Get the free Multi-purpose Tax Return

Get, Create, Make and Sign multi-purpose tax return

How to edit multi-purpose tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out multi-purpose tax return

How to fill out multi-purpose tax return

Who needs multi-purpose tax return?

A Comprehensive Guide to Filling Out a Multi-Purpose Tax Return Form

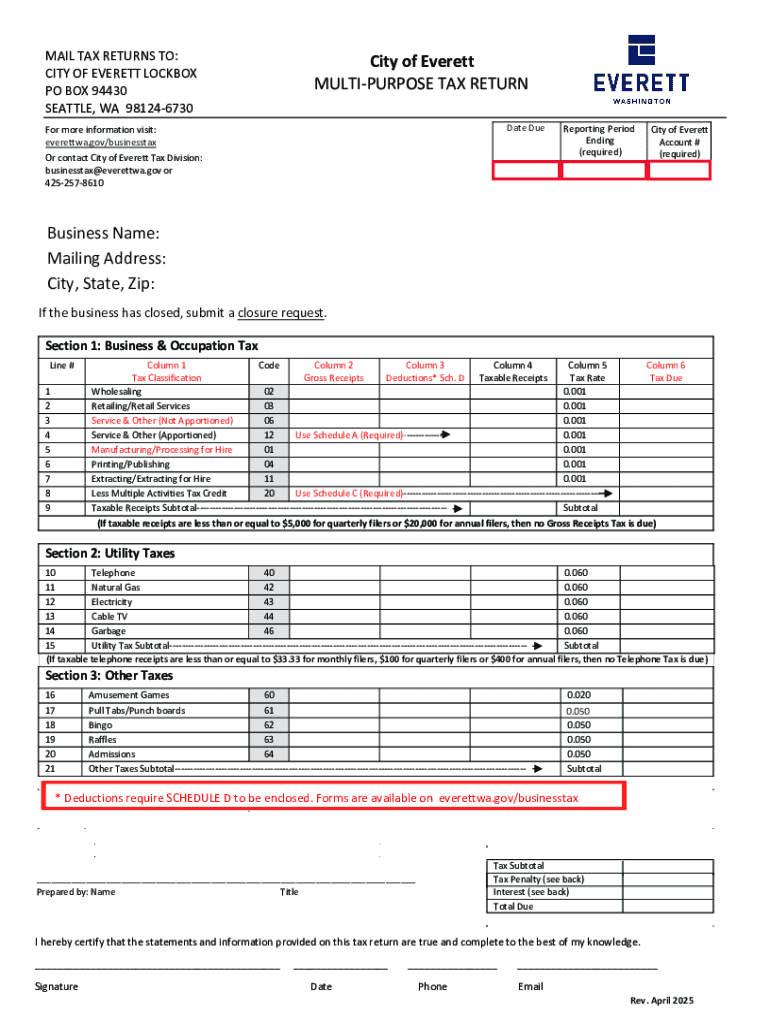

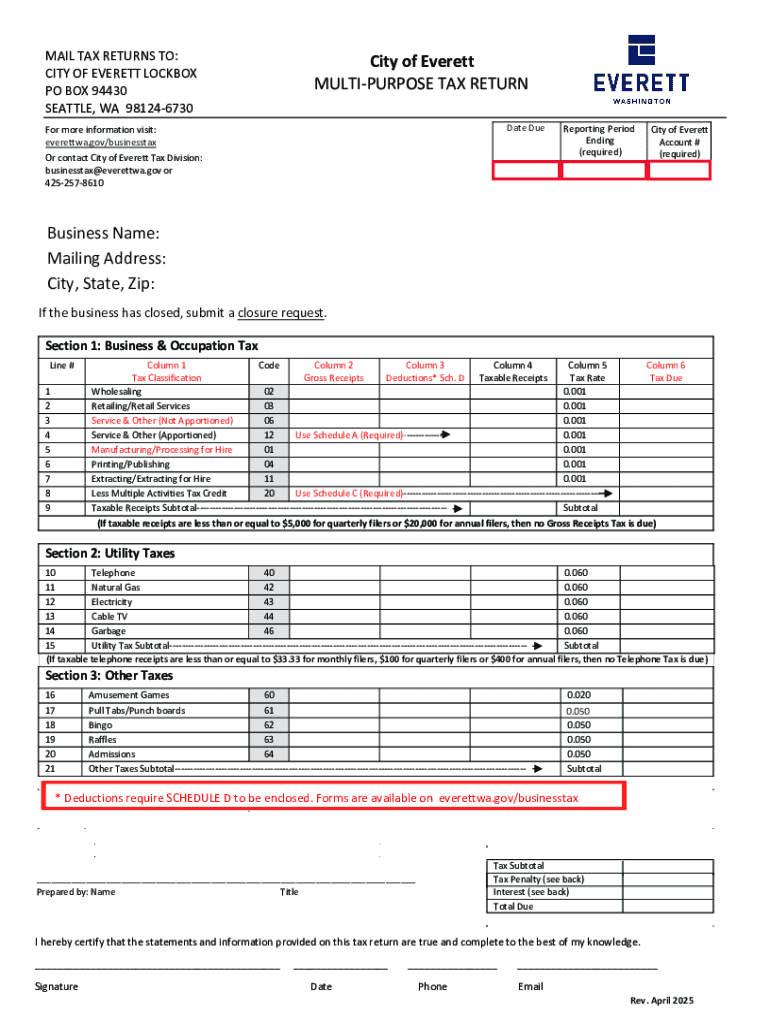

Overview of the multi-purpose tax return form

A multi-purpose tax return form is a versatile document that simplifies the tax filing process for various individuals and businesses. It serves multiple functions, allowing users to report different types of income, apply for deductions, and calculate their owed tax in a single submission. By consolidating various necessary details into one form, it streamlines the often-complex tax process.

The importance of this form cannot be overstated, as it is designed to accommodate a broad spectrum of users, from single filers to small business teams. This all-in-one approach is particularly beneficial during tax season when efficiency and accuracy are paramount. Key features of multi-purpose tax return forms include clear sections for personal, income, and tax-related information, along with areas designated for specific deductions and credits.

Understanding the components of the form

Multi-purpose tax return forms are structured to facilitate easy navigation. The main sections typically include:

Familiarity with terminology such as Adjusted Gross Income (AGI) and various tax credits is crucial. AGI is essentially your gross income minus specific deductions, while tax credits directly reduce the tax owed.

Who should use the multi-purpose tax return form?

This form is suitable for a range of users. Individuals including single filers and families benefit from its comprehensive approach. For single filers, the multi-purpose tax return form allows for simple, streamlined reporting of their income and deductions. Families can use it to document multiple income streams and expenses that may qualify for tax breaks.

Teams and small businesses such as start-ups and freelancers also find value in this form. It can accommodate the nuances of business income, allowing them to report earnings and expenses efficiently. Specific scenarios like changes in employment or having additional income sources, such as side gigs or rental properties, underscore the need for a flexible filing tool.

Step-by-step instructions for filling out the form

Filling out a multi-purpose tax return form doesn’t have to be daunting. Here’s a step-by-step guide:

It's essential to avoid common mistakes like misreporting income or failing to claim eligible deductions, as these can lead to complications down the line, including penalties or delays in processing.

Editing and managing the form using pdfFiller

Managing a multi-purpose tax return form can be significantly streamlined using pdfFiller, an excellent platform for document management.

Many interactive tools enhance the user experience:

Additionally, utilizing the eSigning features of pdfFiller allows you to securely sign your form electronically, making it easier to collaborate with tax professionals or partners during the review process. Effective version control will help you track edits and maintain an accurate filing history, which is essential for managing your tax documentation.

Filing your multi-purpose tax return form

Once your multi-purpose tax return form is complete, it's time to file it. Remember, you have various options for submitting your return.

Ensure you are aware of IRS submission guidelines and any state-specific filing requirements. After filing, understanding your tax status is crucial, as this informs you if you owe taxes or are entitled to a refund. Know what steps to take if you face an audit, as being informed can save you stress down the line.

FAQs about the multi-purpose tax return form

Navigating a multi-purpose tax return form often raises questions. Here are some common queries addressed:

Conclusion

Filling out a multi-purpose tax return form is an integral part of managing personal and business finances. The importance of accuracy and timeliness cannot be overstated.

Using tools like pdfFiller not only simplifies this process but empowers users to efficiently edit, sign, and manage their tax documents seamlessly. By continually learning and staying informed about tax regulations, users can make the best decisions for their financial futures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send multi-purpose tax return for eSignature?

How do I make changes in multi-purpose tax return?

Can I create an eSignature for the multi-purpose tax return in Gmail?

What is multi-purpose tax return?

Who is required to file multi-purpose tax return?

How to fill out multi-purpose tax return?

What is the purpose of multi-purpose tax return?

What information must be reported on multi-purpose tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.