Get the free Nebraska Combined Irp/ifta Application

Get, Create, Make and Sign nebraska combined irpifta application

How to edit nebraska combined irpifta application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska combined irpifta application

How to fill out nebraska combined irpifta application

Who needs nebraska combined irpifta application?

Nebraska Combined IRP/IFTA Application Form - How-to Guide

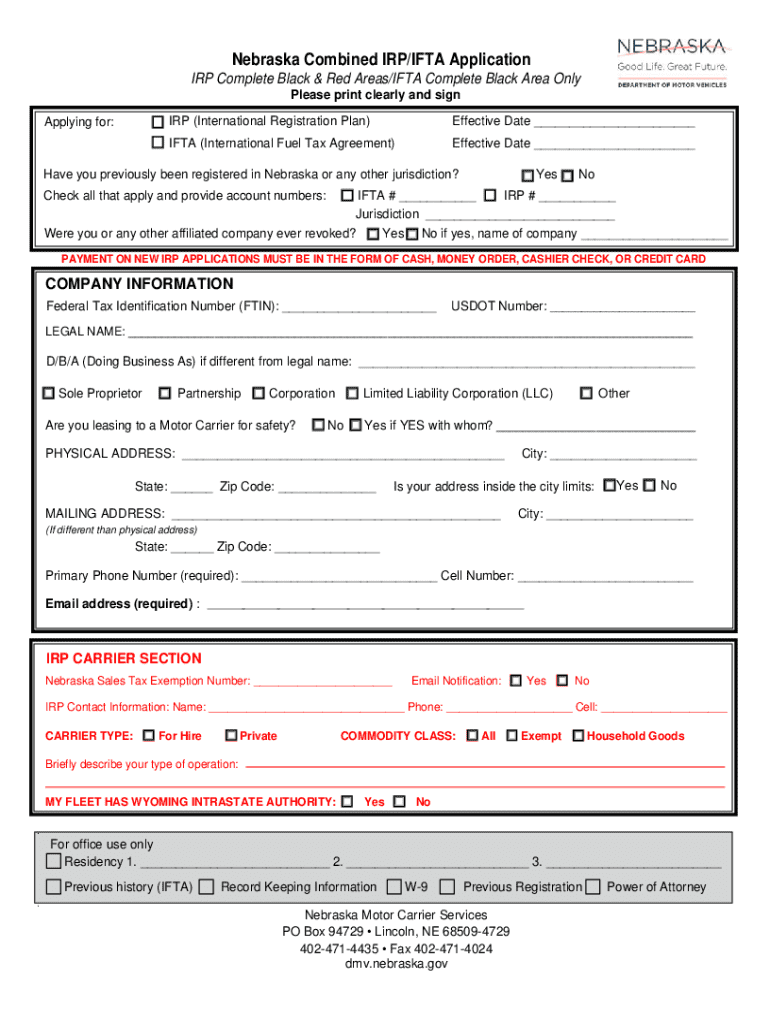

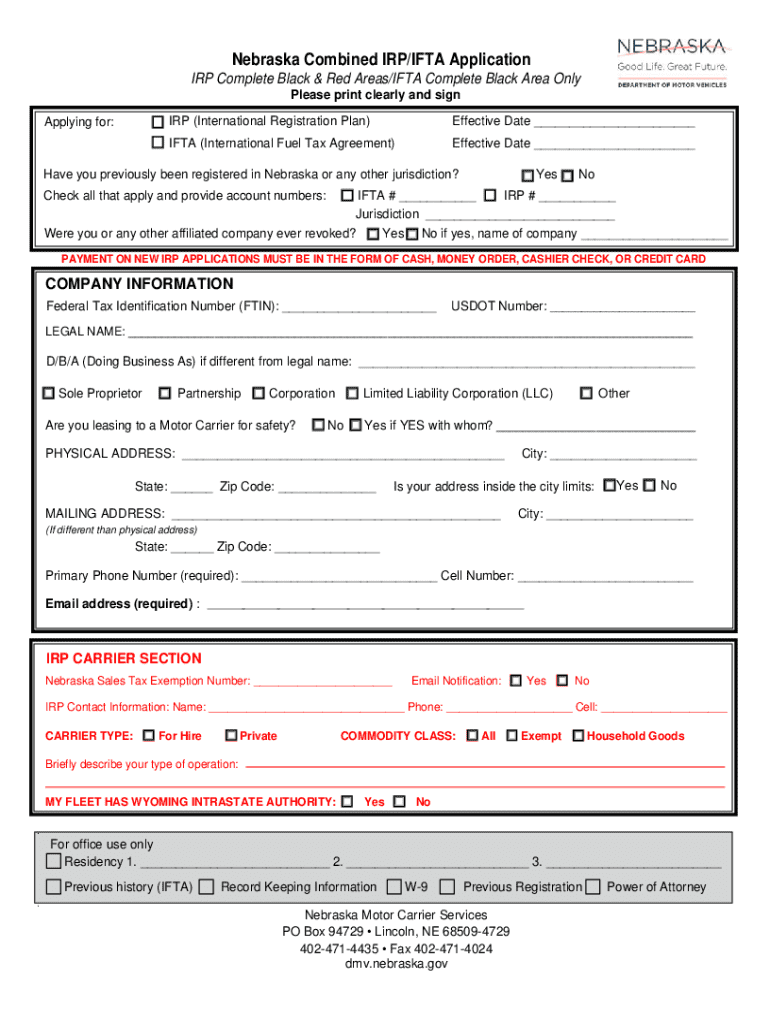

Overview of the Nebraska Combined IRP/IFTA Application Form

The Nebraska Combined IRP/IFTA Application Form facilitates the registration process for motor carriers operating across multiple jurisdictions, primarily focusing on the International Registration Plan (IRP) and the International Fuel Tax Agreement (IFTA). The IRP is an agreement among US states and Canadian provinces that allows for the registration of commercial vehicles traveling interstate. By contrast, IFTA simplifies the reporting of fuel taxes by allowing motor carriers to file a single fuel tax report to cover all jurisdictions where they operate.

Combining these applications is vital for motor carriers as it saves time and reduces redundancy. A comprehensive application helps ensure that all necessary registrations and tax obligations are managed efficiently, minimizing potential errors and delays. Businesses and individuals who operate qualified motor vehicles over the state lines and require multiple permits are encouraged to utilize this combined form to streamline their operational processes.

Eligibility criteria for the application

Eligibility for the Nebraska Combined IRP/IFTA Application Form primarily revolves around the concept of a qualified motor vehicle. A qualified motor vehicle is defined as one that is used for the transportation of property or passengers and has a gross vehicle weight exceeding 26,000 pounds or is designed to transport more than 15 passengers, including the driver.

Additionally, there are specific residency requirements for applicants. Nebraska residents seeking to file this application must provide proof of their residency, which can include documentation like a Nebraska driver’s license or other official identification. This is crucial because it establishes the carrier’s legal base for operations within the state. For businesses, eligibility hinges on meeting tax obligations and providing accurate information about business structure and identification.

Preparation before completing the application

Before diving into the application form, it's essential to prepare by gathering all necessary documentation. This includes proof of vehicle ownership, vehicle identification numbers (VINs), as well as current licensed plates and registrations for all vehicles being claimed. Furthermore, any previous IRP or IFTA certification must be provided if applicable.

Another crucial aspect of preparation is understanding the financial aspects tied to the application. Several fees are associated with the IRP and IFTA ratings, which can vary significantly. Familiarizing yourself with these costs ahead of time helps in budget allocation and prevents surprises during submission. To this end, applicants should also be aware of the timeline for application approvals, as waiting too long can affect operational schedules.

Step-by-step guide to filling out the Nebraska Combined IRP/IFTA application form

Completing the Nebraska Combined IRP/IFTA Application Form requires meticulous attention to detail. Start with Section 1, which seeks your applicant information. Here, accurately enter your full name, business name (if applicable), contact information, and address. This section is crucial, as providing incorrect information can lead to delays in processing.

In Section 2, you will need to provide detailed vehicle information, including the type of vehicle, year, make, model, and VIN. Being precise with vehicle identification is fundamental, as discrepancies can result in complications with registration or potential fines. Proceed to Section 3, where you must list the jurisdictions in which your vehicles will operate. An essential consideration here is to accurately determine your operational areas, reflecting compliance across states and ensuring proper tax allocations.

Section 4 centers specifically on IFTA details, where you will report fuel purchases and usage. Understanding IFTA reporting periods is vital, as accurately documenting fuel expenditures across jurisdictions will impact tax calculations. Lastly, in Section 5, you’ll calculate applicable fees based on your vehicle specifications and tax jurisdiction. Keep a close eye on computations, as rounding errors can lead to audit issues down the line.

Tools for completing the application

Leverage technology to make the application process easier. Platforms like pdfFiller offer interactive filling tools that allow you to manage the Nebraska Combined IRP/IFTA Application Form seamlessly. With pdfFiller, users can edit PDF forms directly in the cloud, and effective document management features enable collaborative efforts for teams dealing with multiple vehicle registrations.

One of the standout features of pdfFiller includes electronic signing, which can significantly expedite the processing times of your application. By utilizing cloud-based document management, you can ensure that necessary inputs and approvals are obtained without delay, minimizing the chance for overlooked details or lost paperwork.

Common challenges and solutions during application

Navigating the intricacies of the application process can lead to various challenges. A common mistake involves inaccuracies in the vehicle information section. Ensure that VINs, weights, and registrations are correctly documented to avoid rejections or delays. If you encounter missing documentation, reach out to past owners for proof of ownership or check registration records through the Nebraska Department of Motor Vehicles.

In the event your application is rejected, carefully review the feedback provided and address the identified issues promptly. Often, amendments can be made without needing to submit a new application. Additionally, keeping track of your application status through the submission method you chose, whether online or traditionally, can help maintain visibility into the process.

Submitting your Nebraska Combined IRP/IFTA application

Choosing your submission method is crucial; applicants can opt to submit their Nebraska Combined IRP/IFTA Application Form either online or via paper submission. Online submission typically allows for instant tracking of your application status, offering greater transparency. Paper submissions, while traditional, might take longer to process and track, requiring patience.

Once your application is submitted, understanding the expected response timeline can alleviate anxiety. Typically, responses can take several weeks. However, if more information is needed or discrepancies arise, expect this timeline to extend. Staying proactive and following up can help expedite the process if required.

Frequently asked questions (FAQs)

Several questions commonly arise regarding the Nebraska Combined IRP/IFTA Application Form. A prevalent query is whether separate licenses are necessary for both IRP and IFTA. Generally, individuals only need one application as the combined form suffices for your operational needs under the jurisdictional laws.

Another common concern involves record-keeping for IFTA purposes. Drivers should maintain meticulous records of all fuel purchases and travel miles in different jurisdictions to ensure compliance during audit periods. Finally, for operators managing fuel reports across multiple jurisdictions, familiarizing yourself with specific reporting periods and tax rates can significantly ease the filing process, ensuring that all records align.

Additional resources and support

For any lingering questions or support needs, the Nebraska Department of Motor Vehicles provides extensive resources to assist applicants. Visit their website or call their customer service line for professional guidance regarding your application. There are also numerous online forums and websites offering additional insights from industry professionals that might help you navigate various challenges effectively.

These resources are invaluable whether you are a new motor carrier or an experienced veteran seeking to adapt to new regulations. Online communities can offer tips based on personal experiences and best practices that can enhance your understanding of the application process.

Enhance your document management with pdfFiller

pdfFiller positions itself as an all-in-one platform for document management, ideal for professionals in the transportation sector dealing with the Nebraska Combined IRP/IFTA Application Form. With its advanced features, users can not only fill out and submit forms with ease but also manage ongoing compliance through seamless updates to their documents.

Utilizing pdfFiller enhances collaborative efforts within teams where multiple individuals may require access to update or sign transport-related paperwork. The ease of sharing documents within a secure environment fosters teamwork while ensuring compliance is maintained month after month.

Related forms and applications

In addition to the Nebraska Combined IRP/IFTA Application Form, various other forms may be relevant to motor carriers. Examples include the Individual Vehicle Identification Application, Temporary IRP Application, and others tied to specific transportation needs. Providing easy access to related applications simplifies the paperwork often associated with motor carrier operations.

For quick navigation, it may be beneficial to compare these forms against one another, as some might have overlapping requirements or processes. This alignment helps streamline compliance across different vehicle registrations and permits, resulting in a holistic approach to transportation management.

Important dates and deadlines

Keeping track of IFTA reporting deadlines is crucial for all motor carriers, as timely filing can prevent considerable fines or penalties. IFTA quarterly reporting dates typically occur every three months, while annual IRP renewals may have specific windows that align with vehicle purchasing dates.

Marking your calendar with key dates associated with filing and renewal makes it easier to manage your compliance efforts proactively. Missing these deadlines not only results in financial repercussions but can also hinder operational efficiency, affecting permits and vehicle operability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in nebraska combined irpifta application?

Can I create an electronic signature for the nebraska combined irpifta application in Chrome?

How do I fill out nebraska combined irpifta application on an Android device?

What is nebraska combined irpifta application?

Who is required to file nebraska combined irpifta application?

How to fill out nebraska combined irpifta application?

What is the purpose of nebraska combined irpifta application?

What information must be reported on nebraska combined irpifta application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.