Get the free Nebraska and Local Sales and Use Tax Return

Get, Create, Make and Sign nebraska and local sales

Editing nebraska and local sales online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska and local sales

How to fill out nebraska and local sales

Who needs nebraska and local sales?

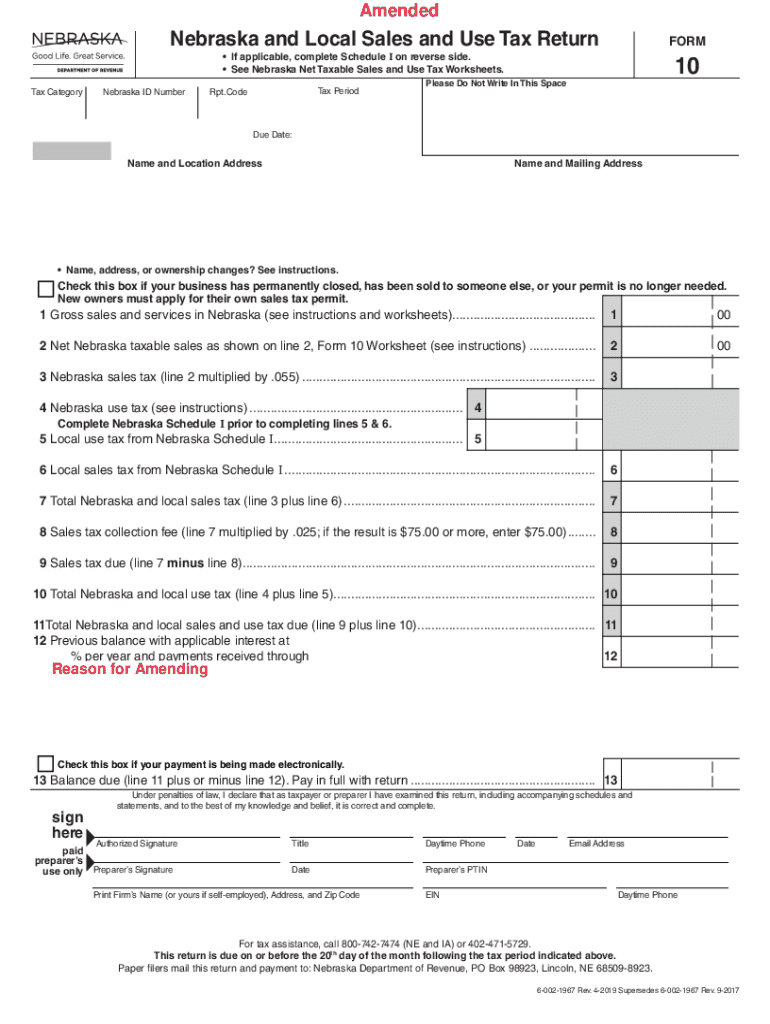

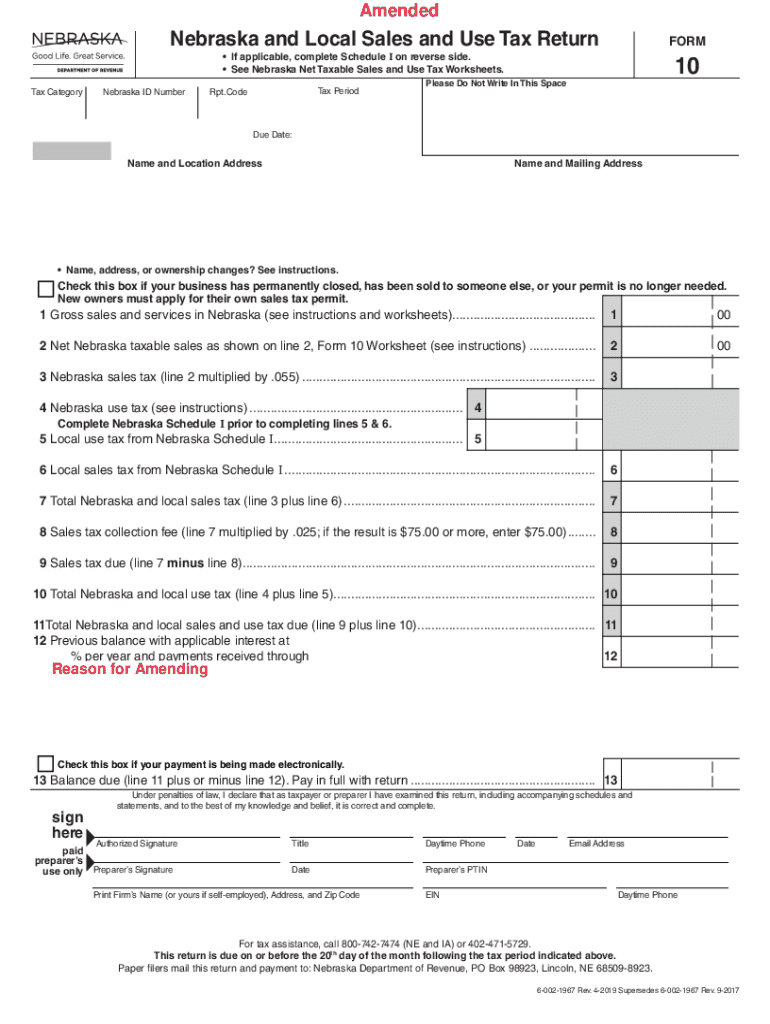

Nebraska and Local Sales Form: A Comprehensive How-to Guide

Understanding Nebraska local sales tax forms

In Nebraska, local sales tax is imposed by various municipalities and counties on top of the state sales tax. Every business operating in Nebraska must be aware of its tax obligations to avoid penalties. Accurate reporting of sales tax is essential as it contributes to local funding for roads, education, and public services. This guide will delve into the importance of local sales tax reporting and the necessary forms to ensure compliance.

Types of sales and use tax forms in Nebraska

Businesses in Nebraska must complete several forms when reporting sales and use taxes. Understanding the different types can help streamline this process. The Nebraska Department of Revenue provides specific forms that cater to various business needs, ensuring that both state and local tax requirements are met.

Step-by-step instructions for filling out Nebraska sales tax forms

Filling out the Nebraska sales tax forms might seem daunting, but with the right preparation, it can be an efficient process. Start by gathering essential business information to ensure accuracy. This includes your business name, address, and tax ID number, which are all critical for the completion of forms.

When completing the Nebraska Sales and Use Tax Return, the first part primarily focuses on reporting sales data. You will need to input the total sales made during the reporting period, breaking it down into taxable and non-taxable sales. Next, calculate the total tax due based on the applicable use tax rate cards for your locality.

Finally, review your payment options. Nebraska allows for multiple methods of payment, including online payment, check, or direct payment authorization. It's also critical to avoid common pitfalls such as misreporting sales figures or misunderstanding the local tax variations that may apply to your business.

Editing and managing your Nebraska sales forms

Efficient management of your Nebraska sales forms can significantly ease the reporting process. Utilizing a platform like pdfFiller can streamline your workflows, allowing you to upload existing forms quickly. Once your forms are uploaded, you can use interactive tools for easy completion, ensuring you fill in all required information accurately.

Storing your filled forms securely in the cloud not only protects your data but also provides easy access in the future. Utilizing version control features ensures you're always using the latest documents or templates, making the filing process even smoother.

Signing and submitting your tax forms

Once your sales forms are completed, it's time to sign and submit. Nebraska allows for electronic signatures, making this process more efficient. If you prefer a traditional approach, you can still print out your forms for physical signatures.

When it comes to submission methods, businesses can opt for online filing through the Nebraska Department of Revenue's website or mail in their completed forms. When submitting online, ensure you receive confirmation of submission for your records, while mailing forms might require a certified method to track delivery.

Collaboration tools for teams

For businesses with multiple team members involved in the sales tax process, utilizing collaboration tools can enhance productivity. pdfFiller allows for easy sharing of forms among colleagues, enabling real-time collaboration. This feature is especially beneficial for ensuring consistency and accuracy in forms.

You can assign specific roles and permissions for document access, which helps in maintaining control over sensitive information. This way, each team member can contribute without the risk of accidental changes or deletions, ensuring a smooth and efficient forms management experience.

Resources for understanding local sales tax regulations

Staying updated on sales tax regulations in Nebraska is essential for compliance. The Nebraska Department of Revenue's website is an invaluable resource, providing access to necessary forms, guidelines, and legislative updates. Additionally, local jurisdiction tax offices are available for personalized assistance, helping businesses navigate specific local tax questions.

Maintaining compliance with Nebraska sales tax laws

To ensure ongoing compliance with Nebraska sales tax laws, understanding filing deadlines is paramount. Businesses need to be aware of how often they need to submit forms, whether monthly, quarterly, or annually, based on their sales volume. Keeping diligent records of all transactions, both taxable and non-taxable, is just as crucial for regulation.

Also, businesses should be prepared in case of audits or assessments by keeping meticulous records and understanding their rights and obligations. Familiarizing yourself with the process can mitigate stress should the need arise, allowing for a smooth response to any inquiries from tax authorities.

Troubleshooting common issues

Despite your best efforts, issues can arise when dealing with Nebraska sales tax forms. Common problems include incorrect tax calculations and, at times, delayed submissions. To avoid penalties, always double-check the accuracy of your calculations and make sure you submit forms before deadlines.

In the event of submitting an incorrect form, Nebraska allows for amendments. Understanding how to amend your sales tax return can save you from potential penalties and interest, ensuring your records remain accurate.

Exploring interactive tools on pdfFiller

pdfFiller offers an array of tools designed to enhance document creation and management. For those filing Nebraska sales tax forms, templates are available to expedite the completion process. Instead of starting from scratch, you can leverage these templates to fill in your information quickly.

Using real-time editing features allows multiple users to access and modify documents simultaneously, fostering collaboration and ensuring that everyone is on the same page. This feature is especially useful during peak filing seasons when time is of the essence.

Frequently asked questions about Nebraska sales forms

Navigating Nebraska sales forms can raise several questions among business owners. One common concern is what happens if you miss a filing deadline. Nebraska allows for late submissions, but you may incur penalties, so it's best to file as promptly as possible.

Another frequent question pertains to the amending of sales tax returns. Yes, businesses can amend previously submitted forms; however, they must follow the designated protocols to ensure proper handling of the amendment process. Additionally, handling exempt sales requires careful documentation to ensure compliance with state regulations.

Conclusion: Mastering your Nebraska and local sales form experience

Successfully managing Nebraska and local sales forms requires diligence, accurate reporting, and a solid understanding of forms and deadlines. Using tools like pdfFiller not only simplifies the process but enhances overall compliance and collaboration among team members.

As you navigate your sales tax obligations, keep these tips in mind and leverage the resources available through pdfFiller to streamline your document management. This proactive approach will empower you to meet your Nebraska sales tax responsibilities effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nebraska and local sales from Google Drive?

How do I execute nebraska and local sales online?

How do I edit nebraska and local sales on an Android device?

What is nebraska and local sales?

Who is required to file nebraska and local sales?

How to fill out nebraska and local sales?

What is the purpose of nebraska and local sales?

What information must be reported on nebraska and local sales?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.