Get the free Business Registration Form

Get, Create, Make and Sign business registration form

How to edit business registration form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business registration form

How to fill out business registration form

Who needs business registration form?

Business Registration Form: Comprehensive How-to Guide

Understanding business registration

A business registration form is a critical document used by individuals and entities to formally register their business with governmental authorities. The purpose of this form is to provide necessary information about the business, such as its name, address, ownership structure, and type of business activities. This registration is essential to ensure that the business complies with local, state, and federal laws, thus establishing its legal standing in the marketplace.

The significance of filling out a business registration form cannot be overstated. It not only legitimizes a business but also enables owners to access various benefits, including the ability to operate legally, open a business bank account, apply for loans, and qualify for grants provided by the ministry of entrepreneurship or the national department of business registration and integration. Without registration, businesses risk facing legal repercussions and losing credibility with customers and partners.

Who needs to fill out a business registration form?

Generally, individuals starting a new business—whether a sole proprietorship, partnership, LLC, or corporation—are required to fill out a business registration form. It is a common misconception that only large corporations need to register; however, even small businesses and microenterprises must complete this form to operate legally.

Additionally, foreign companies planning to operate within any jurisdiction also need to register. Understanding who needs to fill out this form is essential for compliance and to avoid potential fines or legal challenges down the line.

Types of business entities

Choosing the right type of business entity is a fundamental step that can affect your business's taxes, liability, and operations. Common structures include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each type has its pros and cons.

For instance, an LLC provides the benefit of limited liability protection, which means owners are not personally liable for business debts, while sole proprietorships are easier to set up but expose owners to personal risk. It's crucial to evaluate factors like liability, taxation, and management style before making a decision.

What is the difference between an and a corporation?

The primary difference between an LLC and a corporation lies in liability protection and taxation. LLCs offer pass-through taxation, meaning that profits are taxed on the personal income tax returns of the owners. In contrast, corporations are subject to double taxation; the business pays taxes on profits, and shareholders also pay taxes on dividends. Additionally, corporations have a more rigid management structure, while LLCs are often more flexible in terms of operations.

Understanding S corporations vs. corporations

S corporations and C corporations differ primarily in how they are taxed. An S corporation allows profits to be passed through to shareholders’ personal income without facing corporate income tax, providing potential tax advantages. On the other hand, C corporations are taxed at the corporate level, which can lead to higher overall tax rates. Choosing the right format can significantly impact your business's profitability and tax strategy.

Preparing to register your business

Successful business registration begins with preparation. Here’s a step-by-step process to ensure you are ready to fill out your business registration form accurately:

Do have to register with the federal government?

In certain situations, federal registration is necessary. If your business operates in specific sectors such as finance, healthcare, or transportation, additional federal regulations may apply. It's crucial to understand whether your business requires a federal employer identification number (EIN) and ensure that you have the correct registrations in place. Consult the IRS or relevant federal agencies to gain clarity on your requirements.

Filling out the business registration form

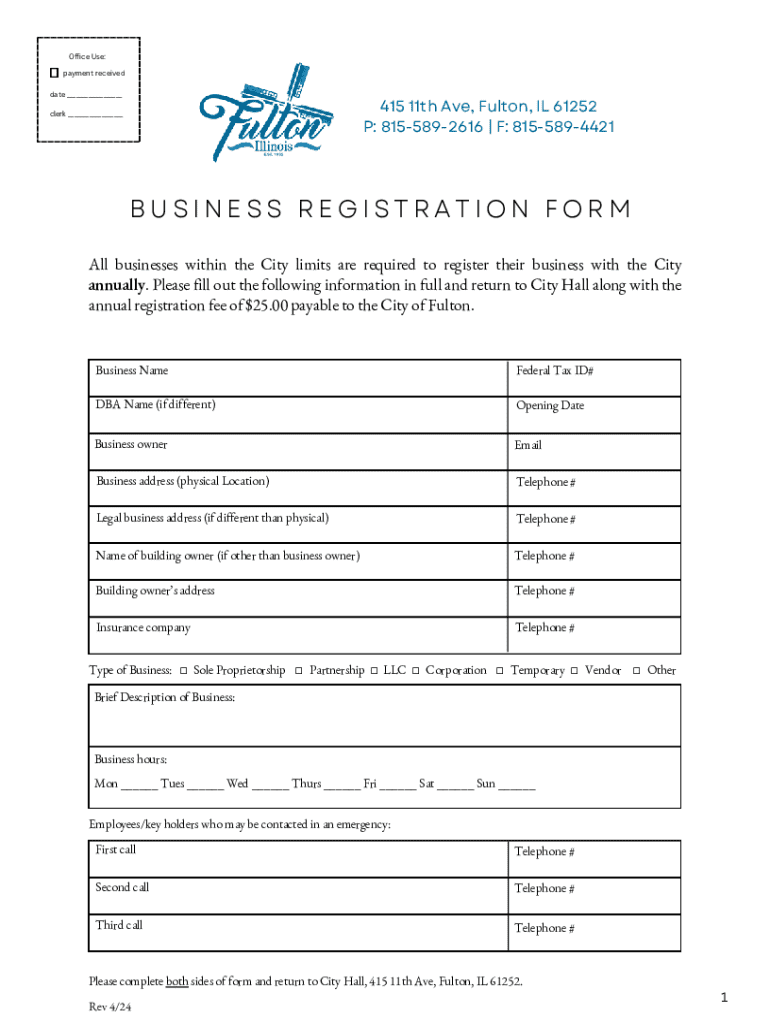

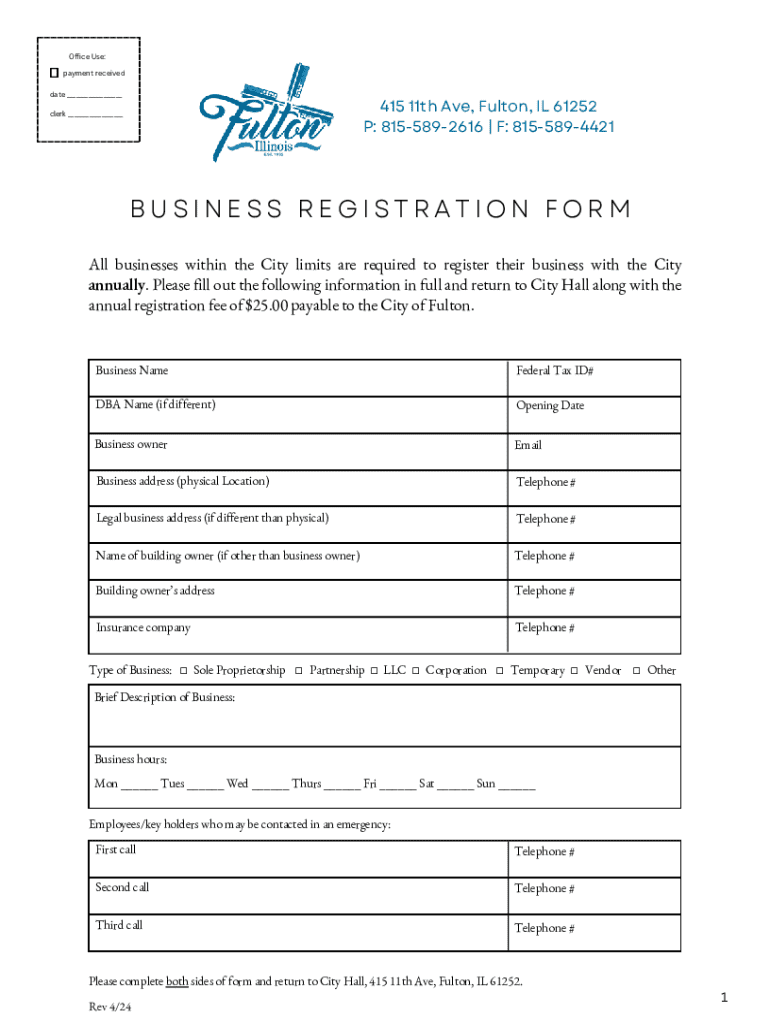

A business registration form typically includes essential information such as the business’s legal name, registration address, owner's contact information, type of business entity, and a description of business activities. Additionally, some jurisdictions require details about initial funding or capitalization of the business and owner demographics.

Optional sections may include information about your business’s website and social media accounts. Being thorough is essential, as any inaccuracies may lead to delays or complications in the registration process.

Should you use a template to create a business registration form?

Using a template for your business registration form can offer benefits, such as saving time and ensuring you don't overlook essential sections. However, ensure that any template you choose is valid in your jurisdiction, as requirements can vary significantly. While templates can be handy, customizing your form to reflect your business accurately is crucial to avoid legal discrepancies.

Registering with agencies

Once your business registration form is filled out, it's time to submit it to the appropriate agencies. This process often differs significantly among federal, state, and local levels.

Register with federal agencies

For federal registration, you'll need to follow specific guidelines set by agencies like the IRS. You may need to submit forms related to your business structure, such as Form 8832 for LLCs or Form 1120 for C Corporations. Resources like the IRS website will provide access to all necessary forms and guidance on submission.

Register with state agencies

Each state has its requirements for business registration. Typically, businesses must register with the state’s Secretary of State or equivalent office. Fees can vary based on the type of entity and business structure, often ranging from $50 to $500, with processing times from a few days to several weeks.

Register with local agencies

Local compliance is equally important. Ensure you understand any city or county licenses that may be required for operation. These could include general business licenses, sales tax permits, or zoning permits, which are critical to legally operating within your locality.

Maintaining compliance post-registration

After successfully registering your business, staying compliant with local, state, and federal regulations is crucial for continued operation. This requires ongoing attention to changing laws and regulations that may affect your business.

Resources, such as the ministry of entrepreneurship or local business associations, can provide updates and guidance on changes in registration laws. Being proactive can help you avoid complications that may arise from non-compliance.

Understanding beneficial ownership information (BOI) reporting

Beneficial ownership information reporting has gained significance in recent years, aimed at increasing transparency in business ownership. Understanding these requirements is crucial as many jurisdictions now mandate that businesses disclose their owners and their respective ownership stakes. Non-compliance could lead to penalties and legal complications, so businesses must stay informed about the latest requirements.

Special considerations

If you plan on operating in multiple states, you may need to file for foreign qualification in each jurisdiction. This process requires registration in each state where your business will conduct operations, ensuring compliance with local laws and regulations.

Additionally, many organizations offer free business counseling, providing valuable resources to help new business owners navigate the registration process and beyond. Look for nearby business development centers or workshops that cover essential startup topics.

Grants & assistance for your business

Various types of financial aid, such as grants and low-interest loans, are available for small businesses and microenterprises. Many local governments and nonprofit organizations offer programs targeting specific industries or demographics. To access these resources, start by checking with your local chamber of commerce or the national department of business registration and integration.

FAQs on business registration

Understanding common queries can aid in navigating the business registration process. Here are frequent questions posed by new business owners:

Additional support for business owners

For personalized guidance, consider reaching out to local business development organizations that offer one-on-one consulting and workshops. These resources can be invaluable as you navigate the complexities of business registration and operations.

Additionally, quick links to key resources, including state registration portals and business templates, can simplify your journey. Being equipped with the right tools and support can significantly ease the business registration process.

Navigating the business registration process

When it comes to managing your business registration forms effectively, opt for a cloud-based solution like pdfFiller, which allows users to create, edit, sign, and store documents securely. Transitioning into a digital format not only saves time but also encourages organization and ensures that all documents are easily accessible from anywhere, a crucial aspect for modern business operations.

Additionally, be aware of common technical issues such as file formatting difficulties or complications with electronic signatures. Utilizing a robust platform can help mitigate these challenges and streamline your registration experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business registration form directly from Gmail?

Can I create an electronic signature for the business registration form in Chrome?

How can I edit business registration form on a smartphone?

What is business registration form?

Who is required to file business registration form?

How to fill out business registration form?

What is the purpose of business registration form?

What information must be reported on business registration form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.