How to Form a Company: A Comprehensive Guide

Understanding the basics of company formation

A company is a legally recognized entity formed by a group of individuals to conduct business. The most common types of companies include sole proprietorships, partnerships, and corporations. Selecting the appropriate company structure is crucial, as it shapes the company’s legal, operational, and financial dynamics. Understanding these basics can guide potential entrepreneurs through the complexities of business formation.

The importance of selecting the right company structure cannot be overstated. It affects everything from liability and taxation to compliance with regulations and the ability to raise capital. Each structure has specific legal and financial implications that can impact your business's long-term success. By carefully considering these factors, you will lay a solid foundation for your new company.

Selected company types and their distinctions

When forming a company, you have multiple options, each with unique features and implications. Understanding these distinctions can help you select the best fit for your goals.

Private limited company (BV/SRL)

A Private Limited Company is characterized by limiting its owners' liabilities to their shares. It offers benefits like easier capital raising through private investments while protecting owners' personal assets. However, there may be restrictions on ownership transfers, making it less flexible than other structures.

Public limited company (NV/SA)

A Public Limited Company allows shares to be sold to the public, significantly broadening the potential for capital. However, going public comes with stricter regulations and greater scrutiny, alongside the potential for increased profitability and company visibility.

Cooperative society (/SC)

Cooperatives are formed to meet members' mutual needs, prioritizing collective decision-making. Benefits include shared resources and profits among members, making this model ideal for community-oriented ventures, but it requires consensus, which can slow decision-making.

Partnership structures

Partnerships are another popular form of business. In a General Partnership, all partners share liabilities and profits, making it easy to establish but potentially risky if disagreements arise. A Special Limited Partnership limits liability for some partners while still allowing others to maintain control, providing a balance between risk and authority.

The formation process: Step-by-step

The formation of a company follows a structured process that requires careful planning and execution. Understanding each step ensures a smoother transition from idea to business.

Initial considerations before formation

Before diving into registration, reflect on your business vision and objectives. Key questions to define include: What services or products will you offer? Who is your target market? Market research and competitive analysis are essential steps to refine your ideas and evaluate potential profitability.

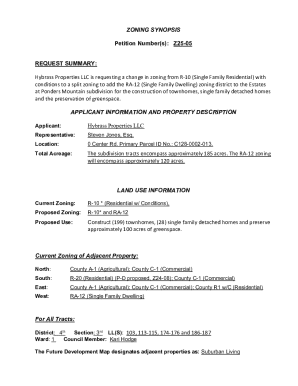

Choosing the right company structure

Factors influencing your choice of company type include your business goals, the level of acceptable risk, and potential funding needs. For example, if you're prioritizing personal liability protection and ease of raising funds, a Private Limited Company might be suitable. Alternatively, community-based goals might point you towards a Cooperative.

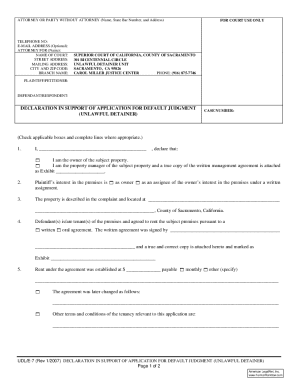

Registering your company: A detailed walkthrough

Registration typically requires various documentation, including identification, proof of address, and the proposed company name. Initial fees vary by the type of entity and location, with incorporations requiring filings with federal, state, and local agencies. Be prepared for potential additional steps specific to your industry, such as zoning approvals or professional licenses.

Creating an operating agreement

An operating agreement outlines the internal workings of your company and is crucial for clarifying roles and responsibilities among partners. Essential elements include profit distribution, operational protocols, decision-making processes, and procedures for resolving disputes. This document ensures that everyone is on the same page, reducing future friction.

Obtaining necessary licenses and permits

Licenses and permits can vary widely based on industry and geographic location. Ensure compliance with all local regulations by checking with relevant regulatory agencies and securing industry-specific licenses. This step is crucial to avoid penalties and maintain your company's operational legitimacy.

Financial requirements and considerations

Forming a company often demands a clear understanding of financial requirements. Carefully considering initial costs and ongoing expenses is vital for sustainability.

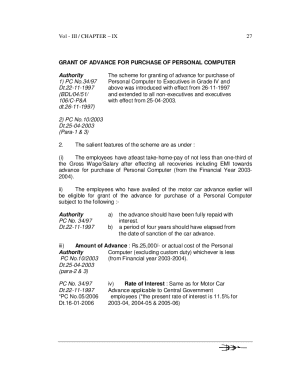

Initial capital investment

Understanding your startup costs is critical for planning. These can include office space, equipment purchases, licensing fees, and employee salaries. Conduct a thorough assessment of potential funding options, such as personal savings, loans, or investors, to ensure you have sufficient capital to cover these initial expenses.

Tax implications of company formation

Each type of company comes with different tax structures that affect how your business profits are taxed. Partnering with a tax professional can help clarify these implications and optimize your business strategy. Knowledge of tax benefits specific to your company type can also lead to significant savings, especially in the early years.

Accounting and record-keeping requirements

Maintaining detailed financial records is not just a legal requirement; it’s vital for understanding your company’s health. Accurate bookkeeping and financial management allow for better forecasting, budgeting, and decision-making. Consider utilizing accounting software solutions tailored for businesses to streamline this process and ensure compliance.

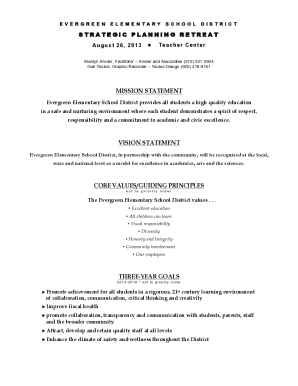

Essential aftercare: Best practices for newly formed companies

After successfully forming your company, the next phase involves ongoing management and strategic planning to ensure growth and compliance.

Opening a business bank account

One of the first steps after registration is to open a business bank account. This action separates personal and business finances, which simplifies accounting and budget tracking. It also enhances your company’s credibility and professionalism in the eyes of clients and vendors.

Importance of business insurance

Business insurance, including general liability and property insurance, is crucial for mitigating risks. Protecting your company against unexpected events not only preserves your investments but can also be a requirement for certain clients or contracts.

Ongoing compliance: Staying compliant with regulations

Being compliant is not a one-time effort. Companies must stay up-to-date with regular reporting, tax obligations, and renewals of licenses or permits. Establishing a calendar for these tasks can aid in maintaining compliance and avoiding penalties for oversight.

Developing a growth strategy

Strategizing your growth involves long-term planning to adapt to market changes and track progress. Understanding market trends and customer needs is paramount for sustainable expansion. Regular reassessment of your strategies enables agile responses to challenges and opportunities.

Success tips for company formation

Navigating company formation can be complex, but several tips can enhance your chances of success. Seeking resources like business mentors can provide valuable insight and collaboration opportunities. Networking is another essential element that can lead to partnerships and business development.

Utilizing cloud-based tools for document management and collaboration can free up valuable time and resources. By choosing a platform that supports e-signatures and collaboration, such as pdfFiller, you can streamline workflows and enhance productivity. Incorporating feedback loops to regularly reassess strategies will also help ensure you are on the right path.

Frequently asked questions (FAQs)

Company formation often raises several common questions worth exploring. Understanding your obligations for different business entities is critical in navigating the process effectively. Many entrepreneurs may not know the extent of liability protection, the necessary resources, or legal complexities based on their chosen company form.

Clarifying misconceptions about the different types of business entities can also be beneficial. For instance, many people confuse the terms 'limited liability' and 'personal liability' — it is essential to understand both to ensure proper business protection.

Additional tools and resources for company formation

Company formation can be greatly aided by utilizing a range of interactive tools available online. These can help simplify the documentation process, creating clarity and efficiency. For small businesses and startups, software platforms designed for document management and collaboration, like pdfFiller, can streamline your processes and improve operational management.

Professional assistance, such as legal advisors or tax professionals, can navigate complex elements of company formation. They can provide customized solutions tailored to your specific needs, ensuring you meet all your local, state, and federal requirements efficiently.