Get the free N-346a

Get, Create, Make and Sign n-346a

How to edit n-346a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out n-346a

How to fill out n-346a

Who needs n-346a?

Your Comprehensive Guide to the n-346a Form

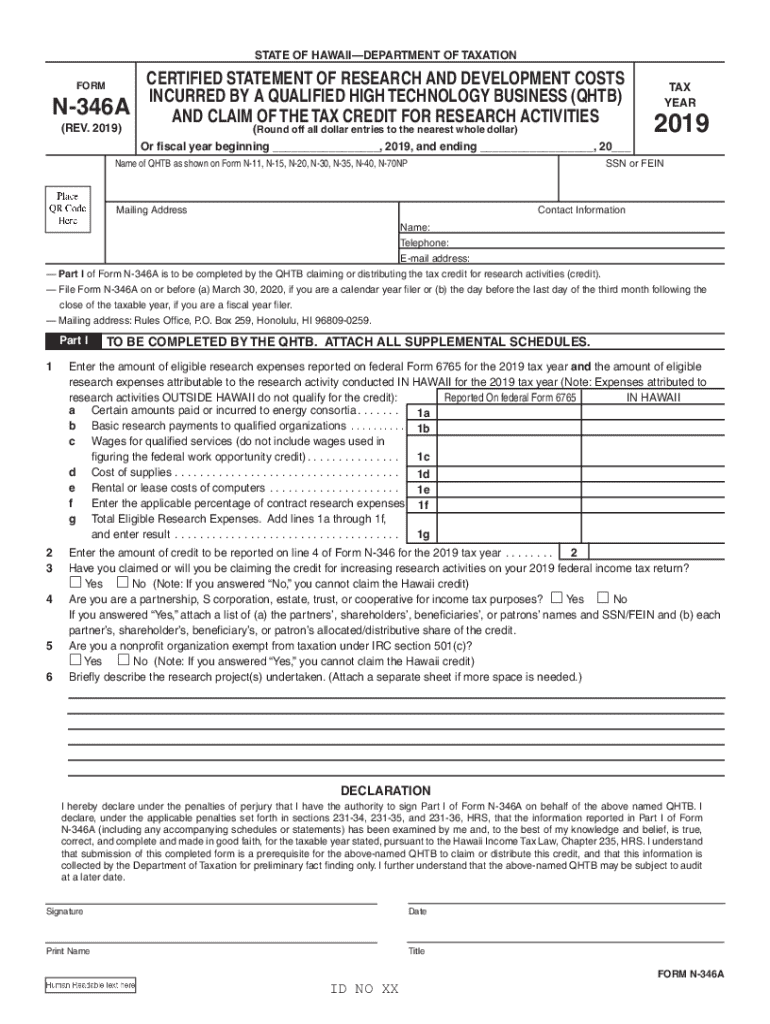

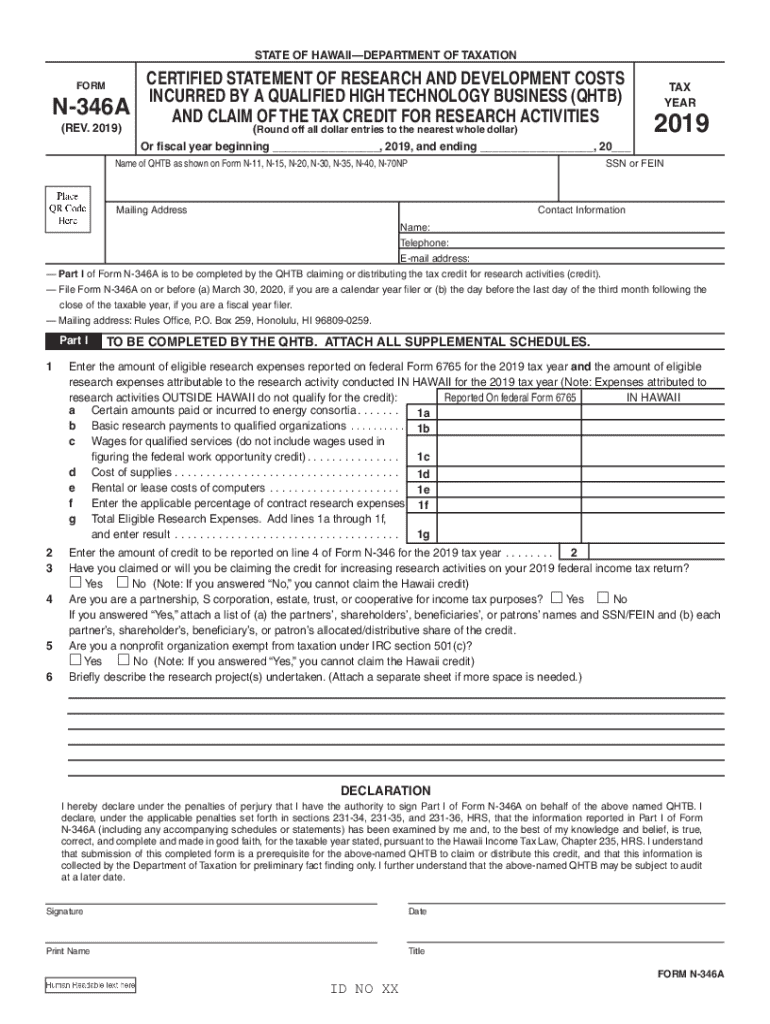

Overview of the n-346a form

The n-346a form serves as an essential document for businesses claiming research and development (R&D) tax credits. This form provides the IRS with necessary details about the qualified research activities your business undertakes, ensuring you receive any applicable tax benefits. Understanding the n-346a form’s purpose helps streamline the tax credit application process, making it a key tool for eligible taxpayers in the tech and research sectors.

Eligibility to file the n-346a form is typically restricted to businesses that engage in qualified high-tech research activities. This includes various sectors such as software development, engineering services, and biotechnology. To determine if your business qualifies, review the IRS guidelines that define the scope of eligible R&D activities and associated expenditures.

Understanding the importance of the n-346a form

Filing the n-346a form can significantly benefit businesses through potential tax credits, which can lead to substantial savings. Many business owners are unaware of the financial opportunities presented by R&D tax credits. By effectively documenting your research expenses through the n-346a form, you not only save on taxes but also reinvest funds into further innovation.

Despite its importance, misconceptions surrounding R&D tax credits are common. Some believe that only large corporations can benefit, while others think the filing process is exempt from standard documentation requirements. In reality, small businesses and startups often qualify, and thorough documentation is crucial for successful submissions.

Step-by-step instructions for completing the n-346a form

Section 1: General information

Completing Section 1 requires both personal and business identification details such as the business name, EIN, and address. It’s essential to provide accurate information to avoid complications later. Definitions of terms like 'qualified high-technology business' will guide you in understanding what qualifies as eligible activities.

Section 2: Research and development activities

In Section 2, you will describe your R&D activities in detail. It's vital to document the nature, purpose, and outcomes of the research clearly. Keeping a log of experiments, tests, and product developments will not only aid in the accurate reporting of your activities but also strengthen your case for claiming the tax credit.

Section 3: Costs incurred

Section 3 requires a meticulous breakdown of all costs related to research and development. Eligible expenses typically include wages, supplies, and contract research. Documenting these expenses effectively ensures compliance and makes it easier to report your total costs, highlighting your commitment to innovation.

Section 4: Summary of credits claimed

The final section summarizes the tax credits claimed. It is essential to calculate these credits accurately based on your documented expenses and cross-check with previous tax returns to maintain consistency. Discrepancies can raise flags with the IRS, so due diligence is necessary.

Tips for efficient form submission

Avoiding common errors during the filing process can save time and resources. Some frequent mistakes include incorrect personal details, failing to document all qualified activities, and underestimating estimated costs. It is advisable to review the form thoroughly before submission and verify all entries against supporting documentation.

Submitting the n-346a form electronically can streamline the process. Utilizing platforms like pdfFiller can enhance your experience, allowing for easy edits, electronic signatures, and submission tracking. It’s also important to maintain copies of your submissions and supporting documents, as having these records can be beneficial in case of audits.

Using pdfFiller for seamless document management

Integrated editing tools

pdfFiller’s tools provide a user-friendly interface for filling out the n-346a form. The platform’s editing capabilities allow users to alter text easily, add annotations, and complete the form systematically. With all forms stored securely in the cloud, ongoing updates to the document are easily managed, saving you time and reducing potential errors.

Collaborative features

For teams working together, pdfFiller offers collaborative features that enable multiple users to edit the n-346a form in real-time. This fosters better communication among team members and allows for swift collection of necessary electronic signatures, facilitating a smoother submission process.

Addressing common FAQs related to the n-346a form

What should you do if your form is rejected? The first step is to understand the reason for rejection, which is usually outlined in the IRS notice. Addressing the specific issues and resubmitting your claim will help you navigate this setback effectively.

If you disagree with an IRS decision regarding your tax credit claim, you have the option to appeal. Gathering comprehensive documentation and consulting a tax professional can strengthen your case during the appeal process. Many businesses face unique circumstances, such as multi-state research costs, that may require tailored advice.

Success stories and case studies

Several businesses across various sectors have successfully utilized the n-346a form to claim R&D tax credits, notably in industries like biotechnology and software development. One such case involved a small startup that transformed its R&D expenditures into significant tax refunds, allowing for reinvestment into product development.

Insights from tax professionals underline the importance of meticulous documentation and strategic planning when completing the n-346a form. Engaging with experts specialized in R&D tax credits can maximize your claims, ensuring you reap the full benefits of the credits available to your business.

Future considerations and updates

Changes to the n-346a form and related tax credits can occur as tax legislation evolves. Being proactive and staying informed about potential updates and adjustments can affect R&D tax credit claims. This knowledge is crucial for businesses that rely on innovation and seek to leverage tax benefits to fuel growth.

Subscribe to newsletters and follow tax advisories to remain updated on potential changes. This vigilance will position your business to adapt swiftly and effectively to any regulatory shifts in the R&D tax incentive landscape.

Interactive tools and resources

Leveraging interactive tools available through pdfFiller can simplify the completion process for the n-346a form. Users can access templates designed specifically for the form along with checklists to ensure all necessary documentation is gathered. Furthermore, handy calculators are available to estimate potential tax credits based on qualified expenses.

These tools not only promote efficiency but also enhance accuracy during the claim process, acting as a fail-safe against errors that could impact your submission.

Contact information for expert assistance

Navigating the complexities of the n-346a form can be enhanced by consulting with tax professionals who specialize in R&D tax credits. Their expertise can provide personalized guidance tailored to your unique business situation, maximizing your potential financial benefits.

For technical issues with the form or the pdfFiller platform, the customer support team is readily available to assist you. They can address queries, ensuring users have a smooth experience when filling out and submitting the n-346a form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send n-346a for eSignature?

How can I get n-346a?

Can I create an electronic signature for signing my n-346a in Gmail?

What is n-346a?

Who is required to file n-346a?

How to fill out n-346a?

What is the purpose of n-346a?

What information must be reported on n-346a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.