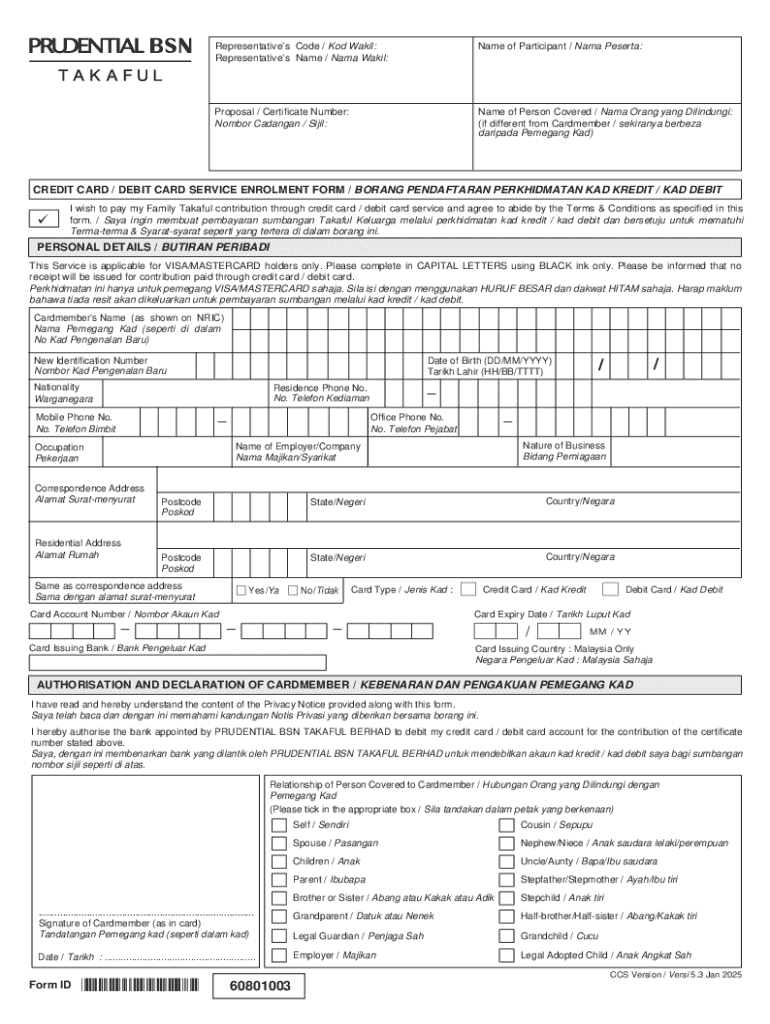

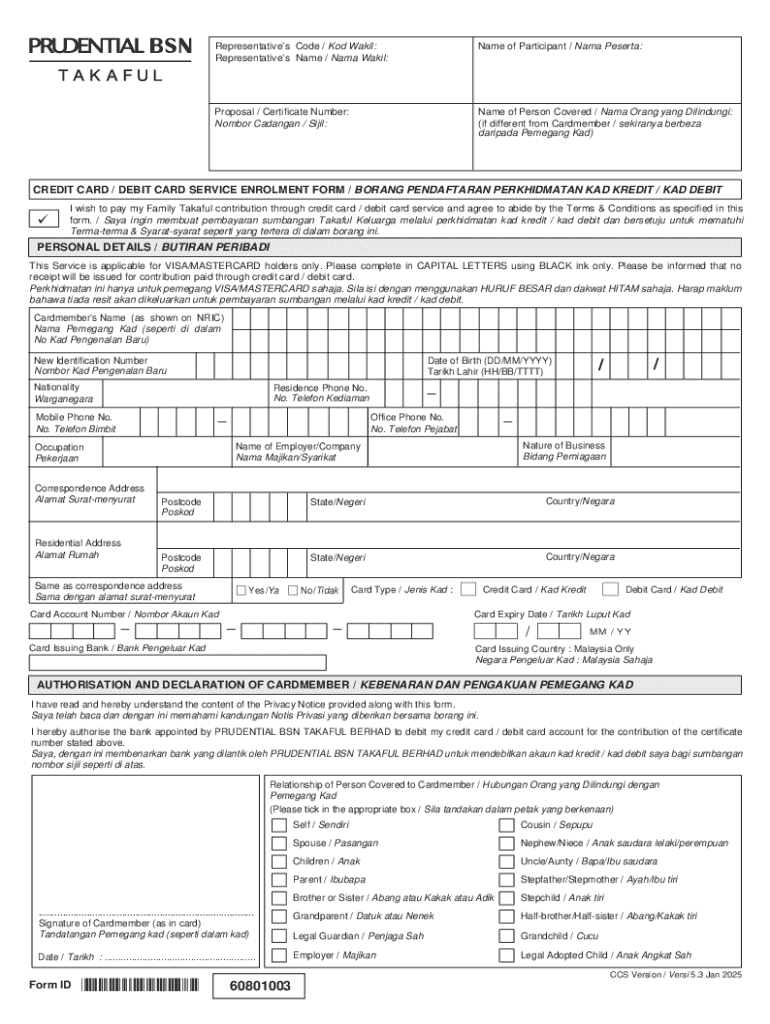

Get the free Credit Card / Debit Card Service Enrolment Form

Get, Create, Make and Sign credit card debit card

Editing credit card debit card online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card debit card

How to fill out credit card debit card

Who needs credit card debit card?

Credit card and debit card form – How-to guide

Overview of credit and debit card forms

Credit card and debit card forms are essential documents that facilitate financial transactions, allowing consumers to apply for credit or obtain payment methods directly linked to their bank accounts. A credit card form typically pertains to applications for credit lines, while debit card forms revolve around accessing funds available in a checking account via a payment card.

The importance of these forms cannot be overstated. They streamline the application process for both consumers and institutions, providing a structure for capturing vital information. Additionally, they ensure compliance with government regulations set forth under acts like the RTI Act and other consumer protection laws.

Key differences between credit and debit card forms lie primarily in their purpose. While credit card forms involve assessing a consumer's creditworthiness to grant credit, debit card forms are focused on linking cards to existing funds, requiring proof of identity and account details.

Types of forms related to credit and debit cards

There are various forms related to credit and debit card applications, each tailored to specific needs.

Credit card application forms

Credit card application forms require information such as your name, address, income, and social security number. It's crucial to provide accurate details, as inaccuracies may lead to application denials.

Common mistakes to avoid include typographical errors, unverifiable income claims, and failing to check the eligibility criteria set by the credit card issuer.

Debit card application forms

On the other hand, debit card application forms require essential banking information such as account number and routing number. Applicants must also demonstrate identity through documents like a government-issued ID.

Frequently asked questions about these forms often relate to the speed of processing and access to funds once the application is approved.

Credit card authorization forms

Credit card authorization forms are used to obtain permission to charge a credit card, especially in scenarios like recurring payments or one-time transactions requiring written consent.

These forms are critical when dealing with remote transactions or subscription services and must be filled out carefully to ensure compliance with financial regulations.

Benefits of using credit and debit card forms

Using credit and debit card forms offers various benefits that enhance both procedural efficiency and user experiences. One of the primary advantages is the streamlined payment process they provide, which allows consumers and merchants to process transactions quickly.

Enhanced customer experience is another key benefit. When consumers can easily fill out forms digitally, it leads to quicker approvals and improved satisfaction.

Security features of card forms are paramount as well. Various data protection measures are in place, including encryption protocols, which reduce the risk of fraud while ensuring compliance with standards set by the Central Bank and regulations enacted in 2005 and further refined in 2020.

Step-by-step guide to filling out credit and debit card forms

Filling out credit and debit card forms requires careful attention to detail. To ease this process, start with a pre-filling checklist: gather necessary information such as personal identification, current financial statements, and any associated documentation.

Detailed instructions for completing a credit card application form

When completing a credit card application, begin with the personal information section. Provide your full name, residential address, and contact information. The next step involves the financial details section, where you'll need to report your income and employment status accurately.

After completing these sections, review all information for correctness, then submit the application. This careful approach increases the likelihood of approval and expedites the overall application process.

Step-by-step guide for debit card applications

Debit card applications typically start by verifying eligibility criteria. This often involves showcasing adequate fund balances or connecting to an active checking account.

Filling in banking information is next, including account numbers and routing details, which require accuracy to avoid processing delays. Confirming your identity through identity verification documents is also essential to secure your debit card.

Managing application status

Once you have submitted your credit card application, it's crucial to manage the status actively. Tracking your application often involves logging into your account or using customer service options provided by the issuing bank.

Understanding the approval process helps set realistic expectations. It typically spans a few business days, but delays can occur. If your application is denied, understanding the reasons behind it is vital so that you can make the appropriate adjustments for re-application.

Editing and modifying card forms

Editing and modifying credit and debit card forms is often necessary to keep information current. Using tools like pdfFiller allows for easy edits to PDF forms, facilitating changes to personal information or financial details.

With interactive editing features, users can manipulate text fields, add signatures, or incorporate notes as needed. Don't forget to save changes to your document after editing to prevent data loss.

E-signing credit and debit card forms

E-signatures have gained prominence for their convenience and legality, especially as digital transactions proliferate. Applying an e-signature to a card application is a straightforward process that enhances the workflow.

The legality and acceptance of e-signed documents are generally upheld, provided they adhere to relevant electronic signature laws. This ability to sign forms electronically is especially useful in the rapidly evolving landscape of mobile banking and online transactions.

FAQs about credit and debit card forms

When dealing with credit and debit card forms, common questions arise. For example, 'What should I do if I lose my card?' The immediate action would be contacting your bank to report the loss and freeze the account.

Concerns about security when using online forms are also prevalent. Reputable banks and financial institutions implement robust safeguards to protect your data. Furthermore, questions about whether one can edit card information after submission often have a straightforward answer: it typically requires contacting the issuer to rectify any discrepancies.

Advanced features of pdfFiller for document management

pdfFiller offers advanced features that enhance document management for credit and debit card forms. Collaborating on forms with team members streamlines the sharing of information and review processes, making it easier to prepare accurate applications together.

Additionally, cloud storage options allow you to access and store your forms securely. Setting reminders for re-application or card renewal ensures you won't miss important deadlines, enhancing your overall financial management.

Related resources and tools

In your journey with credit and debit card forms, various additional resources and tools are available through pdfFiller. You may find templates for financial documents that suit your needs, along with guides on effective document management.

Lastly, applying tips for effective financial planning using card forms is essential. By keeping track of your applications and renewals, you can navigate your financial landscape more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card debit card without leaving Google Drive?

How do I edit credit card debit card on an iOS device?

How can I fill out credit card debit card on an iOS device?

What is credit card debit card?

Who is required to file credit card debit card?

How to fill out credit card debit card?

What is the purpose of credit card debit card?

What information must be reported on credit card debit card?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.