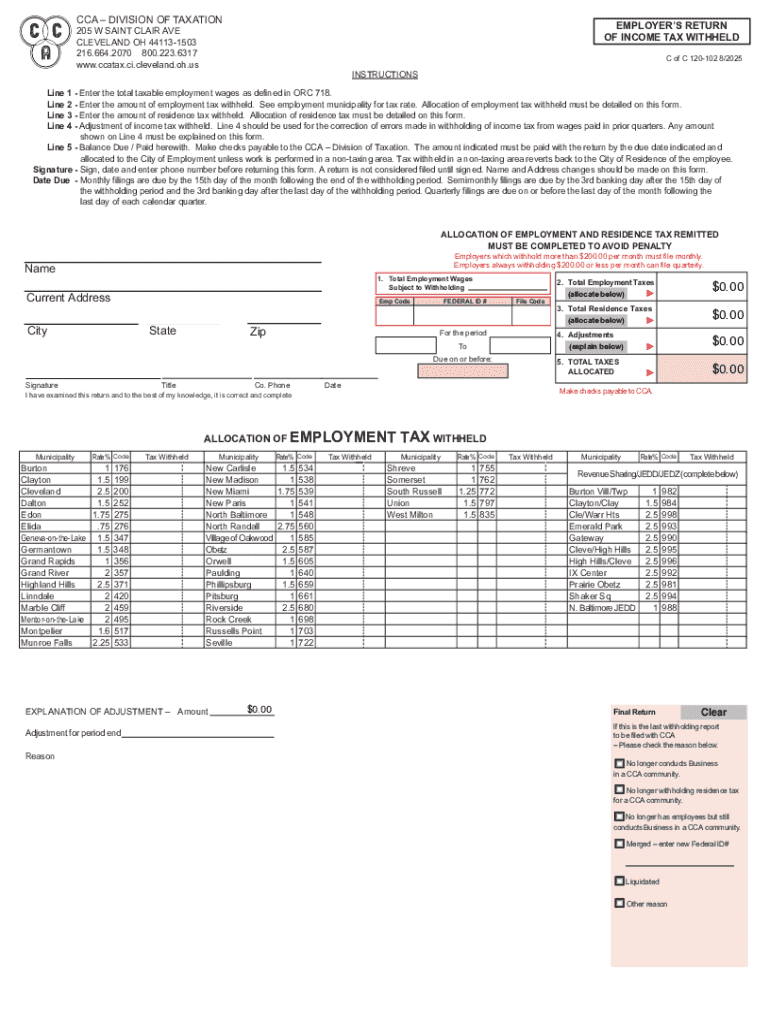

The CCA Employers Return of Form is a critical document that city carrier assistant (CCA) employers must complete to report an employee's hours and wages accurately. This form facilitates the assessment of eligibility for various benefits, including health insurance and retirement plans, and ensures compliance with postal service regulations.

Completing the CCA form is not just a bureaucratic requirement; it plays a pivotal role in maintaining transparency and adhering to regulatory demands. Employers must ensure that their report is accurate to avoid penalties or delays in employee benefits.

Preparing to complete the CCA Employers Return of Form

Before tackling the CCA Employers Return of Form, employers should prepare by gathering essential information. This ensures a smooth filling process and helps in minimizing errors that could lead to delays.

Key information includes details about the employee, such as their full name, employee ID, and Social Security number, along with employer identification, including the business name and tax ID. Accurate reporting of hours worked and wages earned is also crucial, as misreporting can result in penalties.

It's also important to avoid common mistakes such as miscalculation of expected hours worked or incorrect employee data entries. Employers should double-check their records to ensure accuracy, which can save time and prevent complications down the line.

Step-by-step guide for filling out the CCA Employers Return of Form

Completing the CCA Employers Return of Form can be straightforward if you follow a step-by-step guide. Let’s delve into how to effectively fill out the form using pdfFiller, a document management tool that simplifies this process.

Following these steps diligently will ensure that the CCA Employers Return of Form is completed accurately, paving the way for a smoother processing experience.

Managing your CCA Employers Return of Form with pdfFiller

After submitting the CCA Employers Return of Form, managing the document is essential for future reference and updates. With pdfFiller, employers can effortlessly edit or update the form even after submission. This flexibility ensures that changes in employee data or hours can be handled promptly.

Moreover, pdfFiller provides collaborative tools that allow team members to engage with the document effectively. This feature is particularly useful when multiple stakeholders need to review and sign off on the form.

With pdfFiller’s cloud features, employers can store and organize their CCA Employers Return of Form for easy access and reference, boosting overall efficiency in document management.

Troubleshooting common issues with the CCA Employers Return of Form

Errors can occur during the completion of the CCA Employers Return of Form, which is why knowing how to address common issues is vital. Should you encounter any discrepancies or unresolvable errors during the submission process, it’s crucial to know the proper channels to seek assistance.

Being proactive in checking for updates and changes to the form requirements can save you time and trouble. Regulations may evolve, and keeping up-to-date ensures compliance.

FAQs about CCA Employers Return of Form

Understanding the intricacies of the CCA Employers Return of Form can raise several questions for employers. Some of the most frequently asked questions revolve around timelines, deadlines for submission, and penalties for non-compliance.

Being armed with this knowledge can help employers navigate their responsibilities with confidence.

The benefits of using pdfFiller for document management

Utilizing pdfFiller for managing the CCA Employers Return of Form comes with a myriad of advantages. The platform's robust tools make it easy to handle any aspect of document management seamlessly.

From editing PDFs to eSigning and collaborating within teams, pdfFiller consolidates these features into a single, cloud-based platform that enhances productivity and efficiency.

Additional tools and resources for employers

Employers may also benefit from other tools and resources that complement the CCA Employers Return of Form. Identifying related tax forms and employee documentation can streamline broader payroll and compliance processes.

Guidance on other employee forms can aid in ensuring urgency and relevance during document handling.

User testimonials and success stories

Numerous employers have shared how pdfFiller has eased their document management processes. User testimonials reveal a common theme: simplicity and efficiency.

Case studies highlight significant time savings and reduced errors, showcasing how employing pdfFiller can lead to a more organized approach to managing necessary documentation.

Get started with your CCA Employers Return of Form today

The CCA Employers Return of Form is a vital component of employer responsibilities, and using pdfFiller can streamline the process significantly. With user-friendly features designed for comprehensiveness and ease of access, starting with your CCA form has never been easier.

Dive into the world of efficient document management today and discover how pdfFiller can empower you to handle your CCA Employers Return of Form effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cca employers return of in Chrome?

Can I create an electronic signature for the cca employers return of in Chrome?

Can I create an electronic signature for signing my cca employers return of in Gmail?

What is cca employers return of?

Who is required to file cca employers return of?

How to fill out cca employers return of?

What is the purpose of cca employers return of?

What information must be reported on cca employers return of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.