Get the free Non-superannuation Tax File Number Notification

Get, Create, Make and Sign non-superannuation tax file number

Editing non-superannuation tax file number online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-superannuation tax file number

How to fill out non-superannuation tax file number

Who needs non-superannuation tax file number?

Your Comprehensive Guide to the Non-Superannuation Tax File Number Form

Understanding non-superannuation tax file numbers (TFNs)

The Non-Superannuation Tax File Number (TFN) is an essential identifier for tax purposes in Australia. It helps the Australian Taxation Office (ATO) manage your tax obligations effectively. A TFN acts as your unique reference, ensuring that all your tax records are accurately linked to your personal profile. Those who apply for a TFN typically use it for various financial transactions, including filing tax returns, receiving government benefits, and managing savings.

TFNs are crucial for compliance with tax obligations. They streamline tax reporting, allowing individuals and businesses to report income correctly. Unlike Superannuation TFNs, which are tied specifically to retirement savings accounts, Non-Superannuation TFNs pertain to tax obligations on income. Understanding the distinction between these two types helps avoid confusion when managing your finances.

Eligibility for obtaining a non-superannuation TFN

Certain individuals and entities must possess a Non-Superannuation TFN to navigate Australia’s tax system effectively. Eligibility primarily includes:

Understanding which category you fall into will clarify your necessity for obtaining the Non-Superannuation TFN and streamline your tax affairs.

Gathering required information for the application

Before applying for a Non-Superannuation TFN, it's vital to gather the appropriate identification documents. These documents establish proof of identity and your residential address.

Having these documents ready not only simplifies the application process but also reduces the likelihood of delays.

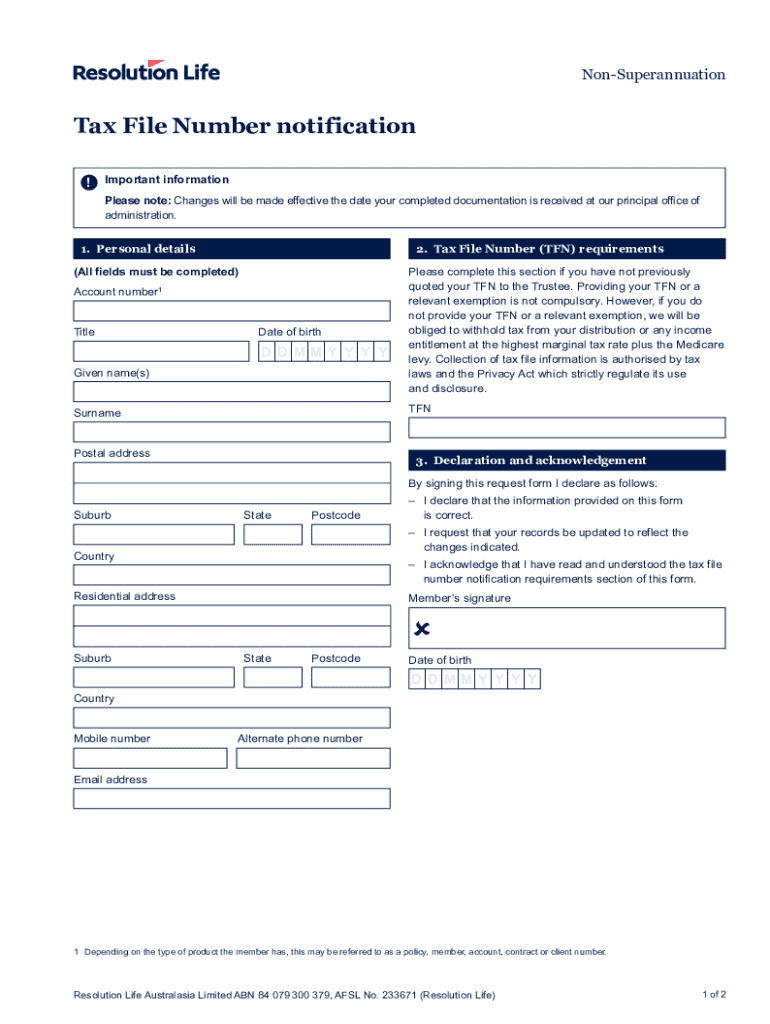

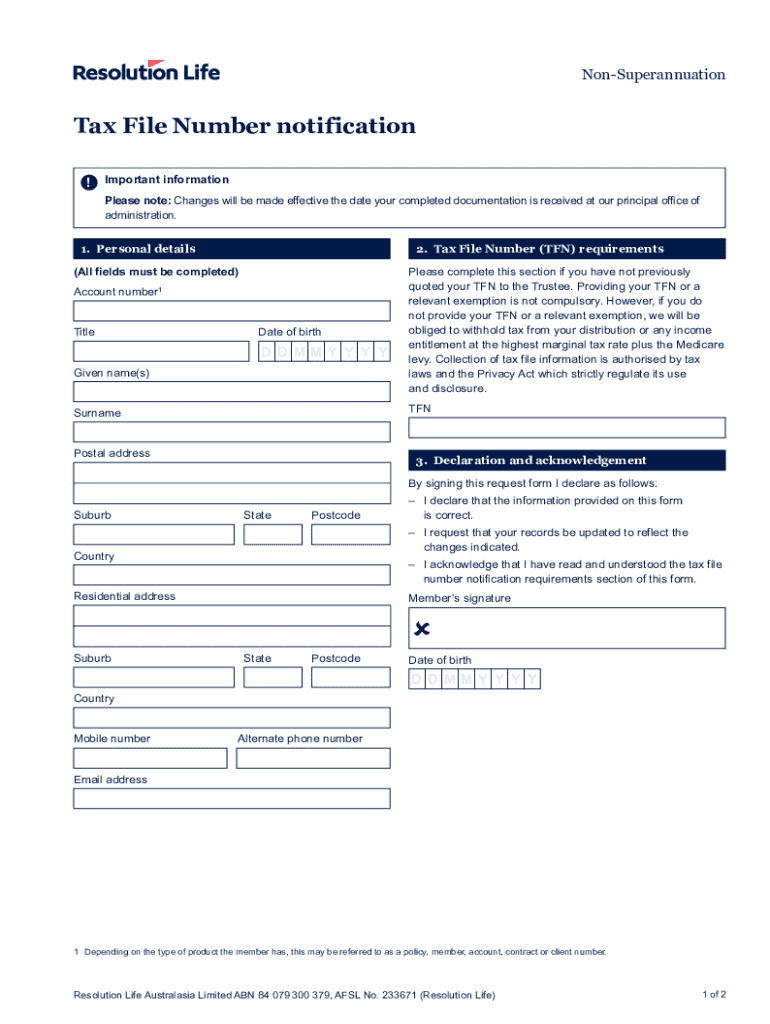

Step-by-step guide to filling out the non-superannuation TFN form

Completing the Non-Superannuation TFN form isn't challenging if you follow a structured approach. Here’s a step-by-step breakdown:

It's essential to avoid common mistakes such as typos or leaving mandatory fields blank, as these can delay the processing of your application.

Submitting your application for a non-superannuation TFN

Once the form is filled out correctly, you can submit your application. You have two main methods to choose from:

Tracking your application status is important. If submitted online, you may receive updates through your provided contact details.

Receiving your non-superannuation TFN

After processing your application, the ATO will send a TFN to your registered address. Once you receive it, here are a few steps to follow:

Being proactive about your TFN helps in maintaining your records accurately and ensuring a smooth tax experience.

Updating or changing your non-superannuation TFN details

Keeping your TFN details up to date is vital for compliance. Here are some instances when updates are necessary:

To make amendments, you can inform the ATO through their online services or by submitting the necessary forms. Failure to keep your information current can lead to discrepancies in your tax filings, which may attract penalties.

Using your non-superannuation TFN for tax obligations

Having a Non-Superannuation TFN comes with responsibilities. Individuals and businesses must understand their obligations regarding tax filings, which include:

Understanding how to report your income and expenses while using your TFN ensures compliance and minimizes tax-related issues.

Frequently asked questions about non-superannuation TFNs

Many individuals have questions regarding their Non-Superannuation TFNs. Here are some clarifications:

Staying informed about your TFN ensures you can handle any related issues promptly.

Interactive tools and resources

As you navigate the process of obtaining and managing your Non-Superannuation TFN, various interactive tools can enhance your experience. Consider using templates for managing tax-related documents or exploring document management solutions like pdfFiller. These resources simplify filling, signing, and sharing important forms.

Leveraging these digital resources leads to a more streamlined process for tax management.

User experiences and testimonials

Hearing stories from individuals who have navigated the Non-Superannuation TFN application can be insightful. Many users have shared how the process was made simpler through efficient document management solutions like pdfFiller.

These testimonials highlight the benefits of well-organized systems in easing the burden of tax-related obligations.

Legal considerations and responsibilities

Understanding the legal framework surrounding TFNs is critical. It’s essential to know that misuse of TFNs can result in serious legal repercussions, including penalties. The Australian government places significant importance on the protection of TFNs, and unauthorized access or sharing can lead to prosecution.

Maintaining the integrity of your TFN is paramount to prevent legal issues.

Best practices for document management

Organizing tax documents does not need to be daunting. Following best practices for document management ensures that you have quick access when needed. Here are some tips:

Implementing these practices will lead to a more efficient workflow and less stress during tax seasons.

Community feedback and user interaction

Engaging with the community fosters a supportive environment for anyone navigating the complexities of the Non-Superannuation TFN form. We encourage users to share their experiences and suggestions.

Interaction within this community enhances collective knowledge and supports better practices.

Tax education and support opportunities

Ongoing education helps individuals stay updated on tax obligations and responsibilities. Look for upcoming webinars or workshops offered through various platforms, including pdfFiller, that explore these themes.

Engaging in educational opportunities equips you with knowledge to make informed decisions regarding your finances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit non-superannuation tax file number online?

How do I edit non-superannuation tax file number on an iOS device?

How do I complete non-superannuation tax file number on an iOS device?

What is non-superannuation tax file number?

Who is required to file non-superannuation tax file number?

How to fill out non-superannuation tax file number?

What is the purpose of non-superannuation tax file number?

What information must be reported on non-superannuation tax file number?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.