Get the free Maximum amount of earnings and minimum assessment ...

Get, Create, Make and Sign maximum amount of earnings

Editing maximum amount of earnings online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maximum amount of earnings

How to fill out maximum amount of earnings

Who needs maximum amount of earnings?

Maximum amount of earnings form: A comprehensive guide

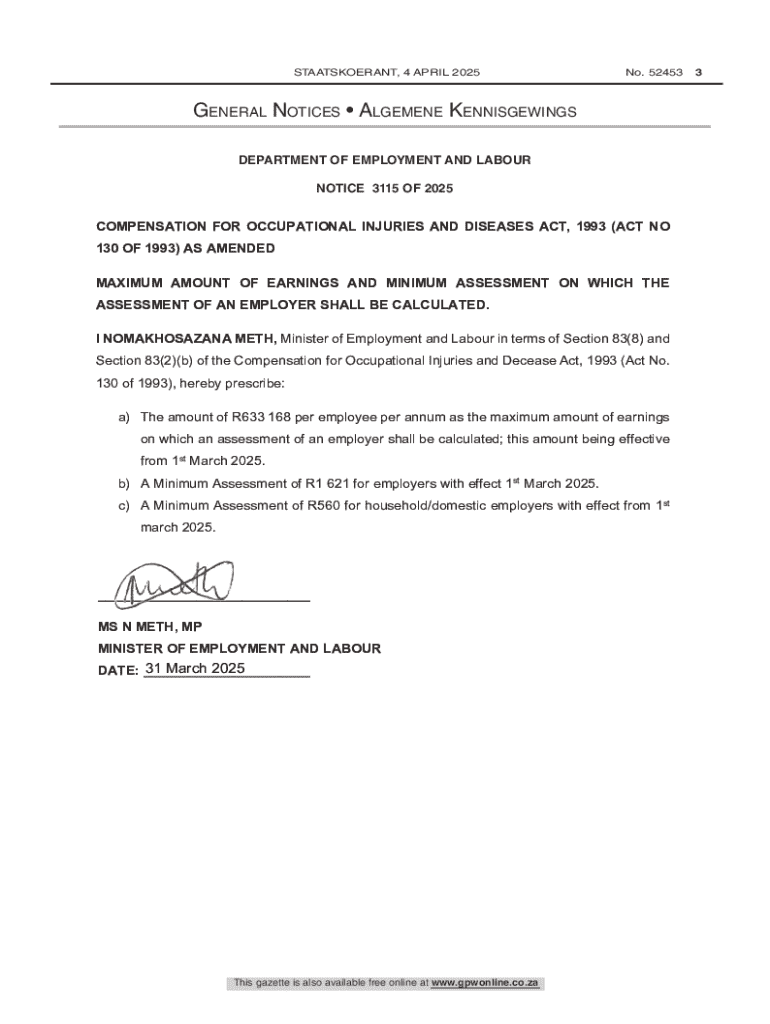

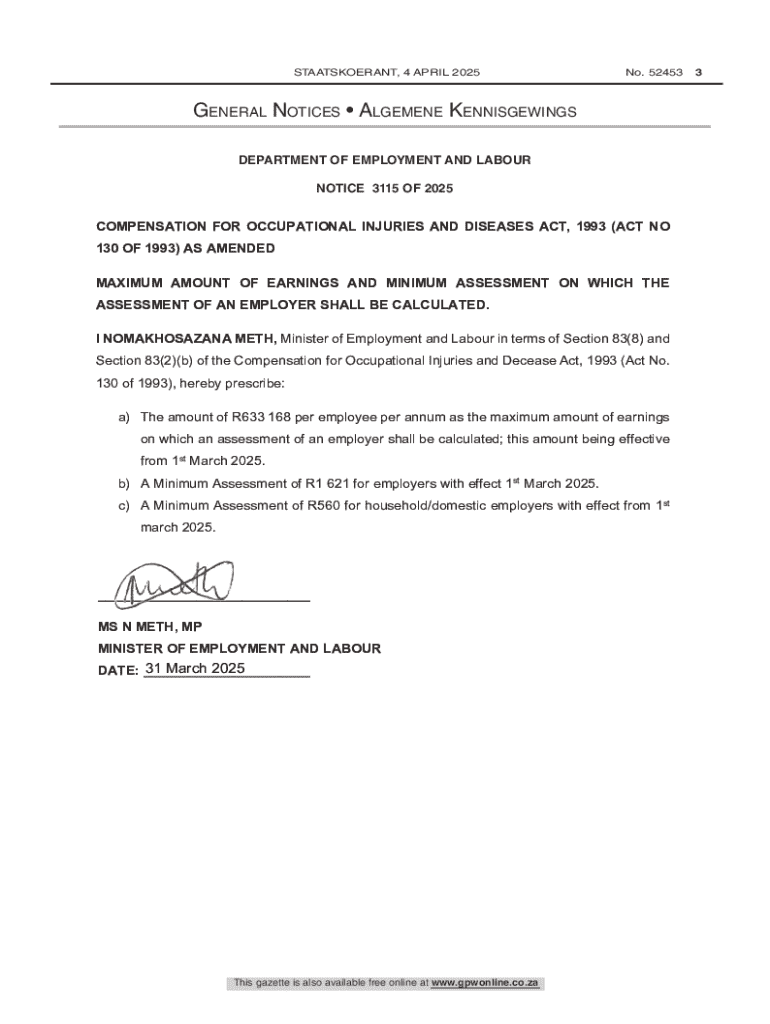

Understanding the maximum amount of earnings

The maximum amount of earnings refers to the cap on income that individuals can earn while still receiving certain benefits from government programs, such as Social Security and disability benefits. Understanding this cap is crucial for individuals navigating benefits eligibility. Each program has distinct earning limits, which can affect your overall financial strategy.

Knowing your maximum earnings can help you make informed decisions about employment, budgeting, and benefit utilization. For instance, exceeding the maximum earnings cap may lead to reductions or complete cessation of benefits, impacting your financial situation unfairly.

Overview of earnings limits for various situations

Understanding earnings limits is essential for different segments of the population, especially when it comes to programs like Social Security and disability. Each program defines its earnings thresholds that directly influence the benefits received.

Social Security earnings limit

Social Security benefits provide essential financial support, particularly in retirement. For those aged 62 or older, there are specific earnings limits where your benefits could be affected. As of 2023, if you earn more than $21,240 before the full retirement age, your benefits will be reduced by $1 for every $2 earned over the limit.

Disability earnings limit

The earnings threshold for disability benefits is designed to ensure those unable to work can still receive support. Individuals receiving Social Security Disability Insurance (SSDI) must report any income. For 2023, the Substantial Gainful Activity (SGA) limit is set at $1,470 for non-blind individuals. Any income exceeding this may affect benefits.

Self-employment and earnings

Self-employment adds complexity to earnings limits because the calculation for allowable income differs. Self-employed individuals need to track all income carefully and report their net earnings accurately. The Social Security Administration (SSA) uses specific guidelines to determine how much of your self-employment income is considered when evaluating benefits eligibility.

How maximum earnings impact your benefits

Exceeding the maximum earnings limits can lead to significant reductions in benefits. For individuals relying on Social Security or disability payments, understanding how these limits affect their financial stability is crucial.

Reductions in benefits

When beneficiaries exceed the earnings cap, it can lead to an automatic reduction in their monthly payments. For instance, retirees who surpass the earnings limit may find their benefits temporarily suspended until their income falls below the threshold again.

It’s essential to recognize that once you reach full retirement age, your earnings no longer affect your benefits, allowing you to earn without worry.

Income reporting requirements

Accurate income reporting is necessary to maintain eligibility for benefits. Beneficiaries must document all earned income, which typically includes pay stubs, tax returns, or self-employment records. Deadlines for reporting these earnings vary by program, and missing a deadline can lead to lost benefits.

Restoration of benefits post-earnings

Beneficiaries who exceed income limits might face temporary loss of benefits, but understanding the process for restoration is essential. If a beneficiary's earnings drop below the limit after exceeding it, they can generally reapply for their benefits without losing their eligibility.

Completing the maximum amount of earnings form

Filling out the maximum amount of earnings form requires attention to detail and an understanding of your financial details. Knowing what information is needed can streamline the process and reduce errors.

Step-by-step guide to filling out the form

Start by gathering all necessary documents, such as pay stubs, tax forms, and any records of self-employment earnings. Ensure you have your Social Security number and personal identification ready as well.

When completing the form, ensure each section is accurate. It's easy to overlook sections, so double-check your entries. Remember to document any exceptions or unique sources of income.

Section breakdown

Each section of the form serves a specific purpose. From the first section detailing personal information to the last one where you acknowledge your understanding of the earnings cap, clarity and accuracy are key. Reviewers will look for consistency in your data—discrepancies can lead to delays in processing.

Interactive tools to assist with form completion

Utilizing tools like pdfFiller can simplify the document management process. With capabilities for form editing, signing, and collaborative features, users can handle their forms seamlessly. Interactive features allow inputs to be validated in real-time, enhancing the accuracy of submissions.

Frequently asked questions about maximum earnings

Individuals often have numerous questions regarding maximum earnings limits. Understanding these queries can provide clarity and prevent potential pitfalls in managing earnings and benefits.

Common questions include clarifications on what counts as allowable income, how to report earnings correctly, and the consequences of failing to report. Myths surrounding earnings caps, such as assumptions that all income counts or that some exceptions apply universally, can lead to confusion.

Strategies for maximizing your earnings while retaining benefits

Successfully navigating earnings limits while retaining benefits requires strategic planning. Understanding work incentives and making informed decisions about income can lead to optimal outcomes.

Understanding work incentives

Programs designed to encourage work among beneficiaries exist. For instance, trial work periods allow individuals to test their ability to work without losing their benefits. Beneficiaries should familiarize themselves with these incentives to leverage their earnings potential.

Planning your earnings wisely

Strategic planning around income can enhance financial stability. This includes establishing realistic earnings goals and being mindful of opportunities that may push income beyond the limit. Understand what counts as gross income and plan accordingly.

Seeking professional advice

Consulting with financial advisors or benefits counselors can provide personalized strategies tailored to individual situations. Having expert guidance helps users navigate the complexities of maximum earnings limits and develop long-term financial health plans.

Case studies: Real-life impacts of earnings limits

Examining real-life scenarios can shed light on how individuals navigate the challenges posed by earnings limits. These case studies often reveal effective strategies and the lessons learned from mishaps.

For instance, a retiree might have benefited significantly by understanding the exact cap on earnings, leading them to adjust their work schedule to avoid exceeding limits. In contrast, another individual may have faced delays and frustrations due to poor reporting practices.

Conclusion of the maximum amount of earnings insights

Understanding the intricacies of the maximum amount of earnings form is essential for individuals receiving benefits. The significance of knowing the earnings limits cannot be overstated, as it impacts both financial health and the sustainability of benefits. By utilizing tools like pdfFiller for document management, individuals can ensure accurate reporting and compliance with requirements.

Staying informed and proactive about earnings reporting not only aids in maintaining benefits but also empowers individuals in their financial journeys. Knowledge, when combined with effective tools and strategies, allows for optimal financial management in relation to earnings limits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit maximum amount of earnings online?

How can I edit maximum amount of earnings on a smartphone?

How do I edit maximum amount of earnings on an Android device?

What is maximum amount of earnings?

Who is required to file maximum amount of earnings?

How to fill out maximum amount of earnings?

What is the purpose of maximum amount of earnings?

What information must be reported on maximum amount of earnings?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.