Get the free Enhanced Due Diligence Form

Get, Create, Make and Sign enhanced due diligence form

How to edit enhanced due diligence form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out enhanced due diligence form

How to fill out enhanced due diligence form

Who needs enhanced due diligence form?

A Comprehensive Guide to Enhanced Due Diligence Form

Understanding enhanced due diligence (EDD)

Enhanced Due Diligence (EDD) is a critical process that organizations undertake to assess and mitigate risks associated with high-stakes clients. EDD goes beyond standard Customer Due Diligence (CDD) by gathering comprehensive information about a customer’s identity, financial background, and ongoing activities to uncover potential risks.

While CDD routinely collects baseline data for customer identification and risk assessment, EDD escalates this process by diving deeper into suspicious or complex cases. For instance, EDD investigates the nature and purpose of client relationships, monitoring for potentially illicit activities.

The importance of EDD lies in its role in effective risk management and compliance. With increasingly stringent regulations around financial crimes and money laundering, organizations find EDD indispensable to prevent violations and protect their reputations.

When is enhanced due diligence required?

EDD is necessitated under various conditions that increase the potential for risk exposure. For instance, organizations must perform EDD when dealing with high-risk customers—those with flagged prior negative incidents or those involved in sectors typically associated with higher instances of fraud or corruption.

Additionally, engaging clients from high-risk geographic regions enhances the need for EDD. These could include locations known for political instability or high levels of corruption. Similarly, customers with complex corporate structures, such as those involving numerous shell companies, may require enhanced scrutiny to ensure transparency.

Regulatory requirements also highlight when EDD is warranted. Financial institutions and other regulated entities must adopt robust EDD processes as mandated by authorities to prevent financial crime and ensure compliance with applicable laws.

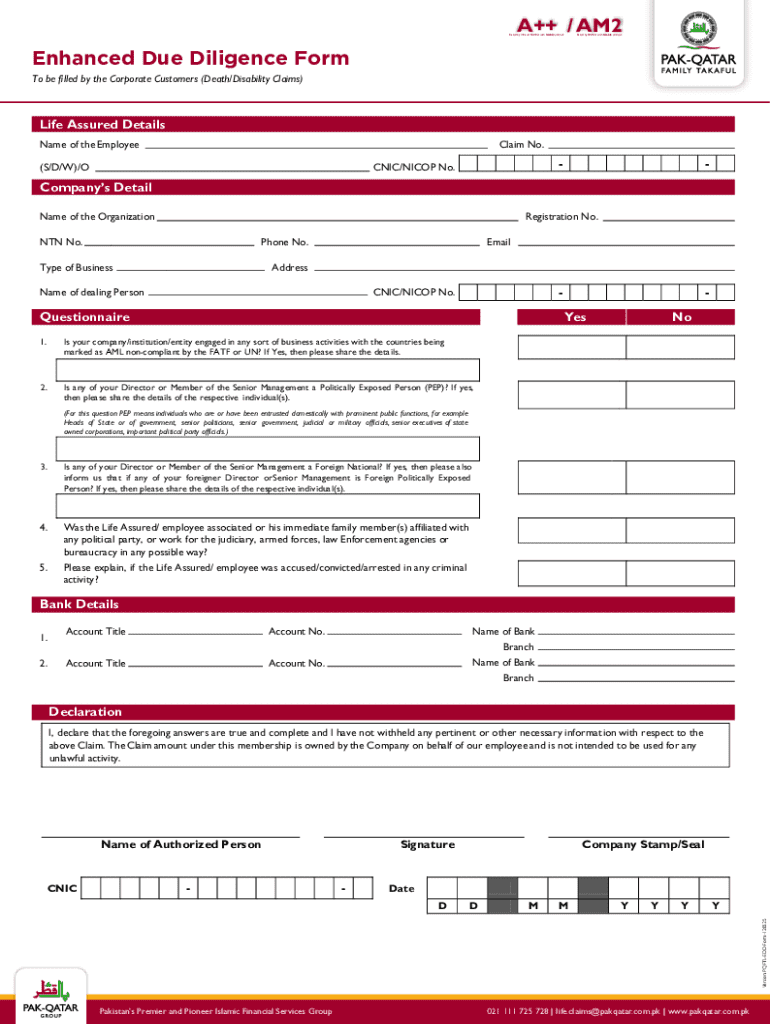

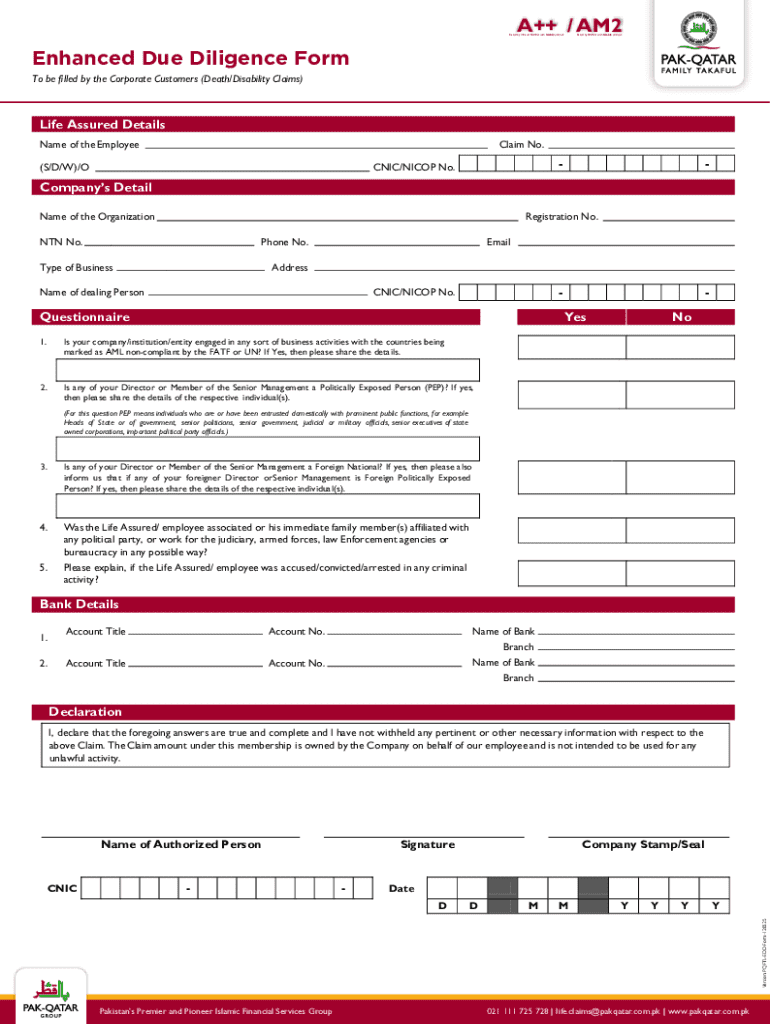

Key components of the enhanced due diligence form

The Enhanced Due Diligence Form is a key tool used to collect vital information for risk assessment. Each form typically requests essential customer identification details, which include the full name, address, and date of birth. Beyond general identification, forms often require details regarding the source of funds, ensuring that transactions come from legitimate origins.

Specific details about the individual or business's nature and activities are equally important. This might include the type of services rendered, operational history, and anticipated business directions. Consequently, the collection of required documentation supports the information submitted in the form.

Additionally, specific fields to fill out in the form usually include sections for any discrepancies noticed, previous interactions, and any risk ratings assigned to the customer during the EDD process.

Steps to complete the enhanced due diligence form

Completing the Enhanced Due Diligence Form involves a systematic approach. The first step is gathering the necessary information. Utilize a checklist of documents needed, which often includes forms of identification and proof of financial status. It’s essential to ask key questions that can shed light on potential risk factors and further clarify the business relationship.

Once you have the required information, you can proceed to fill out the form. Best practices include entering accurate data and double-checking for errors. Common pitfalls to avoid include overlooking critical fields and making assumptions about missing data. After filling out the form, it’s imperative to review and verify the information for accuracy.

Verification methods may involve checking documents against government databases, consulting with financial institutions, or utilizing advanced data analytics platforms to identify red flags during the review. Finally, once all information is validated, it's time for submission.

Understand submission processes, such as electronic records with pdfFiller or traditional methods. Information on the timeline for processing can also aid in setting appropriate follow-up actions for next steps.

Utilizing pdfFiller for enhanced due diligence

pdfFiller can significantly streamline the Enhanced Due Diligence process, catering specifically to teams and individuals who need straightforward document management solutions. The platform allows users to create PDFs effortlessly, fill out forms, and manage all documents in a single, cloud-based environment accessible from anywhere.

With powerful editing and signing capabilities, pdfFiller ensures that EDD documents are filled accurately, legally, and securely. Collaboration features allow multiple team members to participate in the EDD process, revising and updating customer forms effectively.

pdfFiller not only helps in creating and managing documents but also in securely storing them to ensure confidentiality and ease of access. This comprehensive solution enhances user experience while maintaining high compliance standards during EDD.

Best practices for conducting enhanced due diligence

Implementing best practices in Enhanced Due Diligence is vital for organizations aiming to mitigate risks effectively. A key strategy is establishing a risk-based approach, where potential threats from varying clients are assessed uniquely, allowing for flexibility in resource allocation.

Additionally, continuously monitoring high-risk clients is crucial. Organizations should build a framework for regular reviews, ensuring that no changes in customer behavior are left unchecked. This requires diligent tracking and timely reporting of activities that may indicate a shift in risk profile.

Integrating technology into EDD processes significantly boosts efficiency. RegTech solutions, in particular, offer automation opportunities for tedious data collection and risk analysis tasks, minimizing human error and improving speed in the due diligence process.

Understanding risks and challenges in enhanced due diligence

Conducting Enhanced Due Diligence comes with its own set of challenges. Resource limitations often hinder organizations from dedicating sufficient manpower or technology to effectively conduct comprehensive EDD. This may lead to overlooked details or inadequacies in risk assessments.

Another prevalent challenge is ensuring data accuracy and availability. Organizations often struggle with incomplete forms and slow responses from clients, which makes acquiring accurate information difficult. Moreover, the risks associated with inadequate due diligence can be substantial, encompassing legal repercussions and severe reputational damage.

Exploring industry-specific enhanced due diligence requirements

The necessity for Enhanced Due Diligence varies significantly across industries. Financial institutions face specific regulations mandating rigorous EDD protocols to combat money laundering and financial crimes. These regulations often require them to follow detailed record-keeping and customer transaction tracking.

For e-commerce and technology companies, unique challenges in navigating the complex digital landscape necessitate heightened vigilance. Cybersecurity threats and fraudulent transactions require robust EDD measures that may not be typical in traditional sectors.

Furthermore, in real estate and high-value transactions, ensuring thorough due diligence protects against fraud. The stakes in these sectors emphasize the need for a meticulous approach to verify the legitimacy of property ownership and source of funds.

Ongoing monitoring and management of EDD

The completion of an Enhanced Due Diligence Form doesn’t conclude the risk assessment process. Ongoing monitoring of clients is critically important to identify any changes in risk profiles or behavior. Regular reviews help ensure continuous compliance and effective risk management.

Utilizing tools for continuous tracking and reporting enhances the organization’s ability to adapt to evolving risk environments promptly. Case studies illustrate organizations successfully implementing EDD in a manner that emphasizes vigilance, allowing them to mitigate risks dynamically while maintaining a robust relationship with their clients.

Frequently asked questions about enhanced due diligence

Understanding frequent queries related to Enhanced Due Diligence can aid organizations and individuals in navigating this complex process more effectively. Common questions often revolve around the specific information collected during EDD, which typically encompasses identification details, financial backgrounds, and verification sources.

Another common query is how to identify a high-risk customer for EDD; these may include individuals with previous financial misdeeds, those from high-crime geographic areas, or those with complex ownership structures. Furthermore, organizations often seek clarity on common red flags observed during EDD, which can range from inconsistent information to high-volume transactions that lack clear purposes.

The future of enhanced due diligence

The landscape of Enhanced Due Diligence is rapidly evolving. Trends indicate that organizations will increasingly prioritize automation and artificial intelligence to drive efficiencies in EDD processes. These technologies are expected to streamline the collection and analysis of data, allowing for faster assessments and better risk mitigation.

Moreover, potential regulatory changes could shape EDD practices significantly, necessitating adaptations in how organizations approach risk management. Keeping abreast of these developments will be crucial for those involved in compliance and risk management to ensure they remain compliant while effectively shielding against fraud and financial crimes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find enhanced due diligence form?

Can I edit enhanced due diligence form on an iOS device?

How do I complete enhanced due diligence form on an iOS device?

What is enhanced due diligence form?

Who is required to file enhanced due diligence form?

How to fill out enhanced due diligence form?

What is the purpose of enhanced due diligence form?

What information must be reported on enhanced due diligence form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.