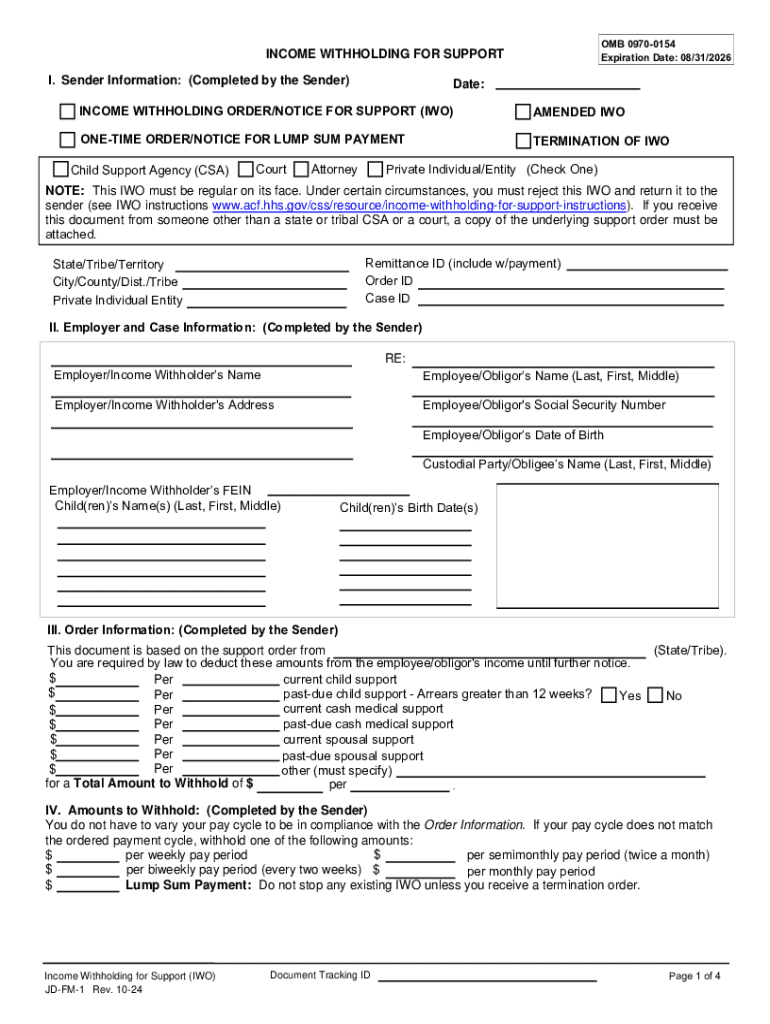

CT JD-FM-1 2024-2026 free printable template

Get, Create, Make and Sign CT JD-FM-1

How to edit CT JD-FM-1 online

Uncompromising security for your PDF editing and eSignature needs

CT JD-FM-1 Form Versions

How to fill out CT JD-FM-1

How to fill out income withholding for support

Who needs income withholding for support?

Understanding the Income Withholding for Support Form

Understanding the Income Withholding for Support Form

The Income Withholding for Support Form is a crucial document used in the enforcement of child support obligations. This form allows a non-custodial parent’s income to be automatically withheld to fulfill child support requirements, providing a safer and more consistent avenue for receiving child support payments. Without such a framework, custodial parents often face challenges in collecting payments, which can directly impact the welfare of their children.

The significance of the Income Withholding for Support Form cannot be overstated; it not only enhances compliance with support orders but also streamlines the process for all parties involved. By ensuring that payments are deducted directly from an employee's paycheck, this form minimizes incidents of delayed or missed payments, ultimately benefiting the dependents reliant on these funds.

Eligibility Criteria for Using the Form

Understanding who can request income withholding is critical for proper use of the form. Typically, custodial parents, or their legal representatives, are the primary requesters of this form when establishing or enforcing a child support order. In situations where a court has mandated child support, the custodial parent can swiftly initiate income withholding to secure regular payments.

The form is applicable in a variety of situations, such as when a new child support order is enacted or when modifications occur in the existing order. Additionally, it is often utilized in cases where non-compliance has been noted, allowing the custodial partner to take formal action to ensure that support payments are consistently made.

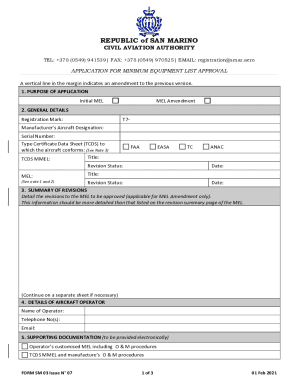

Key components of the Income Withholding for Support Form

The Income Withholding for Support Form consists of several sections that gather vital information about both parents and their respective obligations. Each section must be completed accurately to ensure that the form is processed without delay.

Detailed breakdown of form sections

Section 1 focuses on the Non-Custodial Parent's information. This includes their name, address, social security number, and other related details. Failing to provide accurate information can lead to delays in processing and potential legal repercussions.

Section 2 is dedicated to the Custodial Parent's information, comprising similar details necessary for identification. Privacy considerations are paramount here; custodial parents should ensure that sensitive data is handled carefully to prevent any misuse.

In Section 3, the Employer's Section outlines the responsibilities of employers upon receiving this form. They are required to withhold the specified amount from the non-custodial parent's paycheck and to remit these payments regularly. Employers must adhere to strict timelines to ensure they comply with court orders.

Legal jargon can make the form seem daunting. Understanding terms like 'wage assignment' and 'obligation' is vital for those completing the form, as these terms define the legal expectations placed on both custodial and non-custodial parents.

Step-by-step instructions for filling out the form

Before completing the Income Withholding for Support Form, it’s essential to gather all necessary information, including your social security number, details of your income, and the child’s information. Verifying the accuracy of your data will prevent common issues during processing.

When filling out the form, start by entering personal information clearly in Step 1. In Step 2, detail your support obligations, making sure to reference your court order number if applicable. Step 3 involves providing the employer's information, which is crucial for processing payments efficiently. Finally, review all entries in Step 4 for accuracy, sign the form, and date it appropriately.

Tips for avoiding common mistakes

Consequences of errors in submission can vary from delays in processing to potential legal issues. Thus, taking the time to carefully review the form before submission can save significant stress down the line.

Interactive tools to facilitate form management

pdfFiller offers a range of features to enhance document management. By using pdfFiller to edit the Income Withholding for Support Form, users can easily fill out necessary information electronically, which can decrease the chances of errors and improve the overall submission process.

Using pdfFiller for editing and completing forms

Users can upload PDFs directly to the platform, edit text, and make necessary adjustments without the need for printing or scanning physical documents. The intuitive design of pdfFiller makes it easy for anyone to navigate through the application and complete forms seamlessly.

Electronic signature features

The ability to eSign within pdfFiller provides a legal means of signing the Income Withholding for Support Form. Electronic signatures are legally binding, making them a convenient and efficient option for both custodial and non-custodial parents.

Collaboration features in pdfFiller

With pdfFiller, sharing the form with relevant parties, such as the court or other legal representatives, becomes a hassle-free process. Moreover, real-time collaboration options allow users to discuss changes and corrections instantly, ensuring that all stakeholders are on the same page.

Submitting the Income Withholding for Support Form

After completing the Income Withholding for Support Form, it's vital to follow the submission process accurately. The completed form should be sent to the non-custodial parent’s employer or directly to the local child support agency as determined by court directives.

Being mindful of deadlines is essential to ensure that the non-custodial partner complies promptly with the order. Deadlines can vary, so checking local regulations will assist in timely submissions.

What happens after submission?

Once submitted, the timeline for processing the Income Withholding for Support Form can differ among jurisdictions. Employers usually receive forms within a few days, and they are mandated to start withholding as specified. Clear communication with the employer post-submission can ensure they understand their responsibilities.

Managing changes post-submission

Changes in employment can impact the Income Withholding for Support Form. If the non-custodial parent changes jobs, it's essential to update the form immediately to continue the withholding process seamlessly. Failing to do this can lead to missed payments and unnecessary complications.

Timely updates are essential for avoiding disruptions in child support payments. Should issues arise, contacting the local child support agency should be the first step to identify solutions.

Safety alert: when and how to seek assistance

Recognizing when to seek help can save valuable time and resources. If the Income Withholding for Support Form is not processed correctly, or if payments are delayed, it is crucial to reach out to a child support agency. They can provide guidance and may help correct any oversights.

Frequently asked questions (FAQs)

Several common queries arise regarding the Income Withholding for Support Form. Understanding best practices to ensure acceptance of the form is crucial. For instance, keeping thorough documentation of all communications and agreements can strengthen your case.

Additionally, should the support amount change, following the correct procedures to modify support obligations is essential. Proper documentation of the changes and formalizing them through the court system will ensure that both parties are compliant and informed.

Resources for further assistance

Finding a county child support office is often the first step for individuals in need of assistance. County offices are equipped to provide specific guidance on the Income Withholding for Support Form and related processes.

Moreover, connecting with legal assistance can provide much-needed support for complex cases. There are many resources available for individuals seeking free or low-cost services, which can empower custodial parents to maintain compliance with child support requirements effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CT JD-FM-1 without leaving Google Drive?

How can I send CT JD-FM-1 for eSignature?

How do I execute CT JD-FM-1 online?

What is income withholding for support?

Who is required to file income withholding for support?

How to fill out income withholding for support?

What is the purpose of income withholding for support?

What information must be reported on income withholding for support?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.