Get the free Marks-roos Yearly Fiscal Status Report

Get, Create, Make and Sign marks-roos yearly fiscal status

How to edit marks-roos yearly fiscal status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marks-roos yearly fiscal status

How to fill out marks-roos yearly fiscal status

Who needs marks-roos yearly fiscal status?

Marks-Roos Yearly Fiscal Status Form: A Comprehensive How-To Guide

Understanding the Marks-Roos Act

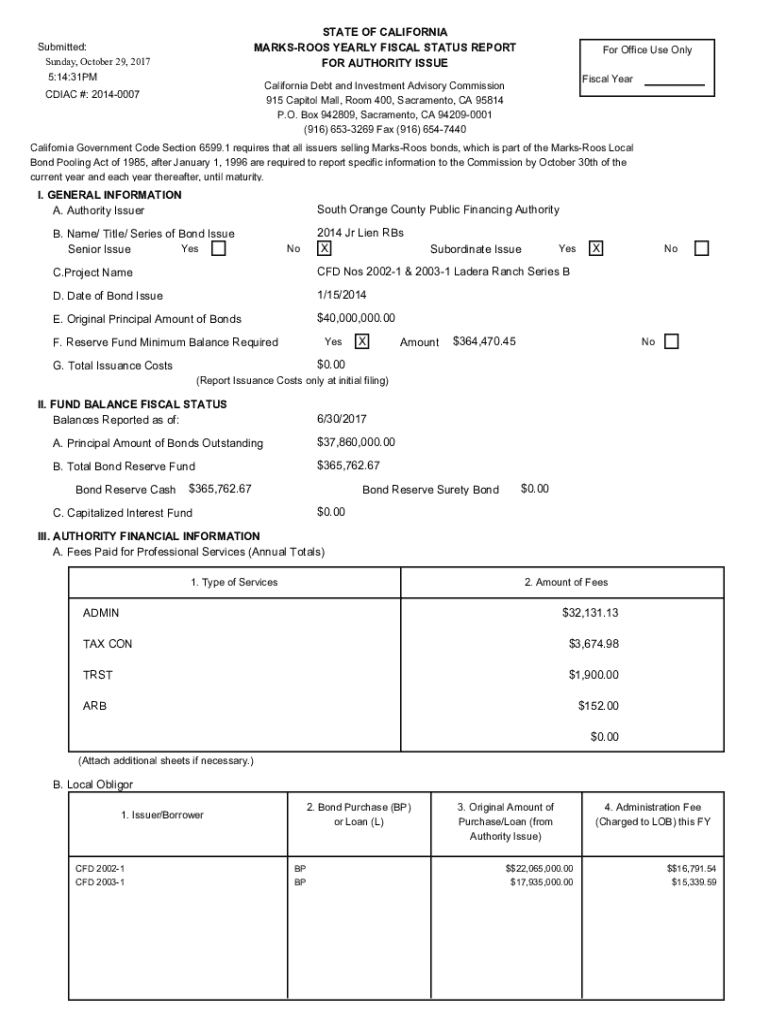

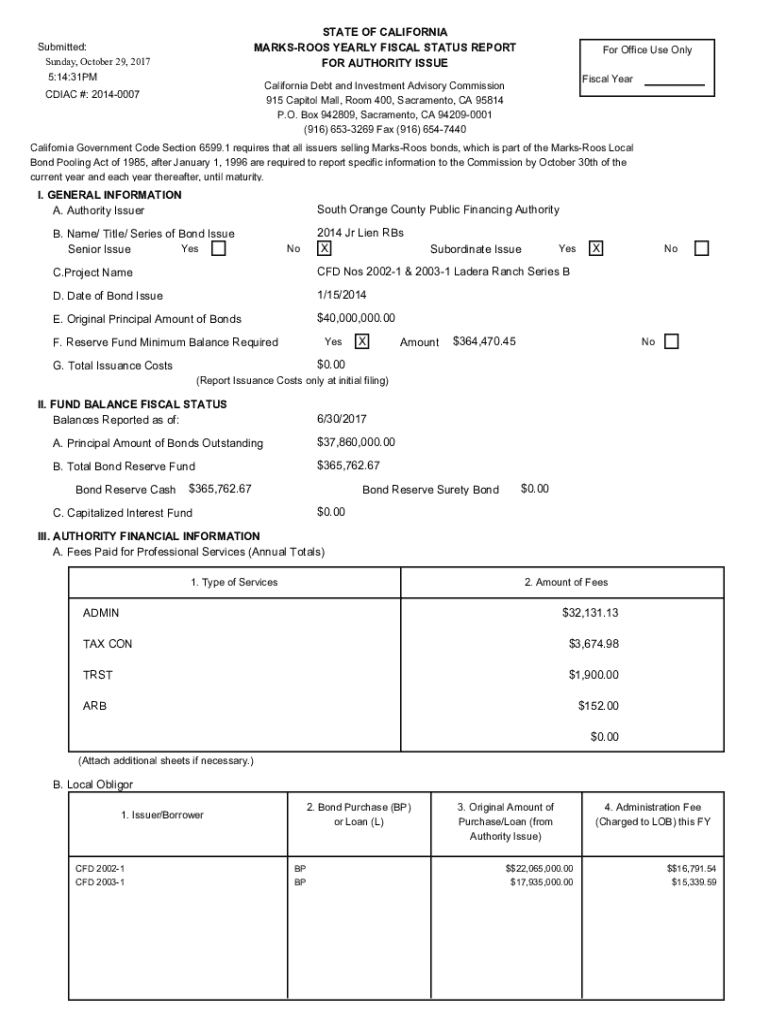

The Marks-Roos Local Bond Pooling Act was established to allow local agencies to pool their financial resources, improving their access to funding. This legislation is crucial as it fosters cooperative financial strategies among entities, enhancing public projects while mitigating individual costs.

One of the key components of this act is the Yearly Fiscal Status Form. This document is vital for transparency and accountability. It consolidates fiscal information, enabling oversight bodies to monitor the financial health and performance of local agencies effectively.

Determining who must file the form is essential. Generally, any public agency participating in bond pooling under the Marks-Roos Act is required to submit this form annually.

Getting started with the Marks-Roos Yearly Fiscal Status Form

Before diving into the form itself, organizations must gather pertinent information. Required data includes financial statements, project funding sources, and a detailed expenditure breakdown. This groundwork ensures a smoother filing process.

Eligibility to file typically extends to all local agencies involved in the pooling arrangement. Further, understanding the filing deadlines and important dates is crucial. Most agencies need to submit their forms within the fiscal year-end, usually aligning with the public agency's month-end closing.

Step-by-step guide to filling out the form

Filling out the Marks-Roos Yearly Fiscal Status Form can be made easier by breaking it down into its respective sections. Starting with Section 1, fill out the basic information. This includes the legal name of the agency, the primary address, and contact details for the designated fiscal officer.

Next, Section 2 covers the financial overview, requiring entries on income and expenditure. Agencies must declare their total assets and liabilities and provide balance sheets alongside income statements. Section 3 focuses on program financing, detailing funding sources alongside reporting grants and contributions.

Lastly, Section 4 is essential for certifying the information furnished. Ensure that the appropriate individuals sign the document, as this emphasizes the importance of accuracy and accountability.

Common errors and how to avoid them

Even with meticulous attention, errors can occur when filling out the Marks-Roos Yearly Fiscal Status Form. Common pitfalls include incorrect financial calculations, which can lead to discrepancies in reporting. Make use of financial software to assist in accurate number crunching.

Incomplete submissions often arise when sections are overlooked. Every field in the form should be verified. Moreover, misunderstanding signature requirements can delay the process; thus, familiarizing yourself with who needs to sign is crucial for expediency.

Using pdfFiller to simplify your filing process

pdfFiller can greatly streamline the process of filling out the Marks-Roos Yearly Fiscal Status Form. First, users can easily upload the document to the platform. The interface allows you to fill in necessary fields without the hassle of printing and scanning.

Interactive tools available on pdfFiller simplify the form completion. Users can take advantage of eSignature features for quick approvals, reducing turnaround times significantly. This feature is especially useful for team members who need to collaborate remotely.

Editing and managing your submissions

Once the Marks-Roos Yearly Fiscal Status Form is submitted, managing it effectively is essential. pdfFiller allows users to store and organize forms seamlessly. Users can edit submitted forms when necessary, although they should be aware of any deadlines regarding modifications.

Tracking submission and approval status is straightforward with pdfFiller. Best practices for document management involve keeping all related files in organized folders along with version histories, making future reviews and audits significantly easier.

Responding to common follow-up inquiries

After submission, local agencies should be prepared for follow-up inquiries regarding their Marks-Roos Yearly Fiscal Status Form. Understanding requests for additional information is crucial; agencies may need to provide supporting documents or clarifications.

Potential audits can also arise from incomplete or unclear submissions. Maintaining open communication channels with fiscal oversight bodies is vital to address any issues promptly and thoroughly.

Tips for future preparedness

To avoid last-minute rushes when filing the Yearly Fiscal Status Form, adopting regular financial documentation practices is recommended. Keeping accurate records year-round will enhance filing accuracy and expedite the process.

Consider building a dedicated team for fiscal responsibility and reporting. This team can help ensure compliance and oversee the documentation process, making them invaluable for maintaining financial integrity across the organization.

Conclusion: maximizing your financial reporting efficiency

In summary, successfully submitting the Marks-Roos Yearly Fiscal Status Form requires attention to detail, proper documentation, and a streamlined process. Utilizing pdfFiller can enhance your overall document management and compliance efforts, facilitating smooth completion and submission.

By adhering to these key steps and best practices, organizations can improve their fiscal reporting efficiency, ultimately benefiting their operations and public transparency goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my marks-roos yearly fiscal status in Gmail?

How do I make edits in marks-roos yearly fiscal status without leaving Chrome?

Can I create an electronic signature for the marks-roos yearly fiscal status in Chrome?

What is marks-roos yearly fiscal status?

Who is required to file marks-roos yearly fiscal status?

How to fill out marks-roos yearly fiscal status?

What is the purpose of marks-roos yearly fiscal status?

What information must be reported on marks-roos yearly fiscal status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.