Comprehensive Guide to Motion for Payment Plan Form

Understanding motion for payment plan forms

A motion for payment plan is a legal request made to a court, asking it to approve a structured payment method for settling debts or obligations. Individuals or businesses may face financial hardships and find it challenging to make lump-sum payments. Therefore, this motion serves as a formal means to propose an installment payment plan, allowing creditors to receive payments over a specified duration.

Typically used in various legal contexts, including family court (for child support), bankruptcy filings, or civil judgments, the motion provides a pathway for individuals wanting to maintain financial stability while honoring their debts. By filing this motion, debtors can negotiate terms that reflect their capacity to pay, promoting better outcomes for both parties involved.

What is a Motion for Payment Plan?

When is it typically used?

Preparing to file a motion for payment plan

Before filing a motion for a payment plan, it’s paramount to understand the eligibility criteria. Generally, anyone who is under financial strain—whether a private individual or a corporation—can file this motion. However, various factors determine eligibility based on jurisdiction, such as existing judgments or creditor consent.

Collecting necessary information is essential in this process. Debtors must provide robust financial details, including income, monthly expenses, outstanding debts, and assets. Additionally, proper documentation such as recent pay stubs, tax returns, and bank statements helps to substantiate the claim, making a compelling case before the court.

Who can file a motion for a payment plan?

Financial information required

Documentation to support your motion

Step-by-step guide to completing the motion for payment plan form

Filling out the Motion for Payment Plan form requires precision and attention to detail. You can easily access the template form on pdfFiller, which provides an intuitive interface for editing and managing documents. Start by visiting their site and navigating to the specific template needed.

When filling out the form, pay careful attention to each section, ensuring you provide accurate information.

Personal Information: Your name, address, contact information, and case number.

Case Details: Summarize the context of your case, references to the judgment, or existing obligations.

Payment Proposal: Clearly outline how much you can pay monthly and for how long.

Justifications for the Motion: Elaborate on your financial situation and why a payment plan is necessary.

Once you’ve filled out the form, utilize pdfFiller's editing tools to customize it further if necessary, ensuring it adheres to required formats.

Filing the motion in court

After completing the motion for payment plan form, preparing your documents for filing is crucial. Ensure you have multiple copies of the form and any supporting documentation as courts often require records for all parties involved.

Submitting the motion follows a structured process. Generally, you will file the motion with the court clerk. Depending on your location, this may be done in person, via mail, or electronically. Be mindful of your court’s specific requirements and filing fees.

Assemble necessary copies of your motion and supporting documentation.

File the motion with your local court clerk.

Serve copies of the motion to other involved parties.

Next, the motion must be served to all relevant parties. This typically includes creditors involved in your case. Service requirements can vary, so check local laws. After service, file proof of service documentation, confirming that all parties received the motion.

Attending the hearing

Attending the hearing concerning your motion is often necessary. Courts may require your presence to clarify your proposal and answer any questions the judge or other parties may have. Being present shows your commitment to resolving the matter fairly and responsibly.

Preparation for the hearing involves practicing key points you want to communicate. Outline your financial situation and clearly state why the installment payment plan serves both your interests and the creditor's interests. Expect to answer questions from the judge that might relate to your proposed terms, your current financial condition, and how you plan to meet the payment obligations.

Why your presence may be required.

Key points to cover during your presentation.

What to expect in the courtroom.

After the hearing

The outcomes after the hearing can vary. The court may either accept the motion and outline specific terms, negotiate adjustments, or even deny the request based on the presented evidence. No matter the outcome, understanding the court's rationale can provide insight into financial planning.

If the motion is granted, you may have the opportunity to modify the payment plan based on the judge’s recommendations or any new financial circumstances. pdfFiller is a valuable resource during this time, allowing you to create and edit updated documents quickly.

Accepting the motion, negotiating terms, or alternative decisions.

How to adjust your motion based on the court's ruling.

Managing your payment plan

Establishing a manageable payment plan is only the beginning. Keeping track of your payments is crucial to ensuring you stay on course with your obligations. pdfFiller provides templates and tracking tools to streamline this process, making it easy to log payments and remain accountable.

Open and regular communication with creditors helps maintain healthy relations. Establishing good rapport helps if you need to negotiate future changes in the payment schedule. Best practices include timely updates about your financial situation and proactive requests for modifications should circumstances change.

Tools and templates available on pdfFiller to manage payments.

Best practices for maintaining good relations and transparency.

Additional support and resources

Accessing pdfFiller's customer support can provide you with additional assistance during the process. The platform offers comprehensive resources for users who have questions about using the service or need help filling out forms. Engaging with support can simplify the experience of managing legal documents.

It is also highly recommended to consider consulting a legal professional when handling motions and court proceedings. Legal advice can help you navigate complexities and ensure you are compliant with all relevant laws. pdfFiller can assist in the documentation process, making it easier to draft and store any necessary legal papers.

Resources for users needing further assistance.

Importance of consulting a legal professional.

Samples and examples

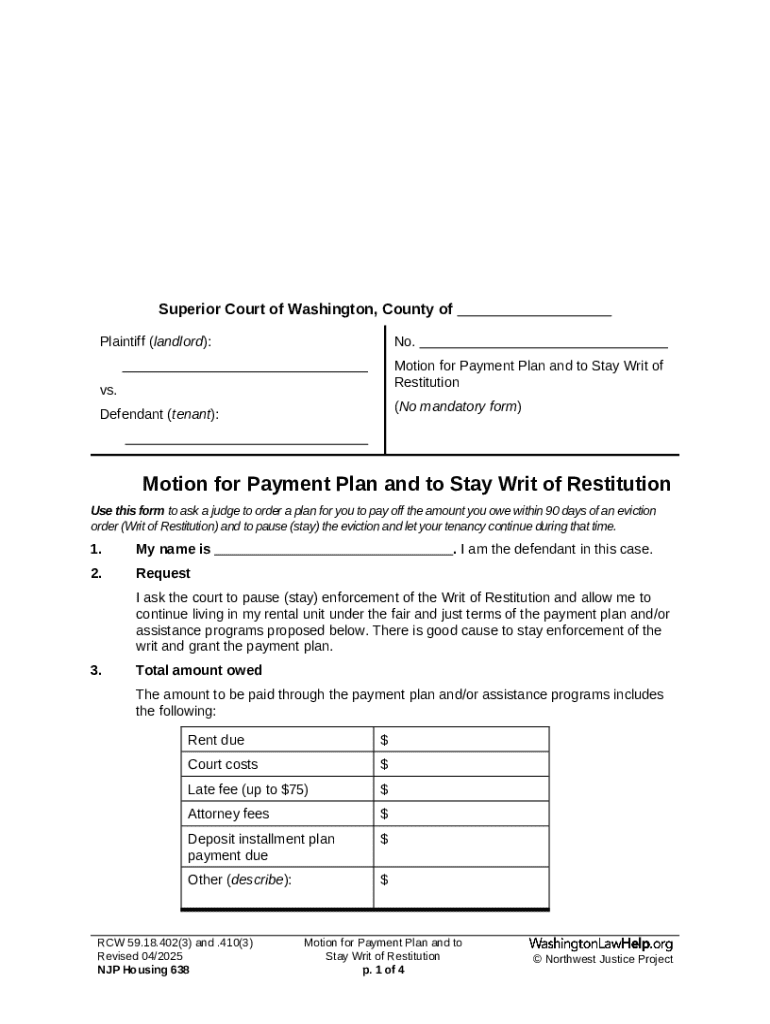

Seeing visual representations can enhance understanding. A sample completed motion for payment plan helps demystify the process, showcasing what a filled-out form looks like. Such samples can guide you in accurately completing your own forms, avoiding confusion.

Moreover, being aware of common mistakes can save you time and stress. Examples of frequent errors include providing insufficient financial information or failing to meet service requirements. Learning about these pitfalls enables you to navigate the filing with more confidence.

Visual representation of a filled-out form.

Highlight frequent errors and how to avoid them.

FAQs about motion for payment plans

Several common questions often arise concerning a motion for payment plan. One significant inquiry includes understanding whether motions can apply to all debts or are limited to specific types. Others may wish to know how decisions on motions typically impact future credit.

Providing quick answers and resources for further clarification can empower individuals seeking this route, ensuring they make informed decisions throughout the payment plan process.

Quick answers and resources for further clarification.