Get the free Appendix A: Deemed Income for Cash Assistance

Get, Create, Make and Sign appendix a deemed income

Editing appendix a deemed income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out appendix a deemed income

How to fill out appendix a deemed income

Who needs appendix a deemed income?

Appendix A Deemed Income Form - How-to Guide Long-Read

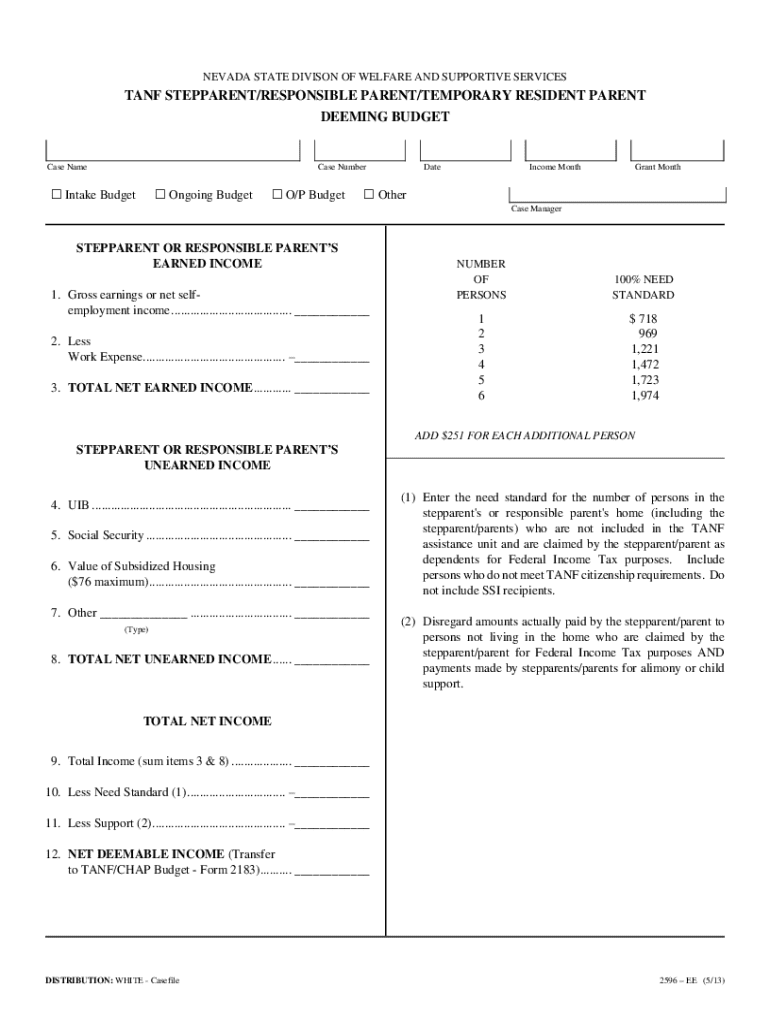

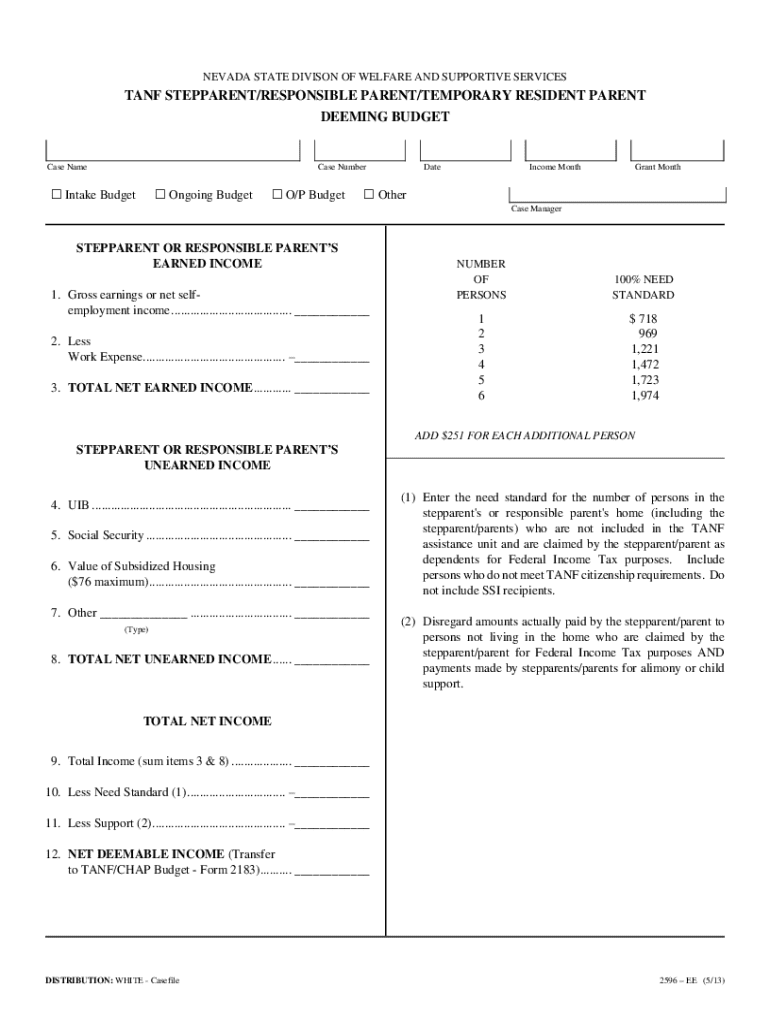

Understanding Appendix A deemed income form

The Appendix A Deemed Income Form is a significant document used in assessing income for various programs, especially those related to Social Security and Supplemental Security Income (SSI). This form is designed to capture income that is regarded as "deemed" from other individuals in the household, such as parents or spouses, impacting the eligibility and benefit amounts of an applicant.

Its primary purpose is to ensure a fair assessment of an individual's financial situation by considering income sources that may not be directly earned by the applicant. This inclusivity is essential as it reflects a more comprehensive picture of an applicant's means beyond their income alone. Understanding who needs this form is crucial; it typically applies to individuals whose financial assessment is influenced by others in their household.

Key terms and concepts

When dealing with the Appendix A Deemed Income Form, it’s vital to grasp the concept of deemed income. Deemed income refers to the income from individuals that is considered in assessing an applicant's financial status. This could include wages, Social Security benefits, and other sources of income, which can affect programs like SSI. Understanding how income is allocated—meaning how it is divided among family members—is essential, as it directly relates to eligibility for assistance.

Additionally, medical considerations related to SSI often intersect with deemed income, as qualifying medical conditions can affect the income assessment process, potentially leading to special exemptions or considerations in the application.

Eligibility criteria

Determining eligibility for deemed income considerations primarily rests on the applicant’s relationship with others in the household. Individuals applying for SSI typically qualify if their household income surpasses established thresholds. Special cases arise with spouses and dependent children, requiring nuanced understanding of how their income can influence an applicant’s benefits.

Further, individuals receiving Long-Term Services and Supports (LTSS) must understand additional eligibility requirements. Here, both the applicant’s and their family members’ income may have implications on support received, making it crucial to choose the right approach when completing the form.

Detailed instructions for completing the form

Completing the Appendix A Deemed Income Form can seem daunting, but a clear step-by-step guide can simplify the process.

Common mistakes while filling out the form include underreporting assets, incorrect calculations, and failing to provide adequate supporting documentation. These oversights can lead to delays or denials in assistance programs.

Special considerations

Special considerations in the deemed income process can impact outcomes significantly. Income deeming rules for nonapplying spouses can result in additional considerations when assessing household income. For example, if one spouse does not apply for SSI, the income they earn will still be counted towards the applying spouse’s eligibility and benefits.

Allocating income appropriately for dependent children is another critical aspect, ensuring that their contributions do not unfairly affect the primary applicant. Furthermore, exemptions from sponsor deeming can benefit individuals, especially in cases where immigration sponsors are involved, and understanding how to budget a sponsor's income can be essential in accurately reporting income.

Managing your deemed income submission

Once the Appendix A Deemed Income Form is completed, submitting it correctly is crucial. The most common methods of submission include online portals or directly to a local Social Security office, depending on the specific requirements of your case.

After submission, the review process may take time, typically ranging from a few weeks to a couple of months, during which the relevant authorities will evaluate the accuracy of the reported information. It's wise to keep track of the submission and be aware of the expected timeframes for responses and possible revisions.

Worker responsibilities

Individuals submitting the Appendix A Deemed Income Form have several responsibilities. Ensuring all information is accurate and complete is paramount, as any discrepancies can delay the process or result in denial. Keeping open communication with case workers is equally critical. They can provide guidance and assistance throughout the submission process.

Case workers themselves play a vital role, reviewing submitted forms, verifying information, and offering follow-up inquiries if needed. Establishing a reliable means of communication with your case worker can facilitate a smoother process, helping to clarify any uncertainties your application may encounter.

Frequently asked questions (FAQs)

Navigating the complexities of the Appendix A Deemed Income Form can often lead to confusion. Addressing common concerns upfront can alleviate some stress. For example, many applicants worry about how income allocation might affect their overall benefits. Clarification on misconceptions regarding income reporting is vital; remember that accurate disclosure is better than estimation.

Another common worry involves how changes in income should be reported. Timely updates about any significant shifts in income or family status are essential for compliance with SSI requirements, allowing for continuous eligibility.

Tools and resources

Using tools to assist with the deemed income calculation can ease the form-filling process. Several interactive tools are available online that can help calculates your deemed income based on the information provided.

These resources are invaluable, ensuring you understand each aspect of the process and don’t overlook critical information.

Additional considerations for success

Managing your financial information accurately is crucial when applying for benefits impacted by deemed income. Keeping meticulous records of your income, expenses, and any changes in financial circumstances will not only help you fill out the form correctly but also facilitate future interactions with Social Security.

Moreover, understanding strategies for managing fluctuations in income can be beneficial. For instance, if you anticipate a drop in income, communicating this promptly to your case worker can prevent any misunderstandings during the review process. After submission, continuing to monitor your financial situation remains essential to adapt to any needed changes.

Quick links

Having these quick links handy can streamline your access to necessary documents and support, enabling a more straightforward approach to your application.

Contact us

If you require personalized assistance regarding the Appendix A Deemed Income Form, do not hesitate to reach out. Engaging with experts can prove beneficial, particularly in addressing complex financial situations or in instances where you feel uncertain about your application status.

Understanding when to seek expert advice is crucial. If your financial situation becomes complicated, or if you encounter repeated issues with your application, professional advice can facilitate a smoother experience and ensure that your deemed income assessment reflects your accurate situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find appendix a deemed income?

Can I create an electronic signature for the appendix a deemed income in Chrome?

How do I fill out the appendix a deemed income form on my smartphone?

What is appendix a deemed income?

Who is required to file appendix a deemed income?

How to fill out appendix a deemed income?

What is the purpose of appendix a deemed income?

What information must be reported on appendix a deemed income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.