Get the free Municipal Net Profit Return

Get, Create, Make and Sign municipal net profit return

How to edit municipal net profit return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out municipal net profit return

How to fill out municipal net profit return

Who needs municipal net profit return?

Municipal Net Profit Return Form: How-to Guide Long-Read

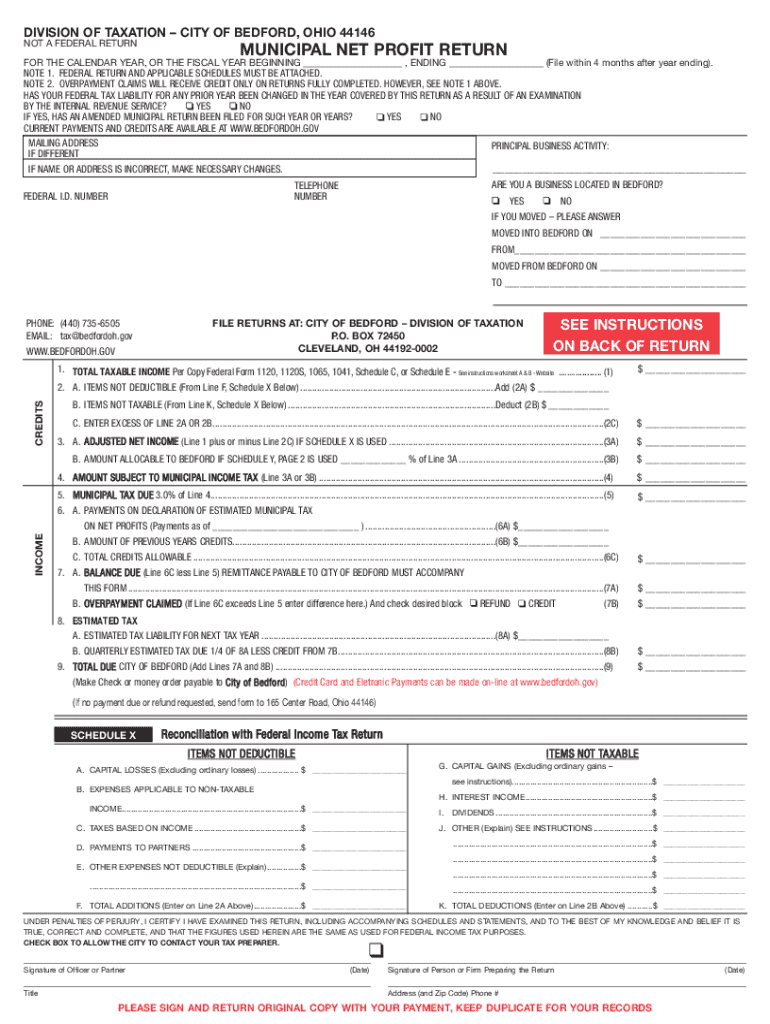

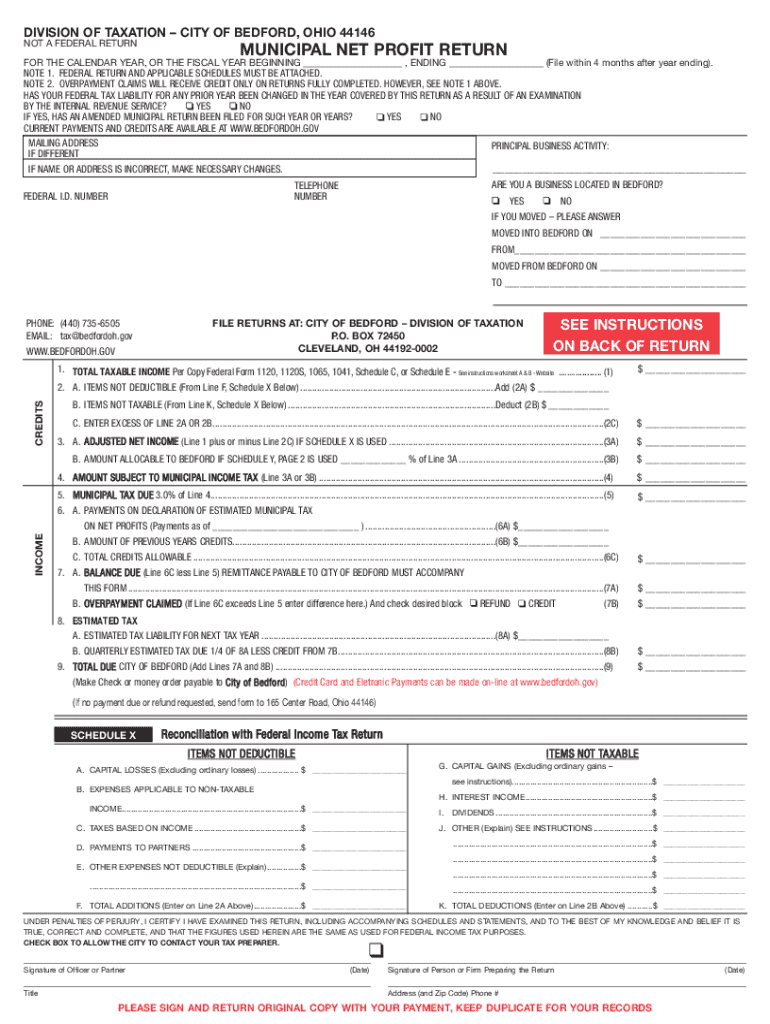

Understanding the municipal net profit return form

The municipal net profit return form is a crucial document that assesses the profitability of businesses operating within various municipal jurisdictions. Its primary purpose is to ensure that local government entities collect taxes based on the net profits generated by businesses. By filing this form, businesses not only comply with local taxation laws but also contribute to the community's infrastructure and development initiatives.

For businesses, the importance of the municipal net profit return form cannot be overstated. Filing this form accurately and on time aids in avoiding penalties, audits, and interest on unpaid taxes. Furthermore, it helps in maintaining a good standing within the community, fostering a positive relationship with local authorities.

Preparing to complete the form

Preparing to fill out the municipal net profit return form involves thorough organization and understanding of your financial situation. First and foremost, gather essential information including your financial statements, which typically encompass profit and loss statements, balance sheets, and cash flow statements. These documents provide a clear overview of your income and expenses, crucial for accurate reporting.

In addition to financial records, specific documentation such as your tax identification number, incorporation documents, and previous tax returns may also be required. Being organized will facilitate a smoother filing process.

Understanding key terms in the form is essential for accurate completion. 'Net profits' refer to revenue remaining after all expenses, while 'taxable income' includes all sources of income minus allowable deductions. Familiarizing yourself with these terms will aid in navigating the form effectively.

Navigating the municipal net profit return form

Filling out the municipal net profit return form can seem daunting at first, but breaking it down into manageable sections simplifies the process. First, you’ll start with Section 1: Business Identification. Here, ensure that all information such as business name, address, and tax ID number is accurate to avoid identity-related issues.

Next, Section 2 includes income reporting where you will detail your net profits. Accurate calculations are vital, so take extra time to reflect your true profit. In Section 3, you’ll report deductions — common deductions include operational expenses, depreciation, and other business-related costs, which can significantly reduce your taxable income.

Section 4 covers tax calculations, including any applicable local tax rates. It’s imperative to consult current tax regulations to apply the right rates. Finally, Section 5 requires your signature, and many municipalities now offer eSigning options, simplifying the submission process.

Editing and modifying your form

After completing your municipal net profit return form, the next step is editing and revising. Tools like pdfFiller can significantly enhance your editing process. With pdfFiller, you can easily review pre-filled forms, making it simple to amend any errors. Additionally, its annotation capabilities allow for clear notes on areas needing modification, ensuring that all changes are documented for future reference.

Collaboration is also key, especially if you are part of a team. pdfFiller's collaborative features enable sharing the form with team members or accountants, allowing for collective input. You can track changes which offer insight into who made specific edits and when these changes were implemented.

Common mistakes to avoid

When submitting the municipal net profit return form, it's crucial to be aware of common pitfalls that can lead to rework or delays. Identification errors are frequent; ensure your business name, address, and tax ID match official documents to avoid discrepancies.

Miscalculations in income or deductions can also lead to incorrect filings. To mitigate this, consider double-checking all figures and utilizing a calculator or accounting software. Lastly, ensure every section of the form is complete and sign the document. Missing signatures or incomplete sections can halt the processing of your form, leading to unwanted penalties.

Filing and managing your submission

Once your municipal net profit return form is completed and edited, the next step is to file it. Many jurisdictions allow for online submissions, which offer a more streamlined approach as opposed to mailing physical copies. Be sure to confirm the filing method preferred by your local authority to ensure compliance.

After submission, tracking your filing status becomes essential. Check with the municipality to confirm receipt, and keep any confirmations for your records. If further information is needed during the review process, being proactive in managing follow-up inquiries can expedite resolution.

Utilizing pdfFiller for future returns

pdfFiller offers a myriad of benefits for ongoing document management, especially for future returns. As a cloud-based document solution, you can access your forms from anywhere, ensuring that you are always prepared for upcoming municipal net profit return requirements. This flexibility proves invaluable for entrepreneurs and business owners on the go.

With secure storage capabilities, pdfFiller allows you to organize your documents efficiently. Setting up reminders for annual filings can greatly aid in maintaining compliance, ensuring that you never miss a deadline. Moreover, as tax laws and regulations evolve, having an easy way to update forms for future years can relieve the stress of last-minute preparations.

Resources for further assistance

If you encounter challenges while completing or submitting the municipal net profit return form, help is readily available. pdfFiller provides customer support for any form-related queries, ensuring that users have direct access to professional assistance when needed.

In addition to customer support, engaging with community forums can be beneficial. These forums offer a platform for users to share experiences, insights, and tips regarding form completion, which can prove invaluable for first-time filers.

Frequently asked questions

Addressing common queries about the municipal net profit return form is essential for guiding new users through the process. Many individuals wonder who is required to file this form. Generally, any business operating within a municipality that generates income must file, although specific thresholds may apply depending on local regulations.

Filing timelines are also a common concern. Each municipality has specific deadlines, and missing these can lead to penalties. It’s vital to stay updated on your local tax authority’s timeline to maintain compliance and avoid consequences associated with late filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit municipal net profit return in Chrome?

Can I sign the municipal net profit return electronically in Chrome?

How do I edit municipal net profit return straight from my smartphone?

What is municipal net profit return?

Who is required to file municipal net profit return?

How to fill out municipal net profit return?

What is the purpose of municipal net profit return?

What information must be reported on municipal net profit return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.