Get the free Marks-roos Yearly Fiscal Status Report

Get, Create, Make and Sign marks-roos yearly fiscal status

Editing marks-roos yearly fiscal status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marks-roos yearly fiscal status

How to fill out marks-roos yearly fiscal status

Who needs marks-roos yearly fiscal status?

Understanding the Marks-Roos Yearly Fiscal Status Form

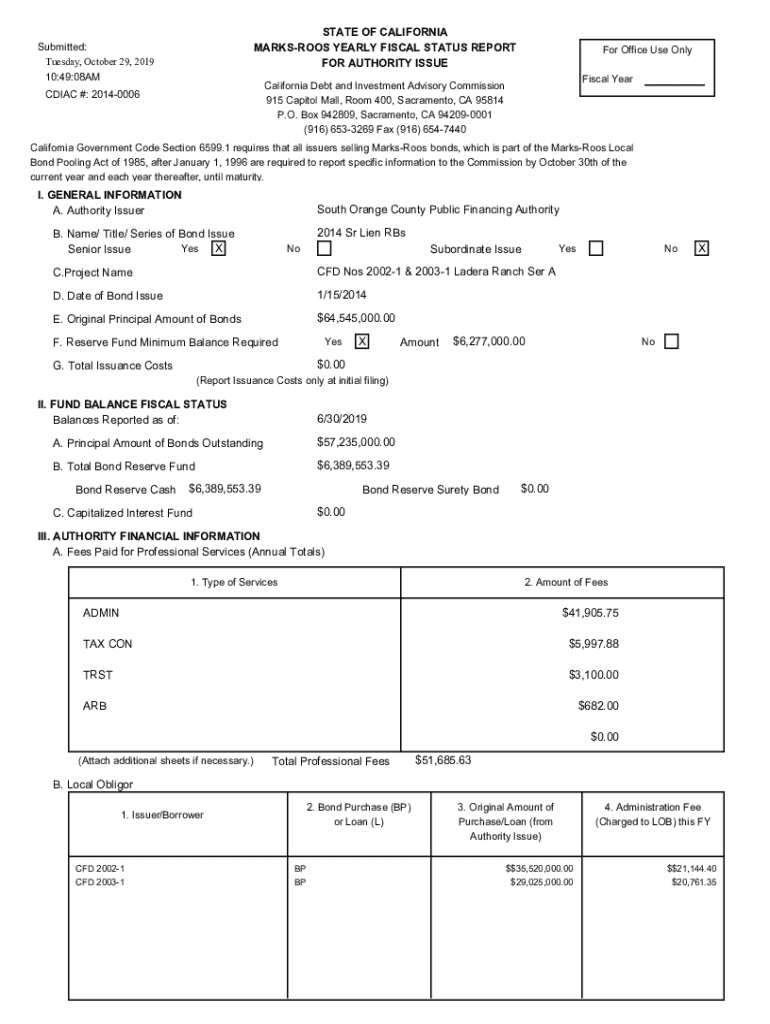

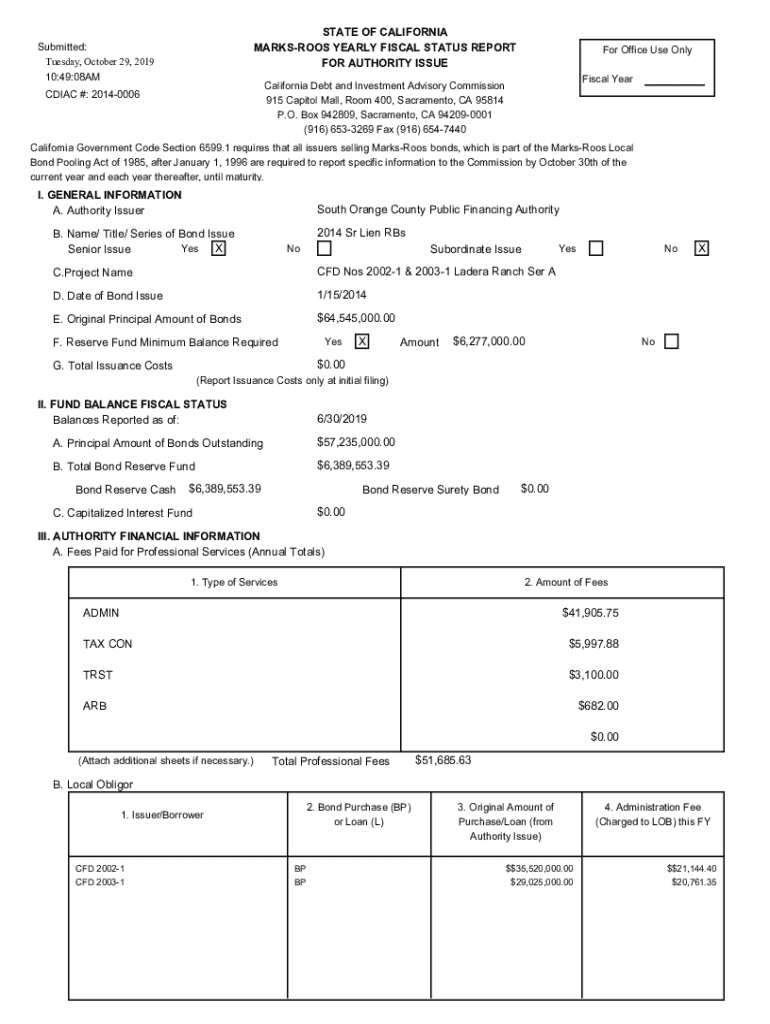

Overview of the Marks-Roos yearly fiscal status form

The Marks-Roos yearly fiscal status form is a crucial document for local government agencies in California. It serves to showcase the financial performance and status of local governments, enabling transparency regarding their revenue and expenditures. By providing consistent and structured financial information, the form helps local communities make informed decisions regarding their budgets.

The importance of the Marks-Roos form extends beyond mere compliance; it facilitates better financial management within local government finance. This is essential, as effective governance heavily relies on accessible fiscal data to understand economic health and project future needs.

Key features of the Marks-Roos form

The Marks-Roos form consists of several key sections aimed at providing a comprehensive financial overview. It typically includes revenue reporting, where local governments must detail all sources of income; expenditure reporting that lists all expenses incurred; and a comparative financial analysis, which allows for evaluations against past performances.

Moreover, with modern advancements, this form now includes digital features that make filling it out more accessible. Users can take advantage of digital fillable sections that effortlessly gather data, and automated calculations that minimize errors. This streamlining not only saves time but also enhances the accuracy of financial reporting.

Understanding state law compliance

Compliance with state law when managing the Marks-Roos yearly fiscal status form is imperative. Specific regulations vary by state, impacting how different local governments approach submission. Generally, the law mandates accurate submission schedules depending on the jurisdiction type, thus it’s crucial for administrators to be aware of these distinctions.

Failure to comply may lead to various penalties, including financial repercussions or restrictions on future funding. For example, a city that neglects to file the Marks-Roos form on time may face a delay in state funding allocations. Local governments must also familiarize themselves with their specific compliance scenarios to avoid such pitfalls.

Step-by-step guide to completing the Marks-Roos form

Before filling out the Marks-Roos form, proper preparation is key to efficiency. This starts with gathering all necessary documentation, including past fiscal reports, revenue streams, and current expenditures. Notably, utilizing financial templates can help organize crucial data, ensuring that your submissions are accurate and complete.

The filling process can be straightforward when approached methodically. Start with accurately entering revenue information; take care to report all sources of income, from taxes to grants. Next, document expenditures thoroughly by categorizing project costs according to defined budget lines to ensure comprehensive disclosure. Finally, performing a comparative financial review can highlight trends and areas for budgetary improvement.

Tips for editing and managing your Marks-Roos form

Once you've filled out the Marks-Roos yearly fiscal status form, efficient editing becomes vital for fine-tuning your financial narrative. Utilizing pdfFiller's editing tools provides you with features that allow for the modification of entries with ease, ensuring that all figures remain current and accurate.

In addition, integrating comments and annotations can pave the way for better collaboration among team members who may also be working on the form. It's essential to maintain version control by tracking changes and modifications systematically, which not only helps with clarity but also enhances document security for sensitive financial information.

Collaboration and sharing options

To streamline the process further, collaboration features in pdfFiller allow team members to work simultaneously on the Marks-Roos form. Inviting colleagues to collaborate not only distributes the workload but also enhances the accuracy of the submission through multiple reviews.

Setting permissions and access levels ensures that team members can only edit or view the sections relevant to them, thus maintaining integrity during the editing process. Tracking edits and feedback in real-time solidifies the collaborative effort, making adjustments seamless and quick.

Common mistakes to avoid

When filling out the Marks-Roos yearly fiscal status form, certain pitfalls may derail the submission process. Inaccurate data entries, perhaps due to haste or oversight, could lead to significant compliance issues. To ensure validity, always double-check figures and source documents.

Another common error would be incomplete submissions, such as missing required signatures or annotations that may be necessary under specific state regulations. Understanding each jurisdiction's precise requirements can help avoid these issues while ensuring that the submission remains valid and accepted.

FAQs related to the Marks-Roos yearly fiscal status form

Frequently asked questions are often focused on the Marks-Roos yearly fiscal status form. Common queries include the type of documents required to complete the form, how to manage changes after submission, and the consequences of late submissions. Understanding these aspects can alleviate anxiety and streamline your form-filling experience.

For instance, essential documents typically include financial reports, budgets, and past fiscal status forms. If any information changes post-submission, promptly consult regional guidelines to understand the next steps. Finally, be aware that late submissions may incur penalties, affecting your local government's financing opportunities.

User testimonials and success stories

Several local governments have reported significant improvements in their processes after using pdfFiller for the Marks-Roos yearly fiscal status form. Testimonials showcase how streamlined editing, ease of collaboration, and proper document management can lead to quicker submissions and greater financial clarity.

One local agency shared a story where they used pdfFiller to manage their fiscal status form, resulting in faster turnaround times and improved accuracy. The clarity in financial reporting allowed local leaders to make informed budgetary decisions, positively impacting the quality of services provided to the community.

Future updates and revisions

As regulatory frameworks evolve, remaining mindful of upcoming changes to the Marks-Roos yearly fiscal status form is essential. Many local governments rely on professionalism and resourcefulness, expecting notable adaptations tailored to legislative updates in the future.

Keeping abreast of regulatory changes ensures that local governments can modify their practices swiftly. pdfFiller remains committed to adapting its platform to support users effectively during transitions, maintaining the form's functionality while empowering users to navigate future requirements confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my marks-roos yearly fiscal status directly from Gmail?

Can I edit marks-roos yearly fiscal status on an Android device?

How do I fill out marks-roos yearly fiscal status on an Android device?

What is marks-roos yearly fiscal status?

Who is required to file marks-roos yearly fiscal status?

How to fill out marks-roos yearly fiscal status?

What is the purpose of marks-roos yearly fiscal status?

What information must be reported on marks-roos yearly fiscal status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.