Get the free Continuing Disclosure in the Municipal Bond Market

Get, Create, Make and Sign continuing disclosure in form

How to edit continuing disclosure in form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out continuing disclosure in form

How to fill out continuing disclosure in form

Who needs continuing disclosure in form?

Continuing Disclosure in Form: A Comprehensive How-to Guide

Understanding continuing disclosure requirements

Continuing disclosure is a crucial aspect of maintaining transparency in the municipal securities market. It refers to the ongoing obligation of issuers to disclose certain financial and operational information to investors and regulatory bodies. This requirement is established to provide essential information that can impact the investment decisions of bondholders and potential investors.

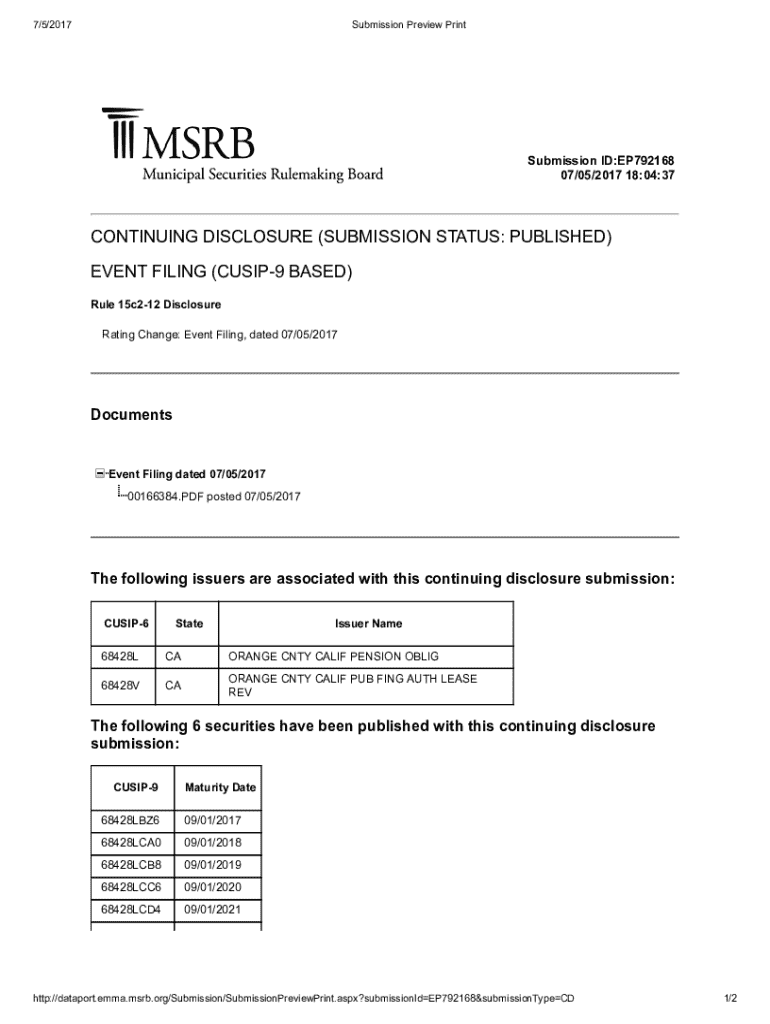

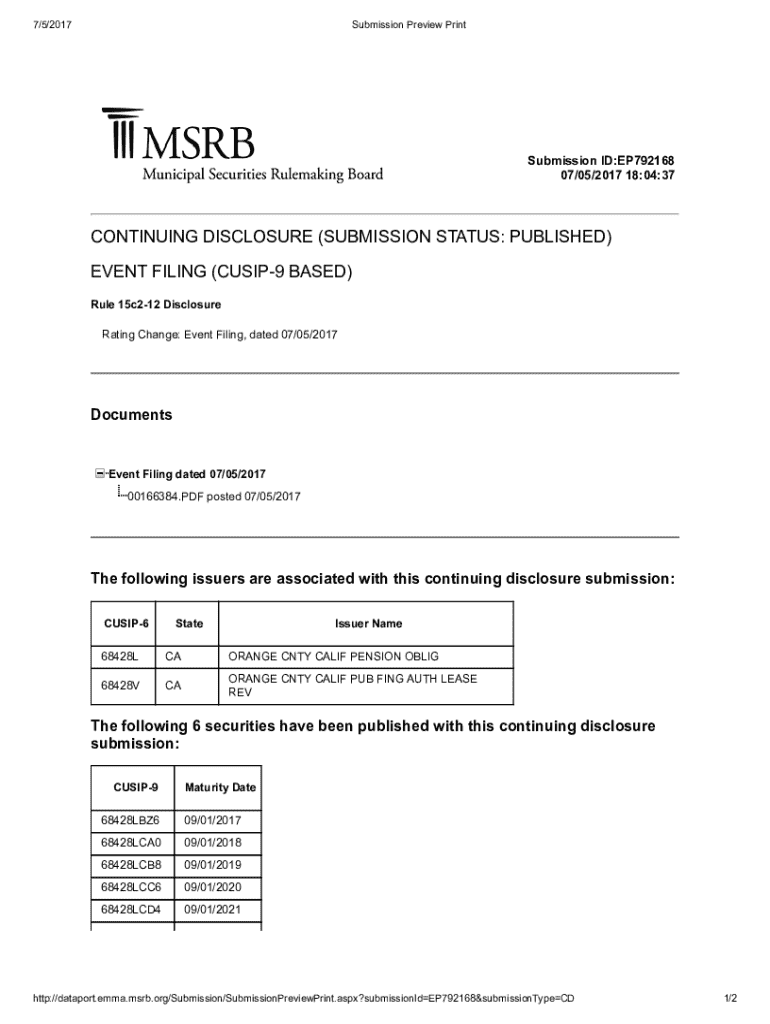

In the realm of municipal securities, continuing disclosures serve as a safeguard for investors, ensuring they are well-informed about the issuer's financial health. The Securities and Exchange Commission (SEC) instigated this requirement through Rule 15c2-12, which mandates that issuers must submit specific information regularly, allowing for a more informed investment landscape.

Types of continuing disclosure forms

Various forms are integral to the continuing disclosure process. These forms convey important financial data and operational updates that help maintain transparency. Municipal issuers often use standardized templates to ensure compliance and facilitate the review process.

Common forms used include the Annual Financial Information form, which outlines the issuer's financial state, and the Event Notice form, which informs investors about significant occurrences that may affect the investment's value. The Municipal Securities Rulemaking Board (MSRB) plays a pivotal role by oversees these disclosures through its Electronic Municipal Market Access (EMMA) system, facilitating public access to this critical information.

Filling out a continuing disclosure form on pdfFiller

Filling out continuing disclosure forms can be streamlined significantly through pdfFiller, a cloud-based platform that allows users to easily access and manage their documents. To begin, users need to log in to pdfFiller, navigate to the form section, and select the appropriate continuing disclosure form.

Once the form is opened, users can fill in the required fields seamlessly. Each section will come with prompts and examples that guide users through reporting necessary information such as updated financial data, operational reports, or any pertinent events impacting the disclosures.

Editing and customizing your form

One of the powerful features of pdfFiller is its editing tools, which allow users to customize continuing disclosure forms as necessary. Users can easily add or remove sections as required, adapting the forms to accurately reflect current circumstances and fulfill compliance obligations.

Interactive tools available on pdfFiller enhance clarity and understanding, allowing users to annotate and highlight critical areas within the form. This customization ensures that the disclosed information is not only correct but also clearly communicated to stakeholders.

Signing and sharing your continuing disclosure form

Once the continuing disclosure form is completed, users may need to sign it electronically. pdfFiller provides a straightforward method for eSigning, allowing users to apply their digital signature, ensuring compliance and authenticity. This feature eliminates the cumbersome process of printing and scanning.

Sharing the completed form is equally simple. Users can invite team members to review or collaborate on the document and distribute it to relevant stakeholders directly through pdfFiller’s sharing options, ensuring that all parties have the most up-to-date information.

Managing and storing your documents securely

Utilizing cloud-based document management systems like pdfFiller provides significant benefits regarding organization and security. Users can manage their continuing disclosure forms and related documents securely, ensuring that they remain compliant with reporting deadlines while accessing their information from anywhere.

Organizing documents efficiently within pdfFiller helps users quickly locate forms needed for filing. Utilizing folders and tags within the platform allows for an ongoing review of disclosures, identifying when updates are necessary to maintain compliance with changing regulatory requirements.

Best practices for ongoing compliance

Staying compliant with continuing disclosure requirements is an ongoing task that involves regularly monitoring any updates in disclosure obligations. Issuers should establish a routine to review ongoing compliance and ensure all necessary adjustments to disclosures are made promptly as conditions change.

Regular reviews of disclosure documents are vital to capture any changes in the issuer's financial condition or compliance landscape. Resources such as the MSRB website and educational webinars help issuers understand the regulatory environment and implement best practices in their disclosure strategies.

Troubleshooting common issues

Even with a comprehensive understanding of continuing disclosure, users may encounter challenges during the form-filling process. Common issues include missing fields, format discrepancies, and submission errors. Learning how to troubleshoot these problems can save time and avert potential compliance lapses.

pdfFiller offers robust support resources, including FAQs and live chat support, to assist users facing hurdles. Additionally, users can reach out to MSRB support for specific inquiries related to regulatory compliance and submission requirements.

Related concepts and further learning

Understanding continuing disclosure goes hand-in-hand with grasping related concepts within the municipal securities realm. Key terms and obligations must be understood to ensure compliance. Keeping up with market updates, changes in laws, and best practices can profoundly affect how an issuer manages their disclosures.

Utilizing blogs, webinars, and forums focused on securities regulation can provide further educational content that enhances users' understanding and application of continuing disclosures. It is beneficial to build a resource base that supports ongoing learning and adaptation.

User experiences and case studies

Real-world testimonials underscore the effectiveness of proper continuing disclosure practices. Users of pdfFiller have experienced improved efficiency in managing disclosures, noting how the platform's features simplify the preparation and submission process. They highlight how digital signature options alleviate administrative burdens, allowing seamless compliance with disclosure requirements.

Specific case studies illustrate successful compliance with continuing disclosure obligations, showcasing how entities were able to mitigate risks and enhance investor confidence by utilizing pdfFiller’s capabilities to manage their reporting effectively.

Interactive Q&A section

An interactive Q&A section allows users to ask common questions concerning the continuing disclosure process. Experts within the field can provide straightforward answers and clarifications, further enhancing user understanding of obligations and processes involved.

Encouraging community engagement enriches the learning experience, allowing users to share insights and best practices regarding continuing disclosure management. This engagement fosters a supportive network among users navigating this complex regulatory environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send continuing disclosure in form to be eSigned by others?

How do I make edits in continuing disclosure in form without leaving Chrome?

Can I create an eSignature for the continuing disclosure in form in Gmail?

What is continuing disclosure in form?

Who is required to file continuing disclosure in form?

How to fill out continuing disclosure in form?

What is the purpose of continuing disclosure in form?

What information must be reported on continuing disclosure in form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.