Get the free Quotation Template. VAT Reverse Charge

Get, Create, Make and Sign quotation template vat reverse

Editing quotation template vat reverse online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quotation template vat reverse

How to fill out quotation template vat reverse

Who needs quotation template vat reverse?

Quotation Template VAT Reverse Form: A Comprehensive Guide

Understanding VAT reverse charge

VAT reverse charge is a mechanism designed to simplify the VAT process by transferring the responsibility of VAT payment from the supplier to the customer. This system is particularly relevant in sectors where tax fraud is rampant, such as construction, where varying income levels and diverse workforces complicate compliance.

Under the reverse charge mechanism, businesses that supply goods or services do not charge VAT on their invoices. Instead, the recipient of the goods or services is responsible for calculating and paying the VAT due directly to the tax authorities. This approach is commonly applied in cross-border transactions and services under the Construction Industry Scheme (CIS) in the UK.

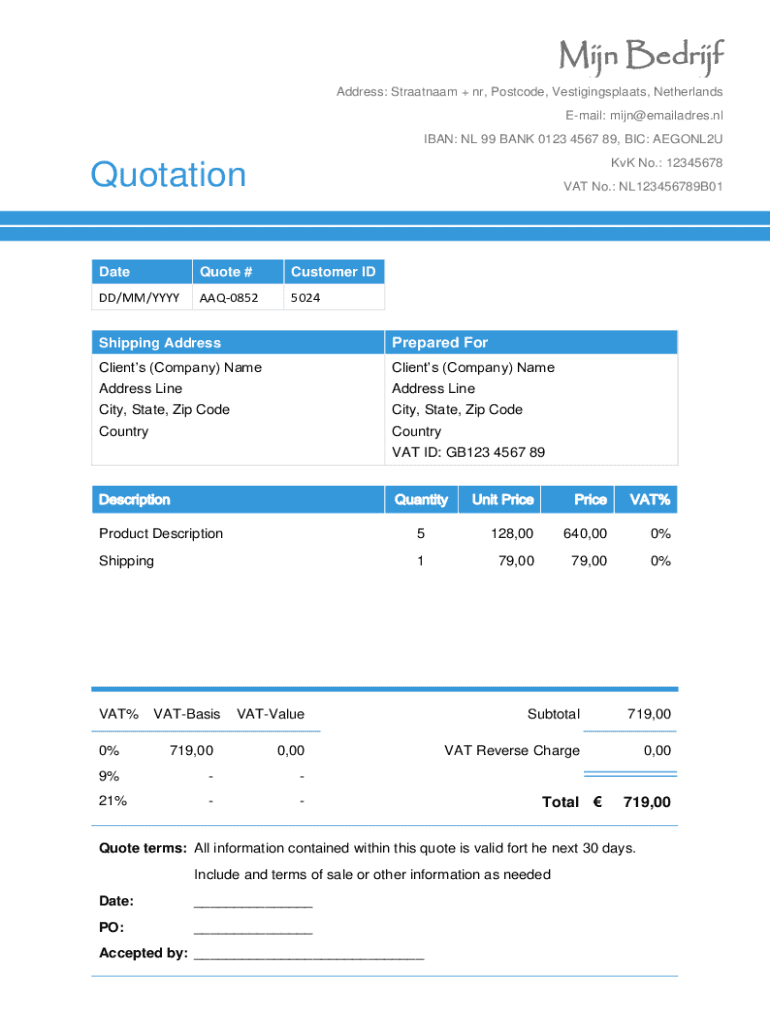

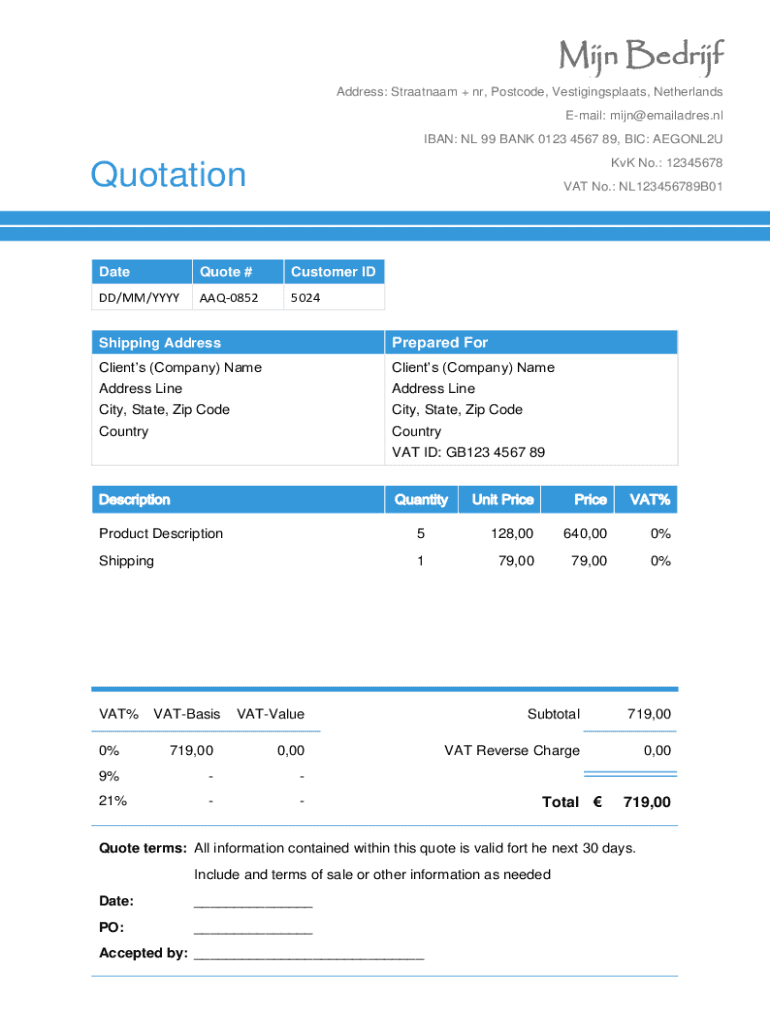

Key components of a quotation template

A comprehensive quotation template must include essential elements to facilitate clarity and compliance with VAT regulations. Key components typically consist of both the supplier's and customer's details, a thorough description of goods and services provided, and a clear pricing structure.

Additionally, it is crucial to format the template to display VAT information prominently. For VAT reverse charge documentation, this includes specifying that VAT will not be charged by the supplier and clearly stating that the responsibility to account for VAT lies with the buyer. This helps eliminate confusion and provides a straightforward reference for both parties.

Creating a quotation template for VAT reverse charge

Designing a quotation template tailored for VAT reverse charge involves several systematic steps. Utilizing tools like pdfFiller, you can create a visually appealing document while ensuring compliance with VAT regulations. Begin by outlining your company's and client’s essential details on the template.

Ensure you include fields for itemized services and their respective pricing. As you build your template, it is vital to add specific sections that highlight VAT reverse charge information, including clear instructions on where and how VAT responsibilities fall within the transaction.

Editing and managing your quotation template

Once your quotation template is designed, proper editing and management are vital to ensure accuracy and compliance. pdfFiller offers interactive editing features that allow users to easily make changes as needed, ensuring your documents remain up-to-date and aligned with evolving business needs and VAT regulations.

To streamline collaboration across teams, you can employ e-signatures within your documents. With features designed for multiple users, pdfFiller not only simplifies document signing but also facilitates feedback from team members, ensuring a collaborative approach to quotation management.

Addressing the needs of different business types

VAT reverse charge applications can vary greatly across industries. Specific sectors like construction, IT, and cross-border trade must address unique VAT challenges, particularly in compliance. For instance, in construction, firms must adhere to the Construction Industry Scheme (CIS), where reverse charges can impact how workers are invoiced and paid.

Moreover, tailoring quotation templates to fit the size and maturity of your business is crucial. Startups may require simpler templates that evolve as they grow, while more established firms could benefit from more sophisticated templates that incorporate additional features or reporting capabilities.

Compliance and legal considerations

Ensuring compliance with VAT regulations when using a quotation template is integral to fostering successful business operations. Keeping accurate records and understanding common pitfalls can vastly reduce the likelihood of legal complications. For instance, overlooking the necessary indications that a service is subject to VAT reverse charge can lead to unexpected liabilities and accountability issues.

In the event of errors in issued quotations, prompt corrective measures should be taken. This might involve issuing an amended quotation while keeping clear records of the changes made. Best practices dictate that all entities maintain thorough records of their communications and document versions to provide a clear chain of compliance.

Real-world examples and case studies

Real-world examples can provide insightful perspectives on how businesses implement VAT reverse charge in practical situations. A sample quotation template tailored for VAT reverse charge might exhibit the essential components discussed earlier while reflecting industry-specific requirements. Businesses can access these templates and adapt them for their use through platforms like pdfFiller.

Case studies demonstrate how companies operating in the construction sector benefitted from implementing VAT reverse charge quotations, significantly reducing compliance headaches and safeguarding against VAT fraud. These practical applications underscore the effectiveness of properly designed quotation templates in navigating complex tax landscapes.

Frequently asked questions (FAQs)

Business owners often have queries concerning the VAT reverse charge procedure. Common queries can range from understanding VAT application nuances to troubleshooting challenges encountered when using quotation templates. Providing accurate responses and tips can empower users to navigate their tax obligations effectively.

In addressing challenges with quotation templates, users can employ strategies such as regular updates and consultations with financial experts to stay informed of any changes. By fostering an environment of continuous improvement, businesses can position themselves better against VAT-related issues.

Tools and resources

Leveraging efficient tools is essential for managing VAT quotations effectively. pdfFiller stands out for its document management capabilities, providing users with the tools necessary to create, edit, and manage quotation templates seamlessly. This platform not only simplifies the process of document creation but also integrates collaboration features that enhance team input.

For those seeking additional software solutions, integrating accounting applications can further streamline the invoicing process linked to VAT documentation. Leveraging specialized invoicing solutions ensures that every financial transaction aligns with tax obligations while offering real-time reporting features to keep your business agile.

Exploring further possibilities with pdfFiller

Once you have established your quotation template, it's worth considering how to expand its functionality beyond just quotes. Transitioning from quotation templates to invoicing can be done effortlessly using pdfFiller's features, which allow you to create a unified documentation process that ensures consistency across all financial documents.

Furthermore, user feedback plays a pivotal role in the ongoing improvement of platform functionalities. By sharing your experiences, you can help shape future features and enhancements, ensuring that pdfFiller continues to meet the evolving needs of its users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send quotation template vat reverse for eSignature?

How can I get quotation template vat reverse?

How do I edit quotation template vat reverse on an iOS device?

What is quotation template vat reverse?

Who is required to file quotation template vat reverse?

How to fill out quotation template vat reverse?

What is the purpose of quotation template vat reverse?

What information must be reported on quotation template vat reverse?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.