Get the free Benefit Deduction Authorization Form

Get, Create, Make and Sign benefit deduction authorization form

Editing benefit deduction authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out benefit deduction authorization form

How to fill out benefit deduction authorization form

Who needs benefit deduction authorization form?

Understanding the Benefit Deduction Authorization Form

What is a Benefit Deduction Authorization Form?

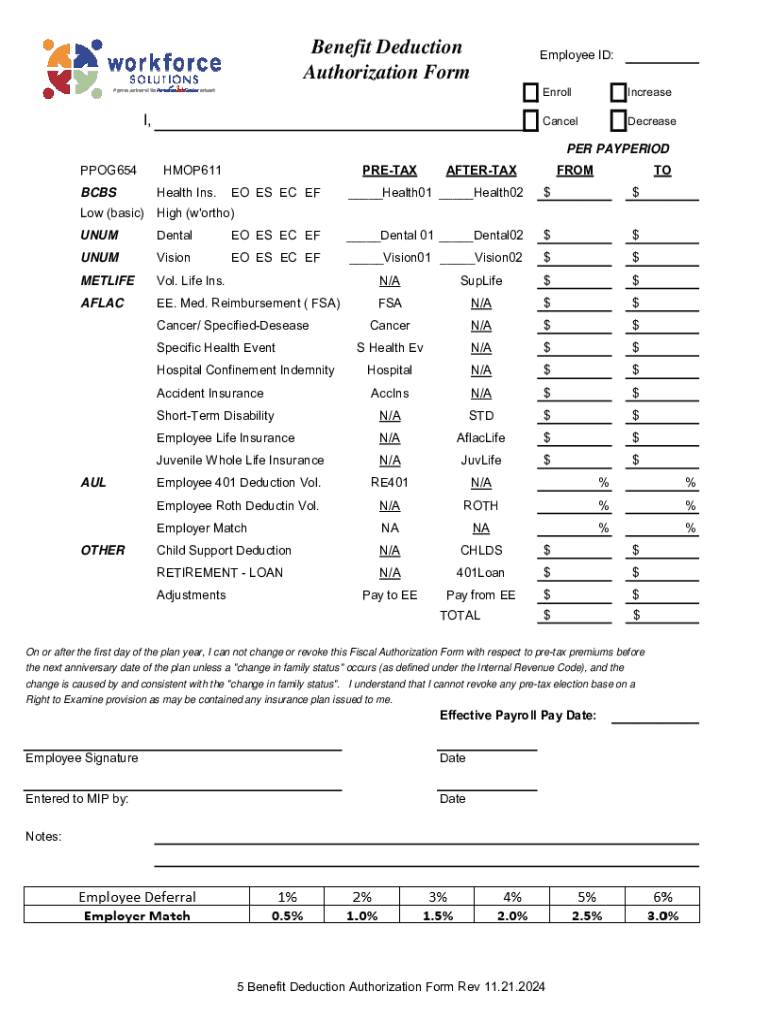

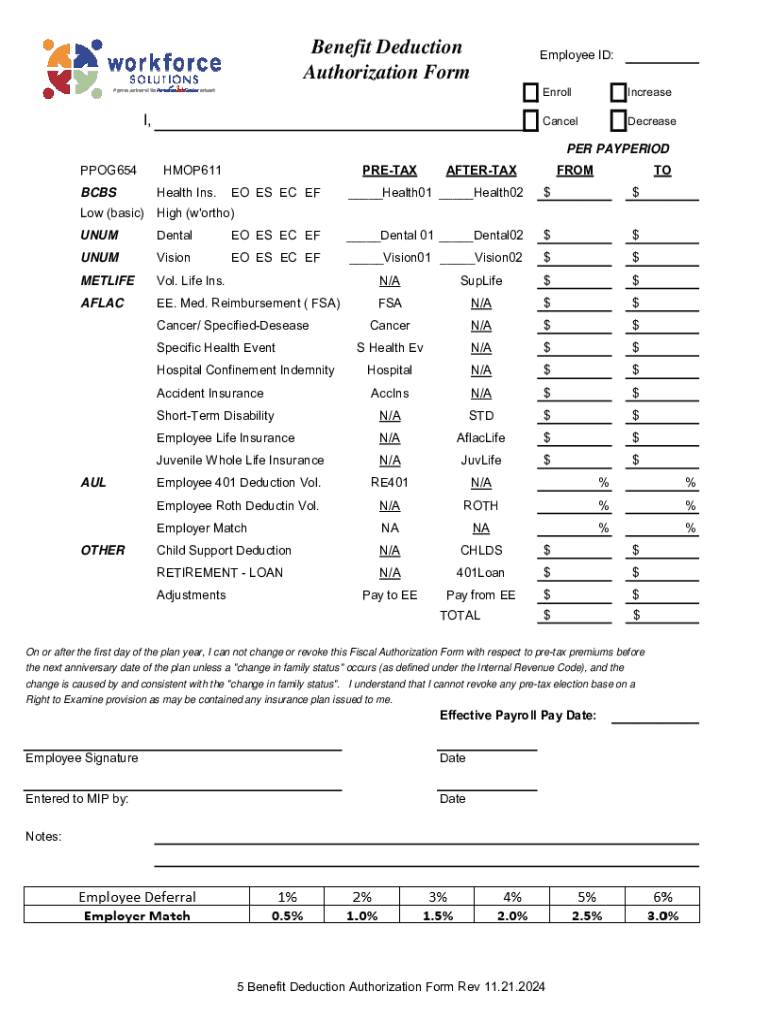

A benefit deduction authorization form is a critical document that allows employers to deduct specific amounts from an employee's paycheck for various benefits. This may include health insurance premiums, retirement account contributions, or other elective benefits. The primary purpose of this form is to ensure that employees have control over which deductions are made from their earnings and that such deductions adhere to the company's policies and legal standards.

Key terms associated with this form include 'deductions,' which refer to the amounts taken out of an employee's salary, and 'benefits,' which are perks offered by the employer, like health insurance or retirement plans. Understanding these terms helps employees navigate their options effectively.

Importance of the form in employment benefits

The benefit deduction authorization form plays an essential role in managing employee benefits. It provides a structured way for employees to opt into various benefits, ensuring both parties are clear about what is being deducted and for what purposes. This clarity is key to maintaining employee satisfaction and trust.

From a legal standpoint, these forms help companies stay compliant with labor laws by documenting employee consent for deductions. Proper use of the form can mitigate disputes related to paycheck discrepancies or misunderstandings about benefit contributions and obligations, ensuring that companies meet their regulatory responsibilities.

Who needs to use this form?

Typically, the benefit deduction authorization form is used by individuals who are employees at a company that offers benefits. This includes full-time, part-time, and sometimes temporary workers. It is also utilized by HR teams or payroll administrators managing employee deductions. Common scenarios for usage include when an employee first joins a company, changes their benefits during open enrollment periods, or when they want to adjust existing deductions.

For instance, when an employee decides to enroll in health insurance or contribute to a retirement plan, they must complete this form to authorize their employer to deduct the appropriate amounts from their paycheck.

Breakdown of the form sections

The benefit deduction authorization form typically consists of several key sections. First, the personal information section requires employees to provide their names, employee ID numbers, and contact information. This is essential for keeping accurate records. Following this, there's a benefit selection area where employees indicate which deductions they authorize, such as health insurance, life insurance, or retirement contributions.

Finally, the form includes authorization and signature fields. Here, employees must sign to agree to the deductions as stated. This section is crucial, as it confirms that employees understand and accept the terms of their benefit selections.

Tips for filling out each section

To ensure a smooth experience when completing the benefit deduction authorization form, there are several important tips to keep in mind. First, accurately filling out personal information is crucial; missing or incorrect data can lead to processing delays.

Being methodical in this process and paying attention to detail can help prevent common pitfalls and ensure your submissions are accurate.

Preparing to fill out the form

Before initiating your benefit deduction authorization form, gathering all necessary documents and information is vital. This may include your current pay stubs, existing benefits information, and a clear understanding of the benefits offered by your employer. Having this information on hand will simplify the process and help you make informed decisions about your benefits.

Understanding your options is equally important. Familiarize yourself with the different benefit packages available, as they may vary significantly from company to company. Speak with your HR department if you have any questions or need clarification.

Completing the form online

Completing the benefit deduction authorization form online can streamline the process and afford greater convenience. Using a platform like pdfFiller makes this easier. Start by accessing the form directly through pdfFiller, where you can fill it out in a simple, user-friendly interface.

Follow the step-by-step instructions provided on the platform. The interactive tools available will help ensure that you don’t miss important sections and that the information entered is clear and legible.

Reviewing and finalizing your form

After completing the form, it's crucial to review the details carefully. Verification of your information for accuracy can save you from potential delays in processing or payroll issues down the line. Look for any typos or incorrect entries, as even small mistakes can lead to discrepancies in funds being deducted from your salary.

If edits are necessary, revisit the relevant sections on the pdfFiller platform. The user-friendly interface allows for quick adjustments, ensuring that your final submission is accurate and complete.

Signing the form electronically

With pdfFiller, electronically signing your benefit deduction authorization form is straightforward and efficient. eSigning provides a secure method to verify your consent and speed up the submission process. This digital signature is legally binding, giving you the convenience of signing from anywhere without the need for physical delivery.

To eSign, simply follow the tool's intuitive prompts on the pdfFiller platform. This method reduces paperwork and increases document security, enhancing your overall experience.

Saving and storing your completed form

Once your benefit deduction authorization form is completed and signed, saving and storing the document safely is the next critical step. pdfFiller offers various options for cloud storage, allowing you to keep your completed forms securely accessible from any device.

When managing your documents, prioritize security. Use strong passwords and enable two-factor authentication where possible to protect your sensitive information from unauthorized access.

Sharing the form with relevant parties

Sharing the completed benefit deduction authorization form with relevant parties, such as HR or payroll administrators, is essential for effective documentation. pdfFiller provides collaboration tools that enable you to share documents seamlessly with team members and stakeholders involved in the benefits administration process.

You can manage access levels for each user, ensuring that sensitive information remains confidential while empowering appropriate personnel to fulfill their roles.

Frequently asked questions (FAQs)

It's common to have questions about the benefit deduction authorization form and its use. Common inquiries include how often the form needs to be filled out, what should be done if an error is discovered post-submission, or whether the deductions can be changed mid-year.

Maintaining compliance and accuracy

To harness the full benefits of the benefit deduction authorization form, it's crucial to maintain compliance and accuracy over time. Employees should regularly review their deductions to ensure that they align with current needs and market conditions. Key regulations to consider include understanding the implications of contribution limits for certain benefits, particularly retirement accounts.

It's also important to keep the form updated, especially when life changes occur that may affect benefit choices, such as marriage, divorce, or the birth of a child.

Leveraging pdfFiller features for enhanced document management

pdfFiller offers a variety of features that enhance document management for users utilizing the benefit deduction authorization form. Collaborative features allow teams to work together on forms, sharing insights and updates instantly. Automated reminders and notifications about renewal dates or needed changes can help ensure that nothing falls through the cracks.

Utilizing these features not only streamlines the documentation process but also improves compliance, keeping all team members informed and engaged with their employee benefits.

Case studies: Successful use of the form

Case studies reveal how effective use of the benefit deduction authorization form can yield positive results for both employees and employers. For example, a mid-sized technology firm improved employee satisfaction by implementing a structured benefits selection process. This led to a noticeable increase in employee participation in available benefits.

Another company saw a reduction in payroll discrepancies after adopting electronic systems for benefit deduction submissions. Employees reported feeling more empowered and informed regarding their benefits choices, leading to increased engagement overall.

Testimonials: Users share their experiences

Users of the benefit deduction authorization form have remarked on the ease and efficiency of submitting their forms electronically. Many appreciate the straightforward process provided by platforms like pdfFiller, highlighting how simple it is to track their benefits selections and make necessary updates when required.

One user noted, 'I felt completely in control of my deductions, and the platform made it easy to navigate all of my options.' This feedback reflects the growing trend toward digitization in HR processes and the demand for user-friendly document management solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send benefit deduction authorization form for eSignature?

How do I execute benefit deduction authorization form online?

How do I edit benefit deduction authorization form on an Android device?

What is benefit deduction authorization form?

Who is required to file benefit deduction authorization form?

How to fill out benefit deduction authorization form?

What is the purpose of benefit deduction authorization form?

What information must be reported on benefit deduction authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.