Get the free nebraska vehicle sales tax calculator

Get, Create, Make and Sign nebraska vehicle sales tax

How to edit nebraska vehicle sales tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska vehicle sales tax

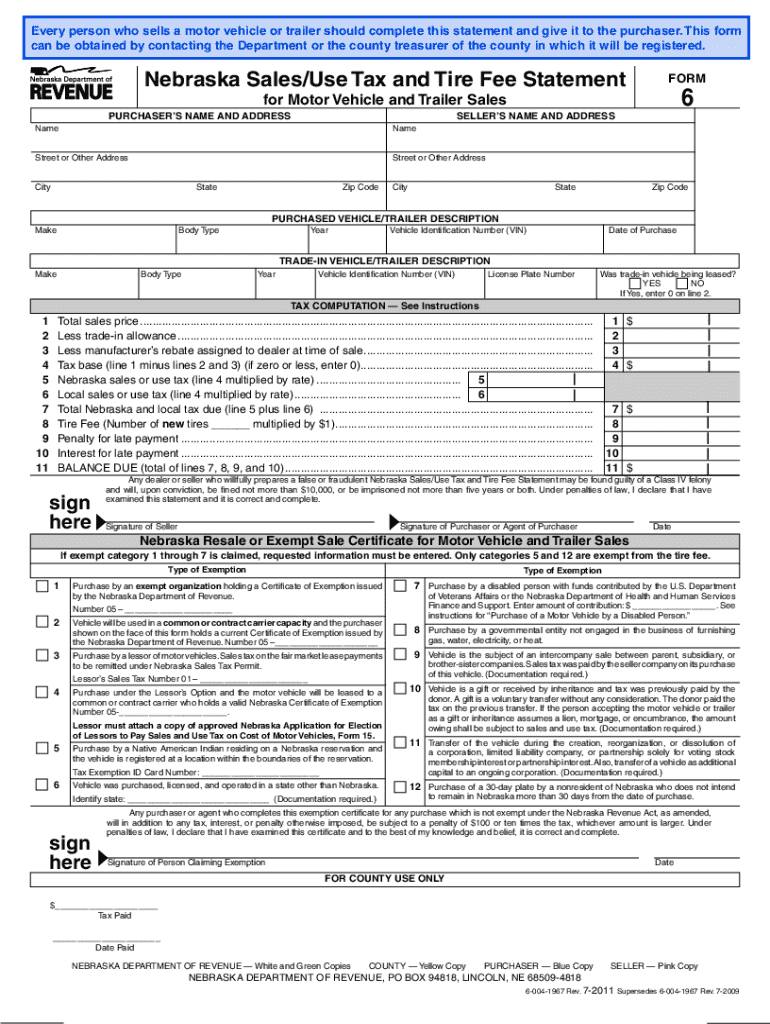

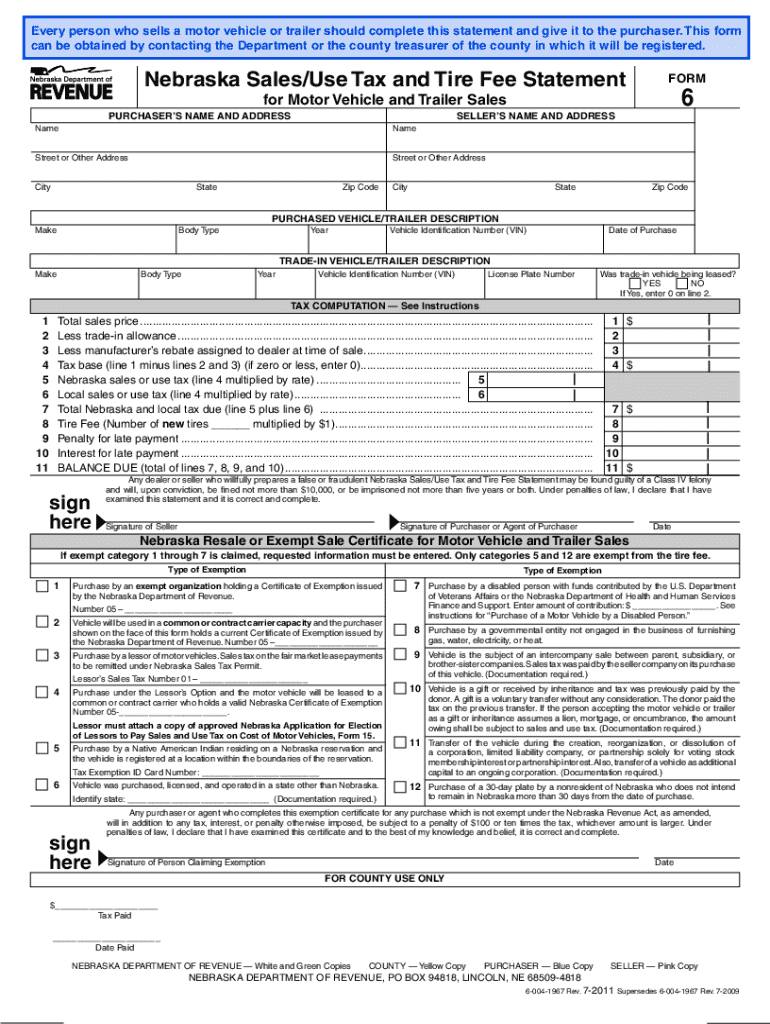

How to fill out nebraska salesuse tax and

Who needs nebraska salesuse tax and?

Navigating Nebraska Sales and Use Tax and Forms

Understanding Nebraska sales and use tax

Nebraska's sales and use tax framework consists of two key components that serve distinct purposes for the state and its residents. Sales tax is imposed on tangible personal property and certain services sold within Nebraska. Conversely, use tax applies to goods purchased outside of Nebraska but used within the state. Understanding the difference is crucial for residents and businesses alike to ensure compliance and to avoid unexpected liabilities.

The Nebraska Department of Revenue administers these taxes, which have evolved since their inception. As of 2023, the statewide sales tax rate is 5.5%. However, local jurisdictions may impose additional sales tax, resulting in varying total rates across the state. Staying informed about these rates is essential for accurate tax calculations.

Sales and use tax categories

Nebraska's sales tax applies to various goods and services. Tangible personal property, such as furniture and electronics, is generally taxable. However, services can also be subjected to tax if they relate closely to the sale of tangible property. Some common exemptions include grocery items, prescription medications, and certain agricultural products.

Use tax operates similarly to sales tax but fills gaps where sales tax has not been collected. For instance, if you purchase an item from an out-of-state online retailer and do not pay sales tax, the use tax applies. This ensures equitability, as residents should not have an unfair advantage by purchasing items outside of Nebraska. Examples of common transactions subject to use tax include electronics, furniture, and even items bought during trips abroad.

Sales and use tax forms

Completing the correct forms for Nebraska sales and use tax is critical for compliance. The primary form is Form 10, the Nebraska Sales and Use Tax Return, which businesses use to report tax collected and owed. This form encourages taxpayers to differentiate between taxable sales and exempt transactions effectively.

Interactive tools like the questionnaires available on pdfFiller can guide taxpayers in identifying which forms they need. This can enhance efficiency, helping individuals and businesses find the correct documentation quickly.

How to complete Nebraska sales and use tax forms

Completing Form 10 can be straightforward if you break it down into its component sections. Start by gathering your sales data, including gross sales, taxable sales, and any exemptions claimed. Be meticulous when entering figures because common errors include misreporting exemptions or underreporting sales, leading to potential audits and penalties.

Additionally, both Form 17 and Form 97 require accurate information. Form 17 needs details about the purchaser and the specific exemption category being claimed. For Form 97, include key identifiers about the business or organization requesting the exemption. To minimize scrutiny, ensure all documentation is consistent and corroborative.

Filing and payment procedures

Filing deadlines for Nebraska sales and use tax returns vary based on the frequency of your reporting. Most businesses will file either quarterly or semi-annually, while a few file annually. It is crucial to know these deadlines to avoid late penalties, which can add up quickly.

For payments, Nebraska offers convenient options such as online payments through the Nebraska Department of Revenue’s website. Alternatively, taxpayers may opt to mail their payments, but this may delay processing times. In-person payments can also be made at designated locations, depending on your need.

Managing and tracking your sales and use tax obligations

Utilizing pdfFiller can streamline your document management process significantly. With cloud storage, you can edit and save completed tax forms, which ensures that you always have your documents accessible. This is especially beneficial for businesses managing multiple transactions and various forms.

Implementing these practices can reduce the likelihood of errors and ensure that all tax-related obligations are met thoroughly and efficiently.

Compliance and audit preparation

Understanding how audits operate in Nebraska is essential for compliance. Common triggers for audits can include discrepancies in reported sales, high volumes of tax-exempt sales, or frequent late filings. Nebraska's Department of Revenue has defined procedures for conducting these audits, ensuring a systematic approach.

To prepare for a sales or use tax audit, maintaining thorough documentation throughout the year is imperative. This includes keeping sales invoices, exemption certificates, and payment records organized. If you receive an audit notice, a prompt response can mitigate complications. Seek assistance if needed and provide the requested documentation efficiently.

Resources for further assistance

For personalized assistance, the Nebraska Department of Revenue offers various support channels. Their official website includes comprehensive guides, FAQs, and contact information for continued support. Reaching out through these channels can provide clarity on specific tax obligations.

For businesses: special considerations

Businesses operating in Nebraska must be aware of unique sales and use tax obligations, especially concerning nexus regulations. Out-of-state sellers with a presence in Nebraska must collect and remit sales tax, which complicates compliance for many businesses. Various industries may also have specific sales tax considerations based on their operational nature.

Moreover, applying for business-specific tax exemptions can yield significant savings but requires careful navigation through regulatory processes.

Other locations and tax regulations

Nebraska has various city and county regulations that might impose additional sales taxes beyond the state level. Understanding these local tax variations is crucial for accurate compliance when conducting business in multiple jurisdictions.

In comparison to other states, Nebraska's sales and use tax regulations can differ significantly, particularly in audit practices and tax rates. Businesses operating across state lines should stay updated on these variations to ensure compliance and optimize tax planning strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nebraska vehicle sales tax in Gmail?

How do I make changes in nebraska vehicle sales tax?

Can I create an eSignature for the nebraska vehicle sales tax in Gmail?

What is Nebraska sales/use tax?

Who is required to file Nebraska sales/use tax?

How to fill out Nebraska sales/use tax?

What is the purpose of Nebraska sales/use tax?

What information must be reported on Nebraska sales/use tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.