Get the free Ach Authorization Agreement

Get, Create, Make and Sign ach authorization agreement

Editing ach authorization agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ach authorization agreement

How to fill out ach authorization agreement

Who needs ach authorization agreement?

ACH Authorization Agreement Form: A Comprehensive Guide

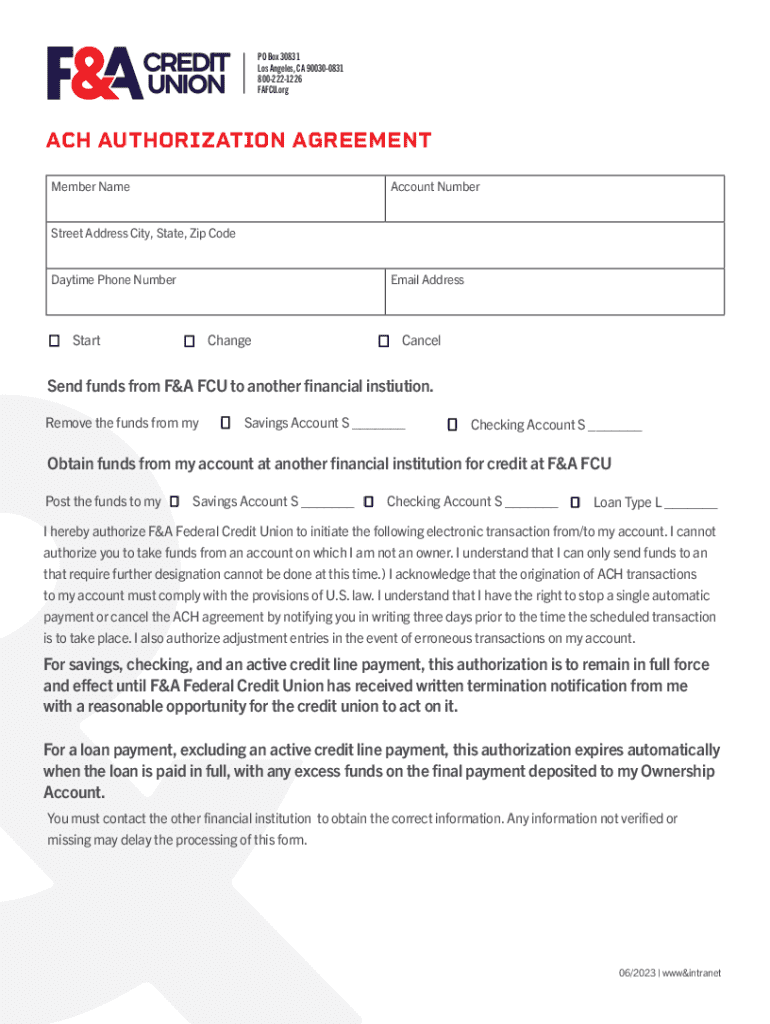

Understanding ACH Authorization Agreement

An ACH Authorization Agreement is a critical document that enables electronic funds transfers via the Automated Clearing House (ACH) network. This agreement serves as a formal consent for businesses or organizations to deduct or credit funds directly from a bank account. The importance of this agreement cannot be understated in the realm of electronic payments, as it ensures both compliance with federal regulations and the security of funds being transferred.

Understanding the two primary types of ACH transactions is essential for anyone involved in electronic payments. ACH debit transactions are initiated by the organization, allowing them to withdraw funds from the account holder's bank. Conversely, ACH credit transactions send funds to an account, commonly used for payroll or vendor payments. Both transaction types play a vital role in increasing efficiency in financial operations.

Essential Components of an ACH Authorization Agreement

Filling out an ACH Authorization Agreement requires specific information to ensure validity and compliance. Essential details include account holder information, such as their name, address, and contact information. This personal data helps identify the individual or organization giving consent for the ACH transaction.

Bank account details are equally crucial, comprising the account number and routing number that facilitate the transfer of funds. Additionally, specifics about the transaction itself, including the amount, frequency, and duration, must be included. The authorization statement, which contains the legal language necessary for compliance, must be clear and comprehensive. Lastly, the agreement must be signed and dated by the account holder, confirming their consent.

How to fill out an ACH Authorization Agreement Form

Completing an ACH Authorization Agreement Form requires careful attention to detail. Begin by gathering all necessary documentation and information to ensure accuracy. Once you have everything ready, you can download the ACH authorization agreement form from pdfFiller, an accessible platform designed for this purpose.

Fill in the form fields clearly, ensuring you utilize electronic tools for precision. Reviewing and verifying the information ensures that any mistakes can be corrected before submission. After you complete the form, digitally sign it and date the agreement for compliance purposes, then save and securely store it online to maintain quick access and enhance security.

Different ACH authorization formats available

When considering formats for an ACH Authorization Agreement, users have options between paper forms and electronic forms. Electronic forms offer myriad benefits in terms of accessibility and document management. They can be filled out anytime and anywhere, significantly speeding up the authorization process. Transitioning from paper to electronic is straightforward, especially with platforms like pdfFiller, which simplify the workflow.

Verbal authorizations also exist but must be used judiciously. These can replace formal agreements in specific situations, such as in immediate payment situations. However, it is always advisable to follow up verbal agreements with written documentation to ensure compliance and maintain clear records.

Best practices for ACH authorization agreements

Adhering to compliance regulations is paramount when dealing with ACH Authorization Agreements. Users must familiarize themselves with the rules established by NACHA (National Automated Clearing House Association) and other federal regulations. These guidelines help maintain secure authorization processes and protect both the payer and payee from potential fraud.

Storage and management of agreements also require attention. Keeping documents both secure and accessible is essential for efficient operations. Utilizing cloud-based solutions like pdfFiller allows users to maintain organized, easily retrievable documents while ensuring all sensitive information is well-protected. Moreover, creating audit trails facilitates compliance reviews and enhances operational transparency.

How to cancel an ACH authorization agreement

If you need to cancel an ACH Authorization Agreement, it’s crucial to follow a structured process. Start by formally submitting a cancellation request, which may vary depending on the institution but usually involves contacting the department that handles ACH transactions. Ensure you do this in writing to create an official record of your request.

Timing is key when canceling an agreement; you must allow sufficient time for the organization to process the cancellation. After the request, you should receive confirmation regarding the cancellation status. Additionally, remember to notify any relevant parties to prevent unauthorized transactions from occuring after cancellation.

Frequently asked questions (FAQs)

Understanding the nuances of ACH authorization forms can sometimes be challenging. One common question people have is whether there is a difference between ACH debit and credit authorization forms. The key difference lies in the transaction direction; debit forms authorize withdrawals, while credit forms authorize deposits into an account. Recognizing these distinctions is essential for correct financial management.

Another frequently asked question is what to do if a mistake is made while filling out the form. The best approach is to review the form immediately after completion, and if errors are identified, rectify them promptly. Most platforms like pdfFiller offer editing tools, allowing users to make these corrections efficiently. Lastly, processing time for ACH authorizations typically ranges from one to three business days, depending on various factors, including the entities involved and the transaction type.

Utilizing pdfFiller for your ACH authorization needs

pdfFiller offers invaluable tools for document management, especially for ACH Authorization Agreements. Users can easily upload, edit, and sign forms using its interactive features. This streamlined functionality not only enhances productivity but also minimizes errors associated with manual entry.

Furthermore, pdfFiller encourages collaboration among teams by allowing multiple users to edit and complete documents together in real-time. All these capabilities are housed in a secure, cloud-based platform that provides access to your documents from any location. Secure sharing features also safeguard sensitive information, ensuring compliance and confidentiality.

Conclusion and next steps

Ensuring smooth financial transactions through proper authorization is vital for both individuals and organizations. By utilizing a comprehensive ACH Authorization Agreement Form and adhering to best practices, the risks associated with electronic transfers can be significantly mitigated. Clearly, the benefits of efficiently managing these agreements using pdfFiller are evident. The platform empowers users to create, edit, and manage their ACH Authorization Agreements seamlessly, reinforcing efficiency and facilitating smooth transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ach authorization agreement?

How can I edit ach authorization agreement on a smartphone?

How do I complete ach authorization agreement on an iOS device?

What is ach authorization agreement?

Who is required to file ach authorization agreement?

How to fill out ach authorization agreement?

What is the purpose of ach authorization agreement?

What information must be reported on ach authorization agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.