Get the free Estate Planning Inventory

Get, Create, Make and Sign estate planning inventory

How to edit estate planning inventory online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate planning inventory

How to fill out estate planning inventory

Who needs estate planning inventory?

Estate planning inventory form: How-to guide

Understanding estate planning

Estate planning is a critical process that involves organizing your assets and determining how they will be distributed upon your passing. This process goes beyond simply writing a will. It integrates various elements—like trusts and financial directives—to create a comprehensive legal plan that reflects your wishes. Effective estate planning ensures that your loved ones are taken care of during a difficult time, providing them clarity and reducing potential conflicts over asset distribution.

The importance of an estate planning inventory

Creating an estate planning inventory is a fundamental step in the planning process. This inventory serves as a detailed list of your assets, which helps streamline the distribution of your estate. Without a thorough inventory, heirs may overlook valuable assets, potentially leading to disputes or financial losses.

Having a clear inventory is not just beneficial for asset allocation; it can also alleviate stress for your loved ones during a challenging time. They will have a clear guide to follow, reducing confusion and ensuring your intentions are honored.

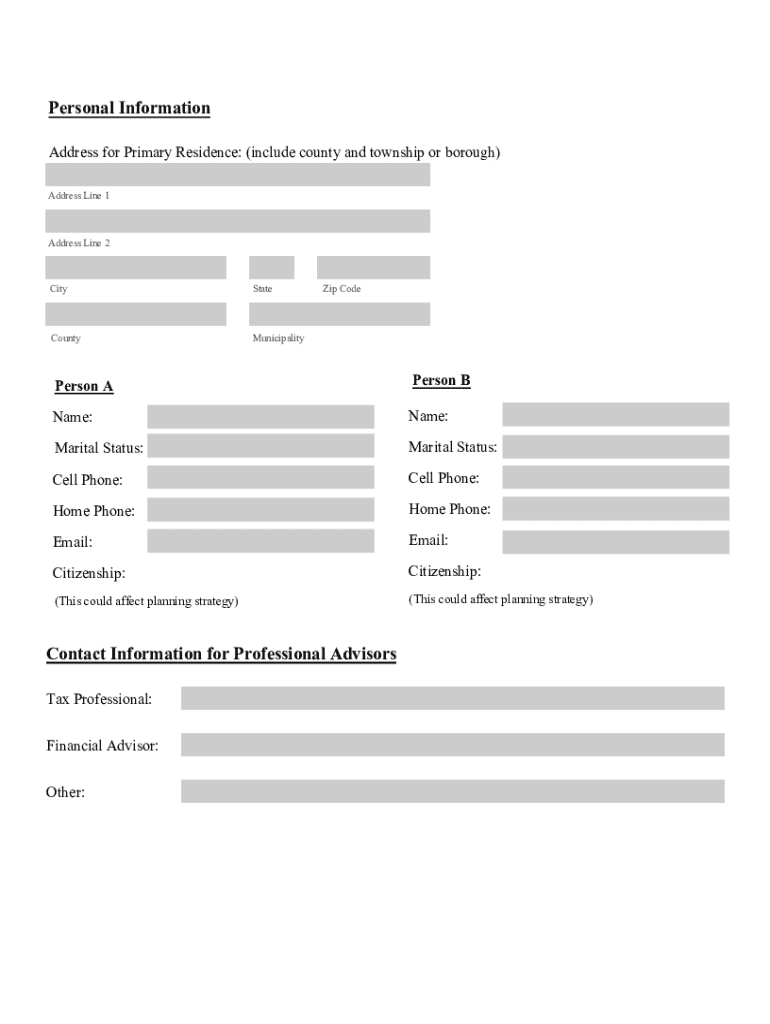

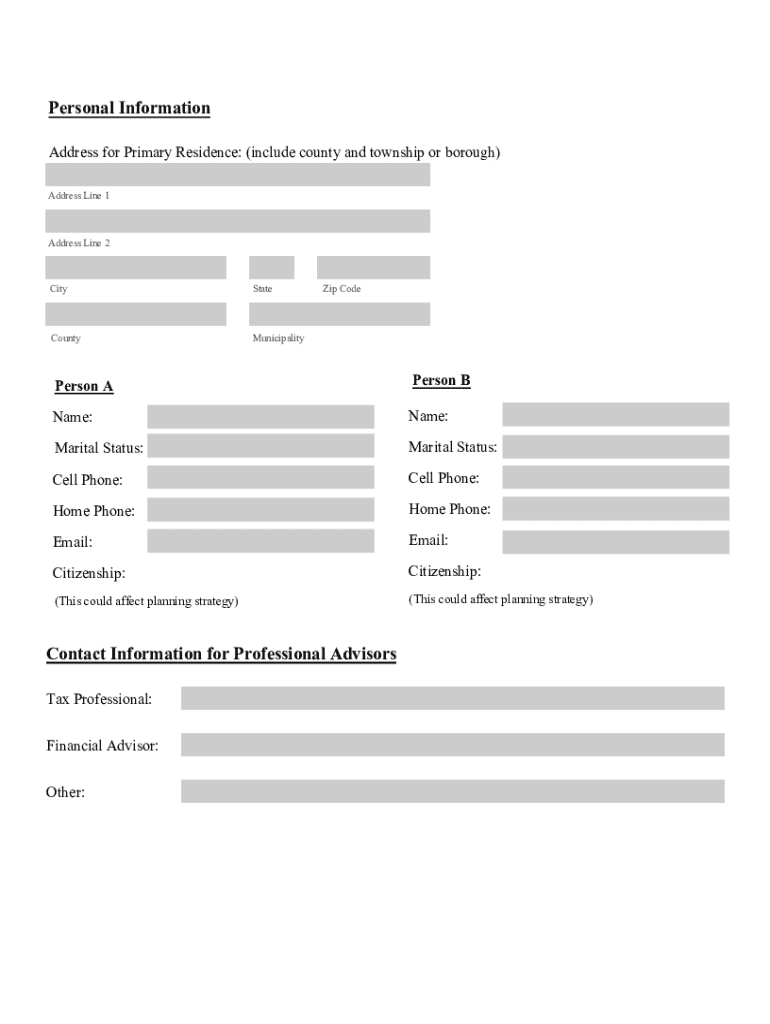

How to complete the estate planning inventory form

Filling out the estate planning inventory form can seem daunting initially, but breaking it down into manageable steps can simplify the process. Start by gathering all necessary information about your assets, liabilities, and any relevant documentation. This ensures you don't overlook any important details.

When completing the inventory form, focus on the following sections:

Additionally, incorporate tips for accuracy, like regularly assessing the value of your assets and keeping your inventory updated to reflect any changes in your financial situation.

Interactive tools and resources

Using pdfFiller provides an intuitive platform to create and edit your estate planning inventory form efficiently. Whether you need to fill out personal information or add intricate asset details, pdfFiller features tools that allow for easy document completion.

The ability to edit and save your inventory at any point means you're not locked into a single version. You can adjust and revisit your estate plan as your wealth or circumstances evolve. Signatures can be securely added through pdfFiller's eSignature integration, ensuring your documents have the necessary legal standing without the hassle of printing or scanning.

Managing your estate planning documents

Properly organizing your estate planning documents is vital not just for personal ease, but also for ensuring your family has access to everything required. Keeping both physical and digital records organized will save time and stress for your beneficiaries.

Consider using secure storage solutions—both online and offline—to protect sensitive information. For example, maintain physical copies in a safe and store digital versions in a secured, password-protected location. These protocols ensure your documents are safe yet accessible when needed.

Moreover, collaboration can enhance your estate planning process. Sharing your completed estate planning inventory form with financial advisors and attorneys allows for a team approach to ensuring your wishes are legally binding and adequately addressed.

Common questions about the estate planning inventory

Many individuals have questions regarding the estate planning inventory form, including how often it should be updated. Generally, it’s advisable to review your inventory annually or whenever significant financial changes occur—this includes purchasing new assets or undergoing relationship changes.

Even if you have no assets, completing an inventory can help you clearly define your current state and prepare for future planning. If your circumstances change, such as acquiring new assets or marrying, revisit the form to ensure it reflects these changes for clarity.

Hearing testimonials from people who successfully navigated this process can also illuminate the importance of maintaining a thorough inventory form. These stories underscore how proper planning results in peace of mind for both planners and their beneficiaries.

Next steps in your estate planning journey

Completing your estate planning inventory form is just the beginning. Additional forms or resources may be necessary to create a comprehensive estate plan. Tools like pdfFiller provide links to related resources, templates, and forms that facilitate this ongoing journey.

Continuing education on estate planning and understanding associated laws can also help inform your decisions. By integrating these resources into your planning process, you ensure that your estate plan evolves alongside your life.

Contact information and support

If you require assistance with your estate planning inventory form, pdfFiller offers support tailored to user needs. Whether you're having technical difficulties or simply need guidance on best practices, the support available can help you navigate this crucial aspect of financial planning.

Furthermore, if your need extends beyond the form itself, consider connecting with estate planning professionals. Their expertise can provide invaluable insights and personalized strategies for effectively managing your estate.

The value of pdfFiller in your estate planning

The value of using pdfFiller extends beyond merely filling out forms. This cloud-based platform empowers users to seamlessly edit PDFs, eSign documents, collaborate with professionals, and manage their documents from any location. This versatility is crucial for individuals seeking a comprehensive and accessible estate planning solution.

Overall, a straightforward interface combined with powerful collaboration features makes pdfFiller an essential tool in your estate planning journey. Leveraging this technology can reduce stress around paperwork, enabling you to focus on what truly matters—your personal wishes and ensuring your legacy is well managed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit estate planning inventory in Chrome?

Can I create an electronic signature for the estate planning inventory in Chrome?

Can I create an eSignature for the estate planning inventory in Gmail?

What is estate planning inventory?

Who is required to file estate planning inventory?

How to fill out estate planning inventory?

What is the purpose of estate planning inventory?

What information must be reported on estate planning inventory?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.