Get the free Beneficiary Designation Form

Get, Create, Make and Sign beneficiary designation form

Editing beneficiary designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

Beneficiary Designation Form: A Comprehensive How-To Guide

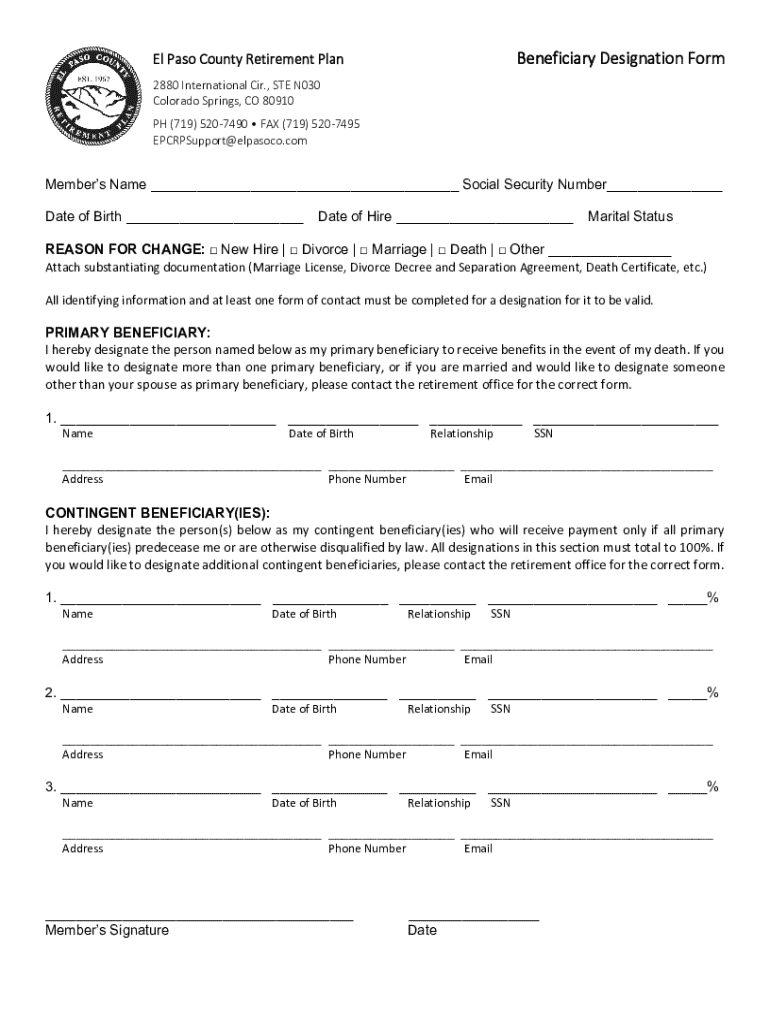

Understanding the beneficiary designation form

A beneficiary designation form is a crucial document that allows individuals to name who will receive their assets upon their passing. This form is significant in financial and estate planning, as it ensures that an individual’s wishes regarding asset distribution are honored. Without a designated beneficiary, assets may be subjected to lengthy probate processes or distributed in a manner that may not align with the individual's intentions.

The importance of a beneficiary designation form cannot be understated; it serves as a straightforward way to transfer wealth and avoid disputes among potential heirs. Moreover, it can provide a measure of financial security for loved ones.

Types of beneficiary designation forms

Beneficiary designation forms apply to various financial products and situations. Some common scenarios include retirement accounts, such as 401(k) plans and IRAs, as well as life insurance policies. Each of these products may require separate forms, and it’s vital to ensure that the correct form is used to avoid complications.

In most cases, beneficiaries can be categorized as primary or contingent. Primary beneficiaries are the individuals who will receive the assets outright upon the account holder’s death. Contingent beneficiaries, on the other hand, are those who will inherit the assets only if the primary beneficiaries are unable to do so, such as if they predecease the account holder.

Key elements of a beneficiary designation form

When filling out a beneficiary designation form, several key elements must be included to ensure clarity and legality. Required information typically includes personal details of the account holder, such as name, address, and Social Security number, as well as comprehensive information about the beneficiaries. The correct spelling of names, relationships, and contact information are essential to avoid confusion later.

Optional information can also play a significant role. Individuals may wish to include special instructions or conditions, such as specifying that a beneficiary must reach a certain age before inheriting proceeds. Additionally, if multiple beneficiaries are listed, it is crucial to define the distribution percentages among them clearly.

Legal considerations also play a role in beneficiary designation forms. Laws can vary significantly by state, affecting how beneficiary designations are viewed and executed. Furthermore, some forms may require notarization or witnessing to enhance their validity, ensuring that disputes are minimized during asset distribution.

Step-by-step guide to completing the beneficiary designation form

Completing a beneficiary designation form can be straightforward if approached systematically. Begin by gathering the necessary documents, which may include identification documents and relevant policy or account statements. These will help ensure that the information provided is accurate and reflects all pertinent details.

Next, begin filling out the form, following detailed instructions for each section. Start with the section for primary beneficiaries, providing full names, relationships, and any additional required details. Proceed to fill out the section for contingent beneficiaries in the same manner. If applicable, clearly articulate any special instructions in the designated section.

Once the form is completed, it is essential to review your designations carefully. Double-checking all details ensures that no crucial information has been omitted or entered incorrectly. Additionally, consider verifying with each beneficiary to confirm their understanding and acceptance of their designated status.

Tools for managing your beneficiary designation

pdfFiller is an exceptional tool for individuals looking to manage their beneficiary designation forms efficiently. By offering features such as online uploading and editing, pdfFiller empowers users to easily make adjustments to their forms as circumstances change. This flexibility allows individuals to maintain control over their financial planning.

With collaborative features, pdfFiller enables users to efficiently engage family members or advisors in the form-filling process. Users can eSign documents or work on them in real-time, ensuring that everyone involved has a clear understanding of the designations being made.

Additionally, pdfFiller provides cloud storage, enabling users to access their documents from anywhere at any time. This convenience ensures that individuals can stay up to date with their beneficiary designations, no matter where life may lead.

Common mistakes to avoid

Despite the straightforward nature of beneficiary designation forms, a few common mistakes can lead to significant issues. One major mistake is misunderstanding terms. Clarifying what is meant by 'beneficiary' versus 'contingent beneficiary' is crucial to ensure proper designations are made. Mislabeling a beneficiary can lead to unnecessary complications in asset distribution.

Another prevalent mistake involves neglecting to update the form regularly. Major life changes, such as marriage, divorce, or the birth of a child, can all warrant updates to beneficiary designations. Regularly reviewing and updating these forms can prevent potential disputes or unintentional exclusions of individuals who should be included.

Incomplete information is yet another common pitfall. Omissions can lead to delays or even invalidation of the form. Providing comprehensive data, along with clear outlines of percentages when dealing with multiple beneficiaries, ensures that the distribution process will go smoothly. Being meticulous at this stage can save headaches later.

Frequently asked questions (FAQs)

One common question people ask is, 'How often should I update my beneficiary designation?' It's advisable to review your designations at least annually, or following significant life events such as marriage, divorce, or the death of a beneficiary. These checks can help ensure that your wishes remain aligned with changing circumstances.

Another frequently raised concern is, 'What if I want to change my beneficiary after the form is submitted?' Most beneficiary designation forms allow for changes to be made at any time; however, it’s crucial to follow the specific procedures set by your financial institution or insurance company.

Tax implications also come into play, leading to questions such as, 'Are there tax implications for my beneficiaries?' While most life insurance benefits are not taxable to the beneficiary, it's essential to consult a financial advisor for detailed implications based on individual circumstances.

Lastly, individuals may wonder, 'What should I do if a beneficiary predeceases me?' In such instances, it’s advisable to have contingent beneficiaries named; this ensures that assets can still be distributed without delay and in accordance with the individual’s wishes.

Final steps in managing your beneficiary designation

Once the beneficiary designation form is completed and submitted, it’s vital to keep copies for your records. Best practices for storing your designation include keeping digital copies in secure cloud storage, such as with pdfFiller, as well as printing copies for physical storage in a safe place. This ensures that you, and your family, have access to this important document when needed.

Effective communication regarding your beneficiary designations is also essential. Discussing these decisions with family members and trusted advisors can mitigate confusion in the event of your passing. Being transparent about your wishes fosters understanding and helps prevent any disputes among family members.

Lastly, considering a legal review may also be beneficial. Consultation with financial or legal professionals can provide clarity on any nuances relating to your particular situation. They can also offer guidance on optimizing your beneficiary designations to ensure they align with your overall estate planning objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my beneficiary designation form directly from Gmail?

How do I execute beneficiary designation form online?

How do I make changes in beneficiary designation form?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.