Get the free Nebraska Resale or Exempt Sale Certificate

Get, Create, Make and Sign nebraska resale or exempt

Editing nebraska resale or exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska resale or exempt

How to fill out nebraska resale or exempt

Who needs nebraska resale or exempt?

Guide to the Nebraska Resale or Exempt Form

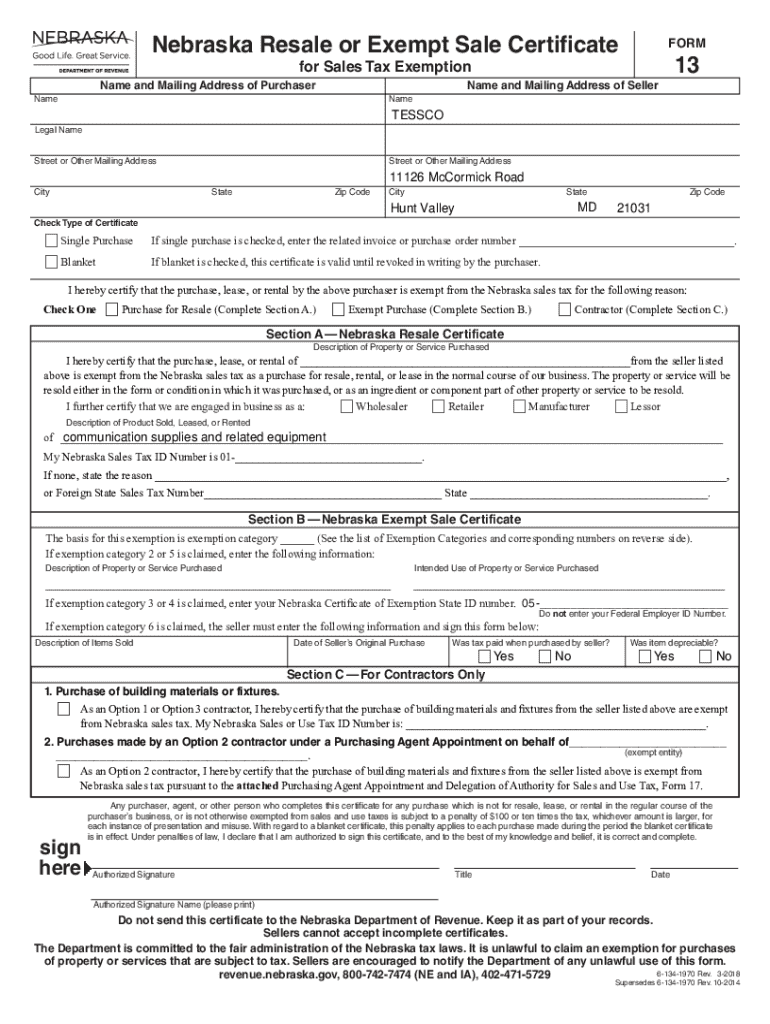

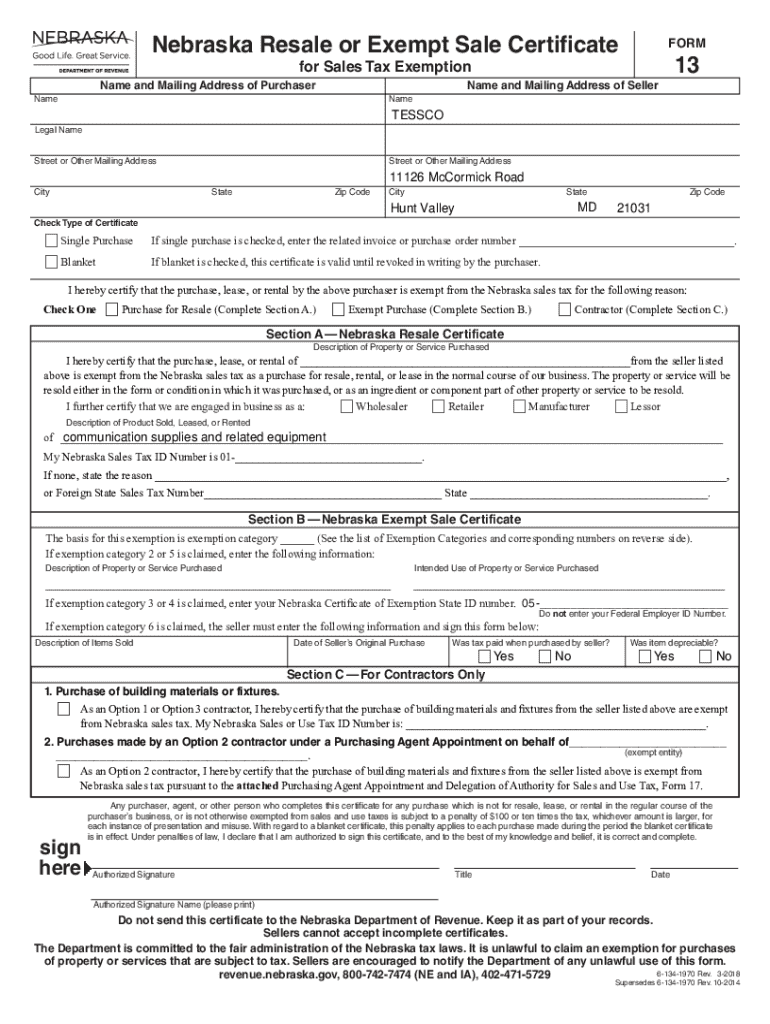

Understanding the Nebraska resale certificate

A Nebraska resale certificate is an official document that allows businesses to purchase goods tax-free, intending to resell them in the normal course of business. This certification is critical for the state's commerce, as it ensures that sales tax only applies when an item is sold to the final consumer. For example, a clothing retailer can present this form when purchasing inventory without having to pay sales tax upfront, thus improving cash flow and maintaining competitive pricing.

Many businesses rely on resale certificates when dealing with suppliers or wholesalers. The form is not only about tax exemption; it also streamlines the purchasing process, allowing for smoother transactions. It's crucial for anyone involved in retail or providing services that require materials to understand this instrument's significance.

Eligibility criteria for a Nebraska resale certificate

To qualify for a Nebraska resale certificate, businesses must primarily engage in selling tangible personal property or services that are taxable when sold to final consumers. This includes retailers, wholesalers, or service providers that need goods for various purposes like sales in their store or assembling products for services. Individuals looking to make personal purchases without tax do not qualify.

Necessary documentation typically includes a completed application form, which will ask for details such as the applicant's name, address, and sales tax identification number. In some instances, the Nebraska Department of Revenue may require additional forms of verification, like proof of business licenses or federal EIN numbers, to validate the business's legitimacy.

How to apply for a Nebraska resale certificate

Applying for a Nebraska resale certificate involves completing a straightforward process aimed at gathering necessary business information. Here’s a detailed step-by-step breakdown of the application procedure: First, download the Nebraska resale certificate application form from the Nebraska Department of Revenue's website. Next, fill in required fields like your business name, address, and tax identification number.

Once complete, you can submit your application either online through the Nebraska Department of Revenue's e-file system or through traditional mail, sending it to the department's address. Upon approval, you'll receive a confirmation of your resale certificate, allowing you to make tax-exempt purchases efficiently.

Utilizing your Nebraska resale certificate

Once you have your Nebraska resale certificate, understanding how to use it effectively is key. When making a tax-exempt purchase, present your resale certificate to the seller at the time of the transaction. Be sure to check that they accept resale certificates to avoid any complications. It's beneficial to notify the seller about the context of your purchase to clarify that it is intended for resale.

If you’re on the selling end, accepting a Nebraska resale certificate requires you to validate the authenticity of the document. Ensure that it includes the buyer's information and check that the sales tax ID is consistent with their business registration. Keep a copy of the certificate in your records, as this serves as proof of exemption should you undergo an audit.

Managing sales tax exemption certificates

Understanding exemption certificates in Nebraska involves knowing the varied types and their specific uses. Common exemption certificates include those for agricultural purchases, manufacturing, and other service-related supplies. To ensure compliance, businesses must stay abreast of updates and maintain meticulous records of each exemption certificate utilized.

Verifying a Nebraska resale certificate can be done through the Nebraska Department of Revenue’s online resources, which provide tools for validating sales tax IDs. Businesses should routinely check that certificates are up to date and not expired, as previous versions may be rendered invalid under new legislation. Staying informed about Nebraska's tax laws is essential for avoiding potential compliance issues.

Key regulations and legal considerations

Nebraska's sales tax legislation, as delineated in the Nebraska Revised Statutes, encompasses the rules surrounding resale and exemption certificates. Statute § 77-2706 discusses the criteria and limits that apply to these certificates, ensuring they are not misused. Engaging in tax evasion by improperly using a resale certificate can lead to severe penalties, including fines or interest on unpaid taxes.

Businesses must educate their staff on the proper use of resale certificates and establish best practices to ensure compliance. Regular audits of internal processes regarding tax exemption claims can help partners understand and mitigate the risks associated with improper use.

Frequently asked questions (FAQs)

Curious about whether you need a resale certificate in Nebraska? If you intend to purchase products for resale, this certificate is essential. The application process is typically free, requiring only your business details. Many ask whether Nebraska accepts out-of-state resale certificates; the answer is context-dependent, as it typically recognizes valid out-of-state certificates if you operate a business that holds a retailer's sales tax permit.

Lastly, it's important to know that Nebraska resale certificates do not expire, but maintaining accurate records and verifying the validity of exempt purchases is crucial. Regularly cross-check your documents and ensure your information is consistently updated to comply with regulations.

Resources and tools

Accessing the Nebraska Department of Revenue's official resources can streamline your understanding of resale or exempt forms. Their website offers templates, guides, and tools to help businesses effectively navigate the sales tax landscape. You’ll find pertinent information related to applying for permits, exemptions, and learning about the use of forms in Nebraska sales transactions.

Furthermore, using tools like pdfFiller can enhance your document management experience. It provides features for editing, filling, and signing PDFs, ensuring that your resale certificate application is always accessible and up-to-date. This empowers you to collaborate with team members seamlessly on documentation.

Getting help with your Nebraska resale certificate

If you have questions or need assistance, reaching out to the Nebraska Revenue Department is vital. They can provide detailed guidance regarding compliance, application processes, and any clarifications concerning regulations. Moreover, using services like pdfFiller can ease the process by enabling you to create and manage necessary documents seamlessly in the cloud.

Combining these resources ensures you stay compliant while eliminating stressful paperwork processes. Whether you need help with editing forms or managing submissions, leveraging both state resources and comprehensive tools is vital for effective operations.

Related topics and further reading

Understanding sales tax laws spans a variety of topics crucial for effective business operations. For instance, recent changes related to Marketplace Facilitator Sales Tax Laws in Nebraska affect businesses engaging in e-commerce. Additionally, grasping the concept of economic nexus is critical, particularly for online businesses exporting goods into Nebraska. It’s essential to remain informed about state-specific rules to maximize compliance and minimize liabilities.

Moreover, delve into sales tax regulations concerning digital products, as different states, including Nebraska, are commencing to implement specific tax protocols surrounding these transactions. Leveraging knowledge from these resources and adjusting accordingly enhances operational success and should lead to long-term benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get nebraska resale or exempt?

How do I make edits in nebraska resale or exempt without leaving Chrome?

How do I edit nebraska resale or exempt on an Android device?

What is Nebraska resale or exempt?

Who is required to file Nebraska resale or exempt?

How to fill out Nebraska resale or exempt?

What is the purpose of Nebraska resale or exempt?

What information must be reported on Nebraska resale or exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.