Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out asset disposition form

Who needs asset disposition form?

Asset Disposition Form: A Comprehensive How-to Guide

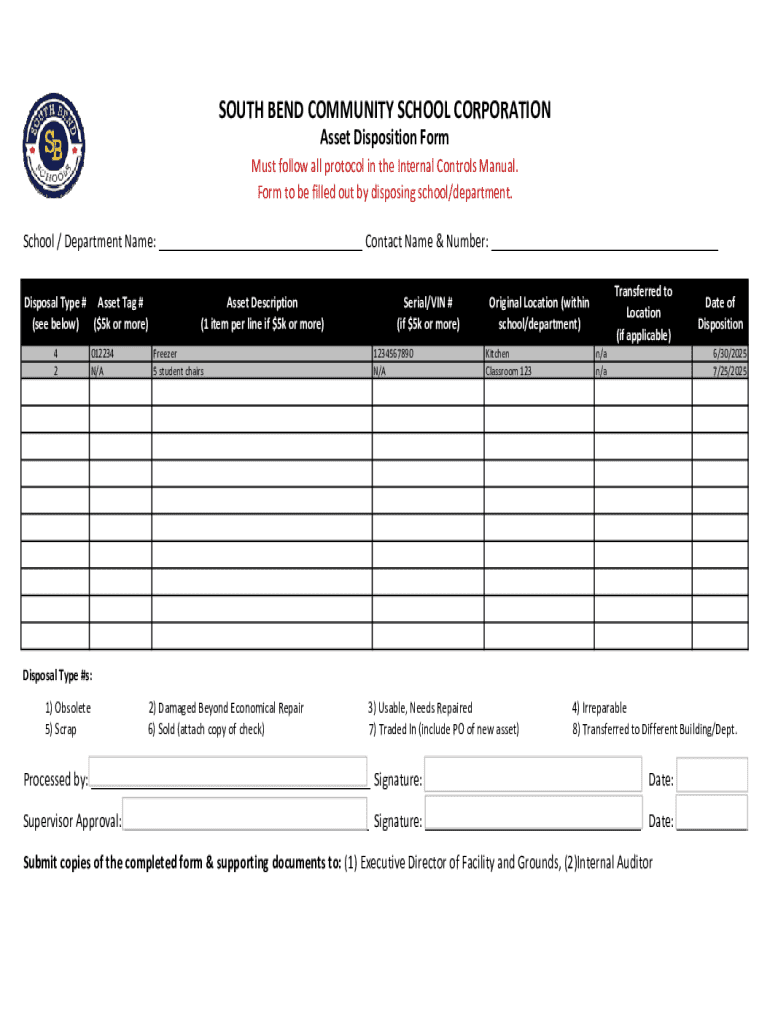

Understanding Asset Disposition

Asset disposition is a critical process for organizations managing their inventory and financial health. By definition, asset disposition refers to the official method used to dispose of, sell, or otherwise remove assets from an organization's records. This step is essential not only for maintaining accurate financial records but also for ensuring compliance with legal regulations.

Common scenarios for asset disposal include the retirement of outdated computer systems, selling excess inventory, or removing damaged assets that can no longer be used effectively. Each of these scenarios requires careful documentation to manage the implications on financial statements, tax liabilities, and compliance with industry regulations.

The asset disposition process typically involves several key steps: evaluating the asset’s condition, determining the method of disposal, documenting the transaction on an asset disposition form, and updating asset records accordingly. Organizations are also required to uphold certain regulatory compliance measures, such as disposing of electronic waste responsibly, making this a multifaceted process.

Types of Asset Disposition Forms

Different situations necessitate various types of asset disposition forms. One of the primary forms used is the Asset Disposal / Removal Request Form. This form serves the purpose of officially notifying relevant departments or teams about the planned disposal of an asset. It's often instrumental in initiating the disposal process and securing necessary approvals.

Another important form is the Missing, Stolen, or Damaged Asset Form. This form is essential in cases where assets are unaccounted for, have been stolen, or are no longer functional due to damage. Each of these forms comes with specific procedures and requirements to ensure accurate reporting and compliance with organizational policies, as well as local and federal laws.

Customizing Your Asset Disposition Forms

Customization of asset disposition forms can significantly enhance your organization’s professional image and operational efficiency. Incorporating your organization’s logo, colors, and contact information not only streamlines the process but also reinforces your brand identity within the internal and external communication landscape.

To submit a customization request, organizations typically need to contact their IT department or designated forms manager. This process may involve filling out a specific request, providing details about the desired changes, and possibly undergoing a review process to ensure that the final product aligns with organizational standards.

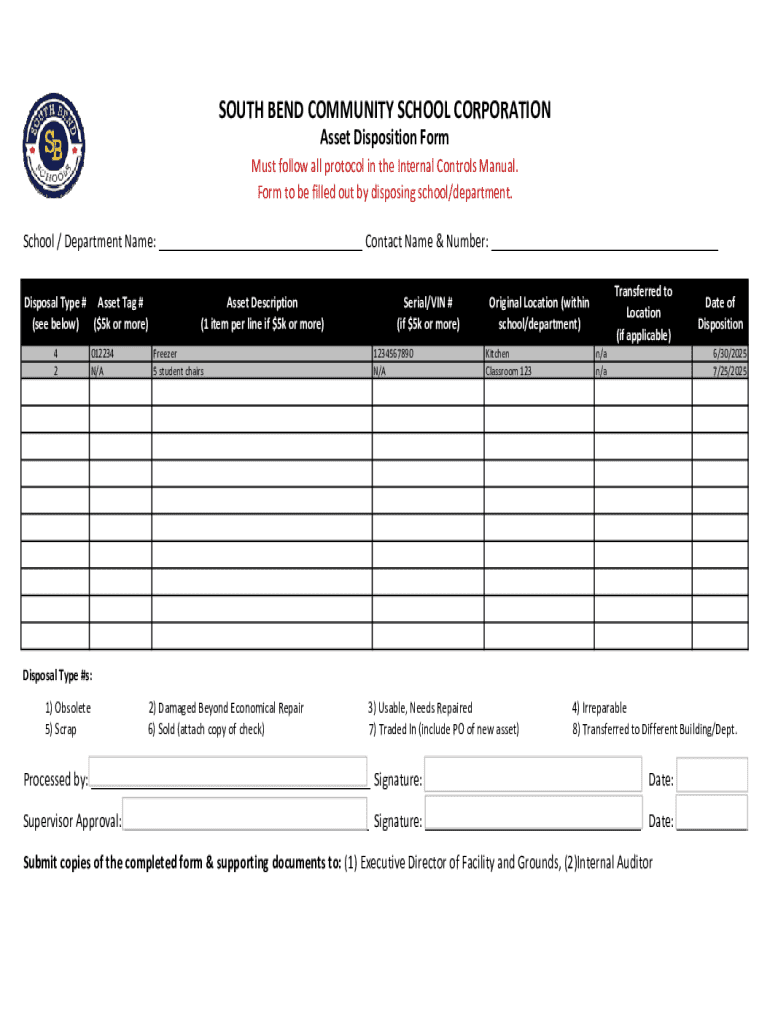

Step-by-step guide to completing the asset disposition form

When preparing to fill out the asset disposition form, begin by gathering essential information and documents related to the asset in question. This includes details like asset ID, descriptions, conditions, and any relevant ownership documents. This preparation ensures that the form is completed efficiently and accurately.

When filling out the Asset Disposal / Removal Request Form, you must provide various required sections. Key areas to focus on include the asset description, which should detail specifics about the item; the condition and saleability, which assess whether the asset can be sold or is better suited for recycling; and responsible party information, ensuring that someone is accountable for the asset disposition.

In the case of the Missing, Stolen, or Damaged Asset Form, essential information to include involves detailing the incident, such as when and how the asset was declared unaccounted for. Furthermore, including the reporting officer's details is crucial, as this person may be responsible for following up with an investigation or filing a police report.

After completing the forms, review and verify all provided information meticulously. Cross-checking for completeness and accuracy minimizes the chances of processing delays or complications arising from incorrect data.

Submission methods for asset disposition forms can vary depending on organizational protocols. They are often submitted online via an internal system, emailed directly to the relevant department, or physically mailed. Additionally, tracking the submission status ensures accountability and allows for timely follow-ups if necessary.

Managing asset disposition beyond the form

Effective record-keeping is a vital aspect of the asset disposition process. Organizations should maintain detailed logs of disposed assets, including dates, methods of disposal, and copies of any supporting documentation such as the asset disposition forms. This practice not only helps gauge asset management efficiency but is also crucial for compliance during audits.

Compliance with environmental and legal standards is another critical aspect of asset disposal. Organizations must be aware of regulations governing the disposal of certain types of assets, such as electronic waste, which often mandates specific recycling practices to minimize environmental impact. Adopting environmentally responsible disposal options is not just good practice but can also boost an organization's reputation and stakeholder trust.

Frequently asked questions

Individuals and teams frequently ask about asset disposition policies and the processes involved. Common questions include inquiries about the types of assets that require disposition forms, timelines for completion, and how to rectify issues when forms are not accepted or are incorrectly filled out.

When experiencing problems with forms or submission processes, a quick review of the organization's asset management policy can often shed light on discrepancies. When in doubt, reaching out to organizational support services or the IT department is advisable, ensuring that the correct procedures are followed to avoid delays.

How pdfFiller enhances your asset disposition process

pdfFiller offers a powerful solution to streamline your asset disposition processes. With its seamless PDF editing capabilities, users can quickly fill out asset disposition forms without needing complicated software applications. This feature simplifies the completion process, enabling teams to focus on other critical tasks.

Additionally, pdfFiller allows for digital signatures, ensuring quick authorization of asset dispositions, which helps eliminate delays often caused by the routing of physical paperwork. The platform also supports collaborative features, allowing for team-based submissions, where members can access and edit documents together efficiently.

With cloud-based access, users can manage their documents from anywhere. This level of accessibility means that team members can fill out and submit asset disposition forms, review submissions, and maintain records on the go, ensuring that asset management is efficient and adaptable to modern workflows.

Related services and tools

In addition to asset disposition services, pdfFiller provides a range of additional forms available for various asset management needs, each designed to improve organizational efficiency. Integration with existing workflows is made simple through various tools that streamline form creation, approval processes, and record management.

Furthermore, pdfFiller offers comprehensive customer support services to assist users with any form-related queries or technical issues. This ensures that all aspects of form handling are covered, providing peace of mind as teams navigate the complexities of asset management.

Learning more about asset management solutions

Implementing best practices for asset lifecycle management is critical for optimizing operations. Organizations may benefit from learning about strategies for minimizing asset loss, maximizing asset utilization, and applying proactive measures during the disposition phase to enhance productivity and profitability.

Staying informed through ongoing education and resource availability, such as workshops and online courses, can greatly enhance teams’ understanding of the asset lifecycle. This approach fosters a more knowledgeable workforce ready to tackle challenges faced in asset management.

Connecting with pdfFiller

pdfFiller invites users to stay connected by following on social media platforms, where regular updates, insights, and tips on document management are shared. Engaging with this community can enhance the overall understanding of how to optimally use the platform for asset disposition and beyond.

Additionally, signing up for the newsletter allows users to receive regular insights, updates on new features, and best practices directly to their inbox. This resource serves as an asset in itself, enhancing overall productivity within your organization.

Your next steps in asset disposition

To enhance your organizational efficiency in asset management, engage with pdfFiller’s interactive tools designed to streamline asset disposition tasks. These tools simplify processes, making it easier for teams to concentrate on higher-level strategic initiatives.

For a deeper dive into the world of document solutions, explore our blog for insightful articles and resources. Each piece aims to equip individuals and teams with the knowledge they need to navigate the complexities of forms and documents in asset management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my pdffiller form in Gmail?

How do I complete pdffiller form on an iOS device?

How do I fill out pdffiller form on an Android device?

What is asset disposition form?

Who is required to file asset disposition form?

How to fill out asset disposition form?

What is the purpose of asset disposition form?

What information must be reported on asset disposition form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.