Get the free Business Debit Card Application

Get, Create, Make and Sign business debit card application

How to edit business debit card application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business debit card application

How to fill out business debit card application

Who needs business debit card application?

Your Comprehensive Guide to the Business Debit Card Application Form

Understanding the business debit card

A business debit card serves as a vital financial tool for companies, allowing easy access to funds directly from the business checking account. Unlike personal debit cards, which cater to individual expenses, business debit cards are designed specifically for managing business-related transactions. This distinction is crucial, especially when it comes to tracking expenses and maintaining clear financial records.

The primary purpose of a business debit card is to facilitate cash flow management and simplify the payment process for business expenses. It operates in conjunction with a business checking account, where transactions are directly withdrawn. This integration helps streamline bookkeeping and ensures funds are readily available for operational needs.

Key requirements for application

Applying for a business debit card requires meeting specific eligibility criteria set by financial institutions. The type of business structure plays a significant role in determining eligibility. For instance, sole proprietorships, LLCs, and corporations may need to provide different documentation and identification.

Typically, applicants must be at least 18 years old and possess a valid government-issued ID. Additional documentation is necessary to substantiate the business's identity and financial status.

Preparing your application

Before you even pick up the pen or click the mouse, gathering all relevant information about your business is crucial. Ensuring that your business details are current and accurate will expedite the application process. Small errors can lead to unnecessary delays or even rejections.

Understanding your financial history is equally important. Many banks consider your credit score when reviewing applications. A robust credit profile can significantly enhance your chances of approval. If your score is less than stellar, consider taking steps to improve it before applying. This might include paying down debts, ensuring timely payments, and reviewing your credit report for inaccuracies.

Step-by-step guide to the application process

The application process for a business debit card can be straightforward if you approach it methodically. Start by researching banks and financial institutions that offer business debit cards. Comparing various providers will ensure you select one that best aligns with your business needs.

When choosing a bank, consider factors such as fees, available features, and customer service. Some banks may offer additional services like budgeting tools or integrated accounting solutions, which can be beneficial for your business management.

Managing your business debit card post-application

Once you have submitted your application and received your card, activating the card is the next important step. This process typically involves calling a designated number or navigating online to verify your identity and set a pin.

Setting up online banking services is also essential as it enables you to monitor transactions and manage your card efficiently. Utilize features such as spending alerts and transaction categorization to keep ongoing budgets in check. Establishing spending limits can further enhance financial control.

Utilizing pdfFiller for document management

pdfFiller serves as an invaluable resource for managing your business debit card application form. With features that allow document editing, eSigning, and storage, this platform enhances your overall application experience. You can customize your forms to reflect specific business needs, ensuring all necessary fields are accurately completed.

Additionally, the ability to track your application progress and collaborate with team members simplifies the management of documentation. You can easily save your application and share it securely for review before submission.

Troubleshooting common issues

In case your application is denied, understanding why is crucial. Common reasons include inadequate credit history, discrepancies in provided information, or non-compliance with eligibility criteria. Analyzing feedback from the bank can help you rectify these issues if you decide to reapply.

It is not uncommon to have queries regarding business debit cards. Often, potential applicants seek clarity on issues such as fees associated with the card, daily or monthly spending limits, and the card's usability for international transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business debit card application without leaving Google Drive?

Can I create an eSignature for the business debit card application in Gmail?

How do I edit business debit card application on an Android device?

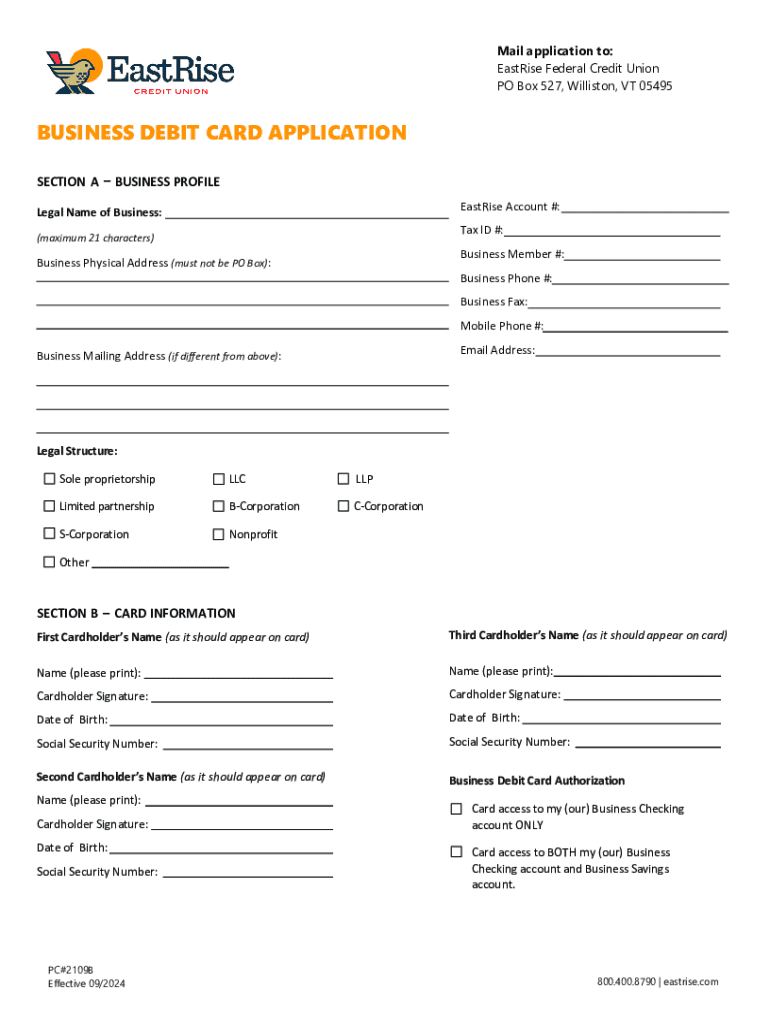

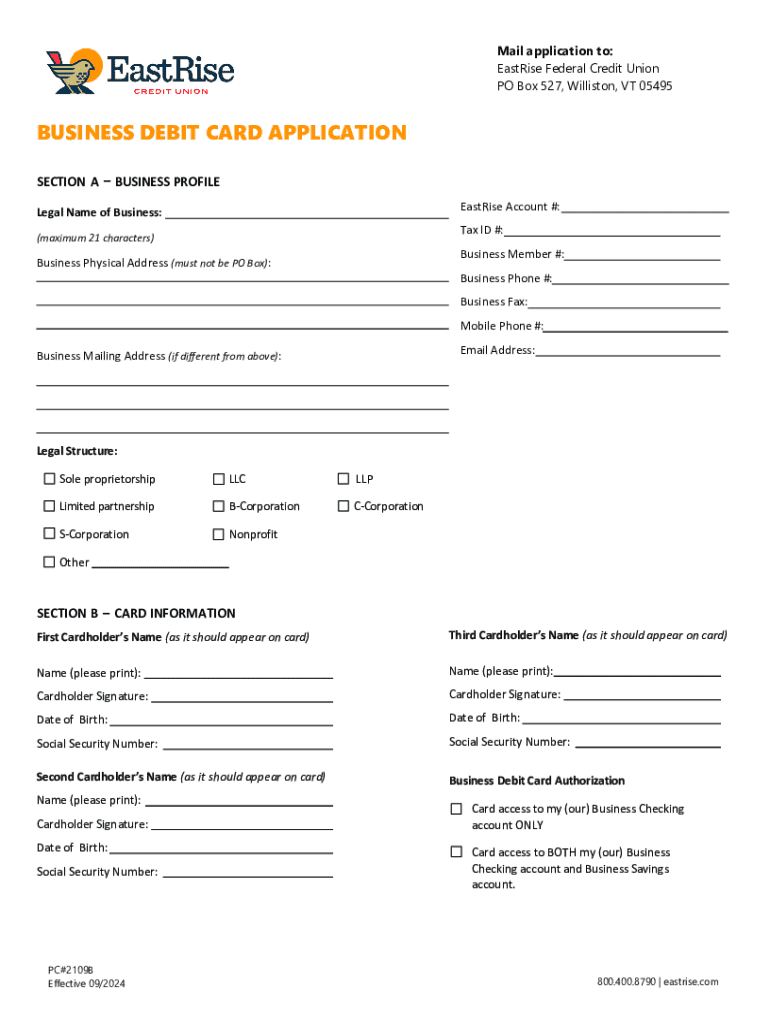

What is business debit card application?

Who is required to file business debit card application?

How to fill out business debit card application?

What is the purpose of business debit card application?

What information must be reported on business debit card application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.