Get the free download the dtaa annexure form from the tax countries involved in the double taxation avoidance agreement msockid 06c95fce911d66b033484eed901c671d

Get, Create, Make and Sign download the dtaa annexure

How to edit download the dtaa annexure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out download the dtaa annexure

How to fill out dtaa annexure

Who needs dtaa annexure?

DTAA Annexure Form: Your Comprehensive How-to Guide

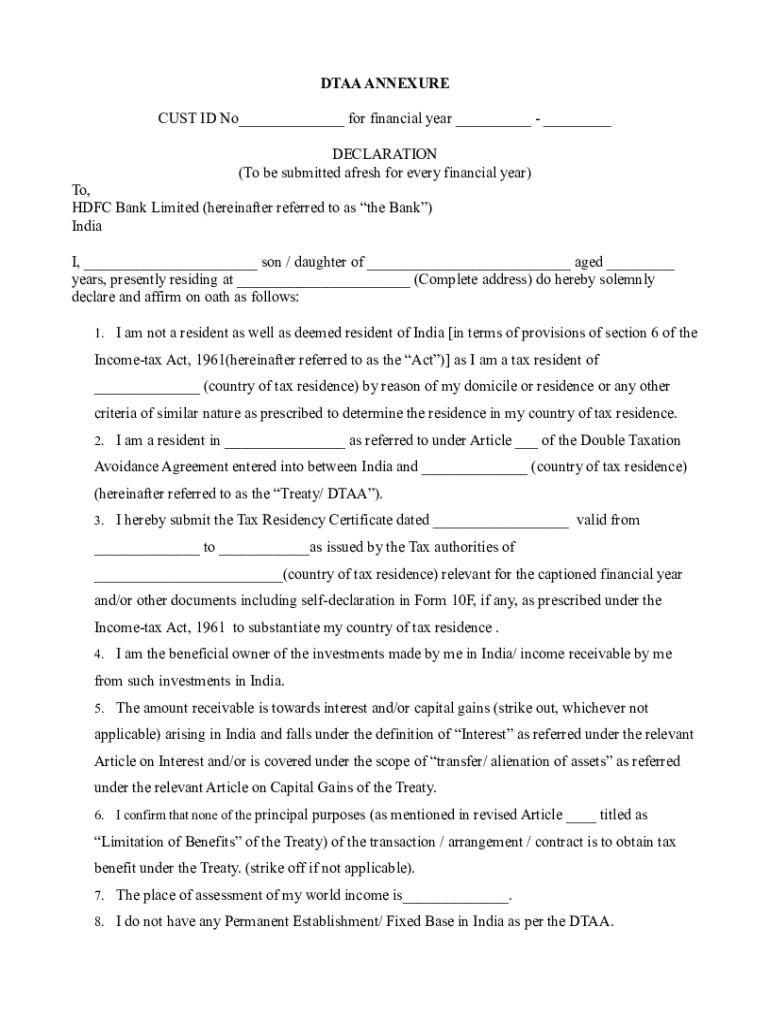

Understanding the DTAA Annexure Form

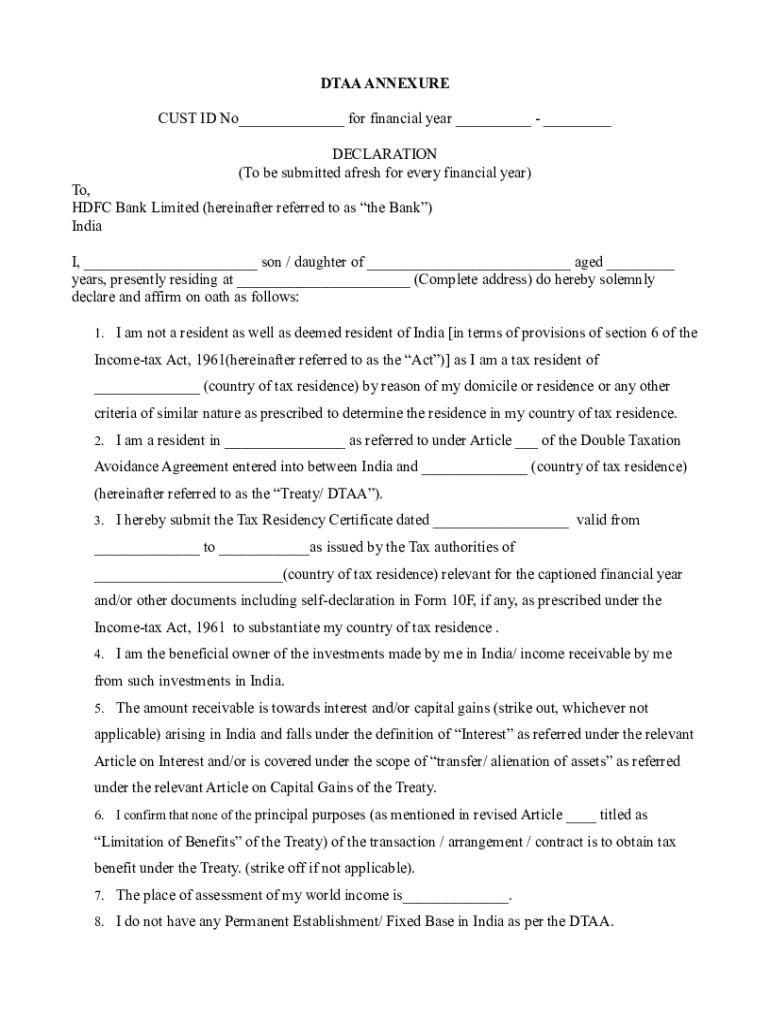

The DTAA Annexure Form, crucial for individuals and corporations engaging in cross-border transactions, is designed to facilitate the application of the Double Taxation Avoidance Agreement (DTAA). This agreement aims to prevent double taxation on the same income in two different jurisdictions, which is especially significant for taxpayers generating income from abroad. The annexure form plays an essential role in tax compliance, providing necessary information about the taxpayer's residency status and income sources, enabling the concerned tax authorities to ensure correct tax treatment.

One key feature of the DTAA Annexure Form is its stringent requirements for detailed information on income sources. Taxpayers are required to complete specific mandatory fields, which may vary depending on the relevant treaty. For instance, distinguishing between various types of income—such as salary, dividends, or royalties—is crucial for determining applicable tax rates. Failure to fill out these sections accurately could lead to delays or disputes.

Pre-fill checklist for the DTAA Annexure Form

Before you start filling out the DTAA Annexure Form, it’s crucial to gather all required documents and information for seamless processing. This includes identification documents such as your passport or national ID, proof of residency like utility bills, and specific income details along with your tax residency context. Ensuring you have these documents organized can significantly expedite the completion process.

However, common mistakes can arise during this preparatory phase. Mislabeling documents, providing outdated residency proof, or submitting inconsistent information can lead to complications such as enquiries from the income tax department or delays in receiving tax credits. Avoiding these pitfalls requires careful attention to detail and a systematic review of your documentation.

How to fill out the DTAA Annexure Form

Completing the DTAA Annexure Form can feel overwhelming, but following a step-by-step approach simplifies the process. Start with your personal information; ensure that you clearly enter your name and contact details as registered with the income tax department. It’s important that this information matches your identification documents to avoid confusion or processing delays.

Next, provide specific residency information. Declare your residence status accurately to establish your tax obligations. This is especially vital for expatriates or those who frequently travel, as tax residency can significantly influence potential treaty benefits. Following this, detail your income sources systematically; categorize each type of income accurately and ensure all amounts are precisely stated.

Finally, indicate tax treaty benefits applicable under the corresponding articles of the agreement. Utilize precise language and refer directly to the article numbers when applicable. This not only justifies your claims but also expedites the review process by tax authorities.

Editing and reviewing your DTAA Annexure Form

Reviewing your DTAA Annexure Form before submission can prevent costly mistakes. Ensure that every section is accurately filled and completeness is checked, as missing or incorrect information could lead to rejection or queries from the income tax department. Accuracy is paramount; a few minutes of careful review can save weeks of potential correspondence.

Utilizing tools like pdfFiller can assist in editing and finalizing the document. This platform offers a user-friendly interface that allows you to collaborate seamlessly with teammates. You can also utilize features for tracking changes, thereby enhancing the accuracy of your submission.

Signing and submitting the DTAA Annexure Form

Once your DTAA Annexure Form is completed, the signing process is the next critical step. Today, electronic signatures are legally accepted in many jurisdictions, streamlining the submission process. However, it is essential to understand the legal implications of e-signatures, as they must comply with the governing laws of the correspondence jurisdiction.

Using pdfFiller for e-signing makes this process simple. Just follow their user-friendly interface to add your electronic signature securely. After signing, you need to submit the form according to the guidelines provided by the tax authority, which may allow both digital submissions or require physical mailing. Make sure to confirm the preferred submission method.

Managing your DTAA Annexure Form post-submission

After submitting your DTAA Annexure Form, it is crucial to manage the document effectively. Tracking the status of your submission through the tax authority’s reporting system can help you remain informed about any updates or requests for additional information. Keeping organized records is vital; ensure you have a log of your submissions and any correspondence related to your claims.

Additionally, consider future reviews and potential renewals of your residency status or changes in income. Annual evaluations of your tax situation can help preempt issues with compliance or dispute over treaty benefits. Keeping these records organized and accessible will ensure a smoother experience each tax filing season.

FAQs about the DTAA Annexure Form

Understanding the nuances of the DTAA Annexure Form can lead to questions, especially regarding specific circumstances. Common inquiries focus on what to do if the form is rejected—a situation that usually calls for immediate review of the provided materials to correct errors or gather additional information as requested. Engaging with tax authorities rapidly can significantly reduce frustration.

Moreover, it is essential to stay informed about updates or changes in tax treaty provisions. Ensuring compliance with new laws can enhance both individual and corporate facilitation of treaty benefits, minimizing instances of tax evasion or disputes arising from misinterpretation of regulations.

Leveraging pdfFiller for DTAA Annexure management

pdfFiller offers robust features for managing the DTAA Annexure Form, making the process of document handling simpler and more efficient. Utilizing a cloud-based platform allows users to access their documents from anywhere, enabling real-time collaboration. Users can easily edit, sign, and share documents, streamlining their compliance efforts considerably.

Moreover, numerous case studies highlight how users succeeded in managing their DTAA forms using pdfFiller. For instance, businesses reported improved accuracy and reduced processing times after implementing pdfFiller solutions, leading to fewer complications and smoother interactions with tax authorities.

Expert tips for smooth tax filing with DTAA

While the creation and submission of the DTAA Annexure Form can appear straightforward, many individuals can benefit from professional advice, especially when navigating complex tax situations involving multiple jurisdictions. Consulting with a tax professional can provide insights into optimizing your claims and ensuring compliance with international tax regulations, which can vary wildly.

Moreover, staying updated with tax regulation changes is essential for taxpayers. Regularly check reputable sources such as government websites or dedicated tax information platforms to ensure that you understand any new developments, which can impact how you fill out and submit forms like the DTAA Annexure. Knowledge is crucial when it comes to avoiding unintentional tax evasion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my download the dtaa annexure directly from Gmail?

How can I edit download the dtaa annexure on a smartphone?

How do I fill out download the dtaa annexure using my mobile device?

What is dtaa annexure?

Who is required to file dtaa annexure?

How to fill out dtaa annexure?

What is the purpose of dtaa annexure?

What information must be reported on dtaa annexure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.