Get the free Nyc-nold-ubti

Get, Create, Make and Sign nyc-nold-ubti

How to edit nyc-nold-ubti online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nyc-nold-ubti

How to fill out nyc-nold-ubti

Who needs nyc-nold-ubti?

NYC NOLD UBTI Form: A Comprehensive How-to Guide

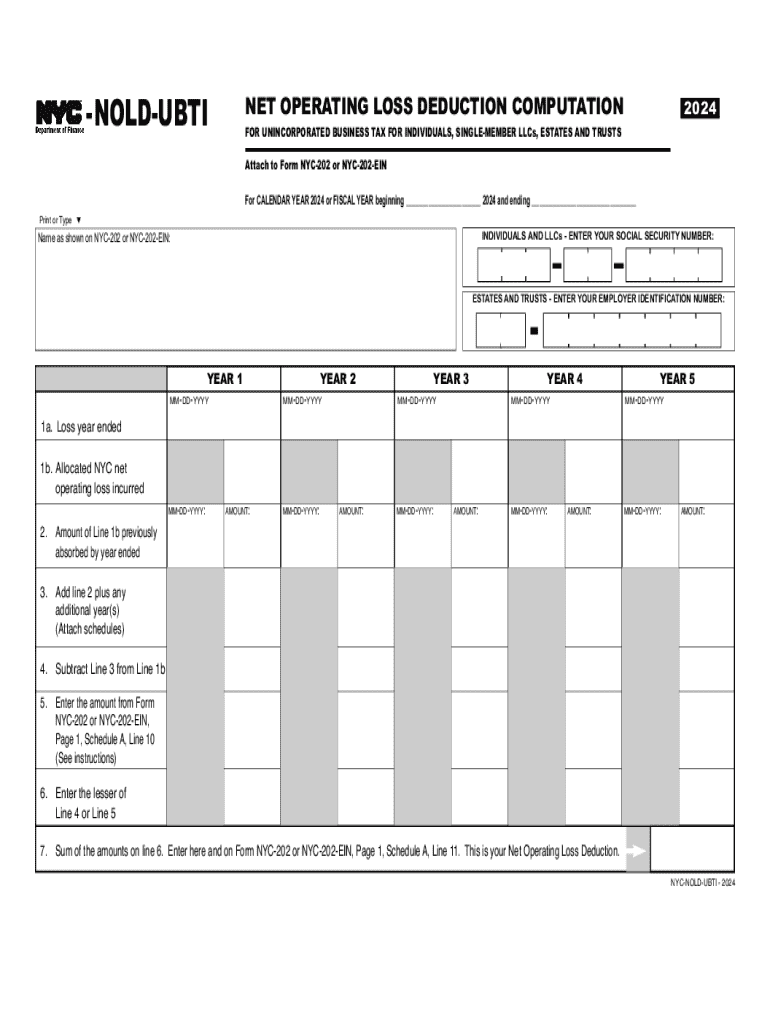

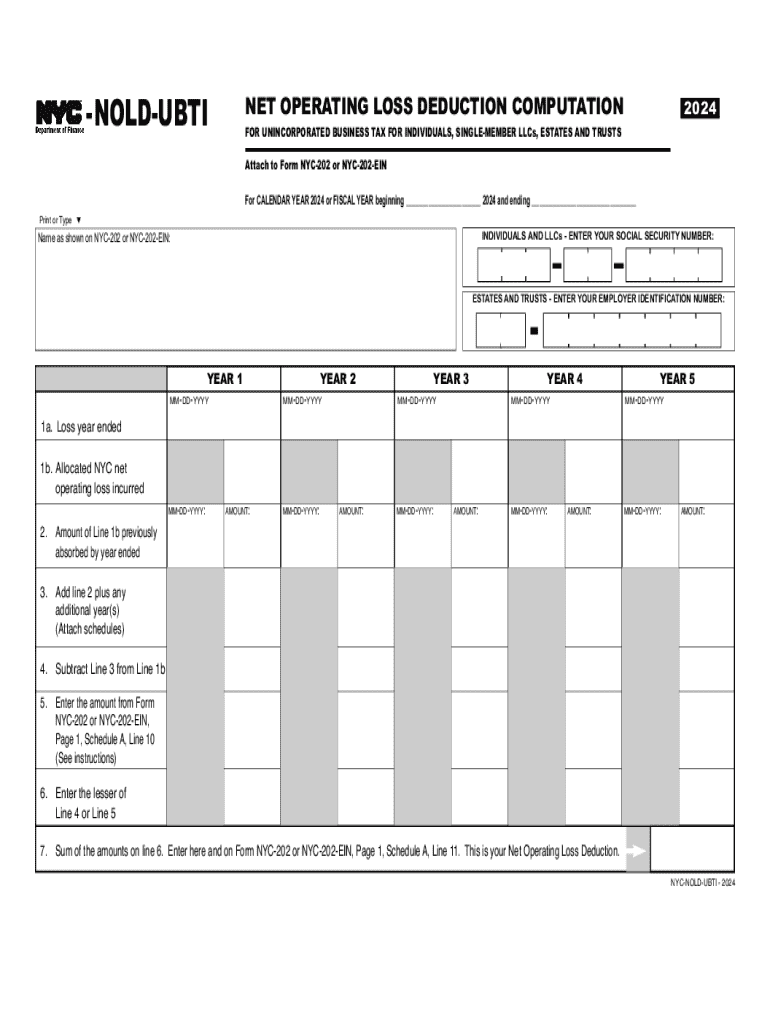

Overview of the NYC NOLD UBTI Form

The NYC NOLD UBTI Form is essential for those operating within the City of New York who need to report Unrelated Business Taxable Income (UBTI) derived from New York City activities. NOLD stands for Net Operative Loss Deductions and plays a critical role in determining how businesses and entities report their finances. Understanding NOLD and UBTI not only provides clarity on tax responsibilities but also influences strategic business decisions.

The importance of the NOLD UBTI Form lies in its specific requirement for certain organizations, particularly non-profits and educational institutions, to file a report that reflects their taxable income from activities that are unrelated to their primary mission. All involved entities must be aware of their obligation to file this form to avoid penalties and ensure compliance with New York City taxation laws.

Key features of the NYC NOLD UBTI Form

The NYC NOLD UBTI Form consists of several critical sections which must be completed to accurately report income from unrelated activities. The main sections include identification information, detailed income and expense reporting, and the calculation of UBTI. Each part is designed to capture specific financial data that is crucial for tax assessment.

What differentiates the NOLD UBTI Form from other tax documents is its focus on income that doesn’t directly support the entity's primary mission. Many organizations mistakenly assume that all income is tax-free, leading to compliance issues. It's vital for organizations to recognize the importance of correctly reporting UBTI to avoid miscalculations and penalties.

Step-by-step instructions to complete the NYC NOLD UBTI Form

Before you fill out the NYC NOLD UBTI Form, prepare by gathering all necessary documents including income statements, expense reports, and other relevant financial records. Knowing the types of income that need to be reported, which typically include earnings from unrelated business activities, will streamline the process and help avoid potential oversight.

Now, here's a breakdown of the sections of the form:

Tools and resources for completing the NYC NOLD UBTI Form

In today’s digital age, various interactive tools can facilitate the completion of the NYC NOLD UBTI Form. pdfFiller offers users powerful editing tools, enabling you to fill out, eSign, and share your completed documents seamlessly. From PDFs to online submissions, these features cater specifically to help users manage their documents efficiently.

You can also leverage additional online resources, such as the NYC Tax website where thorough guidelines and links to necessary forms are readily available. For accurate calculations of UBTI, consider utilizing recommended calculators available online.

Common challenges and troubleshooting tips

Filing the NYC NOLD UBTI Form presents certain challenges, especially for first-time filers. One frequent issue is insufficient documentation supporting income claims or expense deductions, leading to discrepancies that could trigger audits. It’s advisable to keep meticulous records and receipts for all transactions to mitigate these risks.

If you notice errors post-submission, promptly contact the relevant city department for advice on adjusting your filing. Make sure to keep abreast of common FAQs related to the NOLD UBTI Form to preemptively address potential hurdles.

Best practices for managing your NOLD UBTI Form

Maintaining thorough records is paramount when dealing with the NYC NOLD UBTI Form. It's advisable to create a filing system for all supporting documents, such as tax forms, financial statements, and correspondence with tax authorities. This will not only help streamline your filing process but also provide a safeguard in case of an audit.

Keeping a calendar for due dates and filing requirements will help ensure that you meet all obligations timely. If your business grows or changes significantly, seeking professional assistance from tax advisers who have experience with the NOLD UBTI Form is critical to navigating complex tax landscapes.

Real-life scenarios and case studies

Several businesses have successfully navigated the complexities of the NYC NOLD UBTI Form by adhering to best practices. For instance, a local non-profit organization that usually re-invested its funds in community projects found itself generating UBTI due to a rental income during a fundraising event. By accurately tracking this income and understanding how to leverage deductions effectively, they managed to minimize their tax liability.

Additionally, testimonials from users of pdfFiller’s document management tools reflect a streamlined experience, emphasizing how the ability to access, modify, and digitally sign documents has substantially eased their filing process.

Future updates and changes in NYC NOLD UBTI regulations

Tax laws and regulations are subject to change, and it's crucial for filers of the NYC NOLD UBTI Form to stay informed regarding deadlines and any updates to the form itself. Keeping an eye on communications from the NYC Department of Finance will provide insight into changes affecting filing protocols or guidelines.

To remain proactive, participating in local tax seminars or subscribing to informational newsletters can be beneficial. Additionally, networking with peers through forums can yield insights into current trends and preparation strategies.

Engage with the community

Engaging with fellow filers can be immensely beneficial. Several online forums allow individuals and businesses to share experiences and solutions regarding the NYC NOLD UBTI Form. These discussions can reveal common pitfalls and innovative strategies for successful filing.

Networking can present opportunities for collaboration and provide access to resources that help simplify the completion of this taxing form. By connecting with others, you not only gain support but also contribute to a wider community effort to enhance understanding and compliance with tax obligations in New York City.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get nyc-nold-ubti?

Can I sign the nyc-nold-ubti electronically in Chrome?

How can I edit nyc-nold-ubti on a smartphone?

What is nyc-nold-ubti?

Who is required to file nyc-nold-ubti?

How to fill out nyc-nold-ubti?

What is the purpose of nyc-nold-ubti?

What information must be reported on nyc-nold-ubti?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.