Get the free Marks-roos Yearly Fiscal Status Report

Get, Create, Make and Sign marks-roos yearly fiscal status

Editing marks-roos yearly fiscal status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marks-roos yearly fiscal status

How to fill out marks-roos yearly fiscal status

Who needs marks-roos yearly fiscal status?

Understanding the Marks-Roos Yearly Fiscal Status Form

Understanding the Marks-Roos yearly fiscal status form

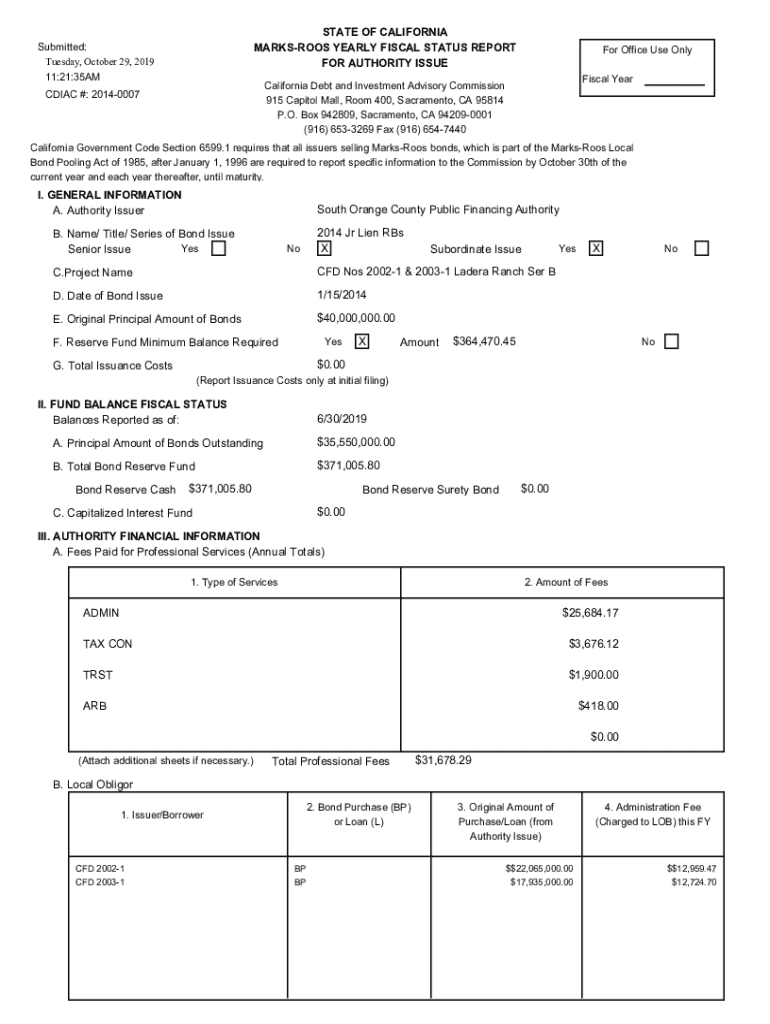

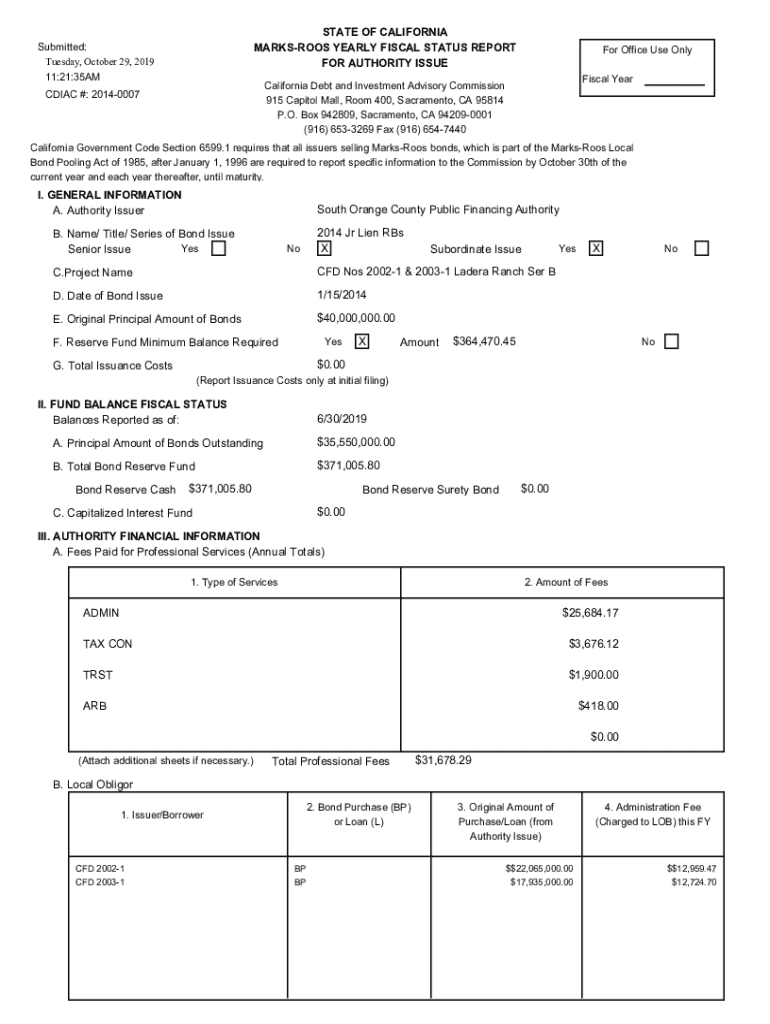

The Marks-Roos yearly fiscal status form is a crucial document for entities complying with California's Marks-Roos Local Bond Pooling Act of 1995. This law allows local agencies to pool their debts for financing public infrastructure, and the yearly fiscal status form is essential for accountability. By providing transparency into the financial activities associated with these pooled funding arrangements, the form ensures that local government bodies adhere to sound financial practices and enables regulators to monitor fiscal health effectively.

The Marks-Roos Act was established to facilitate local government financing while maintaining oversight over the management of public funds. Thus, the significance of this fiscal status form cannot be overstated. It is designed not just to fulfill regulatory requirements but also to serve as a tool for stakeholders, including taxpayers, to understand where and how public money is being utilized.

Who must file the Marks-Roos form?

Organizations that must file the Marks-Roos yearly fiscal status form include local agencies that have engaged in a pooling agreement under the Marks-Roos Act. These agencies encompass municipalities, counties, and special districts. Eligibility criteria dictate that only those engaging in specific types of bond financing qualify for the filing requirement. As such, understanding your organization’s status regarding the types of bonds issued is vital.

Certain entities may be exempt from submitting this form. For instance, those that have not engaged in any financial pooling activity, or that do not fall under the definitions set forth by the Marks-Roos Act, are not required to file. This specialized consideration ensures that only pertinent organizations are burdened with additional paperwork, aligning regulatory focus with actual financial activity.

Key components of the Marks-Roos yearly fiscal status form

The Marks-Roos yearly fiscal status form consists of several required sections that provide comprehensive insights into a filing agency's finances. These sections aim to capture a wide range of data, from basic financial statements to specific details about expenditures and revenues, thus presenting a holistic view of the agency’s fiscal status. The form's design ensures that all necessary information is systematically documented.

Included among the key data points required are: assets and liabilities, which provide a snapshot of what the agency owns versus what it owes; revenues generated from various sources, and expenditures detailing how funds are used. Each agency must carefully record this information, as inaccuracies could lead to compliance issues or not reflect the true financial picture.

Accurate data entry is paramount since inaccuracies can lead to questions regarding transparency and compliance. Errors in reporting can also have financial implications, affecting borrowing power and the ability to secure future funds.

Step-by-step instructions for completing the form

Completing the Marks-Roos yearly fiscal status form requires careful preparation and documentation. Before diving into the form, it’s crucial to gather all necessary financial documentation, including past financial statements, audit reports, and supporting documents. Having these materials organized will streamline the filling process and reduce potential errors.

Each section of the form must be completed methodically. Start with identifying the entities involved in pooled financing, then progress through each section, entering financial data as accurately as possible. When filling out numerical fields, double-check figures to ensure no simple mistakes, like transposing numbers, undermine your submission.

Common mistakes to avoid include failing to update the latest financial information and neglecting to review submission guidelines. Should you find mistakes after submitting, rectifying them often requires filing an amendment, which may further complicate the regulatory process.

Tools and resources for managing your Marks-Roos form

Using pdfFiller offers significant advantages in managing your Marks-Roos yearly fiscal status form efficiently. The platform provides various interactive features for users, including editable PDF capabilities and collaboration tools that allow multiple team members to provide input and revisions. This is especially useful for local agencies that may involve several staff members in filling out and reviewing the form.

Additionally, managing document storage in the cloud provides the flexibility of accessing these forms from anywhere. Being able to upload and organize financial documents securely means that all stakeholders can stay informed and up-to-date, which is critical for maintaining accountability.

Filing and submission process

Navigating the filing and submission process involves knowing where and how to submit the Marks-Roos yearly fiscal status form. Online submission is often the most efficient route, allowing for quick processing and fewer delays. Agencies typically must adhere to specific deadlines, usually aligned with their fiscal years, to avoid penalties for late submission.

Once submitted, it’s important to check the status of your filing regularly. Most jurisdictions provide a method for tracking submissions and will send an acknowledgment of receipt, which serves as proof that your submission was received and is under review.

Navigating compliance post-submission

After filing the Marks-Roos yearly fiscal status form, entities must understand the compliance landscape. Regulatory review often follows, where agencies evaluate the submitted forms for accuracy and completeness. It is prudent for organizations to prepare for potential audits, which may require providing additional documentation and justifying financial entries.

Document retention is essential; organizations must keep a record of submitted forms along with any supporting materials for a specified period. This aids in compliance if a regulatory body requests further information. Establishing a collaborative relationship with auditors and compliance officers ensures that any issues can be addressed swiftly.

Frequently asked questions (FAQs)

The Marks-Roos yearly fiscal status form comes with many common queries, often concerning submission deadlines and penalties for late filings. It’s essential to keep a calendar to track these dates closely, as missing them can result in enforced penalties. Additionally, if there’s ever a need to amend the form after submission, specific questions may arise regarding how to do so without complications.

For more support, agencies can explore additional resources such as user manuals and consultations with pdfFiller’s support team. Access to ongoing updates and insights into IRS-related inquiries can significantly streamline the process.

Case studies: successful filings of the Marks-Roos yearly fiscal status form

Examining real-life examples of successful filings of the Marks-Roos yearly fiscal status form reveals valuable strategies for best practices. For instance, a nonprofit organization streamlined its filing process by adopting a team-based approach, ensuring clarity of roles and responsibilities among staff members. This collaborative effort allowed them to cross-verify financial entries and further reduce errors due to oversight.

On the other hand, a municipal corporation successfully navigated the process by utilizing technology tools. They implemented a document management system that allowed for easy updates and revisions to financial documents. The approach increased efficiency as well as accuracy, showcasing how leveraging technology can play a significant role in effective fiscal reporting.

Enhancing your document skills with pdfFiller

Fostering robust document management skills can significantly enhance the experience of working with the Marks-Roos yearly fiscal status form. pdfFiller offers training resources, including how-to webinars and tutorials that equip users with the knowledge to navigate the platform confidently. Engaging with a user community forum allows individuals to share insights and strategies, further enriching the learning experience.

Beyond the Marks-Roos form, exploring other templates available on pdfFiller can yield additional benefits, helping agencies automate and streamline various document workflows. Integrating such templates into everyday operations leads to smoother processes, thus allowing for more focus on the essential tasks of fiscal management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my marks-roos yearly fiscal status in Gmail?

How do I edit marks-roos yearly fiscal status in Chrome?

How do I fill out marks-roos yearly fiscal status on an Android device?

What is marks-roos yearly fiscal status?

Who is required to file marks-roos yearly fiscal status?

How to fill out marks-roos yearly fiscal status?

What is the purpose of marks-roos yearly fiscal status?

What information must be reported on marks-roos yearly fiscal status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.