Get the free Missionsquare Ira

Get, Create, Make and Sign missionsquare ira

Editing missionsquare ira online

Uncompromising security for your PDF editing and eSignature needs

How to fill out missionsquare ira

How to fill out missionsquare ira

Who needs missionsquare ira?

Comprehensive Guide to the Missionsquare IRA Form

Understanding the Missionsquare IRA

A Missionsquare IRA represents a retirement savings plan designed to help individuals, particularly those in the public service sector, secure their financial future. This plan allows participants to make contributions that can grow tax-deferred until withdrawal, typically during retirement.

Key benefits of the Missionsquare IRA include tax advantages, flexible contribution limits, and a variety of investment options. These features make it an attractive choice for anyone looking to build a substantial nest egg for retirement. Additionally, the IRA plan emphasizes simplicity in management, ensuring users are not overwhelmed by the complexities often associated with retirement planning.

Missionsquare offers various plan types, including Traditional IRAs, Roth IRAs, and SEP IRAs for self-employed individuals or small business owners. Each plan type serves a different set of needs depending on individual circumstances and tax situations.

Who can use the Missionsquare IRA

Eligibility for the Missionsquare IRA primarily includes individuals employed in public service roles, including teachers, government workers, and non-profit employees. However, professionals outside these sectors may also qualify under specific conditions. Prospective participants should verify their eligibility by reviewing the detailed criteria set forth by Missionsquare.

Teams and organizations can also benefit from Missionsquare IRAs, particularly if they offer retirement benefits to their employees. Employers can choose to sponsor plans that meet their workforce's needs while ensuring compliance with IRS guidelines. Considerations when choosing a plan should include factors such as matching contributions, administrative fees, and the types of investment options available.

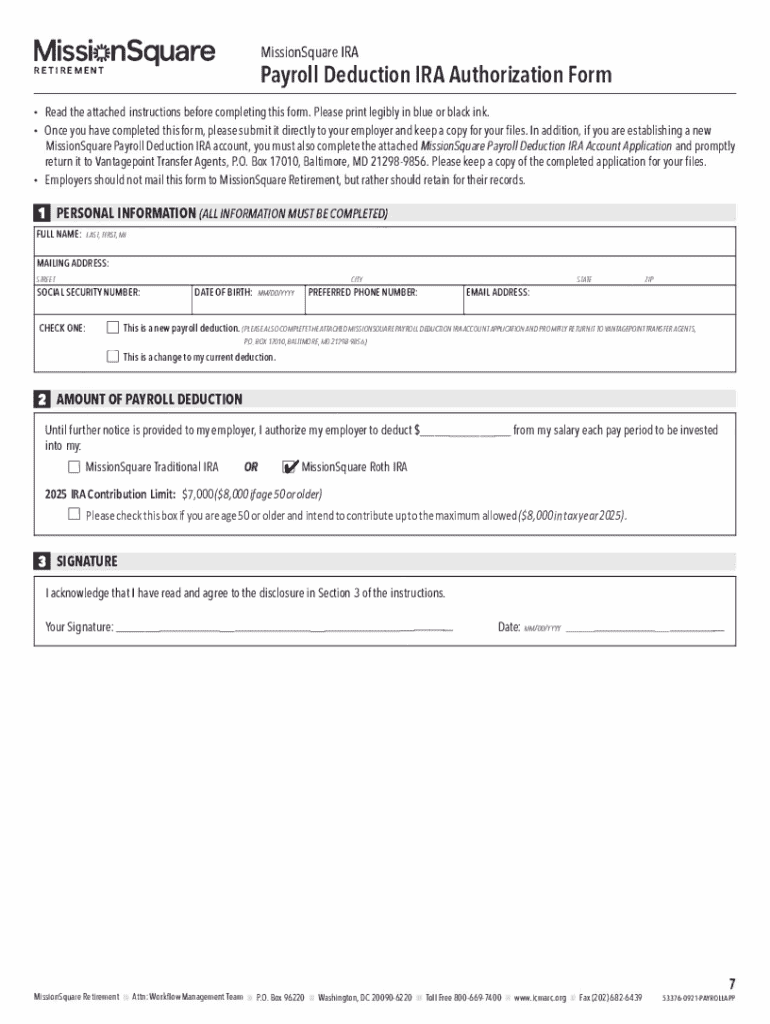

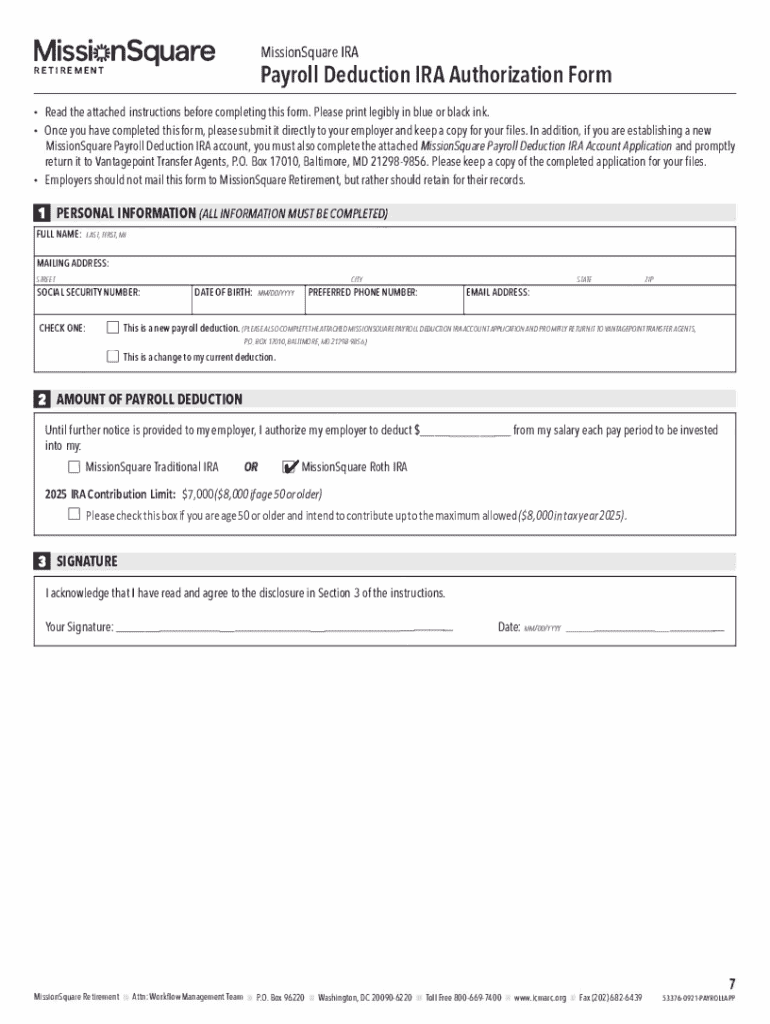

Step-by-step guide to filling out the Missionsquare IRA form

To successfully complete the Missionsquare IRA Form, it’s essential first to prepare adequately. Start by collecting necessary documents like your Social Security number, employment details, and previous tax returns. Ensure you have relevant financial documents that detail your current investments.

When filling out the form, here's a detailed breakdown of what to expect:

Avoid common mistakes such as incorrect Social Security numbers or misunderstandings regarding contribution limits. Double-check that all information aligns with IRS compliance to ensure a smooth processing of your form.

Editing and signing the Missionsquare IRA form with pdfFiller

Once you have the form ready, pdfFiller provides convenient options to manage your document effectively. Start by uploading your Missionsquare IRA form to the pdfFiller platform for easy access.

With pdfFiller, users can utilize a range of editing tools to modify their IRA form. These tools include:

After editing, consider eSigning your form through pdfFiller. eSigning can be performed easily with various methods available on the platform, ensuring the legal validity of your signature, which is essential for document authenticity.

Managing your Missionsquare IRA

Once your form is complete, submitting it correctly is crucial. Users can send their finished IRA form using the submission protocols outlined on the Missionsquare website. After submission, it's wise to track your submission status actively, ensuring you are abreast of any updates related to your application.

Additionally, if you need to make modifications to your contributions after your initial submission, check the policies set forth by Missionsquare. Adjustments might require re-submission of certain forms or direct adjustments through your account portal.

Tips for maximizing your Missionsquare IRA benefits

To optimize your Missionsquare IRA, it’s essential to understand contribution limits set by the IRS. For traditional and Roth IRAs, these limits can vary based on age and income. Staying informed helps you make the most of your yearly contributions.

Best practices for withdrawals and rollovers should also be discussed. For instance, Roth IRAs allow tax-free withdrawals, while traditional IRAs may incur taxes upon distribution. It's important to plan your strategy thoughtfully with an eye on your future retirement needs.

Long-term planning for retirement with your IRA is vital. Regularly reviewing your investment strategy, reassessing your goals, and consulting with financial advisors can help keep your retirement planning on track.

Frequently asked questions about the Missionsquare IRA

Users often wonder about tax implications associated with the Missionsquare IRA. Generally, contributions to a traditional IRA may be tax-deductible, lowering your taxable income for the year, while Roth IRA contributions are made after taxes but grow tax-free.

Comparison with other retirement accounts is also a common question. Missionsquare IRAs provide unique benefits and flexible investment options that can differ significantly from 401(k)s or other retirement plans, particularly for public sector employees.

Missionsquare provides various resources for ongoing account management, including tools for tracking investments and educational materials to help users navigate their retirement strategies effectively.

Additional tools and resources

For anyone managing a Missionsquare IRA, interactive calculators for retirement planning can be invaluable. These tools allow users to simulate various contributions and withdrawal strategies to see how they may affect future savings.

Financial planning services, accessible through pdfFiller, can also aid in crafting a strategic approach to your retirement savings. Furthermore, engaging with community support can provide insights and encouragement from others navigating similar financial journeys.

Staying informed about changes in IRA rules and regulations

It’s essential to stay updated regarding any shifts in IRA rules or regulations that may impact your Missionsquare IRA. Subscribing to updates directly from Missionsquare ensures you receive timely information about any necessary changes.

Keeping your contact information current in their system is crucial. This simple step guarantees that you won’t miss important notifications that could affect your retirement savings or investment strategy.

Connect with us

For personalized support and assistance managing your Missionsquare IRA, various options are available. Users can engage directly through chat support or schedule one-on-one consultations with financial advisors.

In addition, accessing the Missionsquare mobile app allows for on-the-go management of your retirement account. Users can also opt for text updates to stay proactively informed about their IRA status and changes in contribution limits or regulations, ensuring that they're always in the loop.

Additional features

User testimonials and success stories showcase the positive experiences that many individuals have had while using the Missionsquare IRA. These real-life accounts can inspire confidence and inform new users about potential outcomes.

Engaging videos and tutorials for completing the Missionsquare IRA form can also enhance user experience. Visual aids help demystify the process, making it more approachable, especially for those unfamiliar with paperwork and retirement planning.

Lastly, a blog section featuring insights into financial wellness and retirement planning allows users to access a wealth of information that supports their investment journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit missionsquare ira from Google Drive?

Where do I find missionsquare ira?

How do I fill out missionsquare ira using my mobile device?

What is missionsquare ira?

Who is required to file missionsquare ira?

How to fill out missionsquare ira?

What is the purpose of missionsquare ira?

What information must be reported on missionsquare ira?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.