Get the free Marks-roos Yearly Fiscal Status Report

Get, Create, Make and Sign marks-roos yearly fiscal status

Editing marks-roos yearly fiscal status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marks-roos yearly fiscal status

How to fill out marks-roos yearly fiscal status

Who needs marks-roos yearly fiscal status?

Understanding the Marks-Roos Yearly Fiscal Status Form

. Understanding the Marks-Roos yearly fiscal status form

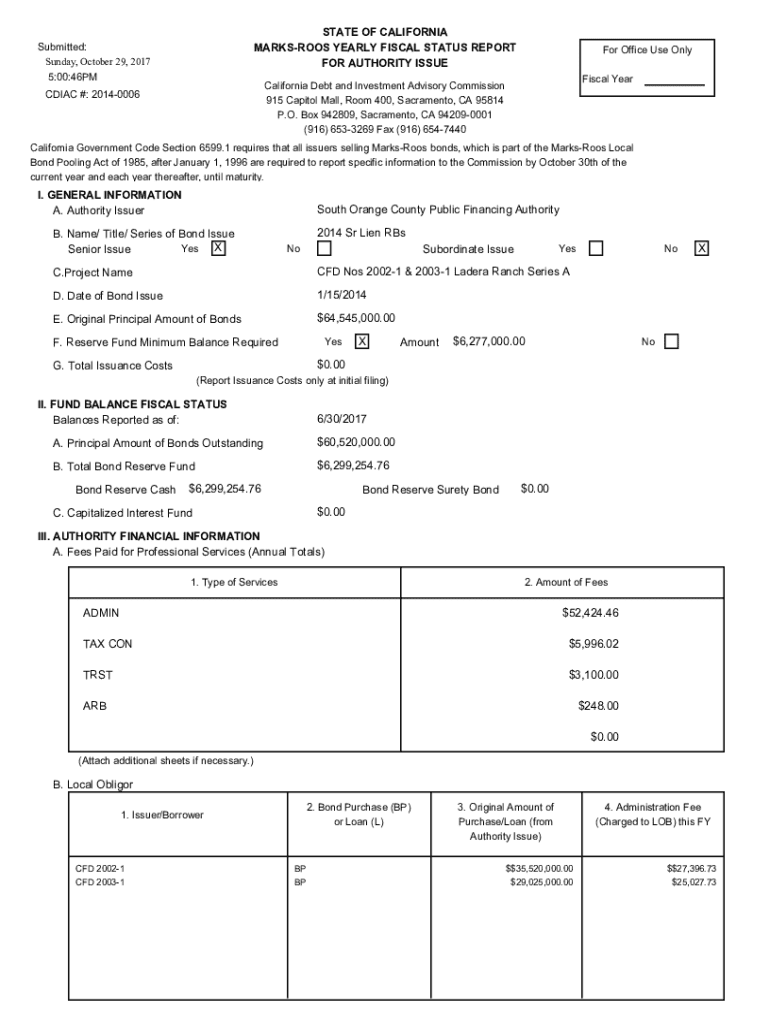

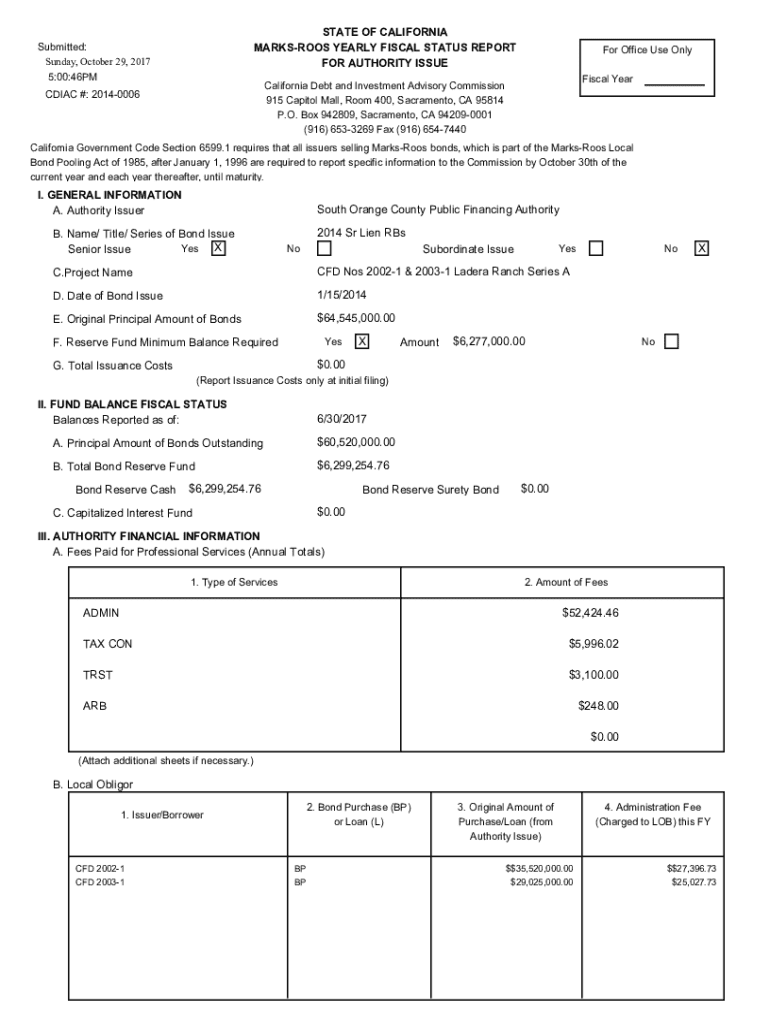

The Marks-Roos Yearly Fiscal Status Form serves as a critical financial reporting tool for local governmental agencies in California. Established under the Marks-Roos Local Bond Pooling Act of 1995, it aids cities, counties, and special districts in managing their fiscal responsibilities transparently. The form is essential for ensuring compliance with state laws while providing vital public access to local government financial data.

The primary purpose of this form is to gather detailed financial information that reflects the fiscal status of a local agency over the previous year. An accurate and timely submission not only satisfies legal requirements but also enhances the trust between local agencies and their constituents. By utilizing this form, agencies can convey their spending patterns, sources of revenue, and overall financial position, which helps in informed decision-making by stakeholders.

Who needs to file this form?

The direct audience for the Marks-Roos Yearly Fiscal Status Form includes all cities, counties, and special districts operating within California. Local agencies that have engaged in bond financing or those participating in any form of public financing need to submit this form. Meeting deadlines for submission is crucial as late filings can result in substantial penalties, which may strain the agency's resources and affect its financial reputation.

. Key components of the Marks-Roos yearly fiscal status form

The Marks-Roos Yearly Fiscal Status Form comprises multiple sections, each designed to capture specific financial data reflective of an agency’s operations. The form typically requires comprehensive financial data submissions that include revenue streams and expenditure allocations, along with detailed organizational information for clarity and compliance.

The breakdown of sections in the form is as follows: Section 1 focuses on fiscal summary data requirements, Section 2 dives into revenue and expenditure details, and Section 3 summarizes the financial position and changes over the fiscal year. Each of these segments plays an important role in illustrating the fiscal health of the agency and ensuring accountability.

. How to prepare for filing the form

Preparing to file the Marks-Roos Yearly Fiscal Status Form involves meticulous planning and documentation. Initially, you need to gather all relevant financial statements and budget reports from the previous fiscal year. These documents help in accurately reflecting the financial activities of your agency. It's advisable to utilize accounting software or tools specifically designed for governmental finances to streamline data collection.

However, common mistakes can lead to inaccurate reporting. Misreporting figures is a prevalent issue that can arise from simple miscalculations or misinterpretation of the data required. Another frequent error includes omitting essential sections or not providing all necessary supporting documentation, which could trigger compliance penalties. Avoiding these pitfalls is critical to ensuring a smooth filing process.

. Step-by-step guide to filling out the form

Filling out the Marks-Roos Yearly Fiscal Status Form can be simplified through a structured approach. Start by downloading the form, which is conveniently accessible through pdfFiller in multiple formats. This ease of access ensures that agencies can quickly begin the filing process without undue delay.

The next step involves completing the form. Each section requires specific entries, so be sure to follow the provided instructions meticulously. Use pdfFiller's interactive form features to enhance ease of editing and collaboration between team members. Once filled, it's crucial to review your entries; this safeguards against errors and ensures compliance with all legal requirements. After verifying accuracy, you can digitally sign the form through pdfFiller, making it ready for submission. Understanding the submission methods, whether opting for digital or paper, is also essential to finalize the process.

. Managing your yearly fiscal status form

Post-filing management of your Marks-Roos Yearly Fiscal Status Form is imperative for maintaining organization and compliance. Tracking the submission status of your form, especially if submitted digitally, can be efficiently managed through tools within pdfFiller, allowing agencies to ensure timely processing. This feature adds a layer of efficiency and responsibility that local agencies can tap into.

Organizing documents for future filings is another best practice. Developing a structured folder system—both digital and physical—for storing previous forms and supporting documentation can save time and reduce stress during subsequent filings. Additionally, be proactive in handling any follow-up requests from oversight bodies. Understanding how to respond to inquiries or corrections will facilitate a better relationship with regulatory authorities and ensure compliance.

. Interactive tools for enhanced understanding

Enhancing your understanding of the Marks-Roos Yearly Fiscal Status Form can be achieved through various interactive tools available on pdfFiller. Financial dashboards and analytics features help visualize your agency’s data, making analysis more straightforward and allowing for quicker adjustments to future fiscal plans. Employing these tools can unlock valuable insights from your financial data that might not be evident through conventional spreadsheets.

Additionally, webinars and tutorials provided by pdfFiller offer further learning opportunities. Engaging in these sessions equips users with the knowledge needed to navigate the intricacies of the form and related compliance measures confidently. This approach not only bolsters understanding but also ensures that the data reported reflects the agency’s financial health accurately.

. Frequently asked questions (FAQs)

Addressing common queries regarding the Marks-Roos Yearly Fiscal Status Form can alleviate confusion among local agencies. For instance, one frequently asked question is about deadlines for submission—these typically vary each year based on the agency’s fiscal calendar. Late submissions not only hinder transparency but also attract penalties which could affect the agency’s future bond issuances or funding.

Another common concern relates to where to seek help if questions arise during the filing process. pdfFiller provides robust support channels, including tutorials and a dedicated help desk, to assist users through their submission challenges. Engaging with these resources is paramount in fostering a successful filing experience.

. Legal considerations and compliance

Understanding the legal landscape surrounding the Marks-Roos Yearly Fiscal Status Form is crucial for ensuring that local agencies remain compliant with regulatory standards. Keeping up-to-date with any changes in the requirements of the Marks-Roos Act allows agencies to adjust their reporting practices accordingly. This awareness minimizes risks related to non-compliance and potential legal ramifications.

pdfFiller plays a significant role in compliance assurance, offering features designed to alert users to upcoming deadlines and changes in regulations. Utilizing these helpful tools fosters adherence to legal standards while allowing agencies to maintain transparent financial records for their constituents, thereby enhancing public trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the marks-roos yearly fiscal status electronically in Chrome?

How do I edit marks-roos yearly fiscal status straight from my smartphone?

How do I complete marks-roos yearly fiscal status on an Android device?

What is marks-roos yearly fiscal status?

Who is required to file marks-roos yearly fiscal status?

How to fill out marks-roos yearly fiscal status?

What is the purpose of marks-roos yearly fiscal status?

What information must be reported on marks-roos yearly fiscal status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.