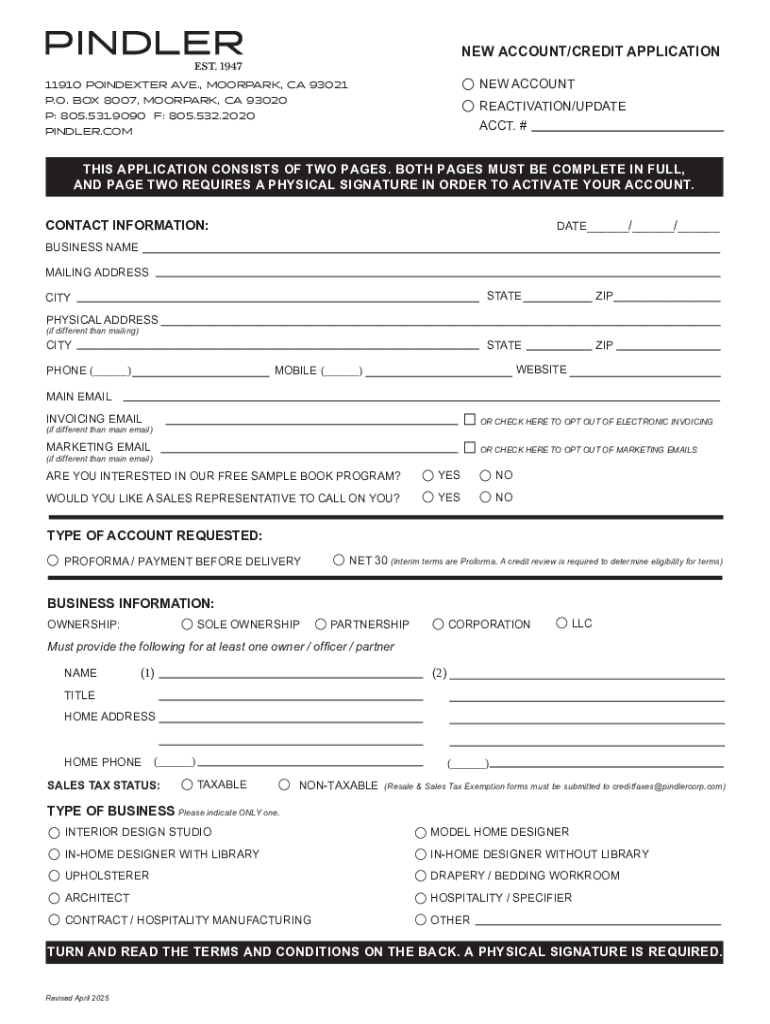

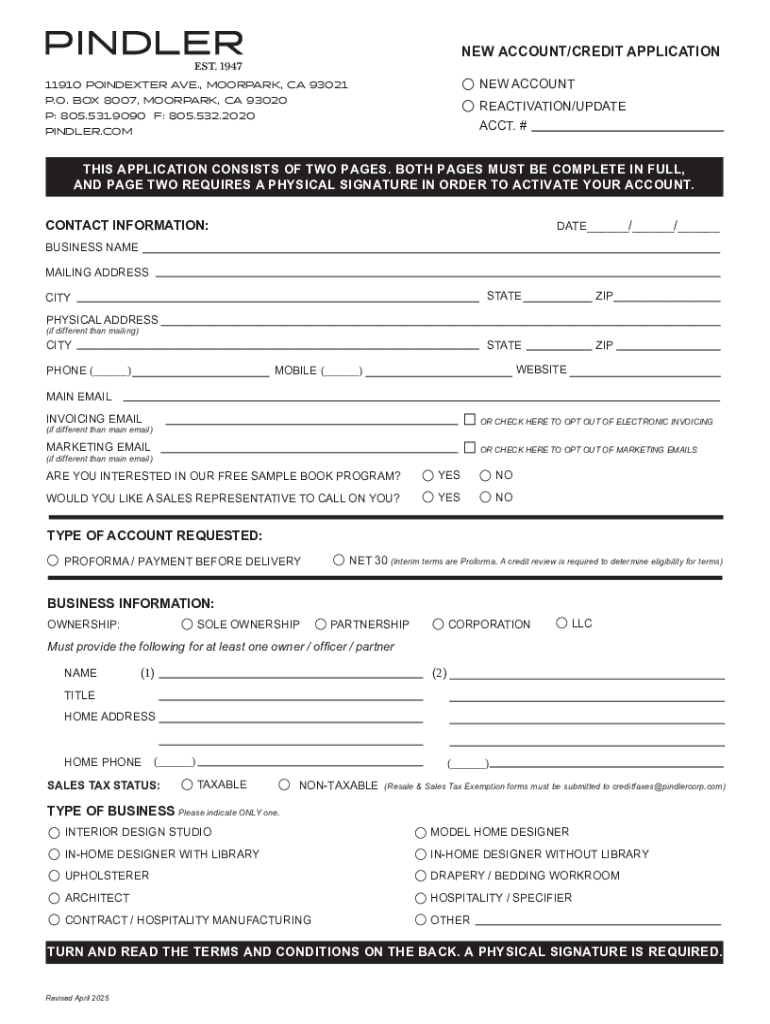

Get the free New Account/credit Application

Get, Create, Make and Sign new accountcredit application

Editing new accountcredit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new accountcredit application

How to fill out new accountcredit application

Who needs new accountcredit application?

Comprehensive Guide to the New Account Credit Application Form

Understanding the new account credit application form

A New Account Credit Application Form is a document used by individuals and businesses to apply for credit from a lender or financial institution. This form is essential as it collects vital personal and financial information necessary for the lender to assess creditworthiness. The credit application process is integral for making informed lending decisions, ensuring that both the lender and the borrower understand the risks involved.

Components of a new account credit application form

Every new account credit application form contains several crucial components. Understanding these components will help you prepare a comprehensive application.

Step-by-step guide to filling out the new account credit application form

Filling out a new account credit application form can be straightforward if you prepare adequately. Follow these steps to ensure your form is completed correctly.

How to submit your new account credit application form

Submitting your new account credit application form can be done through various methods. It's crucial to choose the method that best suits your needs.

Tips for improving your chances of approval

To enhance your chances of getting your new account credit application approved, understanding what lenders look for is key.

Utilizing pdfFiller for your new account credit application form

pdfFiller streamlines the process of completing a new account credit application form through its array of interactive features that facilitate document creation and management.

Frequently asked questions about new account credit application forms

Prospective applicants often have common queries about the credit application process.

Additional considerations when completing a new account credit application form

When completing your new account credit application form, there are various legal and compliance aspects to consider.

Interactive tools and resources

Leveraging pdfFiller’s interactive tools can significantly ease the credit application process.

The future of credit applications

The landscape of credit applications is shifting towards digital solutions, enhancing user experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my new accountcredit application in Gmail?

How can I edit new accountcredit application on a smartphone?

How do I fill out new accountcredit application on an Android device?

What is new accountcredit application?

Who is required to file new accountcredit application?

How to fill out new accountcredit application?

What is the purpose of new accountcredit application?

What information must be reported on new accountcredit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.