Get the free Motor Claim Form

Get, Create, Make and Sign motor claim form

Editing motor claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motor claim form

How to fill out motor claim form

Who needs motor claim form?

A comprehensive guide to completing your motor claim form

Understanding the motor claim form

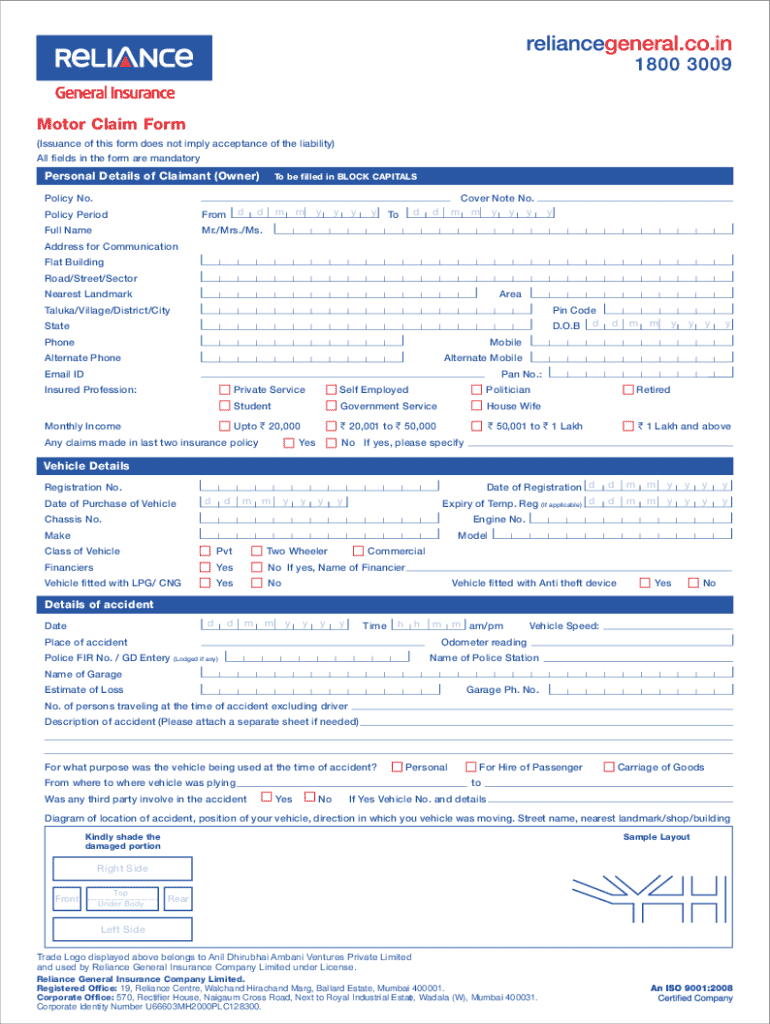

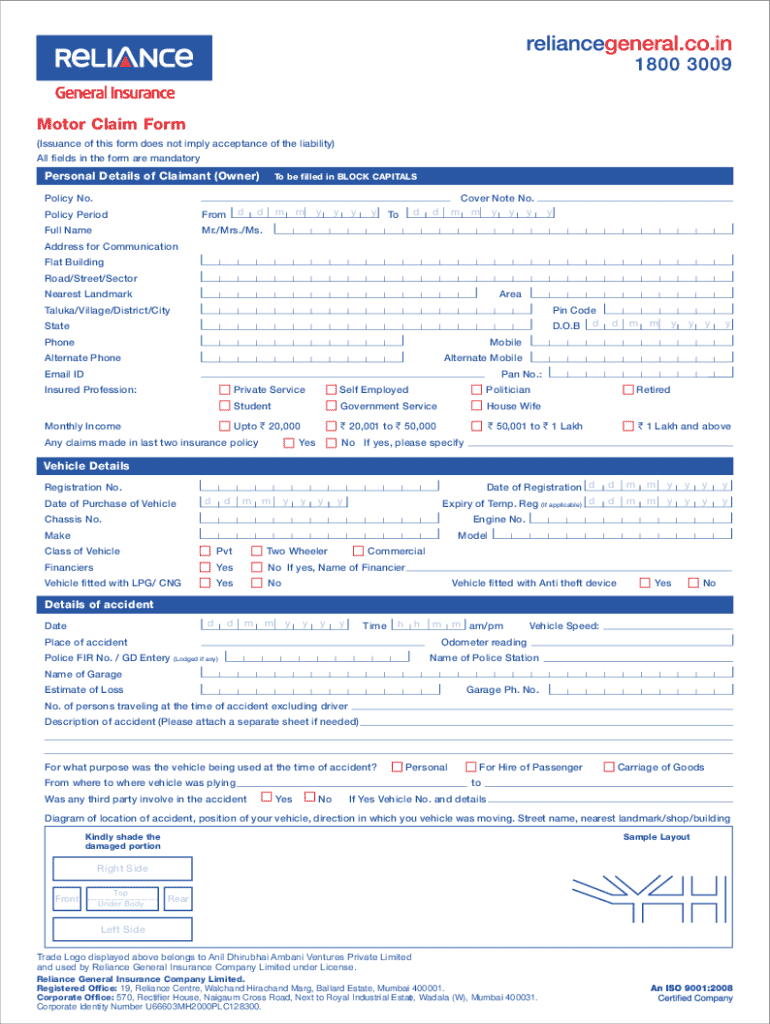

A motor claim form is a crucial document used during an insurance claim process following incidents like accidents, theft, or damage caused by natural disasters. The purpose of this form is to provide detailed information to your insurance provider so they can assess the situation and determine your eligibility for compensation. It's not just a mere formality; it serves as a critical record that helps streamline the claims process.

Choosing to file a claim can stem from various scenarios, primarily including vehicle accidents where liability is assessed, vehicle theft where you'll need to detail the circumstances surrounding the loss, and damage from natural disasters like floods or storms. Each scenario requires precise and accurate reporting on the motor claim form to support your case effectively.

Preparing to fill out your motor claim form

Before diving into the motor claim form, it's crucial to gather all necessary information and documents to ensure an accurate and efficient submission. This includes your vehicle details, such as the make, model, and Vehicle Identification Number (VIN), which uniquely identifies your vehicle. Furthermore, you must compile incident details, including the date, location, and a detailed description of what happened. Having your policy information handy, like the name of your insurance provider and the policy number, is also essential.

A thorough understanding of your insurance policy can make a significant difference in your claims experience. Review what your policy covers in terms of damages, car rental reimbursements, and other necessary aspects. It's also essential to be aware of any limitations or exclusions in your policy that may affect your claim, so you aren't caught off guard later in the process.

Step-by-step guide to completing the motor claim form

Completing your motor claim form doesn't have to be daunting. The form can often be broken down into several key sections. First, you start with personal information. Providing accurate personal details such as your full name, address, and contact details ensures the insurance company can easily reach you for any follow-up questions.

Next, focus on the incident description. Be clear and concise in describing what transpired, including specific details about the event. For vehicle information, include essential specifics like make, model, year, and any unique identifiers. Many providers also request witness information. Gather their statements if available, as they can add significant weight to your claim.

Finally, you must accurately document the damages. Take clear photos and send them with the form if possible. This can provide strong evidence of the damages you are claiming.

Common mistakes include leaving out critical information or being vague in descriptions. Take your time and ensure every entry is thorough and precise.

Submitting your motor claim form

When your motor claim form is completed, the submission process begins. You typically have two options: online submission through your insurance provider's portal or mailing a printed version of the form. Online submission tends to be faster and can incorporate instant confirmation of receipt, while mailing may involve longer processing times.

Regardless of the method chosen, tracking your submission is paramount. This means confirming the insurance company received your claim and following up to ensure timely processing. Staying proactive can help you avoid unnecessary delays and keep the claim moving forward.

What happens after submission?

After you submit your motor claim form, the insurance company will begin its review process. This evaluation involves examining the submitted information, contacting any witnesses, and perhaps even sending an adjuster to assess the damages firsthand. Understanding this process can prepare you for what to expect, which includes timelines that can vary significantly depending on the complexity of your claim.

Communication is key during this phase. Make sure to engage with your insurance adjuster proactively, being open to questions and providing additional information as needed. Be aware that the approval process can take anywhere from a few days to several weeks, depending on various factors, including the claim's complexity and the company’s workflow.

Managing your motor claim using pdfFiller

pdfFiller provides extensive support during your claims process, allowing users to edit and customize their motor claim form online effortlessly. With features like eSigning, you can complete your form quickly, ensuring it’s submitted in time. This convenience allows you to move through the claims process smoothly, minimizing stress during a potentially challenging time.

Additionally, pdfFiller enhances collaboration possibilities. You can share the form with colleagues or legal advisors, ensuring everyone involved stays informed and up to date. Managing documents in a cloud-based system makes retrieval and storage easy, allowing you to access necessary forms from anywhere.

Troubleshooting common issues

Navigating the claims process may lead to some hiccups. If your claim is denied, several common reasons could be at play, such as missing documentation or not meeting policy requirements. Understanding these pitfalls will empower you to effectively appeal any decisions made against your claim. Document the reasons for denial and respond promptly with justifications or additional evidence to support your case.

Moreover, if disputes arise with insurance providers, employing effective communication and negotiation techniques can prove invaluable. Being organized and maintaining a clear record of communication will aid you in resolving conflicts more efficiently.

Additional tips for a smooth claims process

Documenting the incident thoroughly can significantly impact your claim's outcome. Effective methods include taking clear photographs of the damage, noting any relevant circumstances, and collecting statements from witnesses. Keeping detailed records of every communication with the insurance provider is equally crucial. Make a note of names, dates, and the topics discussed to create a reliable timeline and reference point.

Lastly, remember that as a policyholder, you have specific rights. Familiarizing yourself with these rights can bolster your confidence throughout the claims process, ensuring you advocate effectively for a fair resolution.

Enhancing your claims experience with technology

Utilizing pdfFiller not only for your motor claim form but also for other forms and documents can streamline your overall claims experience. The benefits of digitizing your paperwork and storing it in the cloud are immense — from easy access to significant reductions in the risk of lost documents. The integration of advanced online tools can help facilitate smoother conversations with your insurance provider and can significantly decrease the time spent on administrative tasks.

Ultimately, embracing technology in managing your claims is not just about convenience; it can empower you to take control of the process and expedite resolutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find motor claim form?

Can I sign the motor claim form electronically in Chrome?

Can I create an eSignature for the motor claim form in Gmail?

What is motor claim form?

Who is required to file motor claim form?

How to fill out motor claim form?

What is the purpose of motor claim form?

What information must be reported on motor claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.