Get the free Motor Vehicle Claim Form

Get, Create, Make and Sign motor vehicle claim form

How to edit motor vehicle claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motor vehicle claim form

How to fill out motor vehicle claim form

Who needs motor vehicle claim form?

Motor Vehicle Claim Form: A How-to Guide

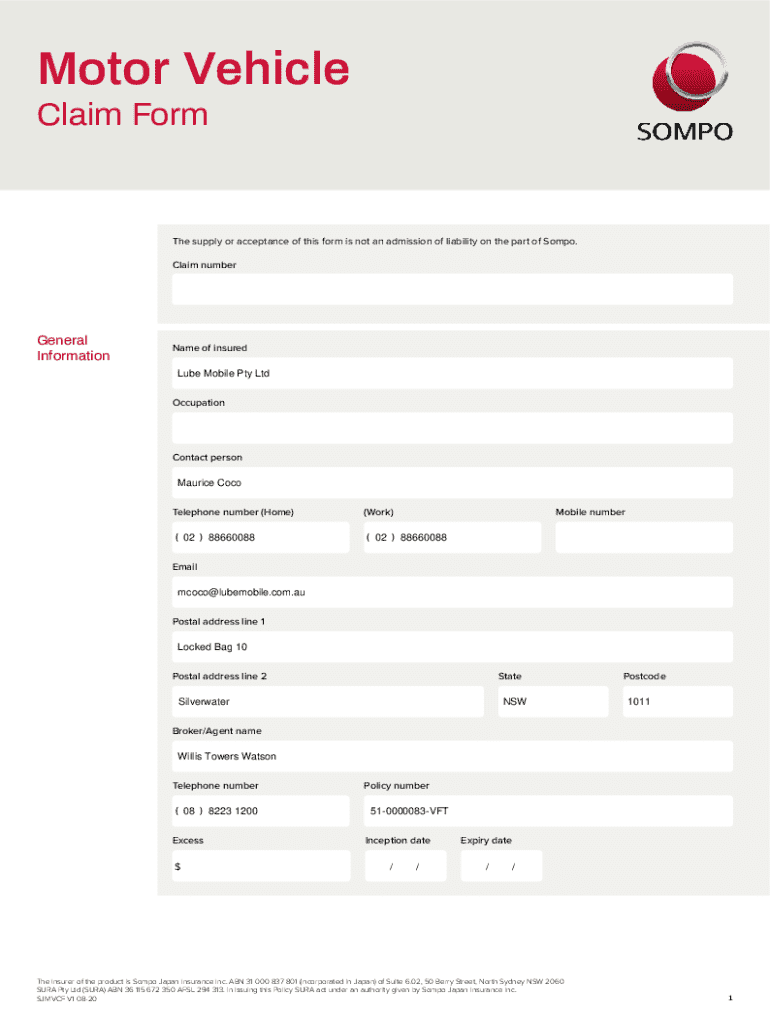

Understanding the motor vehicle claim form

The motor vehicle claim form plays a pivotal role in the aftermath of an accident. It serves as the official document required to report losses to your insurance company, detailing the events and circumstances surrounding the incident. Submitting this form accurately is crucial, as any errors can lead to delays or potential rejection of your claim.

Accuracy in documentation is vital. Insurance companies rely on the information provided to assess claims accurately. To prevent complications, ensure every detail is recorded precisely.

Types of claims covered

Motor vehicle claim forms can cover various types of incidents, including:

Preparing to fill out your motor vehicle claim form

Before you dive into filling out your motor vehicle claim form, it’s essential to gather all necessary information. This preparation step is critical to ensure that you can complete the form without interruptions.

Gather necessary information

Start by collecting details about the accident, such as the date, time, and location. Additionally, you’ll want to document information from all parties involved, including their names, contact information, and insurance details. This information will serve as the backbone of your claim.

Required documentation

Apart from personal details, you will also need to compile critical documentation to support your claim. Essential documents include:

Filling out the motor vehicle claim form step-by-step

After preparing, you'll be ready to fill out the claim form. Follow these steps diligently to ensure you provide all necessary information clearly.

Step 1: Personal information

Begin with your personal information. Fill in your name, address, contact number, and policy number accurately, as these details will help the insurer identify your account.

Step 2: Vehicle information

Next, you should provide specific information about your vehicle. Include details such as the make, model, year, license plate number, and VIN (Vehicle Identification Number). This information helps insurance companies track the vehicle involved in the accident.

Step 3: Accident details

In this step, accurately describe the accident. Include the circumstances that led to it, any contributing factors like weather conditions, and information about other involved parties. This section is critical to determining fault.

Step 4: Claim information

When detailing your claim information, outline the type of claim you are filing, be it collision or liability. Clarify whether you are seeking repairs, medical expenses, or other costs. Understanding your insurance coverage and limits in this context is key.

Step 5: Supporting documentation

Attach all relevant documents to your claim form. Ensure they are organized and easy to read. This might include photos of the accident site, repair estimates, and the police report.

Editing and reviewing your form

Once your motor vehicle claim form is completed, take the time to edit and review it before submission. This stage can save you from potential headaches down the road.

Tips for self-editing

Look for common mistakes such as misspellings or incorrect numbers. Ensure clarity by confirming that every statement is easy to understand and complete.

Utilizing pdfFiller's editing tools

With pdfFiller, editing your PDF form becomes effortless. Their platform offers tools for making annotations, correcting mistakes, and enhancing clarity. Take advantage of these features to fine-tune your document.

Signing your motor vehicle claim form

After reviewing, you’ll need to sign your motor vehicle claim form. eSigning has become a staple in document management for its simplicity and legal acceptance.

Importance of eSigning

An electronic signature is not only convenient but also legally valid in many jurisdictions. It simplifies the process, allowing for quicker processing of your claim.

How to eSign with pdfFiller

To eSign your document using pdfFiller, simply upload your completed claim form, navigate to the signature field, and follow the prompts. It’s a straightforward process that typically takes just a few minutes.

Submitting your claim

Once signed, you’re ready to submit your motor vehicle claim form. Knowing the different submission methods can make this process smoother.

Methods for submission

You can typically submit your claim online or via physical mail. Online submissions are generally faster and allow for easy tracking, so consider this option if available.

Follow-up procedures

After submission, it’s crucial to follow up. Check the status of your claim regularly through your insurance provider’s online portal or customer service. Staying informed helps you address any potential issues quickly.

Managing your claim document post-submission

Once your claim is submitted, it’s vital to manage your documents effectively. Keeping everything well-organized can save time if questions arise later.

Organizing your documents with pdfFiller

Using pdfFiller, you can store your claims and any related documents securely in the cloud. This centralized approach allows you quick access whenever needed.

How to share your claim file securely

Should you need to collaborate with your insurance agent or legal advisor, pdfFiller makes sharing documents straightforward. You can easily manage permissions to maintain control over who accesses your files.

Troubleshooting common issues

Navigating the claim process can sometimes present challenges, particularly if your claim encounters roadblocks.

Dealing with claim rejections

If your claim is rejected, don't panic. Common reasons include incomplete information or lack of evidence. Review your documentation, gather additional evidence if necessary, and consider submitting an appeal.

Resolving disputes

In the event of processing discrepancies, document all communications with your insurance provider. Clearly outline your concerns and provide supporting documentation to facilitate resolution.

Additional tips for success

Success lies in diligence and thorough documentation when dealing with motor vehicle claims.

Keeping detailed records

Documenting every action taken after the accident – from initial accident notifications to claim follow-ups – can provide invaluable support if any disputes arise later.

Using pdfFiller for future claims

Embrace pdfFiller for all your documentation needs. Its capabilities extend beyond this claim process, streamlining any future requests or submissions you might need to handle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete motor vehicle claim form online?

How do I make changes in motor vehicle claim form?

How do I make edits in motor vehicle claim form without leaving Chrome?

What is motor vehicle claim form?

Who is required to file motor vehicle claim form?

How to fill out motor vehicle claim form?

What is the purpose of motor vehicle claim form?

What information must be reported on motor vehicle claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.