Get the free Tdf Form 2 - tltb com

Get, Create, Make and Sign tdf form 2

Editing tdf form 2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tdf form 2

How to fill out tdf form 2

Who needs tdf form 2?

TDF Form 2 Form: A Complete How-to Guide

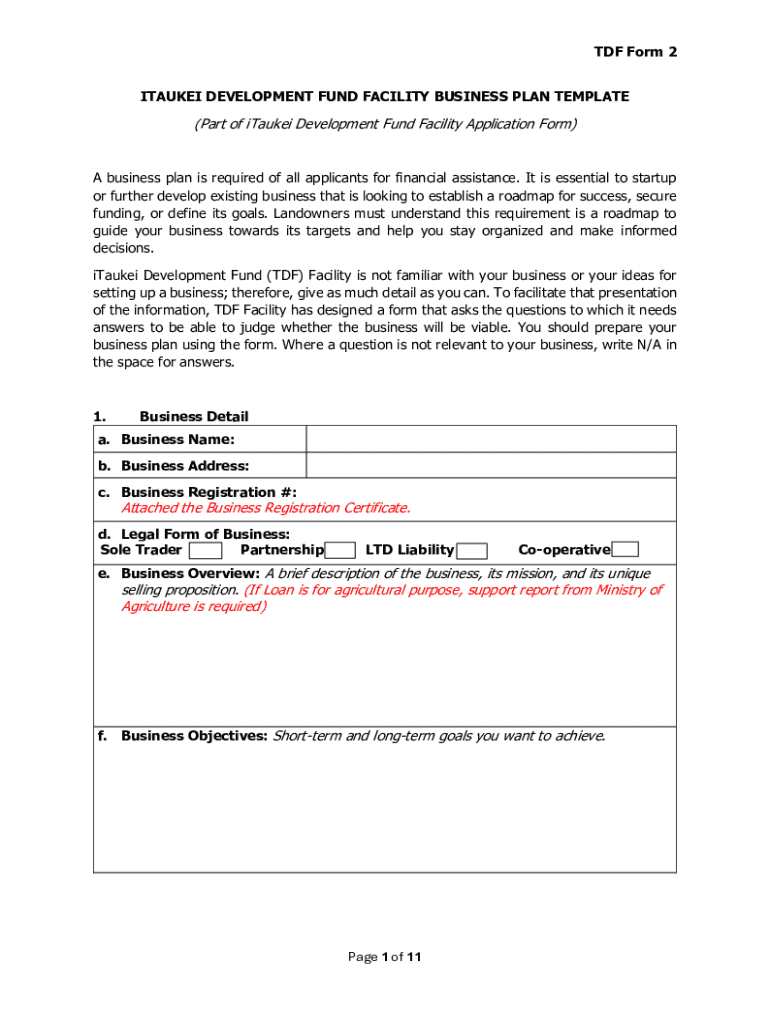

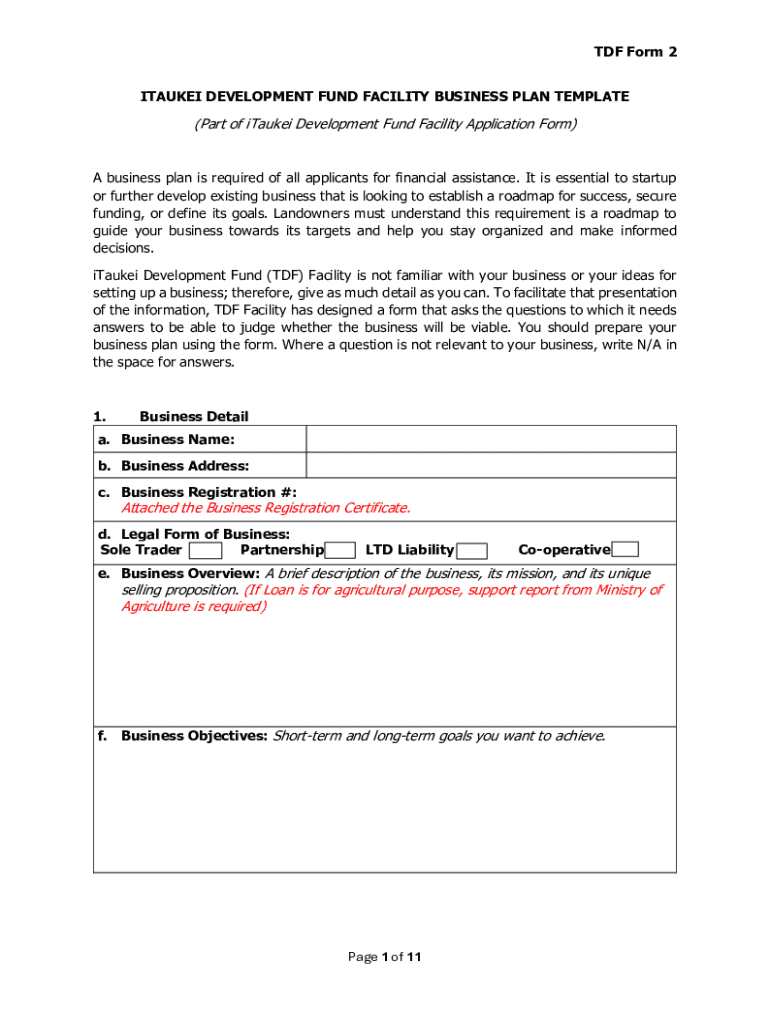

Understanding the TDF Form 2

The TDF Form 2 is a crucial document primarily used in specific regulatory and compliance contexts. Generally, it serves to collect essential information necessary for taxation or other legal purposes. This form is particularly important for both individuals and teams who need to submit accurate and compliant documentation to relevant authorities.

For individuals, the TDF Form 2 can be vital for personal tax declarations, while teams or organizations may use it to ensure that their collective financial activities are transparent and accountable. Having a correctly filled TDF Form 2 can streamline processes, mitigate risks, and avoid potential penalties.

Importance of correctly filling out the TDF Form 2

Filling out the TDF Form 2 accurately is not just a matter of convenience; it carries significant legal implications. An incorrectly filled form can lead to fines, audits, and even legal action. Therefore, understanding the nuances of this form is paramount to personal and organizational compliance.

Conversely, an accurate TDF Form 2 enhances the credibility of your submissions and fosters trust with regulatory authorities. By ensuring that the form is filled out correctly, you not only protect yourself from potential issues but also pave the way for smoother interactions with tax officials or other governing bodies.

Preparing to fill out the TDF Form 2

Before starting to fill out the TDF Form 2, you will need to gather specific prerequisites and required information. This includes documentation such as identification, proof of income, prior tax records, and any relevant financial statements.

It can be helpful to work alongside an accountant or a financial advisor to ensure that you have all necessary data on hand. They can help clarify any complex requirements and ensure that you are prepared to enter the most accurate information.

Understanding each section of the TDF Form 2

The TDF Form 2 comprises several distinct sections, each designed to capture specific information. Understanding the requirements of each section is crucial for ensuring a complete and accurate submission.

Typically, the form may include sections for personal identification, income declaration, deductions, and financial summaries. A thorough reading of the instructions accompanying the form can provide insights into what information is required per section, thereby helping to avoid errors.

Step-by-step guide to filling out the TDF Form 2

Step 1: Accessing your TDF Form 2

To begin, you need to locate and download the TDF Form 2. This can easily be done on the pdfFiller platform, where you can find the latest version of the form. If you are using a mobile device, ensure that you have the necessary applications to view PDF files.

Step 2: Filling out the form using pdfFiller

Using pdfFiller to complete the TDF Form 2 is simple. You can fill out fields directly online, and the platform provides interactive tools for editing and signing the form. Take advantage of the user-friendly interface, which is designed to guide you through each step seamlessly.

Step 3: Reviewing your information

Once filled out, review your TDF Form 2 carefully. This step is critical to avoid mistakes that could lead to administrative issues. Use pdfFiller’s collaborative features to share your form with trusted colleagues for peer reviews, allowing for an additional layer of scrutiny.

Step 4: Saving and exporting your form

After completing your review, you can save the form in various formats per your needs, including PDF or Word documents. Ensure that you choose the appropriate format depending on the requirements of your submission.

Signing and submitting your TDF Form 2

eSigning the TDF Form 2

To finalize your TDF Form 2, you will need to sign it. With pdfFiller, the eSigning process is seamless. Simply use the platform to add your signature, whether by drawing, uploading, or typing it in. The benefits of electronic signing include increased efficiency and a reduced risk of paperwork loss.

Guidelines for submission

Once the TDF Form 2 is signed, you need to submit it. Follow the specific guidelines provided for submission, which may include electronically delivering it through a portal or mailing a physical copy to the relevant authority. Moreover, keep track of your submission using confirmation numbers or tracking tools provided by the platform.

Frequently asked questions (FAQs) about the TDF Form 2

Common concerns when filling out the form

Users often express concerns about the complexity of the TDF Form 2 and whether they have all needed documentation. To mitigate these issues, many find that following a checklist approach, as discussed in previous sections, greatly helps. If you encounter difficulties, consult online resources or reach out to customer support for assistance.

Troubleshooting errors in the TDF Form 2

Mistakes can happen when filling out forms, especially one as important as the TDF Form 2. If you discover an error post-submission, review the correction guidelines specific to the authority managing the form. Ensure that you communicate promptly to rectify any inaccuracies.

Additional tools and features on pdfFiller

Using interactive templates

pdfFiller offers interactive templates that can be leveraged for filling out other related forms, enhancing productivity. Users can explore a library of forms that require similar data inputs, allowing for streamlined document preparation.

Collaboration tools for teams

For teams, pdfFiller provides collaboration tools designed to improve workflow. With these features, team members can work simultaneously on documents, ensuring efficiency and reducing bottlenecks during form-filling processes.

Storing and managing your documents securely

Security is a primary concern when it comes to document management. pdfFiller offers advanced security features, including encrypted storage, ensuring that your data remains safe and easy to manage. Users can also categorize documents for quick access, making the management process user-friendly.

Why choose pdfFiller for your document needs

Seamless integration with other tools

pdfFiller excels in its compatibility with a multitude of other software solutions used in document management. This facilitates a more efficient workflow, allowing you to integrate your existing systems with ease.

Accessibility and cloud-based features

One of the significant advantages of using pdfFiller is its cloud-based infrastructure, which allows users to access forms from anywhere and on any device. This flexibility is essential for individuals and teams juggling various tasks and environments.

Customer support and resources

pdfFiller offers robust customer support options, including live chat and extensive tutorials. These resources ensure that users have access to help whenever they face challenges or need guidance, making it easier to navigate the complexities of forms like the TDF Form 2.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tdf form 2 without leaving Google Drive?

How can I send tdf form 2 to be eSigned by others?

Can I sign the tdf form 2 electronically in Chrome?

What is tdf form 2?

Who is required to file tdf form 2?

How to fill out tdf form 2?

What is the purpose of tdf form 2?

What information must be reported on tdf form 2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.