Get the free Gift Card Distribution Log

Get, Create, Make and Sign gift card distribution log

Editing gift card distribution log online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gift card distribution log

How to fill out gift card distribution log

Who needs gift card distribution log?

Gift Card Distribution Log Form: Detailed How-to Guide

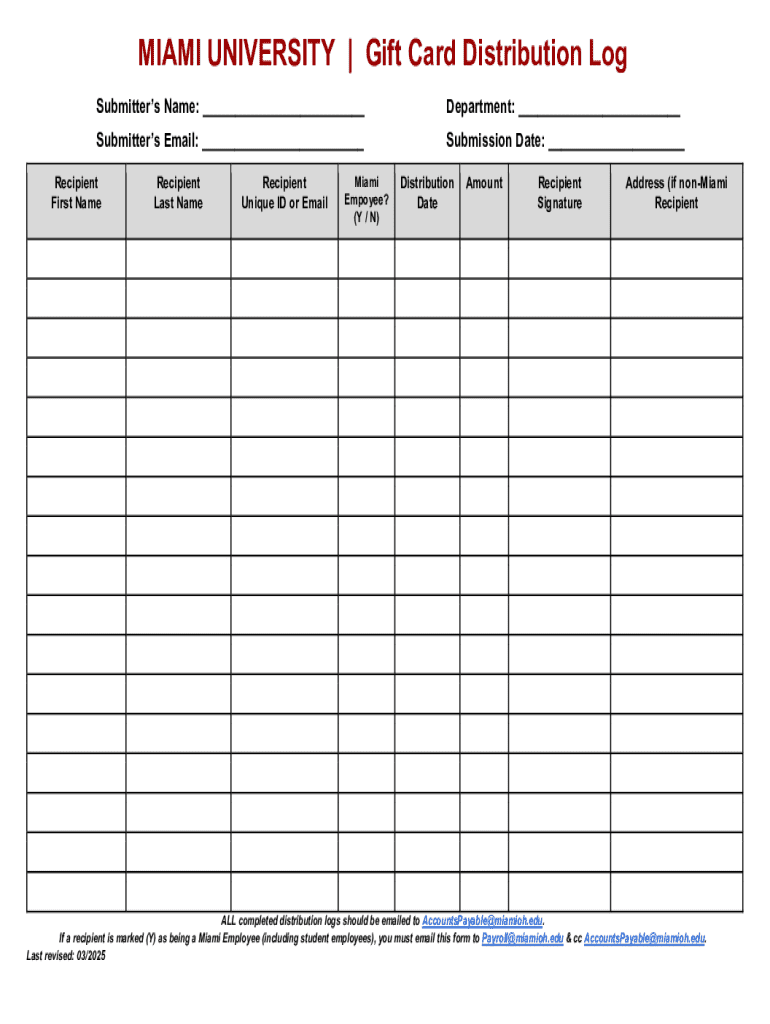

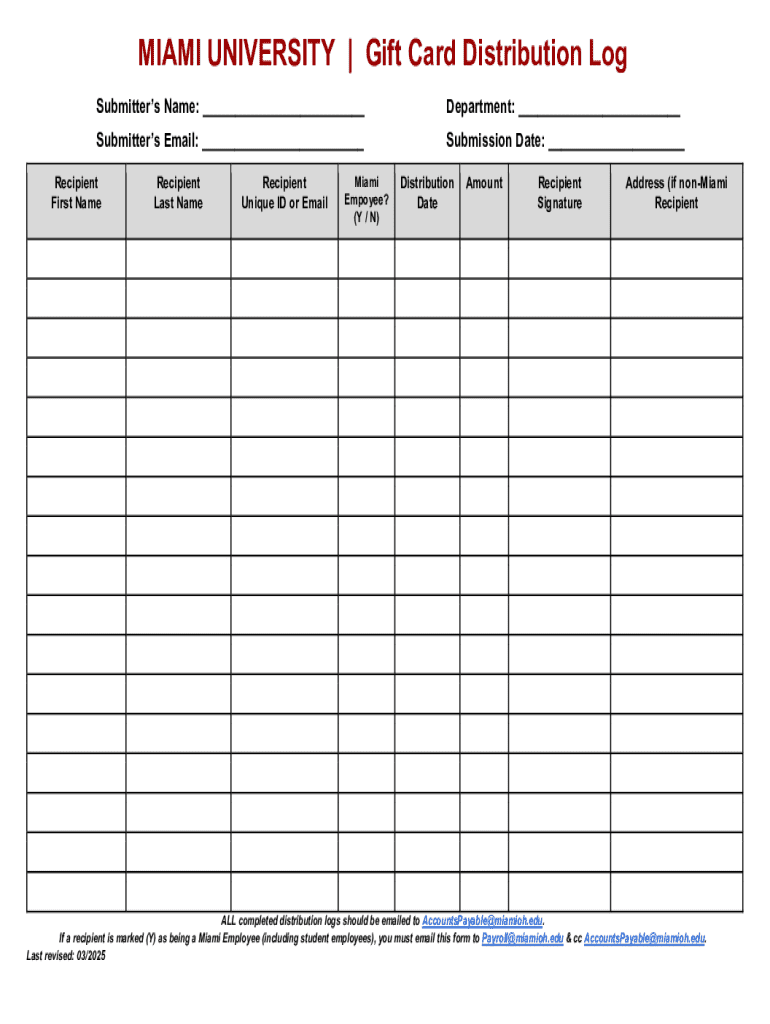

Understanding the gift card distribution log form

A gift card distribution log form is an essential tool businesses and organizations use to track the issuance of gift cards. This document serves not only as a record but also as a safeguard against potential misuse or fraud. By utilizing this form, companies can ensure that each distribution is accounted for and in line with their policies. Proper tracking of gift card distribution is vital for maintaining transparency and accountability, which are cornerstones of operational integrity.

The significance of a gift card distribution log is highlighted during audits and financial reviews, as it allows organizations to present precise records of gift card issuance. This becomes particularly important in settings where gift cards may be a part of incentive programs or employee rewards. Moreover, tracking gift card inventory helps organizations avoid over-issuance, thereby safeguarding against loss and financial discrepancies.

Components of the gift card distribution log form

To create an effective gift card distribution log form, several key components must be included. Required fields capture the essential details needed for tracking, while optional fields can enhance the log’s usefulness by providing additional context. Each component plays a critical role in maintaining order and clarity for both the issuer and recipient, ensuring a streamlined distribution process.

The required fields typically include the name of the recipient, the amount of the gift card, the date of distribution, and the purpose of the card, if applicable. These fields lay the foundation for tracking gift card distribution accurately. Optional fields such as the expiration date, gift card code, and issuer or department name can provide enhanced tracking capabilities and facilitate more comprehensive reporting.

Steps to complete the gift card distribution log form

Completing a gift card distribution log form requires careful attention to detail. Following a structured approach can ensure the accuracy and completeness of the recorded information. First, it is crucial to gather all necessary information about the recipient and the gift card before attempting to fill out the form. This preparation minimizes the risk of errors and omissions.

Once you have gathered all the necessary information, begin filling out the form by following these step-by-step instructions. Input the recipient's name in the designated field. Next, specify the gift card amount clearly. Record the distribution date accurately as this information is central to tracking and reporting. Optionally, add any additional information that could be pertinent, such as the expiration date or specific gift card code.

After filling out the form, reviewing it for errors and completeness is essential. Double-check each entry, ensuring that all required fields are complete and accurately filled in. A final review before submission can save time and prevent issues arising from inaccurate records later.

Managing the gift card distribution log

Managing the gift card distribution log effectively is crucial for maintaining its accuracy and security. Proper storage and security are necessary to protect both digital and physical records. If using a digital log, consider cloud-based solutions for safe and accessible storage. For physical copies, keep them in a locked area to restrict unauthorized access.

Regular updates and maintenance of the log help ensure that it remains current. Scheduling periodic reviews, whether monthly or quarterly, can help identify any discrepancies or required updates promptly. Additionally, implementing access control measures is important. Determine who within the organization should have access to the log and establish restrictions to prevent unauthorized entries or alterations.

Tracking and reporting gift card usage

Analyzing gift card distribution is not just about keeping records; it also involves understanding the patterns and trends in usage. Regularly creating reports can aid in internal audits and help management identify the effectiveness of their gift card programs. Implement structures for reporting that consolidate data from the distribution log, giving stakeholders valuable insights into how gift cards are impacting employee motivation or customer loyalty.

Recognizing trends in gift card distribution helps organizations adapt their strategies to maximize benefits. For example, if certain gift card amounts see more frequent usage, this can inform future awards or incentives. Keeping clear records through a robust gift card distribution log enables teams to recognize these patterns easily and make data-driven decisions.

Best practices for gift card distribution

Adhering to best practices in gift card distribution is essential for compliance with organizational policies. Ensure that all distributions align with company guidelines, which may include eligibility criteria and approved purposes for gift card use. Clearly communicate these policies to all employees involved in the distribution process to avoid discrepancies and ensure accountability.

Further, implementing measures to prevent fraud and mismanagement can significantly minimize risks associated with gift card distribution. Training staff on recognizing potential fraud and instituting audits at regular intervals can help deter misconduct. Being proactive about security will build a more robust system that promotes fair and transparent gift card practices.

Frequently asked questions (faqs)

When dealing with a gift card distribution log form, various questions may arise, especially for those new to the process. One common inquiry is how to correct mistakes on the form. If an error is identified, revise it immediately by striking through the incorrect information and writing the correct entry beside it. It’s good practice to note the date of the change and the initials of the person making the correction.

Another frequent concern is what to do if a gift card is lost or stolen. Establish a protocol for reporting lost cards, including steps like notifying management and reviewing the distribution logs. Lastly, determine how long the logs should be kept; typically, maintaining them for at least three years is advisable to comply with audits and organizational policies.

Related policies and guidance

Establishing clear internal policies on gift card use is crucial for a well-functioning distribution system. These guidelines should outline who is eligible to receive gift cards, the purposes they may be awarded for, and the maximum limits for each distribution. Providing this structure helps reduce ambiguity surrounding gift card policies and enhances compliance.

Moreover, having a relevant procedure for reporting issues is essential. Employees must know the steps to take if discrepancies are found, such as contacting a supervisor or reviewing records. Clear communication channels help in quickly addressing any concerns, maintaining the integrity of the gift card distribution process.

Interactive tools and resources

Utilizing templates and samples of gift card distribution logs can significantly streamline the process. pdfFiller offers downloadable forms that can be customized according to your organization's needs. These templates can facilitate consistency in recording and improve accuracy in tracking distributions.

In addition, pdfFiller provides tools for editing and managing forms. With features for eSigning, collaboration, and easy sharing, organizations can enhance their workflows related to gift card distribution. Utilizing these interactive resources can help teams work more efficiently and ensure accountability in their distribution processes.

Building efficiency in gift card distribution

Leveraging technology can enhance the efficiency of gift card distribution management. By utilizing tools like pdfFiller, organizations gain access to cloud-based solutions that allow team members to create and manage documents from anywhere. This flexibility is especially beneficial for teams that may be working remotely or across multiple locations.

Encouraging team collaboration through pdfFiller's tools also streamlines workflow. Teams can work together on the distribution log, ensuring that all entries are correctly recorded and verified. This collaborative approach reduces the chances of errors and miscommunication, ultimately leading to a more effective gift card distribution process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gift card distribution log to be eSigned by others?

How do I edit gift card distribution log online?

How do I complete gift card distribution log on an iOS device?

What is gift card distribution log?

Who is required to file gift card distribution log?

How to fill out gift card distribution log?

What is the purpose of gift card distribution log?

What information must be reported on gift card distribution log?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.