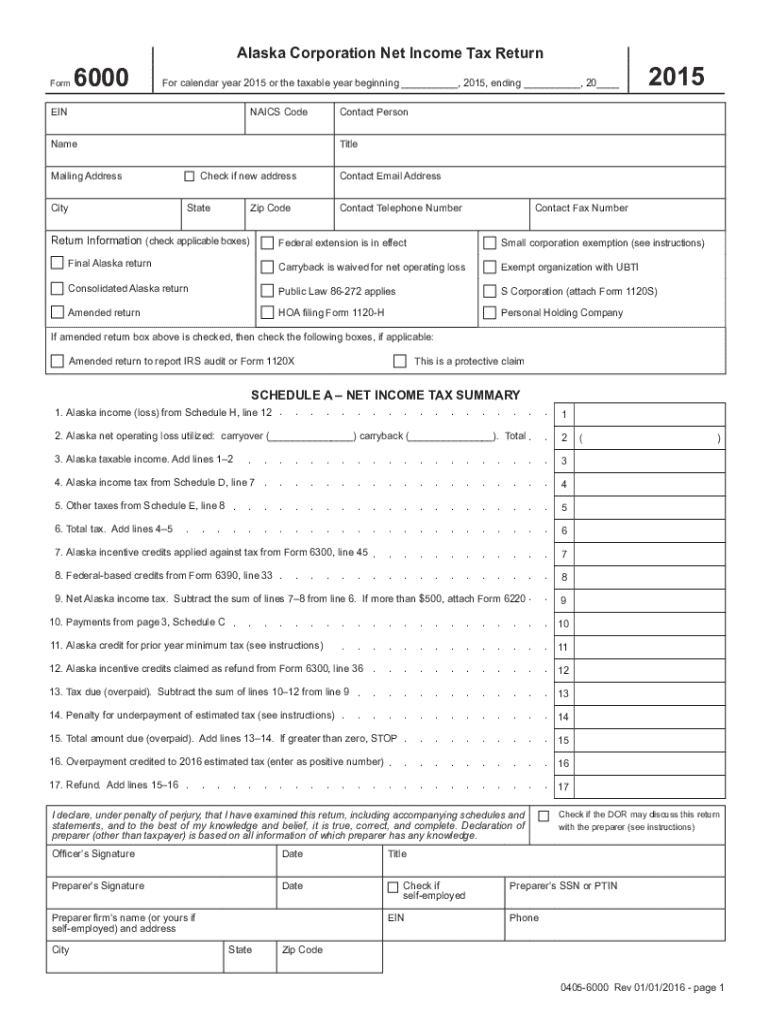

Get the free Alaska Corporation Net Income Tax Return

Get, Create, Make and Sign alaska corporation net income

How to edit alaska corporation net income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out alaska corporation net income

How to fill out alaska corporation net income

Who needs alaska corporation net income?

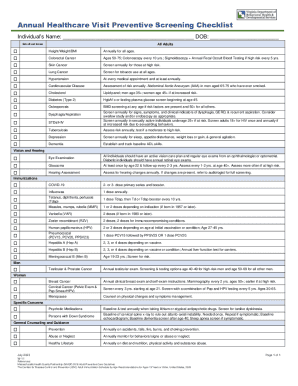

A Comprehensive Guide to the Alaska Corporation Net Income Form

Understanding the Alaska Corporation Net Income Form

The Alaska Corporation Net Income Form is a crucial document for businesses operating in Alaska, providing a structured method to report financial performance to the state. Filers use this form to disclose their net income, which directly influences tax liabilities. The form is essential for ensuring that corporate taxes are calculated correctly, enabling businesses to comply with state regulations while optimizing their tax obligations.

Companies required to file the Alaska Corporation Net Income Form include all corporations that generate income within the state of Alaska, whether they are incorporated in the state or operate there via registration as foreign corporations. This includes S corporations, C corporations, and limited liability companies (LLCs) that choose to be taxed as corporations. Understanding your filing obligations is the first critical step in navigating corporate taxes in Alaska.

Key terms explained

Understanding the key terms surrounding the Alaska Corporation Net Income Form is vital. Net income refers to the profit a company makes after all expenses and taxes are deducted from total revenue, while gross income is the total revenue before accounting for any expenses. In Alaska, corporations are subject to various tax rates, generally ranging as a flat rate of 1% to 9.4% depending on taxable income, making the meticulous reporting of net income crucial.

Step-by-step guide to completing the Alaska Corporation Net Income Form

Completing the Alaska Corporation Net Income Form can seem daunting, but with careful preparation, it can be straightforward. The first step is to gather all necessary financial information and supporting documentation that will assist in accurately reporting your corporation’s income.

Gather necessary information

Your corporation’s financial statements, including profit and loss statements and balance sheets, will be pivotal in this process. Additionally, keep any supporting documents such as receipts for expenses, bank statements, and payroll records, as these will substantiate your reported income and expenses.

Filling out the form

When filling out the form, it’s important to proceed section by section to ensure thoroughness and accuracy. Start with the company identification section that requires your corporation's name and registration number. Next, report your various income streams accurately, including sales revenue and service income, and ensure that you include all allowable deductions to arrive at your net income.

Calculation of net income

Calculating net income means subtracting total expenses from total income. A common mistake here is misreporting expenses, which could result in inaccurate tax calculations. Always cross-verify your figures against supporting documentation.

Reviewing your form

Once you have completed the form, take the time to meticulously review it. Accuracy is paramount; any errors could lead to penalties or additional inquiries from the state tax authorities. Some common errors to check for include incorrect calculation of net income, unsubstantiated deductions or missing information in the identification section.

Filing the Alaska Corporation Net Income Form

After reviewing, the next phase is filing the Alaska Corporation Net Income Form. Companies have the choice between electronic filing and paper filing, each having unique benefits.

Filing options

Electronic filing is often preferable due to its speed, convenience, and confirmation of submission. Many entities file their forms electronically through the Alaska Department of Revenue’s online portal or by using platforms like pdfFiller, which provides easy-to-use tools for document management.

Submission deadlines

Corporations must submit their Alaska Corporation Net Income Form by the annual filing deadline, typically the 15th day of the 3rd month following the end of the corporation’s fiscal year. Missing this deadline can result in significant penalties, including late fees and interest on owed taxes, emphasizing the importance of planning ahead.

Post-filing considerations

Once the form is filed, maintaining awareness of the submission status is vital. This can be done through the Alaska Department of Revenue’s portal. In addition, corporations may receive inquiries from the IRS or state tax authorities, necessitating prompt and clear communication.

Responding to IRS inquiries

Common scenarios include requests for clarification regarding deductions claimed or confirmations of income reported. When responding, ensuring clear and concise documentation is essential for effective communication.

Resources for Alaska corporation taxes

Utilizing available state resources can vastly simplify the process. The Alaska Department of Revenue provides numerous links and tools that assist corporations in understanding tax obligations. This includes directives on allowable deductions, upcoming changes in tax law, and frequently asked questions that can clarify common concerns.

Utilizing pdfFiller for ongoing document management

With pdfFiller, corporations can streamline their interaction with the Alaska Corporation Net Income Form. The platform not only allows for effortless editing but also enables the signing, sharing, and storing of completed forms efficiently. Transitioning to a cloud-based solution decreases the risk of losing critical documentation and enhances collaboration among team members involved in the filing process.

FAQs about the Alaska Corporation Net Income Form

A collection of frequently asked questions often reveals the nuances of preparing the Alaska Corporation Net Income Form. Queries can range from clarifications about specific expenses that qualify as deductions to filing deadlines and potential penalties for inaccurate reporting. Companies can benefit greatly from understanding expert perspectives on these concerns.

Troubleshooting tips for common issues

For example, if you encounter challenges while navigating the online filing process or experience issues with document formatting, utilizing pdfFiller’s customer service and help resources can provide quick solutions.

Leveraging pdfFiller for document management

Using a cloud-based platform like pdfFiller provides companies with a range of benefits—from real-time document updating to the ability to eSign and share forms securely. These capabilities foster collaboration and improve the overall workflow of document management, making it an invaluable asset for any team preparing to file the Alaska Corporation Net Income Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute alaska corporation net income online?

Can I create an electronic signature for signing my alaska corporation net income in Gmail?

How do I edit alaska corporation net income on an iOS device?

What is Alaska corporation net income?

Who is required to file Alaska corporation net income?

How to fill out Alaska corporation net income?

What is the purpose of Alaska corporation net income?

What information must be reported on Alaska corporation net income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.