Get the free Marks-roos Yearly Fiscal Status Report for Local Obligors

Get, Create, Make and Sign marks-roos yearly fiscal status

How to edit marks-roos yearly fiscal status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marks-roos yearly fiscal status

How to fill out marks-roos yearly fiscal status

Who needs marks-roos yearly fiscal status?

Navigating the Marks-Roos Yearly Fiscal Status Form: A Comprehensive Guide

Understanding the Marks-Roos yearly fiscal status form

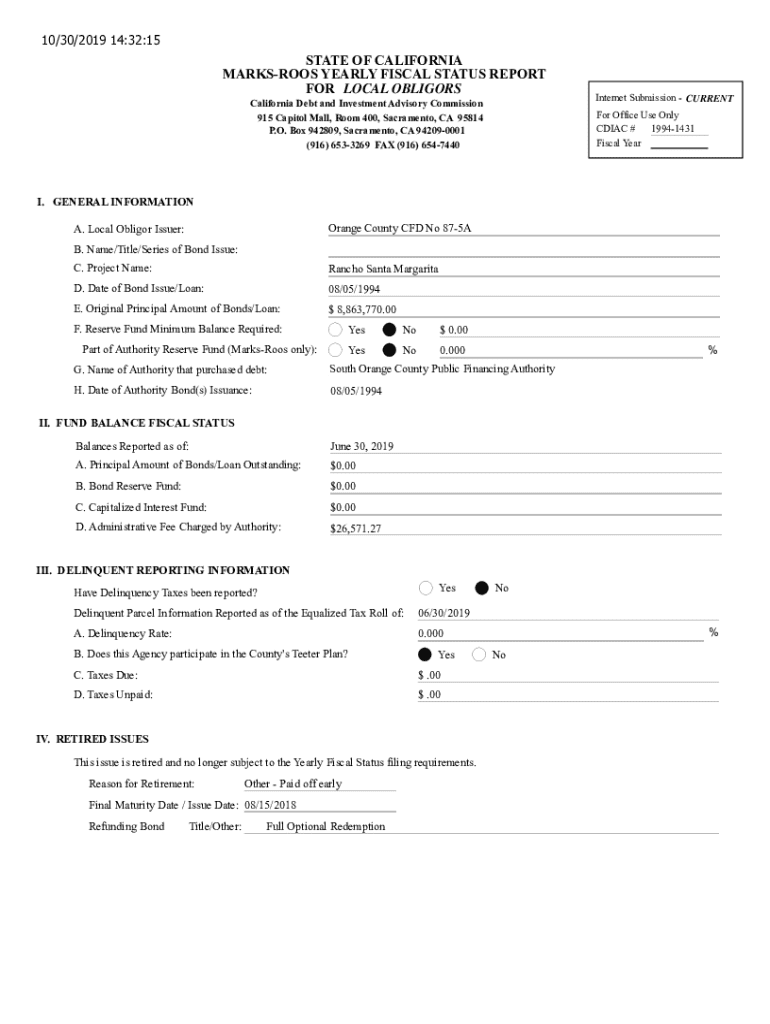

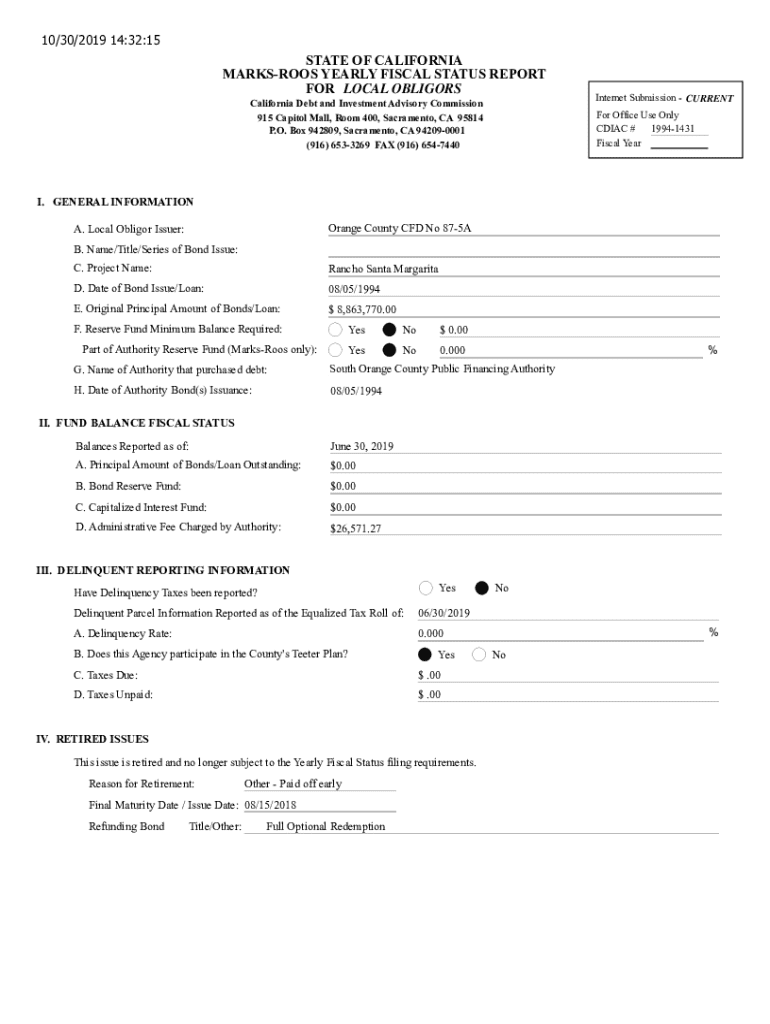

The Marks-Roos Yearly Fiscal Status Form is a crucial document mandated for specific entities under the Marks-Roos Local Bond Pooling Act of 1996. The Act was designed to allow local agencies, such as municipalities and special districts, to pool their resources for financing public projects, thereby maximizing efficiency and financial sustainability. The yearly fiscal status form is essential because it provides transparency and accountability, enabling these organizations to report their financial status and ensure they are operating within the parameters set by the California Department of Justice (DOJ).

This form serves not only as a compliance measure but also as a tool for effective financial management. By completing the Marks-Roos yearly fiscal status form, eligible entities can showcase their commitment to responsible fiscal practices. It informs stakeholders about financial performance, enhances credibility, and supports sound decision-making.

Who needs to complete this form?

Eligible entities required to complete the Marks-Roos yearly fiscal status form primarily include non-profit organizations, municipalities, and special districts engaged in public finance projects. These organizations must adhere to the guidelines established by the DOJ, which emphasizes the importance of accountability and the proper use of public funds. It is vital that the responsible parties within these entities familiarize themselves with the specific requirements and processes outlined by the DOJ to ensure compliance and maintain operational integrity.

Key components of the Marks-Roos yearly fiscal status form

To effectively complete the Marks-Roos yearly fiscal status form, it is essential to understand its key components. Initially, the document requires basic information about the entity, including the name, address, and contact details, alongside the fiscal year being reported. This foundational data ensures that the form is properly attributed to the correct organization and fiscal period.

More intricate details are captured in the financial data requirements. Entities must provide a breakdown of their revenue sources, including taxes, government grants, and service revenue. The form also requires a categorization of expenses, which can include operational costs and project-specific expenditures. Another vital component is the reporting of capital contributions and investments, which gives a clearer picture of the entity's financial health and commitments.

Supporting document checklist

In conjunction with the Marks-Roos yearly fiscal status form, organizations must submit supporting documentation to bolster their reported data. This typically includes essential financial statements such as the balance sheet and income statement, which provide insight into the operations and financial position of the entity. Any supplementary documentation necessary for the submission should also be prepared in advance to ensure a smooth filing process.

Step-by-step guide to completing the form

Completing the Marks-Roos yearly fiscal status form can be straightforward when approached methodically. The first step is to gather all necessary information. This includes not only financial data but also organizational details. Utilizing cloud-based document management tools can facilitate efficient data collection, allowing teams to collaborate in real-time on the form.

Once data is organized, the next step is filling out the form. Each section requires careful attention; it's important to provide accurate and complete information. Specific instructions accompany each part of the form, and users should familiarize themselves with these to avoid common mistakes, such as misreporting figures or neglecting to provide required documentation.

After entry completion, the importance of reviewing your entries cannot be overstated. Taking the time to double-check for accuracy ensures the integrity of the submission. Utilizing online checklists and guides can help verify that all aspects are covered before finalizing the submission.

The final step is submitting the form, which can be done through an online portal or via mail. Entities should be mindful of important deadlines to avoid penalties or required resubmissions. Adhering to the timeline outlined by the DOJ will reflect well on the entity’s compliance efforts.

Tips for efficient management and filing

Effective document management is crucial when dealing with forms like the Marks-Roos yearly fiscal status form. Best practices recommend utilizing tools such as pdfFiller for seamless editing and collaboration. With cloud-based capabilities, teams can access, edit, and share documents anytime, ensuring that everyone involved in the preparation is on the same page.

Additionally, adopting technology to manage reminders for future submissions can alleviate the pressure as deadlines approach. Cloud-based solutions not only facilitate document access and modifications but also enhance data security. Properly storing documents enhances retrieval efficiency, which is essential when responding to inquiries or audits from regulatory bodies.

Frequently asked questions (FAQs)

Navigating the complexities of the Marks-Roos yearly fiscal status form can prompt several questions. For instance, if entities realize a mistake after submission, they should consult the DOJ guidelines on amendments. Understanding whether the form can be changed post-filing is crucial for maintaining accuracy in reporting.

Furthermore, organizations must grasp the implications of non-compliance to avoid potential repercussions. Seeking legal advice when in doubt can be beneficial, particularly if there are concerns regarding the interpretation of financial data or compliance with state regulations.

Interactive tools and resources

For those looking to enhance their experience in completing the Marks-Roos yearly fiscal status form, interactive tools can be a game changer. An interactive checklist for form preparation provides a step-by-step guide that users can download or use online to ensure they do not overlook any crucial components during the filing process.

Also, the availability of webinars and online tutorials dedicated to the Marks-Roos form can bolster understanding and competence. These resources not only explain nuances but also highlight best practices and compliance tips. Additionally, community forums allow users to engage with peers, sharing experiences and solutions to challenges faced during the submission process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find marks-roos yearly fiscal status?

How do I fill out the marks-roos yearly fiscal status form on my smartphone?

How do I complete marks-roos yearly fiscal status on an iOS device?

What is marks-roos yearly fiscal status?

Who is required to file marks-roos yearly fiscal status?

How to fill out marks-roos yearly fiscal status?

What is the purpose of marks-roos yearly fiscal status?

What information must be reported on marks-roos yearly fiscal status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.