Get the free Marks-roos Yearly Fiscal Status Report

Get, Create, Make and Sign marks-roos yearly fiscal status

How to edit marks-roos yearly fiscal status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marks-roos yearly fiscal status

How to fill out marks-roos yearly fiscal status

Who needs marks-roos yearly fiscal status?

Comprehensive Guide to the Marks-Roos Yearly Fiscal Status Form

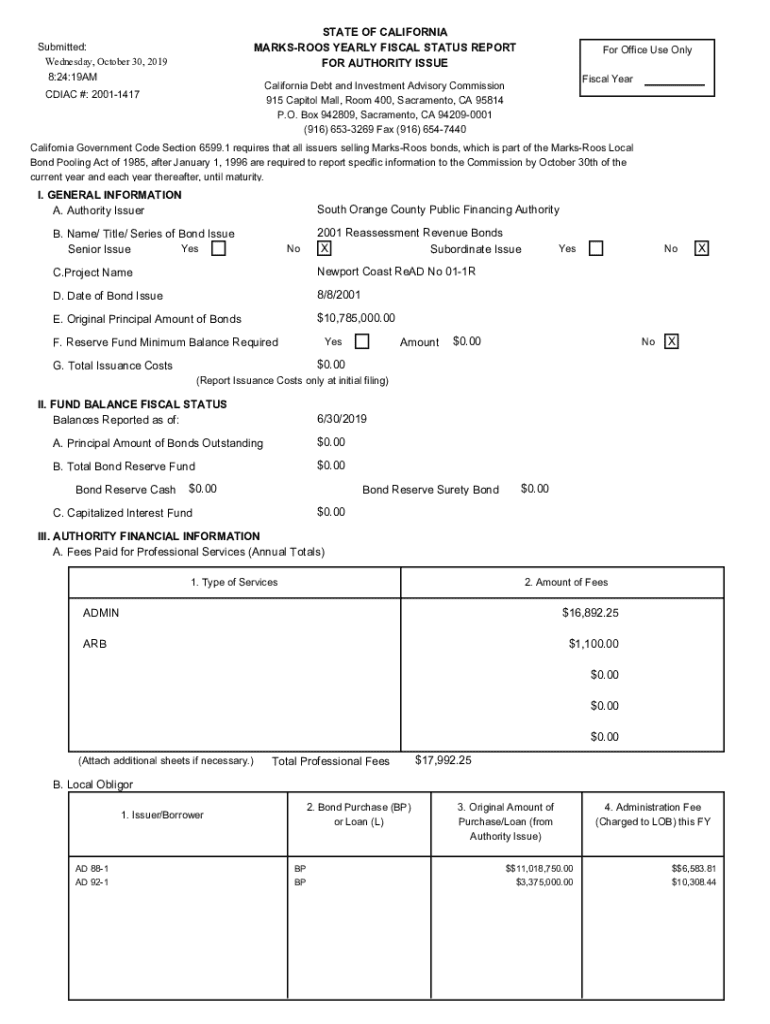

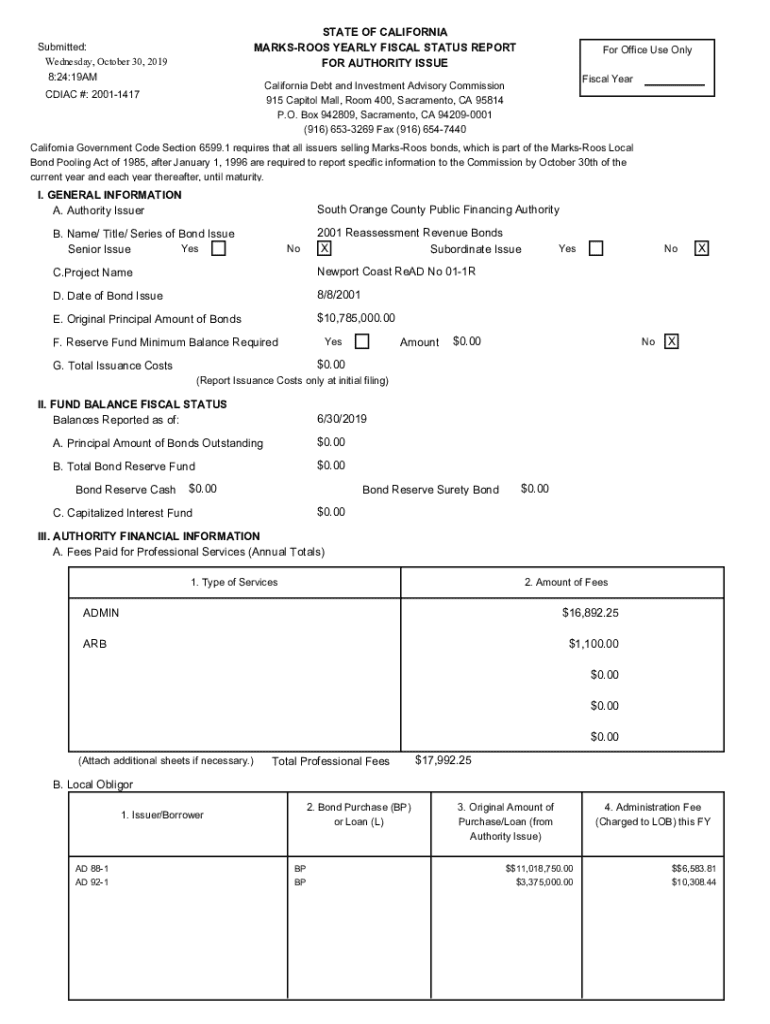

Overview of the Marks-Roos yearly fiscal status form

The Marks-Roos Yearly Fiscal Status Form serves as a crucial document for local agencies in California, ensuring financial accountability and facilitating transparency in public resources usage. This yearly form is designed to provide a comprehensive snapshot of an organization’s fiscal health and operational functionality. Its importance is underscored by the legal requirements set forth in the Marks-Roos Act, which mandates compliance to foster public trust.

Key information required on this form generally includes fiscal year data, a detailed overview of revenue and municipal expenditures, along with any special assessments. Proper completion and submission of this form not only satisfy legal obligations but also bolster organizational credibility amongst stakeholders and community members.

Understanding the Marks-Roos Act

The Marks-Roos Act was enacted to provide local agencies the authority to advance essential public infrastructure projects through bonding, financing, and financial transparency measures. The overarching intent of the legislation is to promote greater fiscal responsibility and to ensure that public funds are managed in a transparent matter.

Key requirements for local agencies include developing clear fiscal reporting procedures, maintaining accurate financial records, and adhering to strict timelines for submission of the Marks-Roos Yearly Fiscal Status Form. Non-compliance can lead to a range of penalties, including fines and public scrutiny, thus emphasizing the need for meticulous reporting.

Who should use the Marks-Roos yearly fiscal status form

Eligible entities for the Marks-Roos Yearly Fiscal Status Form primarily include local government agencies, special districts, and municipal corporations. These organizations are tasked with managing taxpayer funds and resources and are therefore bound to submit this form annually. Stakeholders involved in the preparation typically range from financial officers to senior management teams who oversee budgeting and fiscal reporting.

Completing the form accurately not only aids organizations in fulfilling regulatory requirements but also enhances financial accountability, enabling stakeholders to assess how well the organization is managing public funds. Inviting community members and stakeholders into discussions around this form also encourages transparency and fosters trust within the communities served.

Step-by-step guide to completing the Marks-Roos yearly fiscal status form

Completing the Marks-Roos Yearly Fiscal Status Form requires careful preparation and attention to detail. Below is a structured approach to guide you through the process.

Editing and customizing the Marks-Roos form

When it comes to editing the Marks-Roos Yearly Fiscal Status Form, using tools such as pdfFiller can significantly streamline the process. An interactive document reader allows for customization whereby users can add notes, comments, and even attach additional documents as necessary.

Utilizing pdfFiller’s user-friendly features enables users to safeguard the integrity of their documents while facilitating collaboration with team members. The platform also empowers users to save frequently used templates and drafts for future reference.

Signing and submitting the Marks-Roos yearly fiscal status form

Once the form is accurately completed, it's essential to sign and submit it correctly. With pdfFiller, users have the option to eSign the document, ensuring a secure and efficient process.

Be mindful of specific submission guidelines and deadlines as dictated by relevant authorities to avoid penalties. After submission, utilize the tracking status feature available in pdfFiller to confirm that your form has been successfully received.

Common challenges and solutions

Data collection for the Marks-Roos Yearly Fiscal Status Form can present challenges, particularly if internal processes lack organization. Mistakes in reporting are also common, potentially stemming from unfamiliarity with financial terminology or oversight. Organizations can face issues such as discrepancies in financial data that may arise from outdated records.

To combat these challenges, ensuring a well-established data collection process is vital. Engage with pdfFiller’s support for assistance in navigating any difficulties you encounter while filling out the form. Additionally, consider allocating sufficient time for the preparation phase to ensure the accuracy of submitted data.

Real-world examples and case studies

Numerous organizations succeed every year in filing their Marks-Roos Yearly Fiscal Status Forms accurately. For example, local parks and recreation agencies frequently utilize this form to assess their funding allocation against expenditures for community programs.

Analysis of these submissions reveals common findings such as effective budget management and awareness of financial health. Real-life scenarios illustrate how organizations can navigate and adapt their fiscal management based on the insights gathered from their annual reports.

FAQs about the Marks-Roos yearly fiscal status form

A myriad of questions often arises regarding the Marks-Roos Yearly Fiscal Status Form, particularly in regard to clarification on specific entries, regulatory requirements, and best practices for compliance. Many users are often interested in common errors that lead to rejection or the necessity of re-filing.

Organizations are encouraged to consult frequently asked questions (FAQs) providing guidance on completing and submitting the form. In addition, consider reaching out to regulatory bodies for precise queries about compliance obligations.

Resources for further assistance

Various resources are available to aid organizations in successfully navigating the Marks-Roos Yearly Fiscal Status Form. These include links to relevant regulations and compliance guidelines, as well as contact information for expert help via pdfFiller.

Moreover, numerous tools and templates are available within pdfFiller’s catalog, enhancing the user experience as they prepare to file their financial reports, ensuring a streamlined and efficient documentation process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit marks-roos yearly fiscal status on a smartphone?

Can I edit marks-roos yearly fiscal status on an iOS device?

How do I edit marks-roos yearly fiscal status on an Android device?

What is marks-roos yearly fiscal status?

Who is required to file marks-roos yearly fiscal status?

How to fill out marks-roos yearly fiscal status?

What is the purpose of marks-roos yearly fiscal status?

What information must be reported on marks-roos yearly fiscal status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.