Get the free llc operating agreement kansas

Get, Create, Make and Sign operating agreement llc kansas form

Editing llc operating agreement kansas online

Uncompromising security for your PDF editing and eSignature needs

How to fill out llc operating agreement kansas

How to fill out kansas single-member llc operating

Who needs kansas single-member llc operating?

Kansas Single-Member Operating Form: A Comprehensive Guide

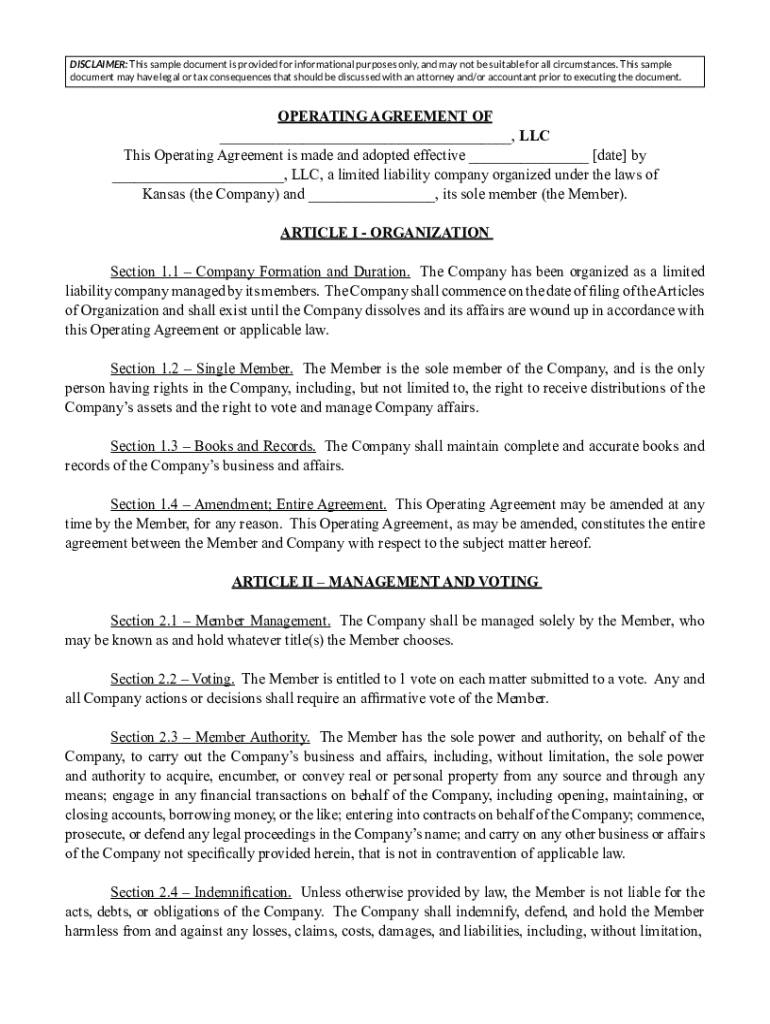

Overview of Kansas Single-Member LLCs

A single-member limited liability company (LLC) in Kansas is an ideal business structure for sole proprietors seeking liability protection while enjoying the benefits of pass-through taxation. This arrangement allows an individual to operate a business under an LLC without the complexities of a multi-member entity.

Choosing a single-member LLC in Kansas offers multiple advantages, such as protecting personal assets from business liabilities and providing a flexible management structure. Unlike sole proprietorships, single-member LLCs provide a clear distinction between personal and business finances, enhancing both credibility and security.

Key differences exist between single-member and multi-member LLCs, primarily in management, tax treatment, and compliance obligations. A single-member LLC allows for simplified decision-making processes and reduced administrative burdens compared to its multi-member counterpart.

Importance of an Operating Agreement

An operating agreement is a crucial document that outlines the management structure and operational procedures of an LLC. While single-member LLCs are not legally required to have one in Kansas, having a well-defined operating agreement is highly advisable.

The operating agreement serves as a blueprint for the business, ensuring clarity in operations, potential funding issues, and outlining the process for profit distributions. It also establishes procedures for dissolving the LLC if necessary. Operating without this agreement may lead to confusion and unintended legal consequences, particularly in matters of liability.

Drafting Your Kansas Single-Member Operating Agreement

Creating a comprehensive operating agreement involves outlining several key aspects of your business. The following sections should be carefully considered and documented:

Optional Provisions in Your Operating Agreement

While the essential components are necessary for all operating agreements, consider adding optional provisions that can further protect your interests. These might include clauses for business continuity, limitations on member liability, and procedures for amending the operating agreement.

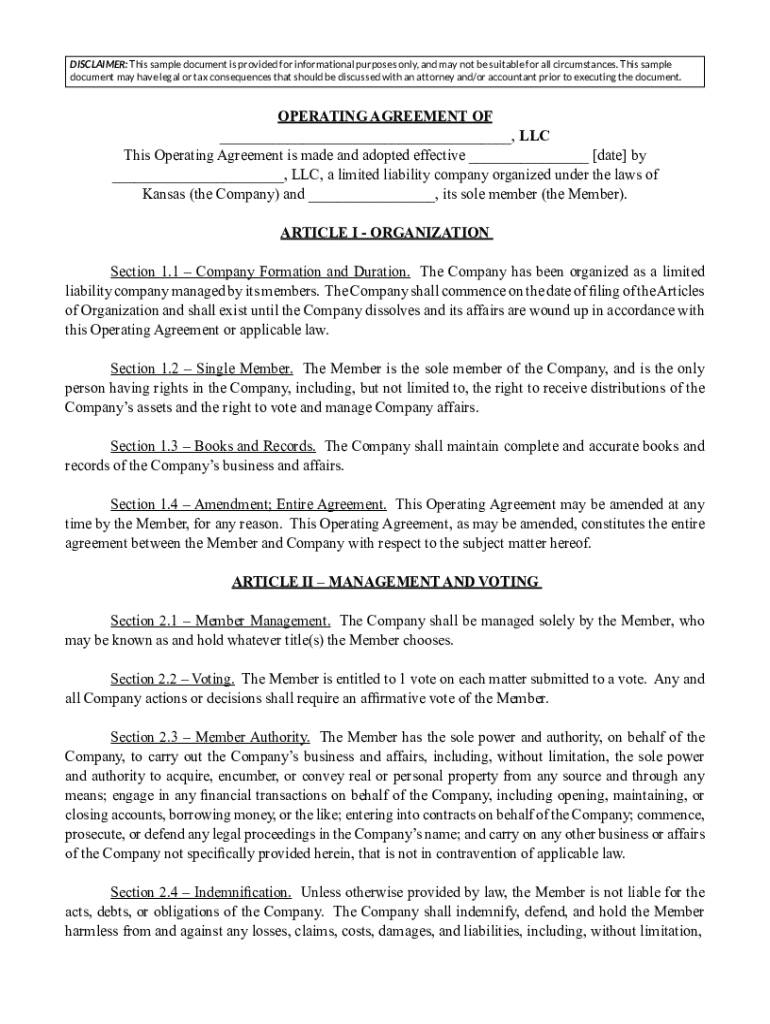

Sample Kansas Single-Member Operating Agreement Template

To facilitate the creation of your operating agreement, a sample template can be immensely helpful. This template provides a structured layout to ensure that all necessary points are covered. Visit pdfFiller to download an accessible template and follow step-by-step instructions on how to edit it according to your specific needs.

FAQs on Kansas Single-Member Operating Agreements

Many common questions surround the operation of single-member LLCs in Kansas. Here are a few FAQs to clarify the topic further:

Tips for Managing Your Kansas Single-Member

Proper management of your single-member LLC is vital for ensuring compliance and maintaining valid legal protections. Here are some essential tips:

Common Mistakes to Avoid in Single-Member Operating Agreements

When drafting an operating agreement, it's easy to overlook crucial details. To avoid complications and bolster your legal standing, steer clear of these common mistakes:

Key Takeaways on Operating Agreements for Kansas Single-Member LLCs

A well-crafted operating agreement is essential for clearly defining the roles, responsibilities, and processes of your Kansas single-member LLC. By understanding your obligations as a member and utilizing platforms like pdfFiller for document creation and management, you can ensure your business operates smoothly and legally.

Additional Considerations for Kansas Creators

Kansas regulations may change, affecting your LLC and its operating agreements. Stay informed about updates that could influence your business and take advantage of available resources for ongoing compliance and support.

Related Documents and Services

To better support your business endeavors, consider the following related documents and services:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get llc operating agreement kansas?

How do I edit llc operating agreement kansas on an iOS device?

How can I fill out llc operating agreement kansas on an iOS device?

What is kansas single-member llc operating?

Who is required to file kansas single-member llc operating?

How to fill out kansas single-member llc operating?

What is the purpose of kansas single-member llc operating?

What information must be reported on kansas single-member llc operating?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.