Get the free form 10 nebraska

Get, Create, Make and Sign form 10 nebraska

Editing form 10 nebraska online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10 nebraska

How to fill out nebraska and local sales

Who needs nebraska and local sales?

Nebraska and Local Sales Form: How-to Guide

Understanding Nebraska sales tax

Sales tax in Nebraska is levied on the sale of tangible personal property and certain services. This tax is crucial for funding state and local programs, making it essential for both businesses and consumers to comprehend its implications. Sales tax not only helps in generating revenue but also plays a role in ensuring tax compliance among vendors. Failure to understand local sales tax regulations can lead to financial penalties and missed opportunities for tax exemptions.

Local sales tax variations depend on specific counties and cities, which can impose additional sales taxes on top of the state rate. For example, Douglas County has a higher sales tax rate compared to more rural areas. Understanding these nuances allows businesses to accurately calculate and collect taxes, thereby maintaining compliance and financial integrity.

Importance of sales forms

Sales forms serve a vital role in documenting transactions made in Nebraska. These forms ensure accurate records are maintained for tax liabilities and potential audits. They also act as proof of sales, which can be critical should discrepancies arise regarding tax obligations. For businesses, having a streamlined documentation process can facilitate smoother interactions with tax authorities.

In Nebraska, several types of sales forms are utilized, including the Nebraska Sales and Use Tax Form, which is essential for both state and local tax reporting. Sales forms differ in their requirements; for instance, a local sales form may require additional information depending on the local tax regulations and exemptions applicable in a particular area.

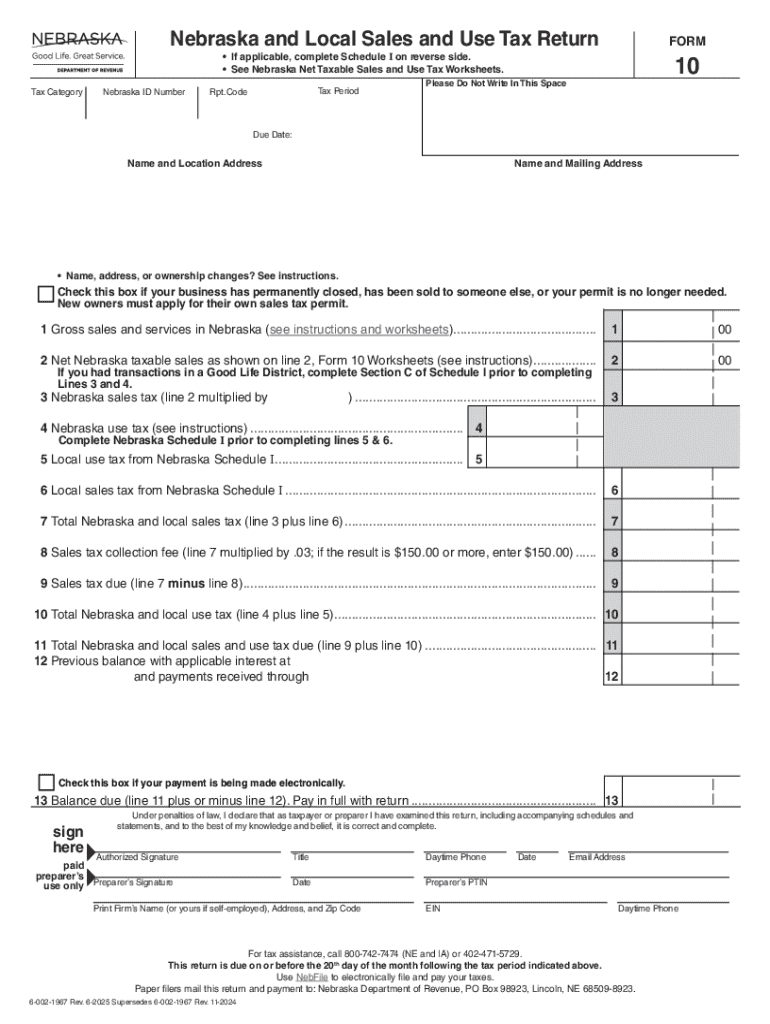

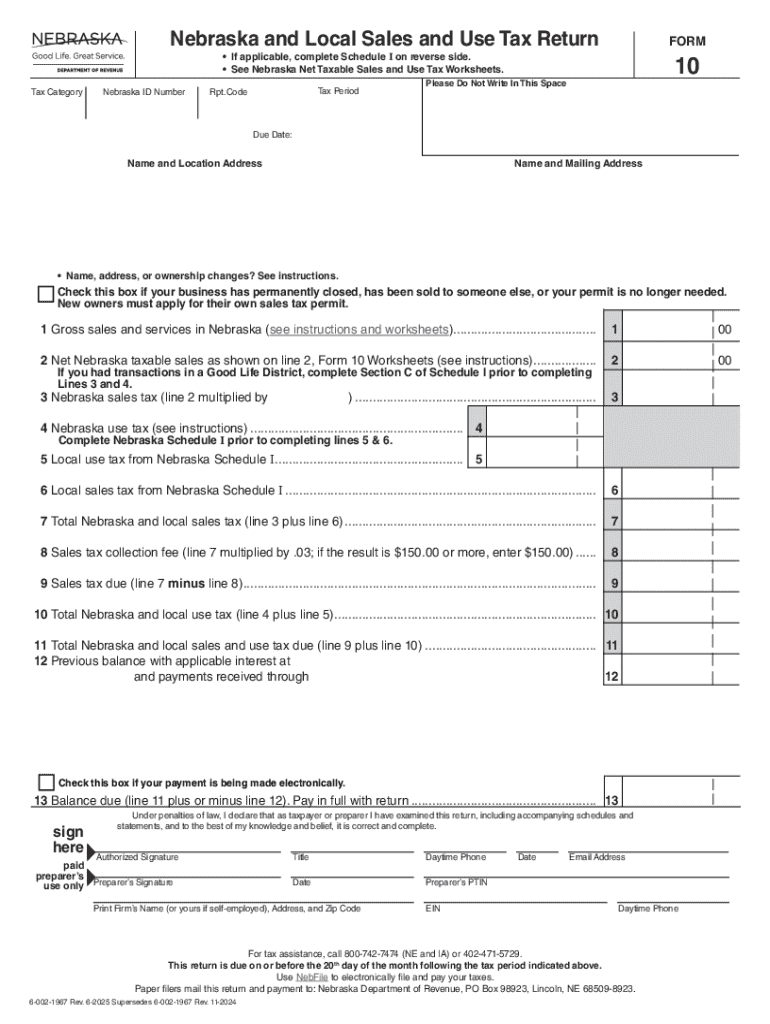

Navigating the Nebraska sales and use tax form

To find the Nebraska Sales and Use Tax Form, visit the Nebraska Department of Revenue's official website. Here, users can access the form in PDF format. Additionally, platforms like pdfFiller provide features such as filling, editing, and signing the form online, allowing users to streamline the process significantly.

Understanding the sections of the form is essential for accurate completion. The form includes several critical categories: Identification Information, Sales Details, Tax Calculation, and Deductions and Exemptions. Each of these sections plays a key role in ensuring that all necessary information is reported to comply with Nebraska's sales tax laws.

Filling out the Nebraska sales form

Filling out the Nebraska Sales and Use Tax Form requires careful attention to detail. Begin gathering necessary documentation, such as invoices and receipts, to facilitate accurate reporting. Each piece of documentation provides essential data that ensures tax calculations are correct.

When using pdfFiller, users can fill out the form digitally, benefiting from features that simplify edits, signatures, and document management. It's crucial to review each section methodically to avoid common pitfalls. Common mistakes include omitting required fields or miscalculating sales tax, which can lead to filing penalties and compliance issues.

Submitting the sales form

Once completed, the Nebraska Sales and Use Tax Form can be submitted online or via physical mail, depending on the preference of the taxpayer. Understanding submission requirements is vital to ensure that forms reach the appropriate tax authority without delay. Additionally, businesses must be aware of the submission deadlines to avoid penalties, which can add up quickly if missed.

After submission, users utilizing pdfFiller can track their submissions, ensuring that they are accepted and processed. This feature not only provides peace of mind but also allows businesses to maintain accurate records of all submitted forms, which can be beneficial during audits.

Managing sales forms and records

Proper management of sales forms and transaction records is essential for any Nebraska business. By maintaining organized records, companies can prepare for tax season more efficiently and mitigate issues related to tax compliance. Using tools like pdfFiller helps streamline document management, enabling easy access to forms and transaction history.

Additionally, staying updated with Nebraska sales tax law changes is crucial for ongoing compliance. Businesses can utilize interactive tools on pdfFiller to access updated tax information and legislative changes, ensuring they’re always informed about applicable rules and rates, including aspects such as the use tax rate cards and eligibility for tax exemptions.

Additional help and resources

For further assistance regarding Nebraska sales tax and forms, tax authorities provide valuable resources, including direct contact information for inquiries. Nebraska's Department of Revenue offers support for questions related to tax obligations, forms, and submission processes.

Moreover, pdfFiller’s customer support is also available to address any form-related queries, ensuring users have access to help when needed. For ongoing education, several online resources outline the intricacies of Nebraska sales tax, from comprehensive guides to FAQs provided by pdfFiller itself, making it easier for users to navigate the complexities of tax forms.

Interactive tools on pdfFiller

pdfFiller boasts numerous interactive tools that enhance user experience when dealing with sales forms. Its cloud-based platform allows users to create, edit, and manage documents without the need for physical storage, thus improving efficiency. With pdfFiller, not only can users fill out the Nebraska Sales and Use Tax Form seamlessly, but they can also collaborate on forms in real time with team members.

The advantages of a cloud-based solution are numerous, including easy access from anywhere, the ability to share documents securely, and reduced risk of loss due to hardware failure. Users appreciate how pdfFiller’s tools integrate into their workflows, making managing tax forms an easier and more organized task, especially during busy tax periods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 10 nebraska?

How do I execute form 10 nebraska online?

How do I edit form 10 nebraska online?

What is nebraska and local sales?

Who is required to file nebraska and local sales?

How to fill out nebraska and local sales?

What is the purpose of nebraska and local sales?

What information must be reported on nebraska and local sales?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.