Get the free Marks-roos Yearly Fiscal Status Report

Get, Create, Make and Sign marks-roos yearly fiscal status

How to edit marks-roos yearly fiscal status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marks-roos yearly fiscal status

How to fill out marks-roos yearly fiscal status

Who needs marks-roos yearly fiscal status?

Understanding the Marks-Roos Yearly Fiscal Status Form

Understanding the Marks-Roos yearly fiscal status form

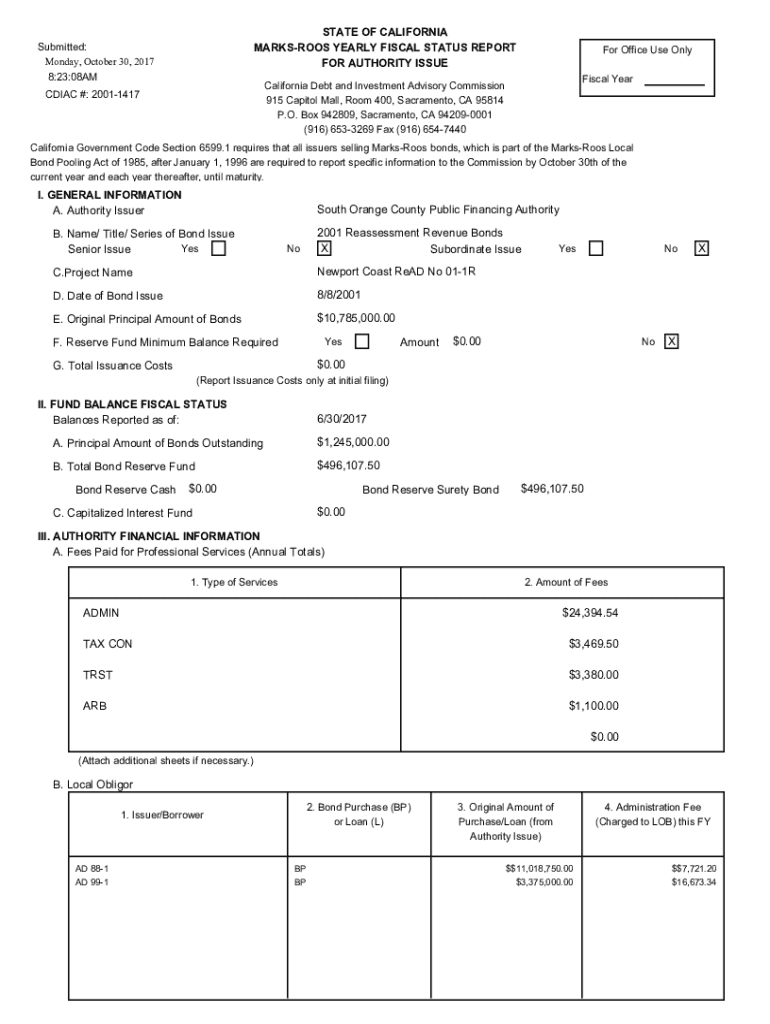

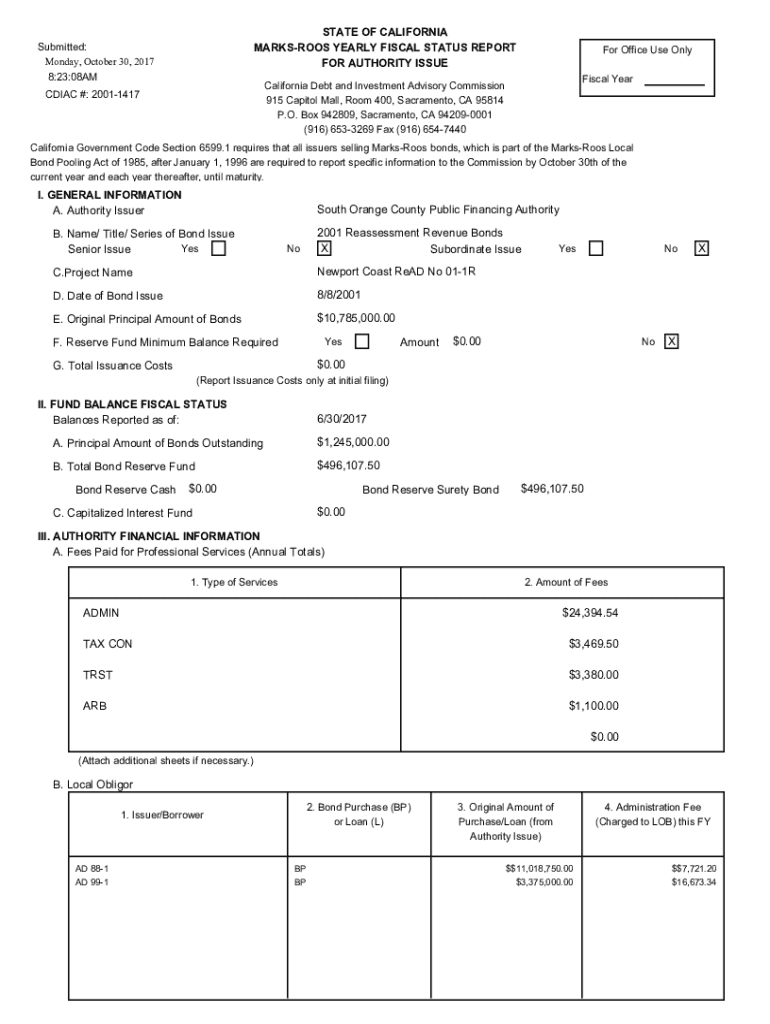

The Marks-Roos Yearly Fiscal Status Form is an essential reporting document used primarily by local agencies and authorities in California. This form serves to provide transparency and accountability in the municipal finance landscape, ensuring that local governments adhere to statutory requirements for fiscal reporting.

The primary purpose of the Marks-Roos Fiscal Status Form is to summarize the financial activities of local agencies over a specific fiscal year. It provides a snapshot of revenues and expenditures, which aids in informed decision-making and budgeting processes. This form plays a critical role in local government finance as it supports stakeholders, including citizens, policymakers, and auditors, in assessing the financial health of their local entities.

Moreover, timely submission and compliance with the filing requirements are critical. Failure to submit the form on time can lead to potential penalties and can hinder the agency's ability to operate effectively, as funding and financial planning often depend on this accurate reporting.

Key components of the form

Understanding the key components of the Marks-Roos Yearly Fiscal Status Form is essential for accurate completion. The form requires information that ensures comprehensive insight into the financial operations of the reporting entity.

The financial data contained in the form is broken down into two primary categories: revenues and expenditures. Agencies must detail various sources of revenue, which could include property taxes, sales taxes, and grants. Conversely, expenditures must be classified accurately, with careful consideration of operational costs, capital expenditures, and other outgoing funds.

Who needs to file the Marks-Roos yearly fiscal status form?

The Marks-Roos Yearly Fiscal Status Form must be filed by all eligible local agencies and authorities within California. These entities typically include city governments, county governments, special districts, and regional authorities that manage public services.

Understanding the eligibility and requirements is vital for any local agency to maintain compliance and ensure that they can leverage the opportunities provided through local bond financing.

Step-by-step guide to completing the form

Completing the Marks-Roos Yearly Fiscal Status Form involves several steps. By following a structured approach, agencies can ensure accuracy and compliance with filing requirements.

Attention to detail at each step can minimize the risk of rejection or non-compliance, leading to a smoother submission process.

Interactive tools for assistance

For ease of use, pdfFiller offers several interactive tools to assist in navigating the filing process of the Marks-Roos Yearly Fiscal Status Form.

Leveraging these tools can simplify the process and enhance accuracy in preparing the form.

eSigning and submitting the Marks-Roos form

Once the Marks-Roos Yearly Fiscal Status Form is completed, it must be signed and submitted. Understanding the eSignature requirements is crucial in today’s digital age.

Understanding the advantages of each method can help agencies streamline their reporting practices and maintain compliance with filing deadlines.

Common issues and troubleshooting

As with any form, complications may arise in the process of completing and submitting the Marks-Roos Yearly Fiscal Status Form. Preparing for potential challenges can help mitigate frustration.

Having access to reliable support and knowing how to navigate these challenges can ensure a smoother process for those involved.

Managing your documents after submission

After submitting the Marks-Roos Yearly Fiscal Status Form, it’s imperative to establish a robust document management practice for your records.

Implementing these practices can safeguard against miscommunication and ensure that agencies are prepared for future audits or reviews.

Leveraging pdfFiller for efficient document management

pdfFiller offers a range of features that can significantly enhance the process of completing and managing the Marks-Roos Yearly Fiscal Status Form.

By integrating pdfFiller into your workflow, you can streamline the entire fiscal reporting process, enabling more accurate and efficient submission of essential documents.

Related fiscal reporting forms

In addition to the Marks-Roos Yearly Fiscal Status Form, several other financial reporting forms are critical for local government entities.

Being aware of these forms enhances a local agency's financial reporting strategy while minimizing duplication of effort and confusion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute marks-roos yearly fiscal status online?

How do I fill out the marks-roos yearly fiscal status form on my smartphone?

Can I edit marks-roos yearly fiscal status on an iOS device?

What is marks-roos yearly fiscal status?

Who is required to file marks-roos yearly fiscal status?

How to fill out marks-roos yearly fiscal status?

What is the purpose of marks-roos yearly fiscal status?

What information must be reported on marks-roos yearly fiscal status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.